Predictive analytics has quickly moved from being a buzzword to a boardroom priority. From executive discussions in New York and London to tech innovations in Dubai, business leaders everywhere are asking a vital question: “What is the Predictive Analytics ROI, and how does it translate into measurable business impact?”

Businesses do not wish to throw money into another tool they cannot illustrate the value of. Good news: Predictive analytics ROI is no longer a guessing game! The companies that can truly make predictive analytics work for them are already seeing superior forecasting accuracy, optimised operations, better customer engagement, and directly improved bottom lines.

Businesses are usually confused about predictive analytics vs traditional analytics but more about predictive analytics crunching numbers and printing charts. This is about strategic, data-operated decision-making before the problems arise or opportunities you have.

According to the report, financial institutions have made, on average, between 250 and 500% return on investment within the first year of deployment. Such a phenomenally high return is due to several reasons, including cost savings through the automation of processes, revenues generated from better targeting, and loss prevention through better risk management.

In this blog, we’ll explore the future of analytics and, more importantly, why it’s emerging as one of the smartest investments modern businesses can make.

What Is Predictive Analytics?

Predictive analytics uses past data, algorithms, and machine learning to accurately forecast future events and trends, helping businesses make better decisions. However, it goes beyond simple forecasting, providing actionable insights that directly influence strategies and outcomes.

In turn, predictive analytics has the best potential to apply a competitive accelerator when adopted strategically. It does not merely consume “what could happen but induces actions that induce outcomes.

This is what distinguishes predictive analytics:

- It combines data with intelligence, turning raw numbers into real-time foresight.

- It’s embedded within the entire AI-ML ecosystem: AI is the brain, ML the engine, and predictive analytics the decision-making compass.

- It empowers us not only to see into the future but also to determine the best next action.

Many still think of it as a fancy reporting tool used for sales estimates or inventory estimates. But the predictive analytics consulting today plays a big role in various industries:

- Customers personalise retail experiences

- Preceding equipment failure in manufacturing

- Find out fraud in financial services

- Improves the patient’s results in healthcare

Changes in mentality occur when the business stops closing the future analysis as the forecast tool and starts hugging it as a strategic advisor. This is the place where the future analytics ROI conversation becomes serious because now you are not just reducing estimates. You are giving maximum value at each decision point.

So, how much is predictive analytics worth? The answer lies in how smartly you deploy it and how ready your organization is to let data drive action

Why Predictive Analytics Is Worth the Investment

Predictive analytics trends are no longer simply more of a technology upgrade. It is fast turning into a business-critical component. Global trend data shouts at this change.

Recent reports in the industry project that by 2028, the value of the predictive analytics ROI market is expected to go past $40 billion due to the furious pace of AI adoption and the quest for real-time decision-making. (statista)

From start-ups to Fortune 500s, businesses have left the arena of whether to invest in this field behind them. Now, it is all a reckoning on how fast to scale it.

Why the urgency? Because the competitive edge today doesn’t come from reacting; it comes from knowing what’s next before anyone else does.

The leading enterprises in the US, UK, and UAE are doubling down on predictive analytics ROI for a major reason: it turns uncertainty into clarity. Whether it’s optimizing supply chains, forecasting market trends, or tailoring customer experiences, companies with advanced future systems are moving fast and smarter than their competition. What have the forward-thinking companies considered?

- Active Strategy – Spot Market Shift before affecting revenue.

- Rapid decision – Eliminate the delay in decisions caused by estimates.

- Data-powered leadership – Empower executives with scenario-based insights.

- First-mover advantage – Act before competitors even see the opportunity.

In today’s dynamic markets, the cost of waiting is often higher than the cost of action. This is exactly why predictive analytics returns on investment are no longer nice to have; they’re a strategic necessity.

What ROI Really Means in Predictive Analytics

When we talk about Predictive Analytics returns on investment, the conversation often starts and stops at profitability. But the true return goes far beyond revenue; it’s embedded across multiple layers of business performance.

Predictive analytics offers ROI in the form of:

- Better decision-making – Predictive intelligence will enable teams to decrease risk and gain confidence in each move.

- Operational efficiency – An increasing amount of waste may be eliminated, such as that related to planning demand and controlling inventory.

- Retention of customers – Churn prediction and personalised interaction will enable firms to retain customers for a longer time.

- Faster innovation – Spotting trends will prepare organisations to bring new products or services ahead of the curve.

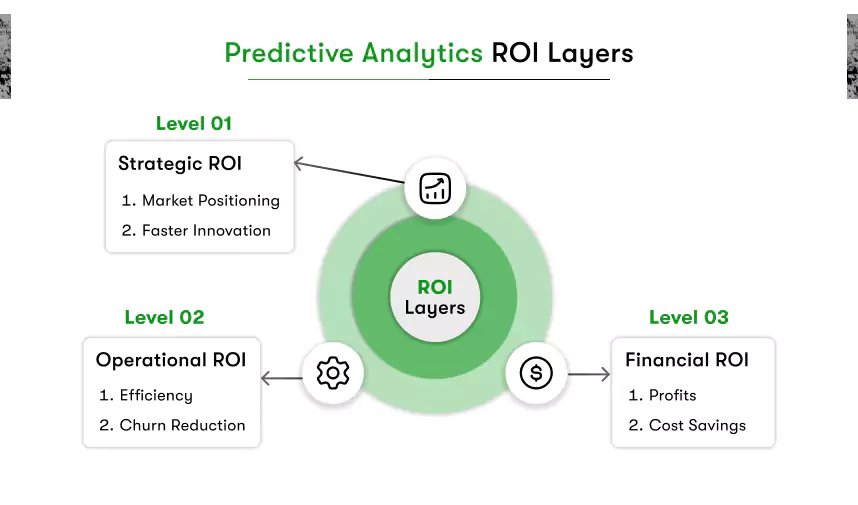

This is returned layered into three dimensions for a layered ROI:

- Strategic ROI: The long-range payoff from better decisions about new business development and market positioning.

- Operational ROI: Immediate payback in efficiencies, cost savings, and improvements to processes.

- Financial ROI: Realized increases in profits, reduced losses, and improved margins.

This layered return makes the question “How much is predictive analytics worth?” important. The answer depends on how deeply it’s integrated into your organisation’s decision-making process.

Ultimately, predictive analytics isn’t just a tool that pays for itself. It’s a door to get future-ready, giving you a measurable edge where it matters most: ahead of the curve.

Let’s Look at a Case Study on Predictive Analytics ROI

How an Online Retailer Boosted ROI by 22% in Just 6 Months Using Predictive Analytics

Background:

An online fashion retailer operating across the US and UK was struggling with high cart abandonment rates, unpredictable inventory levels, and seasonal overstocking. Despite having plenty of data, they weren’t using it effectively.

Challenge:

The company wanted to improve revenue per user, optimise stock levels, and retain at-risk customers without increasing marketing spend.

Solution:

They implemented a predictive analytics platform focused on three core areas:

- Dynamic Pricing: Adjusted prices in real-time based on competitor changes and customer behaviour.

- Churn Prediction: Identified customers likely to leave and targeted them with personalised re-engagement emails.

- Inventory Forecasting: Predicted which products would be in high demand during upcoming sales periods, reducing overstock and stockouts.

Results (Within 6 Months):

- 22% increase in average order value

- 18% drop in cart abandonment

- 30% reduction in unsold inventory

- 12% increase in repeat purchases from at-risk customers

Key Takeaway:

The retailer didn’t just predict customer behaviour. They acted on it. That’s the real ROI of predictive analytics. It turns raw data into real-time decisions that directly improve the bottom line.

ROI Timeline: What to Expect in the First 1–12 Months?

When applied effectively, predictive analytics can deliver clear results within six months. In data-rich industries like eCommerce, delivery, and fintech, these results often appear even faster.

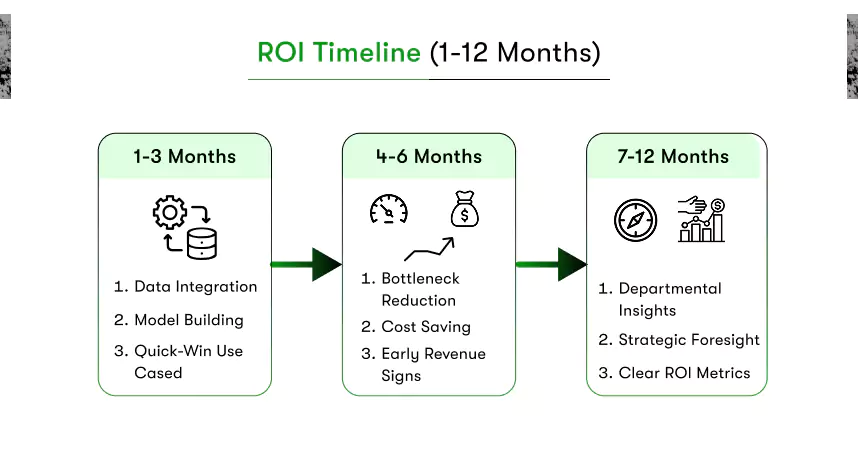

More or less, every business follows its own growth curve, but a very well-executed predictive analytics strategy usually follows as below:

In the first 1-3 months, the predictive analytics strategy includes:

- Data integration, refinement and classification, and model building.

- Perceived rapid wins from fictitious use cases such as demand forecasts and churn prediction.

- Automated reporting scenarios.

Within 4–6 months, the predictive analytics strategy includes:

- Evident ingestion of decisions.

- Reduction of bottlenecks.

- First signs of money impact: savings or an increase in revenue.

After 7-12 months, the predictive analytics strategy includes:

- Having a good predictive insight into departmental processes.

- Rendering strategic decisions with immediate foresight.

- Full visibility into the ROI specifications: customer retention, delivery efficiency, inventory optimisation, and so forth.

Use Cases That Show Real Predictive Analytics ROI

Keen on observing live returns? This is how several businesses across significant industries unlock predictive analytics returns on investment in a few months instead of years. Here are a few predictive analytics use cases.

eCommerce

- Dynamic Pricing: Automatically adjust product prices based on real-time customer activity or competitors’ pricing.

- How it delivers ROI: Customers buy more because prices stay attractive and competitive, directly increasing revenue.

- Personalised Product Recommendations: Suggests products customers are likely to buy based on past behaviour.

- How it delivers ROI: Leads customers directly to desired products, boosting sales and increasing average order value.

- Churn Prediction: Identifies customers likely to leave so companies can proactively engage them before they do.

- How it delivers ROI: Retains valuable customers, cutting losses and maintaining steady revenue streams.

- Predictive Analytics ROI Example: Businesses often see a 10–20% increase in average order value and lower cart abandonment rates within months.

Healthcare

- Predictive Patient Care: Identifies patients at high risk of hospital readmission or treatment complications.

- How it delivers ROI: Reduces costly readmissions by targeting care to those who need it most, optimising resource use.

- Operational Forecasting: Accurately predicts staff requirements, medication needs, and equipment use.

- How it delivers ROI: Lowers staffing costs, minimises waste, and streamlines inventory, improving efficiency and care quality.

- Predictive Analytics ROI Example: Noticeable reductions in operational costs and improved patient outcomes are common within six months.

Predictive Analytics Guide: Understand Its Purpose and Why Businesses Rely on Predictive Analytics for Smarter Decisions.

Fintech

- Fraud Detection Models: Quickly identifies suspicious transactions while reducing false alerts.

- How it delivers ROI: Minimizes financial losses from fraud and frees staff time from handling false positives.

- Enhanced Credit Scoring: Uses more precise analytics to assess borrower risk, making loan approvals faster and safer.

- How it delivers ROI: Increases lending efficiency, improves repayment rates, and reduces defaults.

- Predictive Analytics ROI Example: Immediate reductions in fraud-related expenses and quicker, more reliable loan approvals.

Travel

- Price and Offer Forecasting: Predicts optimal times and pricing to target customers effectively.

- How it delivers ROI: Boosts bookings by offering the right deals at the right times, maximising profits per sale.

- Customer Segmentation and Customization: Groups travellers based on behaviours or preferences, enabling tailored offers.

- How it delivers ROI: Drives higher conversion rates and repeat bookings through personalised experiences.

- Predictive Analytics ROI Example: Increased bookings, more efficient inventory management, and higher customer satisfaction within a few months.

Delivery & Logistics

- Route Optimization and Accurate ETAs: Predict the fastest routes and delivery times based on real-time data.

- How it delivers ROI: Reduces fuel expenses, ensures timely deliveries, and enhances customer service reliability.

- Demand Spike Forecasting: Anticipates high demand periods, preparing adequate fleet resources.

- How it delivers ROI: Prevents missed deliveries or delayed shipments during busy times, protecting customer relationships and profitability.

- Predictive Analytics ROI Example: Significant savings on fuel costs and improvements in customer satisfaction due to consistently reliable deliveries.

Manufacturing & Logistics

- Predictive Maintenance: Forecasts when machines will need maintenance before failures occur.

- How it delivers ROI: Avoids costly downtime and unexpected repairs, maintaining productivity.

- Supply Chain Forecasting: Predicts production and inventory requirements to prevent overstock or shortages.

- How it delivers ROI: Reduces excess inventory costs, prevents waste, and improves resource planning.

- Predictive Analytics ROI Example: Immediate cost savings from fewer breakdowns and better inventory management, boosting overall productivity.

According to the experts, this industry is defined by the obvious potential, from a predictive analytics point of view, to target the most decision-intensive and high-impact processes with respect to maximised investment return. The knowledge lies in the data that is in existence; it studiously depends on how you choose to activate it.

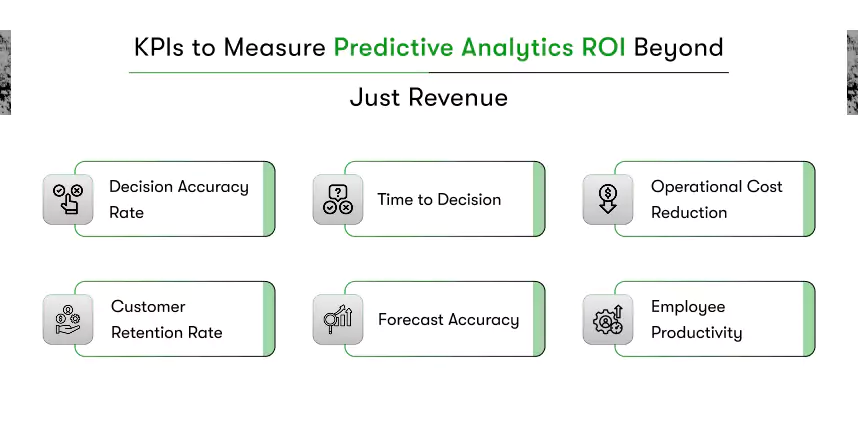

KPIs to Measure ROI Beyond Just Revenue

By measuring these KPIs, businesses get a 360° view of their predictive analytics returns on investment, from frontline impact to executive strategy. The bottom line is important, but the full story is told through improved performance at every layer of the business.

These are the metrics that truly soak up its potential:

Decision Accuracy Rate

How often do decisions based on predictive insights come true?

Time to Decision

Do insights help your teams move faster? Explicit and immediate ROI comes from decision cycles becoming shorter.

Operational Cost Reduction

The goal is for cuts in manual labour, in-process inefficiencies, and in downtime, particularly indelivery and manufacturing.

Customer Retention Rate

Are predictive models helping to lower churn and extend lifetime value in arenas such as eCommerce and FinTech?

Forecast Accuracy

How much more precise have demand, sales, or inventory forecast methods become as compared to pre-analytics?

Employee Productivity

Are teams embracing data? Or are they wrestling with it? Good predictive analytics should lessen cognitive burdens and never heighten them.

By measuring those KPIs, businesses get a 360° view of their predictive analytics return on investment from front-line benefits up to executive strategy. The bottom-line view is important indeed, but the full story is told through an improved process at darn near every layer of the business.

Factors That Make or Break ROI

When businesses invest in predictive analytics, the technology itself isn’t the only factor determining success. In fact, the real difference between seeing strong returns and struggling with underwhelming results lies in how predictive analytics works. And how the solution is executed and embedded into everyday decision-making.

One of the most important drivers of Predictive Analytics ROI is a clearly defined target. Companies that begin with specific, average commercial purposes such as reducing delays, predicting equipment failure, or identifying high-risk patients are able to align their analytics strategy with high-effects results.

Equally required data is quality. Predictive Analytics thrives on clean, consistent and integrated data. Without it, even the most advanced models can be reduced. Organisations that prefer strong data foundations see rapid deployment and more accurate predictions.

What drives Predictive Analytics ROI?

- Clear business goals tied to use cases.

- High-quality, accessible, and connected data.

- Strong collaboration between technical and business teams.

- Executive sponsorship that prioritises analytics as a growth driver.

- Agile deployment that keeps updating continuously.

The other big key is cross-functional teamwork. When data scientists, business analysts, and line executives work alone, insights don’t translate to action. When teams are interconnected, forecasted insights flow through the organisation for decision-making at all levels.

Equally important is leadership support. If the highest levels view predictive analytics as a strategic endeavour rather than merely a technical exercise, it will obtain the exposure, the funding, and the cultural importance required for its very existence.

Problems do pop up quite frequently, though, which can hamper the returns on investment from predictive analytics:

- Ambiguous or changing KPIs.

- Poor uptake among end users due to a lack of understanding or trust.

- Data or teams in silos prevent model success.

- Models that are overly complex provide no real useful information.

Ultimately, how much predictive analytics is worth comes down to execution. With the right alignment between people, processes, and purpose, predictive analytics becomes more than just a data tool; it becomes a powerful, measurable driver of business performance.

How AI and ML Increase the ROI of Predictive Analytics

Predictive analytics is powerful on its own, but when AI and Machine Learning in predictive analytics are utilized, that’s when businesses start to see exponential returns.

With the passage of time, AI and ML have made predictive analytics smarter, faster, and, most importantly, more accurate. They overcome the limitations of manual analysis through models learning real-time, fresh data.

This means that your predictions change in alignment with market trends, as well as with customer behaviour and operational feedback.

- AI improves pattern recognition, revealing complex trends that the human mind may overlook.

- As more and more data gets exposed, ML improves its models continuously.

- Automation shortens decision cycles and enables immediate reactions to predicted actions.

In industries such as eCommerce and fintech, for example, AI-powered customisation and fraud detection have consistently produced double-digit increases in retention and savings. These applications augment machine learning-based treatment outcomes in healthcare and decrease downtime in logistics.

When combined with a lucid business strategy, AI and ML do not just enhance predictive analytics; they turn it into an ever-scaling, self-improving system which can generate continuous returns on investments.

A Business Roadmap To Predictive Analytics ROI

Beyond technology, businesses require a clear set of scalable plans incorporating data, goals, and people to extract maximum benefits from predictive analytics.

Choose a predictive analytics strategy for non-tech teams that will drive high-impact, rapid action. Rank use cases that provide measurable and tangible ROI: reducing churn, stock-keeping forecasting, and delivery route optimisation.

You will have your data infrastructure evaluated. Predictive models work with great data; otherwise, the solutions die an early death because of an ancient or broken system. Please clean up those pipelines and enable each team to access relevant data.

Business roadmap essentials:

- Identify use cases with measurable ROI potential

- Ensure high-quality, centralized data

- Choose tools that align with your industry and scale

- Involve both tech and business stakeholders early

- Define clear KPIs before you start

- Invest in training and change management for adoption

AI in Predictive Analytics: Forecasting Business Growth

It’s also important to align stakeholders from the start. Predictive analytics isn’t just a data project; it’s a cross-functional initiative. Teams from product, marketing, operations, and finance all have a role in making the most of insights.

Finally, don’t try to boil the ocean. Start with pilot projects, gather quick wins, and scale what works. Predictive analytics ROI compounds over time when you build momentum with smart, targeted implementation.

Conclusion: Predictive ROI Is Real if You Build It Right

The question “How much is predictive analytics worth?” is no longer just theory. Companies worldwide see clear benefits within months, including better decisions, more customers staying loyal, smoother operations, and higher profits.

But that ROI doesn’t happen by accident. There are a few predictive analytics challenges. It takes a combination of the right tools, clean data, focused use cases, and, most importantly, business alignment.

When predictive analytics is built with intention, powered by AI and ML, and embraced across the organization, it becomes more than a technology investment. It becomes a strategic driver of growth, resilience, and long-term success. So yes, predictive analytics ROI is real. The only question now is: are you ready to build it right?

Contact Information

Contact Information