Are you leveraging the power of mobile banking to transform your financial institution? In 2023 alone, over 76% of Americans have used a mobile banking app like Chime to streamline their financial activities. These platforms offer more than just transactional capabilities; they are pivotal in shaping financial habits and security.

For both investors and financial institution leaders looking to build a mobile banking app, it is essential to understand the nuances of the process. This blog will guide you through the operational frameworks and strategic decisions that you need to make in order to create apps that not only emulate the success of entities such as Monzo and Chime but also beyond the limits of what is possible in the realm of digital banking.

Projected to reach $1.82 billion by 2025, the mobile banking market is expanding at an annual growth rate of 12.2%.

The trend is not just growing; it’s evolving, as highlighted by Ryan Caldwell, founder & CEO of MX:

“Americans are turning to mobile banking as a way to take control of their finances and plan for their economic future.”

This sentiment is underpinned by the increasing adoption of digital banking solutions, especially among millennials and Gen Z. Remarkably, 98% of millennials and 99% of Gen Z regularly use mobile banking apps for various financial tasks, including depositing checks, checking credit ratings, and keeping track of account balances.

As the journey into mobile banking app development continues, the demand for high-quality, secure applications becomes more apparent. Choosing the right development partner or hiring a banking app developer who is equipped with the expertise and foresight to navigate this complex field will be essential. This blog serves as your starting point for understanding how to develop a mobile banking app that meets and exceeds modern financial needs.

A brief about mobile banking app named Chime,

Chime stands apart in the fintech industry as it is a financial technology startup rather than a conventional bank. Millions of people have come to trust it since its software allows for quick transactions with only a few taps. Without having to worry about unintentional costs, users can easily monitor the balances of their accounts and manage their spending. Additionally, Chime expands on its user-friendly strategy by providing access to more than 60,000 fee-free ATMs at establishments such as CVS, Walgreens, and 7-Eleven.

Why consider building a mobile banking app like Chime?

Adopting a digital-first approach through a mobile banking app like Chime can significantly reduce manual banking operations. This shift allows banks and financial institutions to redirect their focus toward enhancing strategic services, thereby boosting sales and improving customer retention. Here’s how embracing Chime’s business model could revolutionize your operations:

- User Engagement: Mobile apps enhance user engagement by providing convenient access to banking services anytime, anywhere.

- Competitive Edge: Offering features like instant notifications, budgeting tools, and seamless transactions can help your app stand out in the market.

- Customer Satisfaction: Providing a user-friendly interface, personalized experiences, and quick support can lead to higher customer satisfaction.

- Revenue Opportunities: Mobile banking apps can generate revenue through transaction fees, premium features, partnerships, and targeted marketing.

- Brand Loyalty: A well-designed and functional app can build brand loyalty and trust among users, leading to long-term relationships and increased referrals.

Chime’s Features: Enhance Your App with Similar Offerings

- Enhanced Transparency: Chime modifies the game by enabling real-time transaction reflection. After making a withdrawal or payment, users don’t have to wait to view their updated balance, which promotes transparency and increases confidence.

- Robust Security: Chime provides strong procedures like two-factor authentication to assure user protection in an era of widespread internet security threats. Users are protected from potential cyber risks and illegal activities with this level of security.

- Increased Operational Efficiency: With Chime, customers may conduct transactions at any time, anywhere, as there is no longer a need for queues at banks. By expediting banking procedures, this convenience not only saves time but also improves the user experience overall.

- AI Integration in Banking: The way financial services engage with their clients can be revolutionized by the use of AI. Chime sets the standard for AI use cases in banking by using AI to automate customer support, provide tailored financial advice, and forecast user behavior.

How to Develop a Mobile Banking App Like Chime

Are you aiming to develop an app like Chime and tap into the evolving market of digital banking transformation? Mastering the mobile banking app development process is crucial and involves much more than just coding.

Step-by-Step Process to Create an App Like Chime:

Getting up a team of experienced banking app developers is the first step towards creating a mobile banking app. However, this step emulates the functionality and popularity of Chime. Additionally, these professionals should be well-versed in the most recent advancements in digital banking as well as every facet of the mobile app development process.

- Strategic Planning: Launch the project with a well-defined strategy plan combining reliable technology and user-friendly service delivery. In the creation of mobile banking apps, this initial stage is crucial since it establishes the overall project’s direction.

- User Interface Design: Design an intuitive and engaging user interface. The ease of use can significantly affect the app’s success, making this one of the critical aspects of app development like Chime.

- Technology Integration: Effectively use cutting-edge technology to guarantee that the app is both user-friendly and strong enough to manage intricate banking tasks. This is the key when creating an app like Chime.

- Security Implementation: Use advanced security methods to protect user data. This is a crucial step in keeping your mobile banking app trustworthy and authentic.

- Quality Assurance and Testing: Rigorous testing is required to ensure the app operates smoothly across all devices and scenarios. This phase helps identify and rectify any potential issues before launch.

You may create an app similar to Chime that not only satisfies the needs of today’s clients. It also makes a name for itself in the crowded mobile banking market by concentrating on these crucial elements. Work with a development team that understands the technical aspects of creating a banking app. This ensures the success of your project from the ground up.

How long does it take to build a mobile banking app like Chime?

Have you ever wondered how long it takes to transform an initial app idea into a fully operational mobile banking platform? Developing an app like Chime is not just about coding—it’s about creating a seamless, secure, and engaging user experience. This process aims to stand out in the competitive fintech landscape.

Phase 1: Ideation and Conceptualization:

The first step in our mobile app development process involves deep-dive brainstorming sessions. Here, we flesh out your project idea, laying the groundwork with a comprehensive, well-sketched plan that aligns with your strategic goals.

Phase 2: Prototyping and Validation:

Moving forward, our focus shifts to prototyping. This crucial stage allows both developers and stakeholders to preview the app’s functionality, ensuring alignment with the envisioned end product. It’s where ideas begin to take shape, offering a tangible glimpse into the future.

Phase 3: Development and Quality Assurance:

With a prototype in hand, our team of expert banking app developers steps in to build the actual application. This phase is complemented by rigorous quality assurance testing. This ensures that every feature operates flawlessly under various scenarios, guaranteeing reliability and security.

Phase 4: MVP Development and Market Introduction:

The development of a Minimum Viable Product marks the highest point of the process (MVP). This version includes all the necessary features. It’s then shown to a small group of people to gather insightful feedback before making any last-minute changes. Your app is prepared to launch into the market after a successful MVP trial.

From concept to launch, the process usually takes four to five months. Ready to develop a banking app that has the potential to completely change the mobile banking market? Think of hiring experienced developers from outside. They understand the ins and outs of banking and have experience developing banking apps. Using a tried-and-true, methodical mobile app development process, realize your concept.

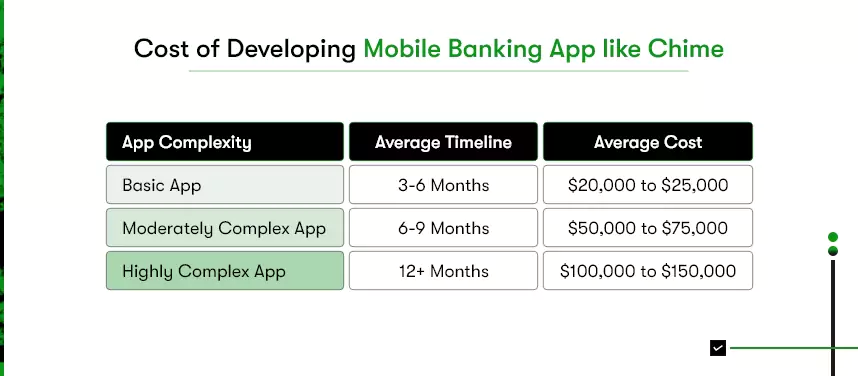

What is the cost of developing a mobile banking app like Chime?

Are you thinking about developing a Chime-like mobile banking app and are curious about the possible expenses? An app like Chime can be developed for a very different price depending on several different development-related factors. Ideally, the mobile app development process typically takes around 4 to 5 months to complete a project. However, the exact timeframe can vary depending on the complexity of your app and your specific needs. Let’s dive deep and understand the pricing breakdown by functionality.

Pricing Breakdown by Functionality

- Basic Features and Functions: For a mobile banking app with basic functionality such as account viewing, transaction history, and simple transfers, you can expect prices to start from around $20,000.

- Advanced Features: Incorporating more complex features like loan applications, multiple account management, and investment services could push costs upwards of $40,000.

- Third-party APIs: Integrating external services for features like credit score checks or automatic bill payments typically adds to the budget, potentially increasing costs by $5,000 to $15,000 depending on the APIs used.

- Security Features: High-level security features such as biometric authentication, encryption, and fraud detection systems are crucial for a banking app. However, these features can add an additional $10,000 to $20,000 to the development costs.

- UI/UX Design: Crafting a user-friendly and aesthetically pleasing interface might cost between $5,000 and $15,000, based on the complexity and uniqueness of the design.

- Technology Stack: Choosing the right technology stack, whether it’s native or cross-platform development, affects both the capabilities of the app and the cost. Additionally, this decision can potentially add $10,000 to $25,000 to the overall budget. However, you can create the application more cost-effectively by leveraging Flutter for banking apps. Flutter is a cross-platform framework that streamlines development, maintenance, and costs by using a single codebase for Android and iOS.

- Platform Selection: Developing the app for multiple platforms (iOS and Android) will generally increase the project’s scope and cost. This could potentially add $10,000 to $20,000 for each additional platform.

These generalized pricing estimates give you an idea of what you might expect to pay when you build a mobile banking app like Chime. Remember, every detail from the app’s functionality to the chosen technology can influence the final cost.

Factors Affecting the Cost to Develop an App Like Chime

What aspects of developing an app like Chime vary in cost, and how can you efficiently manage your budget? Examine the main elements affecting the price of creating a Chime-like mobile banking app.

Authentic Pricing Example:

Unlocking the authentic pricing example unveils the financial landscape of developing an app like Chime, offering clarity amidst cost complexities.

Learn how several factors affect the total cost of your app development process.

| Factors | Description | Impact on Cost |

| Features and Functions | The complexity and range of features, such as account management, bill payments, fund transfers, etc., significantly influence development costs. | High |

| Third-party APIs | Integration with external services for functionalities like payment gateways, data analytics, or security enhancements can add to development costs. | Moderate to High |

| Security Features | Implementing robust security measures like encryption, authentication methods, and compliance with regulatory standards is crucial but can increase development expenses. | High |

| Location of Development | The geographical location of your app development partner affects costs due to differences in labor rates, taxes, and operational expenses across regions. | Moderate to High |

| Hourly Charges | Development rates vary based on the experience and expertise of developers, with senior developers commanding higher hourly rates than junior developers. | Moderate to High |

| UI/UX Designing | Creating an intuitive and visually appealing user interface and experience requires skilled designers and adds to development costs. | Moderate |

| Technology Stack | The choice of programming languages, frameworks like Flutter, databases, and tools impacts development time and costs, with newer or specialized technologies often adding to expenses. | Moderate to High |

| Platform Selection | Developing for multiple platforms (iOS, Android) or choosing cross-platform development affects costs due to additional testing, optimization, and compatibility efforts. | Moderate to High |

Understanding these factors and their impact can help you make informed decisions. It also allows you to optimize your budget effectively while developing an app like Chime.

FAQs

How much time does it take to develop an app like Chime?

- The development time for an app like Chime can vary based on its complexity and features. Typically, it may take around 4 to 6 months for a basic version. The development time can extend to 9 months or more for a highly complex app with advanced functionalities.

What are the advantages of building an app like Chime for a financial institution?

- Building an app like Chime can offer several advantages. These advantages include enhanced customer engagement, improved accessibility for users, and streamlined banking operations. Additionally, they offer increased revenue opportunities through digital channels and help in staying competitive in the evolving fintech landscape.

What are the latest mobile banking trends that financial institutions should be aware of?

- Some of the latest mobile banking trends include AI-powered chatbots for customer service and biometric authentication for enhanced security. Additionally, personalized banking experiences through data analytics are on the rise. Integration of voice-enabled banking services and the adoption of blockchain technology for secure transactions are also becoming increasingly prevalent.

How to start the development of a banking app?

- To start developing a banking app, it’s crucial to begin with a clear roadmap and understanding of your target audience’s needs. Conduct thorough market research to identify trends, user preferences, and potential competitors. Moreover, collaborate closely with a skilled development team that specializes in fintech to ensure a seamless process from conceptualization to deployment.

What are the latest mobile banking trends?

- As for the latest mobile banking trends, the industry is witnessing several advancements aimed at enhancing user experiences and security. Additionally, AI-powered chatbots are becoming increasingly popular for customer service interactions, providing quick and efficient support to users.

Biometric authentication, like fingerprint and facial recognition, is also gaining popularity for enhanced security. Real-time data analytics and personalized financial insights are becoming must-have features. However, let’s not forget the rise of contactless payments and digital wallets, offering convenience and speed in transactions. Keeping an eye on these trends can help you stay ahead in the dynamic world of mobile banking apps!

Conclusion

“In conclusion, developing a mobile banking app like Chime involves careful planning and strategic vision. It also requires a deep understanding of the latest trends and technologies in the fintech industry. You can create a successful app that meets the evolving needs of your target audience by addressing key factors such as user experience, security, functionality, and cost.

If you’re ready to embark on this exciting journey of mobile banking app development, consider partnering with Kody Technolab. Additionally, our team of experienced banking app developers is well-versed in digital banking transformation strategies. We can guide you through the entire development process, from concept to launch. We’re here to turn your vision into reality and help you build a cutting-edge app that stands out in the competitive market. Contact us today to hire banking app developers who are dedicated to your success!

Contact Information

Contact Information