Fraud cost businesses a staggering $485.6 billion globally in 2023. In the face of such losses, the role of predictive analytics in insurance industry is becoming essential. For insurers, underwriting fraud risk has always been a tough problem. Fraud is complex, unpredictable, and constantly evolving. Traditional tools can’t keep up.

That’s why companies like Instnt are now using predictive analytics in insurance to tackle fraud in smarter ways.

In late 2023, Instnt launched an AI-powered Fraud Loss Insurance product , a solution designed not just to cover fraud, but to actively prevent it. The platform uses real-time risk scoring to prevent it. (Source)

This approach to fraud coverage is backed by predictive models, not guesswork.

Instnt is not the only insurer making this shift. A 2023 McKinsey & Company report showed insurers using advanced analytics cut costs by up to 30% and improved loss ratios. That’s what happens when the system actually fits the business.

The growing adoption of predictive analytics is a clear signal it’s no longer optional. Predictive analytics in insurance helps insurers price smarter, pay faster, and control risk.

This guide explains how it improves pricing, claims, and risk modeling, and how to build a system that works from the start.

If you’re serious about insurance innovation, this is where you begin.

What Is Predictive Analytics in Insurance Industry and the Role of Risk Analytics

Predictive analytics in insurance is the use of historical data, statistical models, and machine learning to forecast future events such as claim likelihood, customer behavior, or fraud risk. It helps insurers make smarter, faster, and more accurate decisions.

Insurance has always been about managing risk. But relying on outdated rules or gut feeling no longer works. Predictive analytics in insurance turns raw data into real insights that guide every decision, from pricing to fraud prevention.

Predictive analytics works by training models using past data like claims history, underwriting patterns, customer behavior, and fraud incidents. These models then forecast what’s likely to happen next.

Risk analytics is a branch of this approach. It helps insurers identify, measure, and simulate potential losses so they can reduce uncertainty and respond before risk turns into loss.

Where predictive analytics adds value in insurance:

- Underwriting: Identify high-risk applicants early.

- Pricing: Set fair premiums using behavioral data.

- Claims: Predict volume and streamline approvals.

- Fraud Detection: Spot suspicious claims quickly.

- Risk Modeling: Simulate losses and prepare in advance.

Predictive analytics shifts the focus from reacting to risk to preventing it.

Also Read: Predictive Analytics in Fintech Guide to learn how fintechs use data to improve lending, detect fraud, and personalize services.

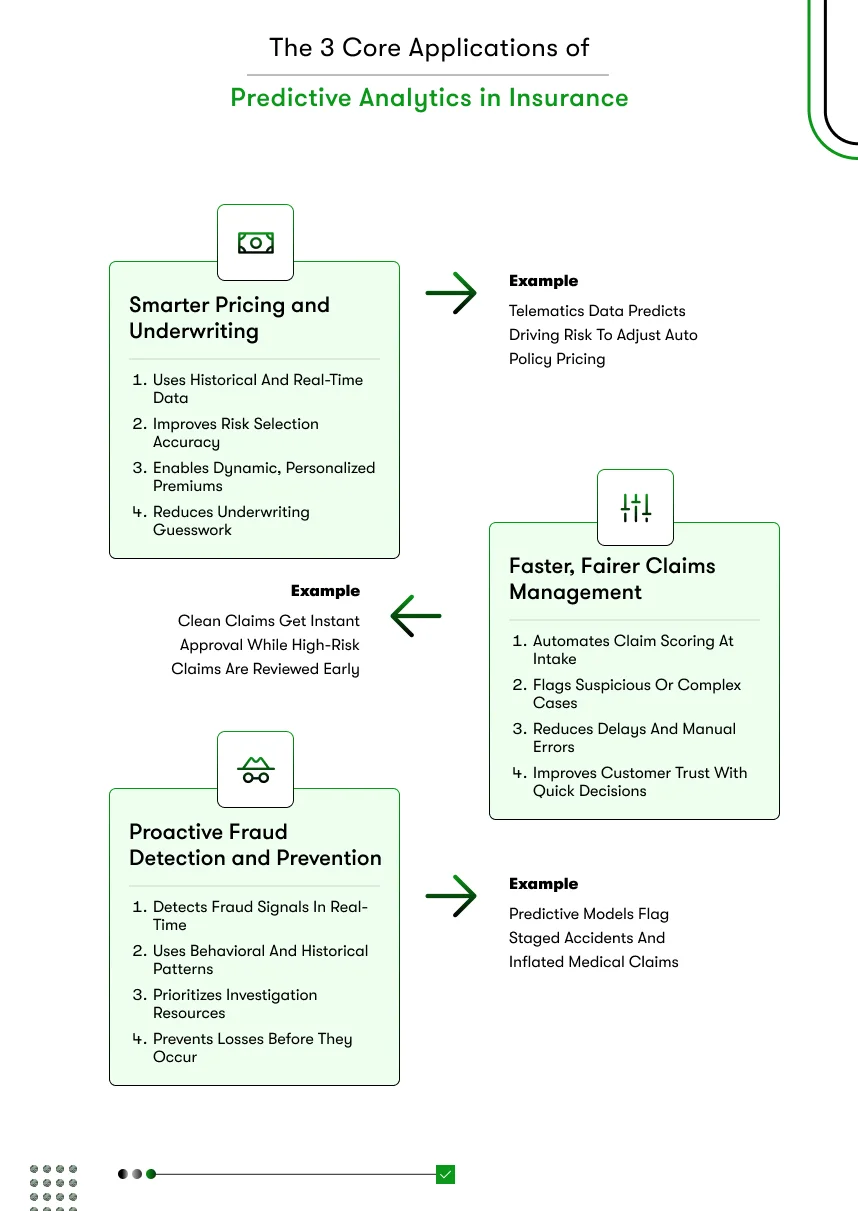

The 3 Core Applications of Predictive Analytics in Insurance Industry.

Predictive analytics in insurance isn’t limited to one task. It strengthens the entire workflow. From pricing and underwriting to claims and fraud control, it helps insurers act earlier, make smarter decisions, and reduce risk without delays or guesswork.

A. Smarter Pricing & Underwriting

Traditional pricing and underwriting rely on static variables like age or ZIP code. That approach barely scratches the surface of risk.

Today, insurers use advanced models trained on historical claims, behavior patterns, and external data sources to improve pricing accuracy and risk selection. Real-time data from telematics or health records can now feed into custom pricing, making premiums more accurate and personalized.

This shift removes the guesswork from underwriting and gives teams a clearer view of each applicant’s actual risk.

The use of predictive analytics in insurance leads to pricing strategies that are more dynamic, data-driven, and fair for both sides, insurer and customer.

B. Faster, Fairer Claims Management

Claims processing often suffers from delay, inconsistency, or human bias. Predictive models solve that with automated claim scoring.

When a claim is filed, it can be assessed instantly using patterns from previous outcomes. Clean, low-risk claims move ahead faster. Suspicious or complex cases are flagged early for deeper review.

This approach removes manual bottlenecks and standardizes decisions across the board.

One major benefit of predictive analytics in insurance is its ability to bring fairness and speed to claims without sacrificing accuracy. Customers get answers sooner. Insurers control losses better.

C. Proactive Fraud Detection & Prevention

Fraud continues to drain billions from the insurance sector every year. Staged accidents, inflated losses, and identity thefts often go undetected until it’s too late.

Predictive analytics helps stop that trend by identifying fraud patterns early. When a new claim or policy application is submitted, the system compares it to known fraud indicators and scores its risk in real time.

These insights let fraud teams step in early and focus on high-impact cases.

The use of predictive analytics in insurance fraud cuts losses, reduces false alarms, and increases investigation efficiency without slowing down real customers.

D. Operational Efficiency: Internal Risk & Resource Optimization

Most insurance inefficiencies don’t start with customers. They begin inside the company. Missed handoffs, overwhelmed adjusters, and delayed claim approvals quietly increase costs and frustrate teams.

This is where predictive analytics in insurance brings control.

Insurers analyze internal data such as claim volume patterns, average resolution times, and workload history to forecast operating pressure. These predictions allow managers to plan ahead, assign resources wisely, and prevent bottlenecks before they build up.

Support teams stay prepared during high-traffic periods. Claims can be routed based on complexity. Fraud teams get alerted before systems are overloaded.

The real benefit is internal clarity. When teams know what’s coming, they can deliver faster service with fewer errors.

Many insurers now seek partners with domain-specific expertise, similar to how banks rely on fintech predictive analytics consulting to streamline internal workflows. In insurance, predictive models are becoming the backbone of smarter, leaner operations.

Real-World Use Cases & Examples of Predictive Analytics in Insurance Industry

Predictive analytics in insurance is no longer a future idea, it’s driving decisions today across pricing, claims, fraud, and customer engagement. Real insurers are already seeing measurable business outcomes through practical applications.

1. AXA’s Customer Behavior Modeling

Global insurer AXA built predictive models to understand which customers were likely to lapse or renew their policies. They used these insights to personalize retention strategies based on risk and behavior patterns. As a result, AXA reduced churn and improved overall customer value.

This is one of the most strategic examples of predictive analytics in insurance being used for long-term growth.

2. Zurich’s Catastrophe Risk Modeling

Zurich Insurance uses predictive analytics to simulate loss scenarios during extreme weather events. Their system integrates historical catastrophe data, customer geolocation, and infrastructure sensitivity to estimate exposure and expected claims before a disaster strikes.

This use case highlights how predictive analytics in the insurance sector supports proactive planning and faster response after natural events.

3. MetLife’s Claims Automation

MetLife implemented predictive analytics to speed up health and life claims. Claims that aligned with known low-risk profiles were approved automatically, while flagged ones were sent for manual checks. This led to a faster average settlement time and increased customer satisfaction.

The benefits of predictive analytics in insurance claims are clearly visible in operational efficiency and customer trust.

4. Progressive’s Risk-Based Pricing

Progressive Insurance analyzes driving data from telematics programs to predict risk and adjust pricing more accurately for individual drivers. The company has used this to improve underwriting performance and create fairer premium structures.

This is a leading example of the use of predictive analytics in insurance for smarter pricing decisions.

5. Allstate’s Auto Fraud Detection

Allstate uses predictive analytics to detect fraudulent auto claims. Their system evaluates new claims against fraud patterns and assigns a fraud risk score. High-risk cases go to special investigation units before payout.

This is a proven application of predictive analytics in insurance fraud, reducing losses and improving fraud team efficiency.

6. Aviva’s Churn Prediction Engine

Aviva built models to identify when customers are likely to drop coverage. They trigger proactive retention campaigns at the right time, helping the company protect recurring revenue.

This is a measurable example of the benefits of predictive analytics in insurance, especially for customer lifecycle optimization.

What Are AI Predictive Models for Investment? A Guide for Wealth Management Teams

7. Swiss Re’s Reinsurance Risk Portfolio Modeling

Swiss Re uses predictive analytics to simulate large-scale loss events across industries. Their models help assess portfolio risk and guide smarter reinsurance structuring.

It’s a powerful use case inside the predictive analytics in the insurance industry, supporting complex commercial underwriting.

These examples prove that predictive analytics in insurance is not just a technical upgrade. It’s a business advantage. When applied with the right data, logic, and goals, it helps insurers reduce losses, retain customers, and make faster, smarter decisions at scale.

The Business Benefits of Predictive Analytics in the Insurance Sector

Predictive analytics in insurance isn’t just about automation or faster decisions. It directly impacts key business outcomes like profitability, retention, risk control, and growth.

Insurers that use predictive models gain more than just data insights, they gain control. With clear predictions and better timing, teams can reduce unnecessary losses and focus resources where they matter most.

Here are some of the most valuable benefits of predictive analytics in insurance:

1. Higher Profit Margins

With accurate pricing, risk scoring, and fraud detection, insurers reduce loss ratios without overcharging customers. This helps grow margins while staying competitive.

2. Faster Decision-Making

Underwriting, claims approval, and fraud checks no longer rely on long forms or manual reviews. Predictive scoring cuts delays and gives teams the clarity to act immediately.

3. Better Customer Retention

When insurers know which customers are at risk of leaving, they can act early. Tailored offers, alerts, and personalized outreach reduce churn and protect lifetime value.

4. Stronger Risk Management

From modeling natural disasters to forecasting claim volume spikes, predictive analytics improves how insurers prepare, respond, and allocate resources.

5. Operational Efficiency

Workloads can be balanced in advance. High-volume periods can be planned for. Teams stop reacting and start operating with foresight.

These results are not hypothetical. They’re proven through real examples of predictive analytics in insurance being deployed by top-tier carriers worldwide.

The Complete Guide to Using Predictive Analytics in BNPL for Smarter Lending

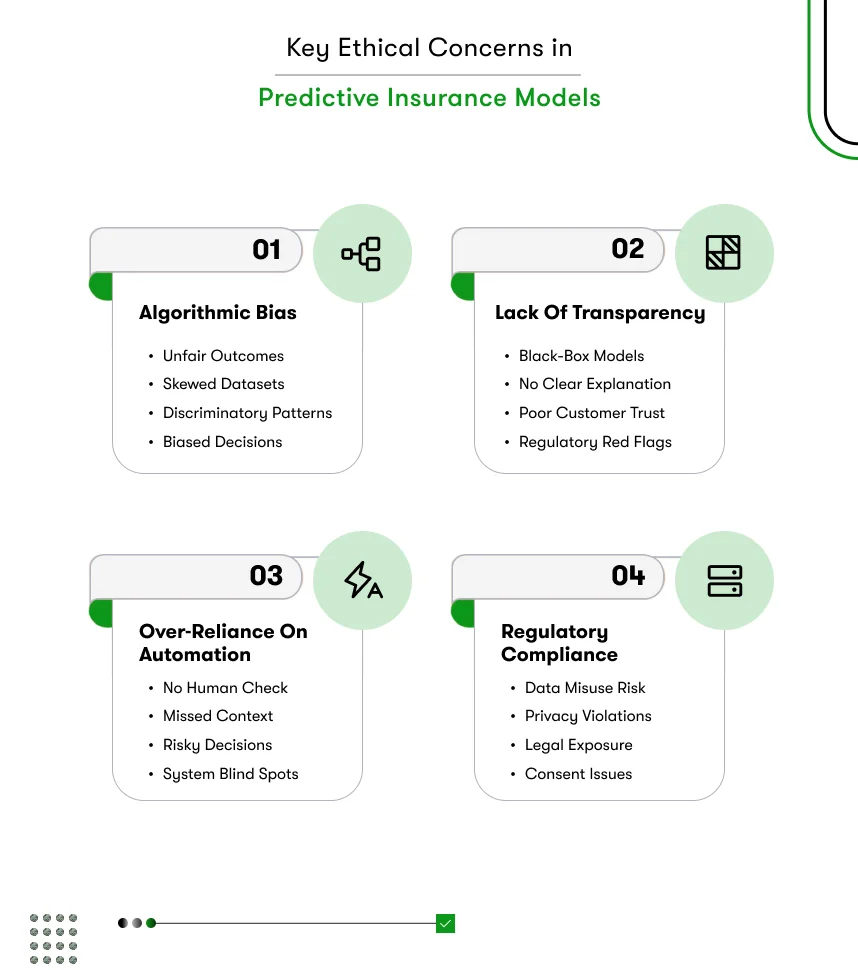

Key Ethical Concerns in Predictive Insurance Models: What Leaders Must Know

Predictive analytics in insurance brings strong advantages, but it also creates new responsibilities. Business leaders must not treat predictive systems as black boxes. If these models affect pricing, claims, or customer outcomes, they must be governed with clear logic and safeguards.

These are the ethical concerns every insurance leader must address:

1. Algorithmic Bias

If models are trained on biased or incomplete data, they may reinforce unfair decisions. Certain customer groups might be penalized without justification. Insurers must test for bias and use diverse datasets during model training.

2. Lack of Transparency

Customers and regulators expect clear explanations for pricing or claim outcomes. Predictive models must produce results that can be explained in simple, traceable terms. Black-box decisions are a reputational risk.

3. Over-Reliance on Automation

Systems that replace human judgment completely are dangerous. Predictive analytics in insurance claims should support human decision-making, not override it. There must be review layers where needed.

4. Regulatory Compliance

Data privacy and usage regulations are evolving. Insurers must ensure their predictive systems comply with all relevant laws, including data consent, retention, and usage.

This conversation isn’t limited to insurance. Ethical issues also apply in other domains that use predictive models, such as predictive analytics to reduce loan defaults in the lending space. No matter the use case, clarity, fairness, and accountability are non-negotiable.

The most advanced companies in the predictive analytics in insurance industry are not only using smarter systems, but also safer, more transparent ones. Ethics is not a limitation, it is a foundation for long-term trust and success.

Case Studies Showing Predictive Analytics in Insurance Apps That Deliver ROI

Predictive analytics is not just reshaping insurance operations; it’s powering specific apps and digital tools that insurers use to gain real business outcomes. Here are verified examples where insurance platforms leveraged predictive models to create measurable results.

1. Allstate QuickFoto Claim App

App Function: Allows users to submit car damage photos via mobile for faster claim approval.

Predictive Analytics Use: Evaluates photo data against historical claim patterns to detect fraud and estimate damage costs.

Result: Cut claim cycle time by up to 50% and reduced adjuster workload.

2. Progressive’s Snapshot Mobile App

App Function: Tracks real-time driving behavior via mobile sensors or plug-in devices.

Predictive Analytics Use: Scores individual risk based on speed, braking, and time of day to personalize pricing.

Result: Boosted policyholder engagement and led to fairer premiums; reduced loss ratio in targeted segments.

3. MetLife’s Vitana App (Singapore)

App Function: Automatically provides pregnancy complication coverage using blockchain and predictive analytics.

Predictive Analytics Use: Assesses risk factors using health and claim data to trigger claim payout automatically.

Result: Enabled zero-claim paperwork and real-time policy issuance and claim settlement.

4. Lemonade AI Claims Bot (Jim)

App Function: Lemonade’s AI bot handles policy issuance and claim processing via mobile app.

Predictive Analytics Use: Detects fraud by analyzing user behavior, voice tone, and claim patterns.

Result: Approved a claim in under 3 seconds and kept loss ratios under control despite fast scale.

5. Aviva Drive App

App Function: Mobile telematics app for motor insurance.

Predictive Analytics Use: Scores drivers based on trip data to recommend discounts or policy adjustments.

Result: Users improved driving habits; Aviva reported better risk prediction and pricing fairness.

6. Zurich Risk Advisor App

App Function: App used by brokers and business clients to assess workplace safety and property risk.

Predictive Analytics Use: Uses historical risk data to model and predict potential loss scenarios based on inputs.

Result: Helped commercial clients identify hidden risk areas, reducing loss events over time.

From instant claim approvals to dynamic pricing and fraud prevention, these insurance apps show how predictive analytics improves real metrics, claim speed, conversion rates, and risk accuracy. The ROI is clear when data powers the tools customers actually interact with.

Tech Stack Behind Predictive Analytics in Insurance: Tools, Platforms & Data Pipelines

Building predictive analytics in insurance starts with the right tech foundation. Tools, data, and infrastructure all play a critical role in making models accurate, scalable, and reliable. Whether it’s for claims, pricing, or fraud, every output depends on what goes in and how well it’s processed.

1. Core Components of the Predictive Analytics Stack

To deliver business results, insurers rely on a combination of:

- Data Sources: Policyholder data, claims history, telematics, CRM data, third-party risk feeds.

- Data Pipelines: ETL tools (like Apache NiFi or Azure Data Factory) ensure clean, timely, and organized data movement.

- Modeling Platforms: Python, R, or platforms like DataRobot and H2O.ai are commonly used for building and training models.

- Storage & Processing: Cloud platforms like AWS, Azure, and Google Cloud provide the scale and speed needed for high-volume processing.

- Deployment Tools: MLOps tools like MLflow or SageMaker deploy models into production safely and consistently.

These layers work together to make predictive analytics in insurance usable at scale.

2. Data Governance and Real-Time Integration

Real-time data is essential in modern use cases like claims automation or behavioral pricing. Insurers use APIs, event-driven architecture, and Kafka-based systems to connect multiple data streams and trigger instant insights.

Just as important is data governance. Predictive models are only as good as the quality, transparency, and compliance of the data feeding them. Insurance leaders prioritize clean pipelines and clear lineage to avoid biased or broken outputs.

3. Use Case-Specific Architecture

The architecture often changes depending on the application:

- Claims: Needs integration with document intake systems, claim scoring APIs, and historical adjudication data

- Underwriting & Pricing: Integrates with policy quoting engines and external risk databases

- Predictive Analytics for Fraud Detection: Often connects to anomaly detection systems, identity verification tools, and behavioral monitoring apps to flag risky activity in real time

The predictive analytics in the insurance sector relies on flexible systems that can support many of these workflows at once.

The Future of Predictive Analytics in the Insurance Industry: Trends to Watch

Predictive analytics in insurance is no longer a back-office tool. It’s quickly becoming a growth driver across underwriting, claims, pricing, customer engagement, and fraud detection. As technology evolves, insurers in the USA, UK, UAE, and other leading markets are adopting new data strategies to gain an edge.

Here are six future-facing trends that are shaping how insurers use predictive analytics in the real world.

1. Real-Time Underwriting and Instant Decisioning

Insurers are replacing traditional risk assessment timelines with real-time decisions. Powered by AI and behavioral data, modern underwriting engines can approve low-risk policies in seconds. This speeds up policy issuance, improves customer experience, and reduces admin load. In both life and P&C lines, real-time underwriting is helping carriers deliver faster, more competitive products.

2. Embedded Insurance Powered by Instant Risk Scoring

Insurance is moving beyond standalone products. Through embedded insurance models, policies are now offered at the point of sale, such as flight cancellation coverage during booking or product protection at checkout. Behind the scenes, predictive models instantly evaluate buyer risk and generate pricing. This trend is reshaping distribution across digital ecosystems and is gaining strong traction in the insurance sector.

3. Behavioral Risk Modeling Using IoT and Telematics

Insurance pricing is becoming personal. Telematics and wearables provide real-time insights into how people drive, live, and manage their health. Predictive analytics in insurance industry now includes behavioral scoring models that tailor coverage to actual risk, not just demographic assumptions. The result: fairer pricing and better risk prediction.

4. Hyper-Personalization and Micro-Segmentation

Insurers are shifting from broad risk pools to customer-level risk views. AI tools segment policyholders into highly targeted groups, enabling more accurate offers and pricing. Just as predictive analytics in credit scoring transformed lending personalization, insurers are using similar models to customize policies by lifestyle, location, and behavior.

5. Explainable AI for Regulatory Transparency

As predictive models become more complex, regulators are demanding transparency. Explainable AI helps insurers show exactly how a decision was made, whether for underwriting, pricing, or claims. This protects against bias and ensures decisions comply with fairness laws. Insurers investing in model governance now are future-proofing against regulatory risk.

6. RegTech and Predictive Compliance Analytics

Compliance teams are now using predictive analytics to detect risk before it becomes a violation. Insurers apply AI to monitor agent behavior, flag unusual sales patterns, and simulate the impact of pricing changes across customer groups. As predictive analytics in banking already proved, compliance analytics reduces manual audits and strengthens internal controls.

The future of predictive analytics in insurance is smarter, faster, and more connected. Insurers who build flexible, explainable, and personalized systems will lead the next wave of innovation in this fast-evolving industry.

Conclusion: Why Predictive Analytics in Insurance Industry Matters

Predictive analytics is helping insurers solve real challenges. It improves fraud detection, speeds up claims, and enables risk-based pricing.

From underwriting to retention, every decision improves when it’s powered by clear, accurate predictions. The results show up in faster service, stronger margins, and better customer trust.

These aren’t minor upgrades. Predictive analytics in the insurance industry now influences growth, compliance, and risk exposure. Just like predictive analytics in credit scoring and predictive analytics in banking transformed financial services, insurance is seeing that same shift, driven by data, not guesswork.

Kody Technolab Ltd. builds predictive analytics systems tailored for insurance. We craft solutions that align with your workflows, data, and business model. Whether you’re building smart claims, automated pricing, or real-time fraud alerts, we help you do it right.

If you’re looking for a fintech app development company that understands how to turn predictive analytics into business results, we’re ready when you are.

Contact Information

Contact Information