The most successful companies don’t wait to react. They’re staying ahead by predicting what’s coming next. Knowing how predictive analytics works is the key to gaining a strategic advantage. With the global market expected to grow from $10.5B in 2021 to $28.1B by 2026 at a 21.7% CAGR, adoption is accelerating, driven by advances in AI, machine learning, and the growing need for faster, smarter business moves. (Markets And Markets)

By analysing historical and real-time information, predictive analytics uses smart algorithms to spot patterns, trends, and signals that indicate what’s likely to happen next. Strategic foresight is built into the core of your business, not just better reporting.

In this blog, we’ll unpack exactly how predictive analytics works, explore the algorithms used in predictive analytics that drive it, how to build a predictive analytics model that makes it usable, and the real-world business applications transforming how companies operate.

But first, let’s look at why predicting the future has become a business necessity.

Why Predicting the Future is the New Business Superpower?

Businesses have the data, they just don’t always know how to use it to their advantage. That’s where AI in predictive analytics makes the difference, shifting strategy from reactive to proactive. It transforms the overwhelming flood of data into forward-looking insights that drive better decisions across operations, marketing, finance, and more.

At its core are algorithms used in predictive analytics, tools that identify patterns and generate forecasts based on real data. Predictive analytics consulting brings tailored predictive analytics models that can, for example, anticipate customer churn, forecast demand, or detect risk long before it surfaces.

And this isn’t hypothetical. Consider these predictive analytics model examples:

- A retailer forecasts product demand to streamline inventory.

- A bank uses fraud detection algorithms in real-time.

- A healthcare provider identifies high-risk patients before complications arise.

With the right approach, and by learning how to build a predictive analytics model, any company can gain this strategic advantage. And it all begins with the right algorithm.

What Problems Does Predictive Analytics Solve for Businesses?

We have discussed how predictive analytics works so far and its emergence as one of the key capabilities for organisations looking into the future. However, for business leaders, the core question actually is: What problems does it solve?

Simply put, predictive analytics, at its heart, is not about technology; it is about the results that come out of it. It is about transforming raw data into strategic foresight that allows a company to find its way through complexity, lower its uncertainties, and with confidence take better decisions. If you want to learn the basics, a predictive analytics guide will help you.

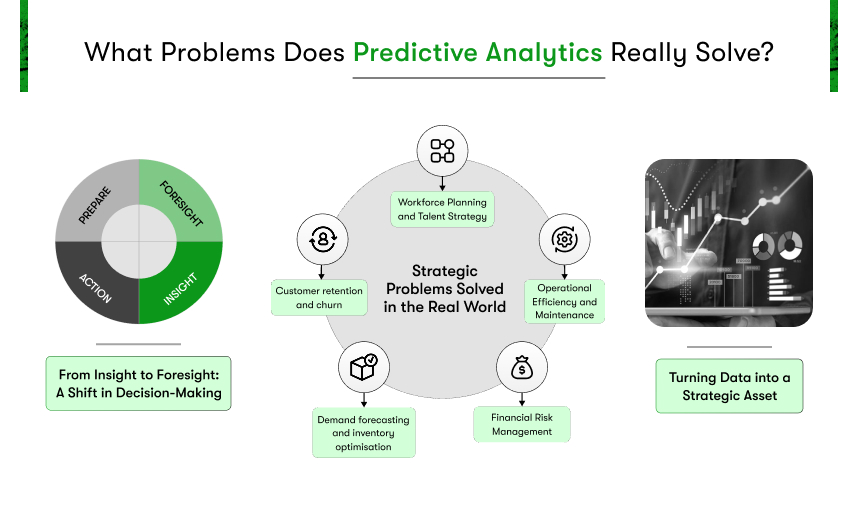

A Shift In Decision-Making

Most companies employ analytics in one form or another. Reports, dashboards, performance metrics, these are all very useful ways to see what happened. Predictive analytics goes a step further and tells you what will happen.

Most business decisions are still made with incomplete data or gut instinct. Whether it’s entering a new market, launching a product, or setting prices, uncertainty slows down momentum and increases the risk of costly assumptions.

Predictive analytics models cover that blind spot. They make visible the updates and give you data-backed foresight that you can use to run different scenarios before actually doing the move. It’s not only better data but better timing, better planning, and ultimately, better business.

Strategic Problems Solved in the Real World

Businesses usually get confused about predictive analytics vs traditional analytics. But across industries, here are just a few of the areas in which predictive analytics today actively solves critical business problems:

- Customer retention and churn: Predictive models provide early warning signs of a customer’s risk of churn, thus enabling sales and service teams to take action before it is too late. Higher retention rates mean lower acquisition costs, while tighter feedback loops between experience and loyalty will obtain real value.

- Demand forecasting and inventory optimisation: Predictive analytics adds precision to supply chains for manufacturers and retailers. Predictive analytics algorithms take seasonal trends, regional behaviors, or external forces into account so that you are neither overstocked nor understocked and never taken by surprise.

- Financial Risk Management: Predictive Analytics Models are changing the lives of CFOs in managing the aspects of credit risk, fraud detection, and financial planning. Businesses will now be able to analyse transactional patterns and flag abnormal behavior, predict late payments, and dynamically adjust lending policies.

- Operational Efficiency & Maintenance: Predictive maintenance models work across industries heavily dependent on machines or logistics to reduce downtime and increase the lifespan of assets. It is about saving a buck, but more about not having the inconvenience of disruptions even coming into existence.

- Workforce Planning & Talent Strategy: HR leaders are using predictive analytics algorithms to forecast attrition, optimise hiring pipelines, and anticipate workforce shifts. It allows teams to be proactive rather than reactive with one of the company’s most expensive resources, its people.

Turning Data into a Strategic Asset

One of the most overlooked values of predictive analytics is how it transforms the way companies view their data.

Predictive analytics engages data not merely as something one might report on, but rather as an active part of current decision-making for the purpose of competitive advantage. For management, this means moving from descriptive dashboards to actual predictive insight seamlessly embedded in their business operations.

And here, predictive analytics go beyond a mere technology investment; It creates a cultural change whereby planning is proactive instead of reactive, where risk is mitigated based on facts rather than crossed fingers, and where business decisions are calculated instead of improvised.

Turning Data into Action: How Predictive Analytics Works (Step-by-Step with Examples)

From the pool of uncertainties, predictive analytics gives input to actionable outputs. But this is not mere number-crunching or modeling; rather, it is the application of data to intelligently solve unique business problems.

Let’s walk through a practical, real-world use case to understand how predictive analytics works in an actual situation, not in theory, but in practice. Suppose you run an e-commerce website and you are encountering some of the challenges that almost every e-commerce website faces.

The Business Scenario: A Drop in Repeat Purchases

The company acquired many new customers, thanks to good marketing, which drew visitors and brightened first-time sales performances. But something’s missing: that repeat purchase isn’t coming in. Customers buy once and disappear.

The leadership sets a target: identify which customer is going to buy again in 30 days, then reconnect with that customer before they fall off.

Stage 1: Define the Business Problem

All predictive initiatives begin with clarity. The more specifics included in the business question, the more accurate and beneficial the prediction.

Instead of the question, “How do we improve customer retention?”, the team looks at it this way: “Which customers might make a repeat purchase within 30 days of their last transaction?”

That one shift from the predictive analytics strategy for non-tech teams to specific one, changes the way the business addresses the problem.

This phase aligns stakeholders to make sure to direct the data science teams toward a definable, action-based objective.

Stage 2: Collect and Prepare the Data

With the objective set, the focus shifts to data. But not just any data, the right data.

The team starts pulling customer behavior and interaction data:

- Purchase history and order frequency

- Browsing patterns and product categories viewed

- Marketing engagement (emails opened, clicked, or ignored)

- Loyalty program activity and coupon usage

- Customer support interactions

From there, they prepare the dataset. Missing values are cleaned, fields are standardised, and meaningful features are created, things like:

- Time since last purchase

- Number of sessions in the past week

- Average order value

- Discount sensitivity score

This process sets the foundation. Strong models are built on clean, structured, relevant data, not just more of it.

Stage 3: Choose the Right Algorithm

Now it’s time to determine how the prediction will be made.

Since the outcome is binary (will repurchase or won’t), the team considers classification algorithms. In this case, they choose Random Forest a model that handles mixed data well and offers strong accuracy with explainable results.

Other algorithms used in predictive analytics might include:

- Logistic Regression – for simplicity and interpretability.

- Gradient Boosting Machines (e.g., XGBoost) – for higher performance with complex data.

- Random Forest strikes the right balance it performs well and is transparent enough to explain which behaviors influence predictions.

Stage 4: Build and Train the Model

With the predictive analytics algorithms selected, the model is trained on historical data, past behaviors and known outcomes.

It learns to associate certain behaviors with outcomes:

- Customers who return to browse within a week of purchasing

- Those who engage with multiple categories

- Frequent email openers or coupon users

These patterns become the model’s logic its way of understanding the early signals of a likely repeat buyer. Behind the scenes, it calculates probabilities for every customer, assigning a likelihood score for a future purchase.

Stage 5: Test and Validate the Model

Training is only half the story. Before the model can guide real decisions, it needs to prove it can perform in real-world conditions.

The team tests the model on unseen data, measuring:

- Precision – Are the predicted repeat buyers actually converting?

- Recall – Is the model identifying most of the customers who return?

- F1 Score – A balance of both

This step ensures confidence. It prevents missteps like over-targeting customers with low intent or ignoring high-potential buyers.

Once the model meets the performance thresholds, it’s ready to go live.

Stage 6: Deploy the Model into Business Workflows

Now, the model becomes part of day-to-day operations.

Each week, it scores active customers and identifies those most likely to repurchase. These predictions plug directly into the marketing platform, triggering personalised campaigns based on customer intent.

- High-likelihood customers receive curated product recommendations.

- Mid-range scores trigger gentle nudges or loyalty offers.

- Low-likelihood customers enter long-term engagement campaigns.

No guesses! Nothing fits all! It’s the only communication made by predictive intelligence in real-time.

Stage 7: Monitor, Retrain, and Optimize

With business conditions changing, customer behavior also changes. Every day, new data is received. It is for this reason that the final stage, i.e., ongoing monitoring and refinement, becomes extremely crucial. Model performance is regularly evaluated, and the model is retrained with new and current data throughout its life cycle to remain relevant.

- Accuracy is tracked over time

- New features are tested and added

- Campaign impact is linked back to model performance

The Predictive Models That Power Smart Business Decisions

Predictive analytics has never been limited to understanding data alone, but going beyond it to making confident decisions under uncertain circumstances. All business problems, however, tend to differ from one another. Therefore, whether it is demand forecasting, churn prevention, or delivering customised experiences, the successful implementation of one’s predictive approach depends on selecting the right predictive model for the desired outcome, as well as achieving better ROI of predictive analytics.

Let’s explore the six core model types businesses use today, and how they drive real impact across industries.

1. Classification Models: The Backbone of Smarter, Faster Yes/No Decisions

These models are built for binary outcomes, yes or no, churn or stay, fraud or legitimate. They’re essential wherever quick, automated decisions are required at scale.

Use it when: You need to identify risks, qualify leads, or trigger timely actions.

Real-world predictive analytics models examples:

- Spotify detects fake streaming activity in real time.

- Salesforce helps sales reps prioritise leads likely to convert.

Classification models reduce uncertainty and streamline decision-making in everything from fraud detection to customer retention.

2. Regression Models: Precision Forecasting for Revenue, Demand, and More

When you need to predict a number such as how much, how soon, or how often, regression models deliver the answers.

Use it when: You’re estimating spend, forecasting sales, or projecting customer lifetime value.

Real-world predictive analytics models examples:

- Uber predicts estimated arrival and wait times.

- Zillow estimates home values based on market trends.

With regression, leaders gain a clearer view of the future, supporting better resource allocation and strategic planning.

3. Time Series Models: Stay Ahead by Predicting What’s Coming Next

Markets move. Behavior shifts. Demand fluctuates. Time series models help organisations anticipate trends over time, not just respond to them.

Use it when: You need to forecast sales cycles, traffic trends, inventory demand, or capacity needs.

Real-world predictive analytics models examples:

- Amazon uses time series forecasting to optimise global inventory levels.

- Netflix predicts viewing surges to manage streaming infrastructure.

These models help businesses reduce waste, stay responsive, and deliver consistently, even in dynamic environments.

4. Clustering Models: Discover Untapped Opportunities in Your Data

Sometimes the most valuable insights are the ones you’re not explicitly looking for. Clustering reveals hidden patterns, segments, or customer groups you didn’t know existed.

Use it when: You want to segment customers, tailor campaigns, or group products based on shared behavior.

Real-world predictive analytics models examples:

- Airbnb segments travelers based on booking habits and travel style.

- Google Ads groups users by behavioral clusters for smarter targeting.

Clustering enables smarter personalisation, better customer understanding, and more relevant marketing with minimal assumptions.

5. Recommendation Models: Drive Conversions Through Personalization at Scale

Customers expect relevance. Recommendation models ensure every product suggestion, message, or content piece feels tailored, because it is.

Use it when: You want to increase engagement, upsell intelligently, or boost basket size.

Real-world predictive analytics models examples:

- Amazon drives a major share of revenue through predictive product recommendations.

- YouTube keeps users engaged with algorithmically tailored video suggestions.

These models aren’t just nice to have; they directly fuel revenue growth and long-term loyalty.

6. Survival Analysis Models: Know Not Just If but When to Act

Timing matters. Survival models estimate the time until a specific event happens, whether it’s churn, failure, or cancellation.

Use it when: You need to predict when customers will leave, when machines will fail, or when action is needed.

Real-world predictive analytics models examples:

- HubSpot predicts when a customer is likely to churn, enabling proactive outreach.

- Healthcare providers use survival analysis to anticipate readmission risks.

By understanding when something will happen, not just if, businesses can act earlier, smarter, and more effectively.

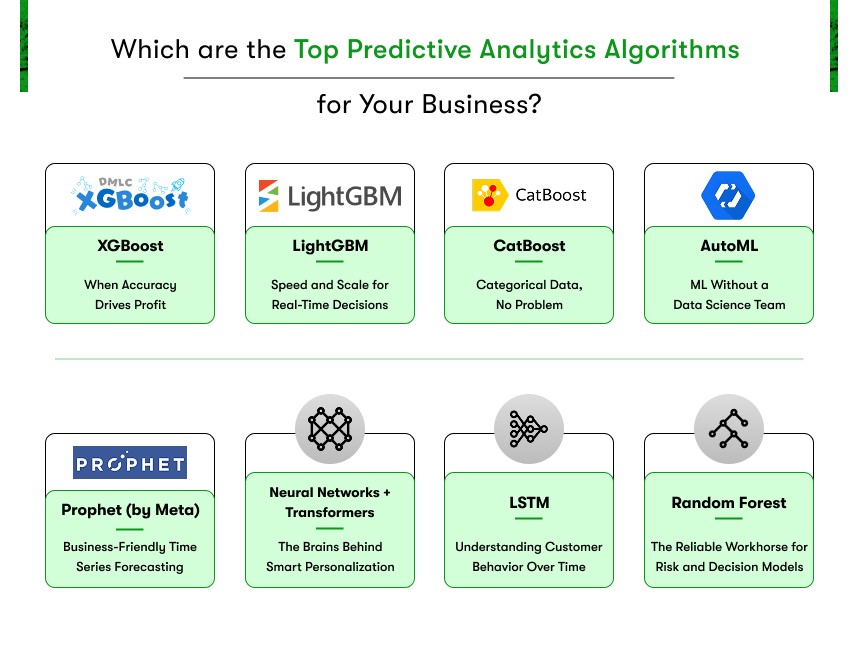

Which Predictive Analytics Algorithms Are Right for Your Business Goal?

Once you’ve defined your business challenge and identified the predictive model you need, whether it’s classification, regression, time series, or recommendation, the next step is choosing the right algorithms used in predictive analytics to drive it.

This is where decisions can get overwhelming. With so many options available in AI & machine learning in predictive analytics, how do you know which one aligns with your data, your goals, and your operational reality?

Below is a practical breakdown of commonly used predictive analytics algorithms, what they’re good at, and where they’re already delivering results in the real world.

Let’s walk through them.

XGBoost – When Accuracy Drives Profit

Best for: Structured data, high-stakes prediction, performance-critical models

XGBoost (Extreme Gradient Boosting) is often the go-to choice when businesses need maximum predictive accuracy and can invest in proper model tuning. It’s particularly effective when you’re working with rows-and-columns-style business data such as sales figures, customer behavior logs, and transaction histories.

Real-world example:

Alibaba uses XGBoost in its recommendation system to personalise product listings based on user behavior. The accuracy helps boost conversions on an enormous scale.

Predictive analytics use cases:

- Customer churn prediction

- Lead scoring

- Credit risk modeling

- Inventory forecasting

In predictive analytics use cases where decisions directly impact revenue or risk, and clean, structured data is available, XGBoost offers one of the best balances of speed, power, and accuracy.

LightGBM – Speed and Scale for Real-Time Decisions

Best for: Fast performance with large datasets, low-latency predictions

LightGBM (Light Gradient Boosting Machine) is engineered for speed and scale. It’s used in real-time systems where milliseconds matter, like ad bidding, fraud detection, or real-time personalisation.

Real-world example:

Bookingcom applies LightGBM in its pricing and recommendation engines, where decisions need to be made instantly across millions of users and destinations.

Use cases:

- Ad targeting platforms

- Real-time fraud detection

- Dynamic pricing systems

- Instant content or product recommendations

If you’re operating in high-speed, high-volume environments, LightGBM delivers results without slowing down your stack.

CatBoost – Categorical Data, No Problem

Best for: Datasets with many categories-like those of customer IDs, product types, locations…

While other algorithms used in predictive analytics have difficulty dealing with categorical features, CatBoost works wonders. It handles categoricals natively without needing complicated preprocessing, thus being an excellent fit for industries heavily laden with labeled data such as retail, telecom, and finance.

A real-world example is:

Applications for small loans at Tinkoff Bank are scored in real time, given the fact that this bank is a large digital bank in Russia. This real and currently made example has possible explanations of performance and convenience in dealing with large and real-time input data processing.

Use cases:

- Product recommendation engines

- Targeted marketing segmentation

- Loan and credit approvals

- Customer support routing

When your data is full of labels such as types, names, or segments, CatBoost is a fast track to accuracy with less preprocessing.

AutoML – ML Without a Data Science Team

Best for: Teams without in-house data scientists who still want predictive power

AutoML tools (like Google Cloud AutoML, Amazon SageMaker Autopilot, or Microsoft Azure AutoML) automate the entire machine learning process, from algorithm selection to training, tuning, and deployment.

Real-world example:

Urban Outfitters used Google Cloud AutoML to launch a style-based recommendation engine, without needing to build a large ML team internally.

Use cases:

- Small-to-mid-sized businesses without data science resources

- Quick experimentation

- Internal proof-of-concept models

If you want to harness predictive analytics but lack the technical muscle, AutoML platforms make AI accessible and operationally viable.

Prophet (by Meta) – Business-Friendly Time Series Forecasting

Best for: Someone in business interested in forecasting predictive analytics trends, seasonality, as well as growth patterns.

Introduced by Meta (Facebook), Prophet is developed as a time series forecasting model aimed at business users. It is great for situations where interpretable, reliable forecasts are needed without statistical knowledge.

Real-world examples:

Internally, Facebook uses Prophet to forecast, ranging from server loads to ad revenue performance.

Use cases:

- Sales forecasts

- Website traffic projections

- Inventory planning

- Seasonal demand forecasting

For teams needing quick, understandable, and business-ready time-based forecasts, Prophet is often the right call.

Neural Networks + Transformers – The Brains Behind Smart Personalization

Best for: Text, customer behavior, unstructured data, personalisation at scale.

Neural networks (especially Transformer-based architectures like BERT or GPT) are behind the most advanced personalisation systems today. They can process text, learn customer behavior, and power smart recommendations that feel human-like.

Real-world example:

Netflix and TikTok use neural networks to understand content preferences and deliver hyper-personalized experiences that keep users engaged longer.

Use cases:

- Natural language search

- Product and content recommendation

- Chatbots and customer service automation

- Behavior-based marketing

If your data includes unstructured elements like text, logs, or sequences, and your customer experience depends on personalisation, neural models deliver.

LSTM – Understanding Customer Behavior Over Time

Best for: Sequential data, subscriptions, usage patterns, app engagement

The main purpose of Long Short-Term Memory (LSTM) networks is to learn patterns associated with time. They create models to study customer journeys, application usage patterns, and subscription behavior.

Real world example :

The Spotify LSTM models are used to predict listening habits and keep playlists up to date with the changing tastes of their users.

Use cases:

- Churn prediction based on app engagement

- Personalised email timing

- Session-based recommendations

- Time-series classification

If you’re tracking behavior across time, like how customers move through your app or how their preferences evolve, LSTM can reveal what’s coming next.

Random Forest – The Reliable Workhorse for Risk and Decision Models

Best for: Balanced performance, explainability, and strong general-purpose modeling

Random Forest is one of the most versatile predictive analytics algorithms. It’s often used as a baseline model because it’s easy to understand, fast to train, and surprisingly powerful across classification and regression tasks.

Real-world example:

Capital One uses Random Forest models to flag potential fraud while still allowing fast approvals for genuine transactions.

Use cases:

- Credit scoring

- Fraud detection

- HR attrition modeling

- Insurance risk profiling

When you want solid performance, explainable results, and ease of implementation, Random Forest is a dependable choice.

Choosing the Right Algorithm Starts with the Right Problem

Each algorithm is optimised for a different type of problem, data, or speed requirement.

The key is knowing:

- What question are you trying to answer

- What data do you have available

- How fast and accurately you need to act

You don’t have to know the math behind every algorithm, but you do need to know which one aligns with your business goal. Whether it’s boosting conversions, lowering churn, predicting risk, or delivering personalised experiences, the right model makes all the difference.

Business Benefits: Why Predictive Analytics Pays Off

At its core, predictive analytics is about clarity: seeing what’s ahead, knowing where to focus, and acting with confidence before it’s too late or too expensive. But the real value doesn’t just lie in better predictions. It lies in the tangible business outcomes that follow.

From reduced costs to faster decisions and more loyal customers, organisations that invest in predictive analytics are seeing returns across every major function. Here’s how predictive analytics works and pays off in practice.

Faster, More Confident Decision-Making

In fast-moving markets, speed is strategy. Predictive analytics enables business leaders to move quickly, but with insight, not just instinct.

Rather than waiting for trends to fully materialise, teams can anticipate changes and respond proactively. Whether it’s adjusting campaign budgets mid-quarter, shifting inventory based on demand forecasts, or optimising pricing, predictive models provide the foresight to act early and get it right more often.

Significant Cost Reduction Across Key Functions

When decisions are driven by data, efficiency follows. Predictive analytics allows companies to cut waste across operations:

- In marketing, it prevents overspending on low-conversion segments by focusing only on high-probability leads.

- In inventory, it reduces overstock and understock situations through accurate demand forecasting.

- In operations, it streamlines staffing, logistics, and supply chain planning by predicting bottlenecks and resource needs in advance.

The result? Lower costs, tighter margins, and less reliance on reactive corrections.

Pinpointed Customer Targeting and Higher ROI

Knowing which customers are likely to buy and what they’ll respond to transforms how companies run campaigns.

Predictive models allow marketing and sales teams to segment with surgical precision. High-intent customers receive personalised offers at the right time. At-risk customers can be engaged before they leave. And low-value segments can be deprioritised, saving time and resources.

This not only boosts conversion rates, but also highlights the ROI of predictive analytics, ensuring teams spend less to earn more.

Early Detection of Risk Before It Escalates

One of the most immediate benefits of predictive analytics is its ability to spot problems before they fully surface.

Whether it’s a user likely to churn, a transaction that looks suspicious, or a customer account showing credit default signals, predictive models can alert teams early, giving them the chance to mitigate risk, recover relationships, or prevent loss.

For industries like banking, insurance, SaaS, and retail, this kind of early warning system is a competitive necessity.

Smarter Inventory and Resource Allocation

Predictive analytics helps operations teams go from guesswork to precision.

Using time series models and historical data, companies can accurately forecast product demand, seasonal trends, and even logistics challenges. This ensures warehouses are stocked appropriately, labor is scheduled efficiently, and customer wait times are minimised.

Retailers like Walmart and Zara have built global efficiency advantages around their ability to forecast and move resources dynamically, backed by predictive systems.

A Clear Competitive Advantage in Every Industry

When decisions are made faster, marketing is more effective, and risk is managed proactively, the advantage compounds.

Companies using predictive analytics gain agility, focus, and resilience. They can test faster, iterate quicker, and pivot more effectively when the market shifts. Over time, this leads to better performance not just operationally, but financially.

As adoption increases, predictive analytics is no longer just a competitive edge; it’s becoming the baseline for how top-performing companies operate.

Deeper Personalization = Better Customer Satisfaction

Customers today expect experiences that feel tailored, timely, and relevant. Predictive analytics is what makes that possible at scale.

By analysing past behaviors, preferences, and engagement patterns, companies can personalise:

- Product recommendations

- Email content and timing

- Support experiences

- Loyalty offers

This leads to higher satisfaction, stronger retention, and a better brand experience without adding manual effort to your teams.

Faster Response to Changing Market Conditions

Markets shift. Customer behavior evolves. Demand fluctuates.

Predictive analytics enables businesses to respond in near real-time. Instead of relying on quarterly reports or lagging indicators, leaders can adjust strategy as new patterns emerge, keeping marketing agile, inventory aligned, and pricing competitive.

Especially in uncertain environments, this ability to course-correct fast is one of the most valuable assets a company can have.

Real-World Applications by Industry: Predictive Analytics in Action

Predictive analytics isn’t theoretical. It’s working right now in the background of hospitals, banks, online stores, airports, and factory floors, quietly driving smarter decisions, reducing waste, and improving experiences.

Here’s a look at how different industries are using predictive analytics to solve their most pressing predictive analytics challenges and stay ahead of disruption.

Healthcare: From Reactive to Preventive Care

Here’s how predictive analytics works in healthcare:

Healthcare is shifting from a reactive model, treating illness after symptoms appear, to a preventive one. Predictive analytics plays a crucial role by identifying patterns in patient data that signal future health risks, enabling earlier intervention and more personalised care.

Real-world applications:

- Mount Sinai Health System uses predictive models to anticipate patient deterioration in ICUs, allowing earlier intervention and reducing mortality rates.

- Geisinger Health applies predictive analytics to reduce hospital readmissions by identifying high-risk patients at discharge.

- IBM Watson Health (prior to its restructure) used AI models to assist in cancer diagnosis and treatment planning.

Impact & data:

A report by Research Gate indicates that predictive analytics implementations have achieved a 67% reduction in hospital-acquired infections and a 45% decrease in readmission rates across participating healthcare facilities.

Fintech: Smarter Risk and Fraud Management

Here’s how predictive analytics works in Fintech:

In financial services, risk is constant but predictable. Predictive models help assess creditworthiness, flag suspicious behavior, and forecast defaults, all in real time.

Real-world applications:

- Lemonade, an AI-driven insurance platform, uses predictive analytics to assess claims and automate payouts, with fraud detection embedded in every decision.

- Capital One uses machine learning to detect fraudulent credit card transactions in milliseconds.

- Zest AI helps lenders make fairer and more inclusive credit decisions using explainable predictive models.

Impact & data:

According to number analytics, DBS Bank’s digibank platform leverages predictive analytics from its customers’ data to provide personalised financial insights and recommendations, resulting in a 40% increase in customer engagement and a 10% increase in product adoption.

Retail & eCommerce: Personalization That Converts

Here’s how predictive analytics works in retail and eCommerce.

Retailers use predictive analytics to anticipate demand, optimise pricing, personalise product recommendations, and tailor marketing to individual customer journeys.

Real-world applications:

- Amazon uses a combination of regression and recommendation models to power its “customers also bought” and “you might like” engines, generating up to 35% of total revenue through predictive recommendations.

- Sephora uses predictive models to personalise promotions and forecast inventory demand across stores.

- Walmart leverages predictive analytics to dynamically price products and manage seasonal stock fluctuations.

Impact & data:

A study by Statista showed that department stores with predictive analytics were forecast to reach 9.2 billion U.S. dollars globally, a 27 percent compound annual growth rate since 2015.

Logistics & On-Demand Services: Efficiency in Every Movement

How predictive analytics helps:

In logistics and last-mile delivery, delays cost money. Predictive models help optimise routing, forecast demand surges, and prevent delivery disruptions, especially during peak periods.

Real-world applications:

- UPS uses predictive analytics in its ORION system to optimise delivery routes in real time, saving more than 100 million miles and 10 million gallons of fuel annually.

- Uber relies on predictive demand modeling to position drivers before ride requests spike, improving pickup times and reducing rider churn.

- DHL uses machine learning to predict parcel volumes and dynamically scale labor and logistics resources.

Impact & data:

UPS reports saving over $400 million per year through its predictive route optimisation system alone.

Travel & Hospitality: Anticipating Demand and Personalizing Experience

How predictive analytics helps:

Travel companies rely on predictive insights to manage bookings, personalise offers, and optimise pricing based on factors like seasonality, customer history, and real-time demand signals.

Real-world applications:

- Hilton uses predictive models to forecast occupancy rates and dynamically adjust room pricing.

- Airbnb analyses booking behavior to recommend properties and travel experiences based on user intent and previous activity.

- Delta Airlines predicts no-shows and rebooking demand to adjust inventory in real time, reducing lost seat revenue.

Impact & data:

Airbnb increased booking conversions by applying predictive analytics models that personalise search results based on user behavior, leading to more relevant and timely recommendations.

Supply Chain & Manufacturing: From Disruption to Resilience

How predictive analytics helps:

In manufacturing and supply chain, AI in predictive analytics improves demand forecasting, prevents equipment failures, and optimises production scheduling to avoid costly downtime.

Real-world applications:

- Siemens uses predictive maintenance models to monitor industrial equipment health and prevent breakdowns before they happen.

- Unilever employs predictive analytics to streamline supply chain planning across its global operations, reducing stockouts and inventory holding costs.

- Tesla combines IoT and predictive analytics to track factory efficiency and proactively resolve bottlenecks in real time.

Impact & data:

GE estimates that predictive maintenance can reduce unplanned downtime by 30–50%, and cut maintenance costs by 10–40%.

Final Thoughts: Making Predictive Analytics Work for Your Business

Predictive analytics consulting isn’t just a data initiative; it’s a strategic asset that leads to faster decisions, sharper targeting, smarter operations, and measurable impact on every part of the business.

It helps companies keep track of trends, minimise risk, and personalise experiences at scale, as seen in multiple industries.

However, success is about more than technology; it is about understanding the objectives you are trying to pursue, working with clean data, cross-functional alignment, and the correct models for the right problems. By incorporating predictive analytics into daily decision-making, an organisation transforms the tool into a competitive advantage: now a capability that allows it to lead with foresight rather than with hindsight.

Contact Information

Contact Information