The eBanking and Mobile Banking trend will eat up the traditional banking services!! 🤯

Though these words do not come from any expert, economist, or FinTech geek, they still sound true. Don’t they?

The mobile banking app market has seen significant growth in recent years. According to a report by GlobeNewswire, The 🌏 mobile banking market revenue was valued at $692.5 million in 2021 and is expected to grow at a CAGR of 11.9% during the period of 2022-28. Talking about banking app scenarios in the Netherlands and Germany,

85.7% of people in the Netherlands used mobile banking services in 2022, while 3.3 million people access online banking in Germany daily.

You can say this growth results from the increasing adoption of smartphones and the convenience of banking through mobile apps. Additionally, the emergence of the COVID-19 pandemic prompted the global audience toward digital banking. Consequently, the demand for creating mobile banking apps started to sprout, showing no sign of halting.♾️

This is the ultimate guide on Banking App Development, taking you through crucial aspects required to ensure a bank’s successful digital transition. With some market insights, we’ll also dive into banking apps that inspire other banks to leverage technology before it’s too late.

Why is it Now or Never for the Banks to develop an app?

The demand for banking app development is also surging with the number of mobile users. And if banks don’t adapt to this digital transformation, they might lose their customers to Fintechs.

Because Bunq, Revolut, Rabobank, N26, and more digital-only banks have started to disrupt the Dutch banking market. These banks constantly invest in leveraging technology to offer superior banking and financial services most conveniently.

According to McKinsey, till September 2022, there were at least 274 fintech companies with a unicorn valuation of more than $1 billion, up from just 25 in 2017. Collectively, they have a market value of more than $1 trillion.

Offering comprehensive financial solutions with the utmost convenience, Fintechs have raised customer expectations. In contrast, once the go-to for comprehensive financial services, traditional banks have lagged behind the rapid technological evolution. Services like checking accounts, loans, and corporate advisory appear indistinguishable. Customers are growing frustrated with the financial fragmentation imposed by banks on various consumer processes.

In response to this growing frustration and the need for modernization, banking app development emerges as a transformative solution. The report says that banks that successfully manage Digital transformation will become bigger and more profitable and grow faster while leading to a value creation opportunity of up to $20 trillion.

Here’s your key to understanding the complete Digital Banking Transformation and creating a marvelous strategy to beat your competitors.

Now, let us see what made mobile app development so prominent for Banks and Fintech.

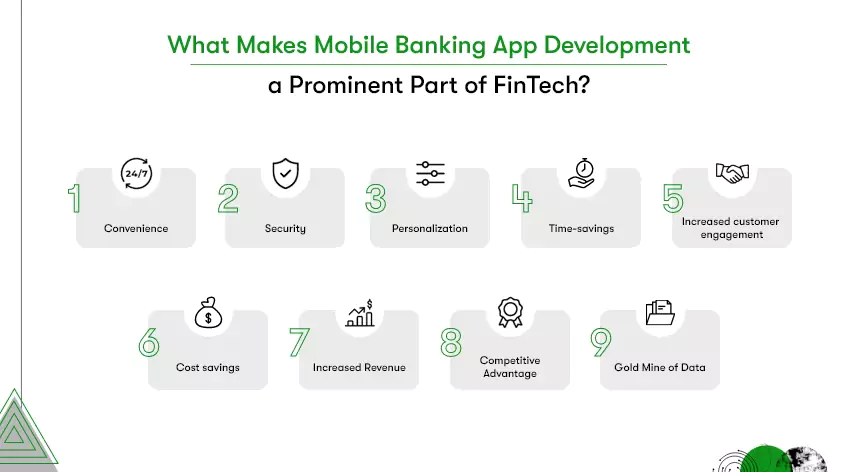

What makes Mobile Banking App Development a prominent part of FinTech?

Mobile banking app development is an inseparable part of FinTech. The reason is apparent. This innovative solution allows financial institutions and companies to provide their customers with convenient, secure, and efficient banking services right through their smartphones. Since people are more mobile-holic🤳 nowadays, there couldn’t be a better solution than developing a mobile app to earn their loyalty.

And, of course, enhanced customer experience will be the by-product of the approach. But you want more benefits than this, don’t you? So just read on…

🏪Convenience: Mobile banking apps allow users to access their bank accounts, view transactions, transfer money, and pay bills from anywhere, at any time.

🔐Security: Mobile banking apps use advanced security features, such as biometric authentication and encryption, to protect user data and transactions.

👥Personalization: Mobile banking apps can provide users with personalized offers, rewards, and financial education, which can help them make better financial decisions.

🗓Time-saving: apps can automate repetitive tasks and save time for the user, such as saving monthly statements.

These were in favor of end customers. Now, let us shed some light on the advantages of creating a mobile banking app for the company, bank, or financial institutions.

🙋🏻Increased customer engagement: Mobile banking apps can increase customer engagement and loyalty by providing customers with convenient and personalized banking services.

🐖Cost savings: By providing customers with the ability to perform banking tasks through a mobile app, financial institutions can reduce the costs associated with maintaining physical branches and ATMs.

📈Increased revenue: Mobile banking apps can generate additional revenue for financial institutions through in-app purchases, advertising, and other monetization strategies.

🙌Competitive advantage: Offering mobile banking services can help financial institutions stay competitive by providing customers with the latest banking technology and services.

🧈Gold Mine of Data: The mobile banking app can help financial institutions gather valuable data on customers’ spending habits, location, and other preferences, which can be used to improve their products and services.

So, now let us get to the business directly, i.e., How to create a banking application.

Which market trends prompt entrepreneurs to create a mobile banking app?

There are several emerging trends in the mobile banking app development industry for new entrepreneurs and existing financial companies:

Artificial Intelligence (AI) and Machine Learning (ML): Banks and FinTechs actively use AI and ML, making it the hottest trend. Here are the top AI/ML use cases.

- Fraud Detection: Real-time analysis to prevent fraud.

- Customer Service Chatbots: 24/7 automated support.

- Credit Scoring: Assessing creditworthiness.

- Personalized Recommendations: Tailored product suggestions.

- AML Compliance: Flagging suspicious activities.

- Sentiment Analysis: Gauging public opinion.

- Data Security: Protecting sensitive information.

- Robotic Process Automation: Automating tasks.

- Predictive Analytics: Forecasting trends and risks.

If you want to use AI in your banking app, you must know Everything about using AI in Banking App Development!

Biometric Authentication: Biometric authentication methods, such as facial recognition, fingerprint recognition, and voice recognition, have become more popular as they provide a more secure and convenient way for users to access their accounts.

Open banking: To offer open banking services, banks can leverage APIs to collaborate with Fintechs. This way, banks provide seamless customer experience and access to a broader range of financial products.

Blockchain: Blockchain technology is also being explored by some banks as a way to provide secure and transparent mobile banking services.

Gamification: Gamification of banking apps is becoming increasingly common to make the banking experience more engaging and interactive for customers. Gamification in the banking app is also an effective way to educate customers on different financial terms.

Integration with other platforms: Integrating the mobile banking app with other platforms, such as social media, messaging apps, and e-commerce platforms, is becoming a trend to provide a more seamless experience to customers.

Now that you know the importance and trends of mobile banking app development, let’s explore how to build one!

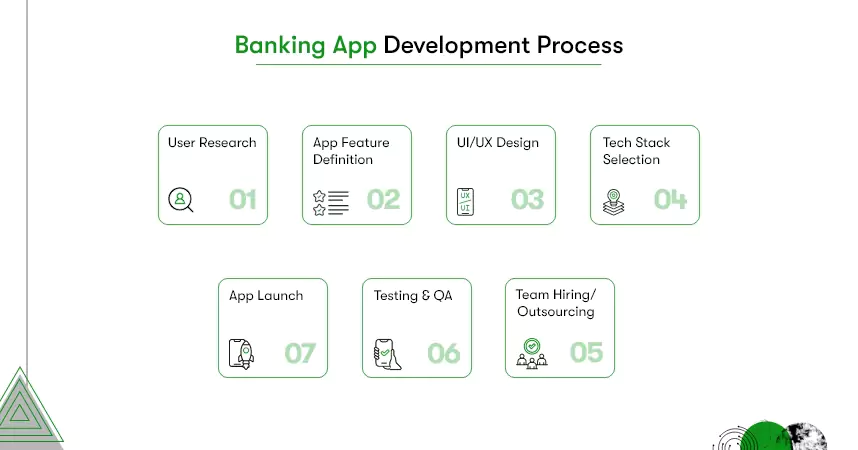

How to Create a Banking Application: Banking App Development Step-by-Step

To understand how to create a banking application, we have broken down the mobile app development process into six steps. But that doesn’t mean there are only six steps. It is because we don’t want to complete things here. Hence, we have cut down the auxiliary and sophisticated information and provided only the necessary information to eliminate confusion.

Conduct user research to understand user needs and pain points.

Market research is a crucial step as it includes studying the pain points of end users, their preferences, as well as competitors, and their strengths and weaknesses. You can conduct interviews and surveys and gain insights into your target audiences. It will become easier to define and align the app design and features, and functionalities to your audience’s expectations using such information.

Defining the app’s features and functionality

Based on the target audience and market research, now you will know what features and UI elements are essential to grab users’ attention and gain a competitive advantage. If we were to consider the USA market, a study by Statista revealed that 90% of users use a mobile banking app to view an account balance, followed by 79% to track recent transactions.

The study also revealed the below reasons why people use such apps that may help you prioritize features in your mobile banking app development.

- 90% to view account balance;

- 79% to view recent transactions;

- 59% to make bill payments;

- 57% to transfer funds;

- 20% to contact customer service;

- 19% to open a new account;

- 17% to reorder checks.

Based on such studies and your own research, you would be able to outline the effective feature set. But in case you need inspiration, we have listed out some significant banking app development features here.

However, you must not forget that the number and complexity of features will directly impact the overall cost of building a banking app. Now, let us shed light on features.

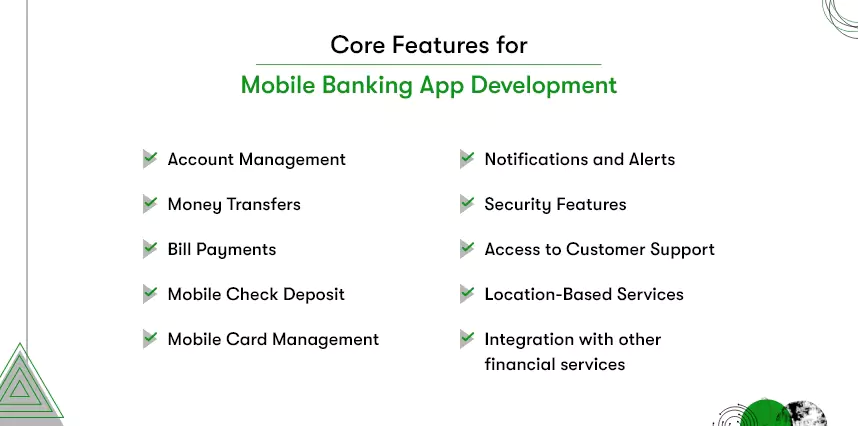

Core Features for Mobile Banking App Development

Account management:

To allow app users to view their account balance with a snapshot of transaction history and basic account details.

Money transfers:

To let app users send and receive money between accounts. And it’s better if you provide external accounts support as well.

Bill payments:

There are many utility bills in our lives to pay regularly, such as telephone bills, electricity bills, water supply bills, etc. You can allow app users to pay such bills right from their mobile devices. Even better if you offer auto bill payment to help users automate such payments.

Mobile check deposit:

It is kind of an advanced feature but a very efficient one for users as it allows them to deposit their checks using their smartphone, which saves them from the hassle of visiting banks every time.

Mobile card management:

Nowadays, people tend to have multiple bank accounts and cards, which makes this feature a must. This feature will make it easier for users to manage their debit or credit cards with the ability to freeze or unfreeze a card if it is lost or stolen.

Notifications and alerts:

Let users control when and what they want to be notified by offering a custom notification feature. They should be able to set up notifications and alerts for account activity, low balances, and other important information.

Security features:

Another must-have functionality in mobile banking apps, security covers various aspects, such as secure login, biometric authentication, and encryption to protect user information and transactions.

Access to customer support:

Remember, 20% of mobile banking app users in the USA use the app to connect to customer support. The ratio might be different depending on your target region. So, offer customer support directly from the app through a chat or call functionality.

Integration with other financial services:

Integrating other financial services, such as budgeting, investment tools, insurance, wealth management, etc., is the best way to extend your reach without spending your fortune.

Location-based services:

Offering an in-app map to locate nearby bank branches or ATMs can also enhance app engagement.

Designing the user interface and experience

After the features and functionalities have been defined, the next step is to focus on good app design. This includes creating wireframes and mockups of the app’s user interface.

Generally, the younger generations tend to use mobile banking apps more than any other. Also, age affects how frequently users access their smartphones and apps. So, considering such factors, you should decide on the app’s user-friendliness, complexity, and navigation. It goes without saying that you must also consider the different screens and resolutions of various mobile devices.

Conducting user testing to gather feedback on the design

User testing is done to gather feedback on the design and user experience. This feedback can then be used to make improvements before the app is built. This step is critical to ensure that the app is user-friendly and that the users can accomplish their tasks easily.

How will you do that? Go for Prototype development as they represent the app’s user interface and navigation flow along with the app’s layout and functionality.

Building the app

This step involves the actual development of the app. There are two more exercises before you start frontend and backend programming, i.e., choose the technology stack and hire a development team.

This includes choosing a development platform and technology stack, and hiring a development team or outsourcing the work. The app should be built with security and compliance in mind, which is essential for financial apps.

Pro tip: Go with the top cross-platform technology Flutter to create and launch your app faster without compromising on quality. And, if you are a CEO or CTO, you must know how to hire Flutter developers.

Choosing a development platform and technology stack

Since Android and iOS devices have divided the global smartphone users, you consider these two platforms to offer your mobile banking app. As for the technology, you can choose either native or cross-platform app development, which will decide the core technology.

If you choose native, you will need to use Java/Kotlin and Swift to build Android and iOS apps separately. On the other side, using Flutter or React Native, you can build apps for both platforms in one go as they are cross-platform frameworks.

Hiring a development team or outsourcing the work

You also have multiple options for the development team, such as in-house developers, freelancers, dedicated developers, or outsourcing. Hiring dedicated mobile app developers has far more benefits than any other. You can explore our blog for more.

However, choosing your development team also depends on the size of your project, budget, and a bunch of other factors.

Testing and Launching the App

Once the programming phase of your mobile banking app development is over, it is time to test the app inside out and upside down. You have to ensure that no functionality is left without testing. Apply as many as applicable quality assurance methods and ensure uninterrupted experience and high performance.

After thorough testing and confirming there is no security loophole, you can deploy the app on the respected app stores and let users download your app.

Note: The mobile banking app development procedure ends, and the app’s journey starts from here. Now onwards, you will have to keep your eye on the market, user feedback, and technology trends to maintain and upgrade your app with the latest functionalities periodically.

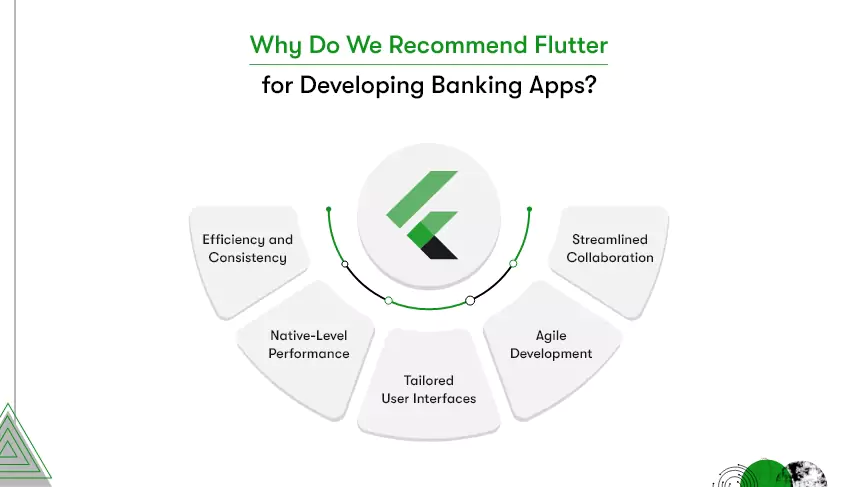

Why do we recommend Flutter for developing Banking apps?

Flutter’s efficiency, native performance, customizable UI, and agile development make it the ultimate choice for building cutting-edge banking apps. Google’s cross-platform framework and SDK, Flutter, stands as the top choice for banking app development due to its remarkable advantages:

Efficiency and Consistency: With Flutter, you can build apps for multiple platforms using a single codebase, ensuring efficiency and consistent performance across iOS, Android, and the web.

Native-Level Performance: Flutter’s “compiled to native” approach guarantees swift, smooth, responsive user experiences on all platforms.

Tailored User Interfaces: Its rich widget library empowers developers to create customized UI components and dynamic animations, ensuring engaging and user-friendly interfaces.

Agile Development: The “hot reload” feature accelerates development, allowing real-time code changes, quicker iterations, and staying ahead of the competition.

Streamlined Collaboration: Flutter’s single codebase fosters clear communication among designers, developers, and stakeholders, reducing discrepancies and promoting seamless collaboration.

Since its inception, we’ve been utilizing Flutter to build our clients’ projects. Thanks to the technology, our clients have achieved outstanding results, providing high-performance apps that meet and exceed their customers’ expectations.

You can hire our Flutter developers to work on your project as well! We have a flexible engagement model for every requirement.

Challenges of Banking App Development You Must Watch Out

Mobile banking app development is not that easy to come by. Even though you think you have achieved a high-performing and bug-free application, there are still some challenges you won’t be able to dodge. After researching the same, we found companies often overlook the below challenges and they fall prey to them.

Security and Compliance

Ensuring that the app meets all relevant security and regulatory requirements is crucial, as financial data is sensitive, and personal information can be used to steal identities. This can be a complex task requiring expertise in data encryption and secure authentication methods.

Regulations and compliance are primary requirements to ensure. However, banking regulations may differ from region to region. So, it falls into your hand to research, study, and comply with the applicable regulations in your app.

User Experience

Many banking app developers make mistakes here and create an app that looks elegant, but the functionalities are very complex to access. But you know, “Simple can be harder than complex,” as it takes so much patience and hard work to get your thinking clean to make it simple. Remember you are building this app for users who might or might not be tech-savvy.

The app must be intuitive and easy to navigate and also be able to handle complex tasks such as account management and money transfers. Designing the app with a simple user interface while the features are complex is a tough nut to crack, isn’t it?

Scalability

You have to be proactive when it comes to scalability. But how much? That is up to your target audience. If you are targeting a large audience from multiple nations, you have a heavy burden on your shoulder.

In that case, you have to ensure the app is able to handle a large number of users and transactions, as well as can scale up when the number of users increases. This can be a complex task and requires careful planning and design.

Keeping up with the competition

The mobile banking market is highly competitive, so entrepreneurs and companies must stay up-to-date with the latest features and trends to stay ahead of the competition. Depending on your experience in the industry, it can be very or moderately challenging to understand the trends, features, and technologies that are constantly emerging.

An ultimate solution to overcome all the above challenges is to team up with an experienced mobile banking app development team. For example, Kody Technolab has developed similar applications and has dealt with everything before. Hence, we can guide you throughout your mobile banking app development journey, saving you from such pitfalls.

Top 18 Successful Mobile Banking Apps to Draw Inspiration From

Rather than a story, let us cut to the chase and examine the key information of emerging mobile banking apps from different parts of the world.

Note: Nubank is a Brazilian banking app built using the Flutter cross-platform framework that helped it secure its position as one of the best banking apps in the world.

1) USA – Bank of America Mobile Banking

This app is the ultimate solution to manage and modify bank accounts based out of the United States. Some of the cool features of the Bank of America Mobile banking app include the ability to track account activity, perform financial transactions, and receive notifications for your accounts.

Revenue: $95B in 2021

2) Germany – N26 — The Mobile Bank

N26 is a mobile banking company founded in 2013 by Maximilian Tayenthal and Valentin Stalf in Berlin, Germany. It offers international money transfer, investment, overdraft, cash withdrawal, and deposit services to customers in the European Union through its smartphone app.

Revenue: €120M in 2021

3) Canada – BMO Mobile Banking

BMO’s online and mobile banking platforms offer various financial services and transactions, such as money transfers, bill payments, and account management. As one of Canada’s Big Six banks and the eighth largest in North America, BMO offers a wide range of products and services, including bank accounts, credit cards, mortgages, loans, and investment platforms. Overall, it serves as a one-stop shop for customers looking to manage their finances.

Revenue: $34.74B in 2022

4) United Kingdom – Revolut

Revolut is a UK-based banking app that offers a variety of financial services, such as money transfer, currency exchange, and fee-free foreign transactions. It also includes features like virtual cards, budgeting tools, and savings accounts. The app has gained popularity among travelers, freelancers, and small businesses for its ease of use, security, and low cost.

Revenue: £261M in 2020

Check Here Our Portfolio about Money Transfer and Convert App Solutions like Revolut

5) Sweden – Nordea Mobile

The Nordea Mobile Banking app provides easy access to your finances on the go, including account balances, money transfers, bill payments, and account management. The app features an overview and insights tab for an organized view of your finances, personalized experience, spending insights, and the ability to add products from other banks to create a budget.

Revenue: $9.9B in 2021

6) Australia – CommBank

CommBank mobile app offers a range of services for managing payments, bills, and savings. It allows for fast and secure payments using Apple Pay and the ability to make and split payments using PayID or account number. It also enables customers to withdraw cash from ATMs using Cardless Cash. The app also allows customers to pay bills and set up recurring payments using BPAY, get bill reminders and notifications and manage credit card payments.

Revenue: $30.16B in 2020

7) Japan – Kyash

Kyash, a Tokyo-based fintech company, aims to improve financial well-being with its mobile banking app. The app offers a range of services, including online and offline payments, remittances, and ATM withdrawals. As an issuer of Visa cards, Kyash also provides added convenience by offering both virtual and physical pre-paid debit cards.

Revenue: $107.6M

8) France – Nickel – An account for all

Nickel is a French FinTech company that aims to provide accessible banking services through non-traditional channels, such as tobacconists, at low cost. Their virtual banking model focuses on providing fast, simple service, and they continuously improve their products for a seamless customer experience.

9) Netherlands – Bunq – bank of The Free

bunq is an Amsterdam-based, mobile-centric bank founded in 2012 by tech entrepreneur Ali Niknam.

Revenue: $93.2M

10) Denmark – Nordea Mobile – Denmark

The same as Nordea Sweden, Nordea Denmark is also a subsidiary of the Nordea European financial service group that operates in northern Europe with headquartered in Helsinki, Finland.

11) New Zealand – BNZ Mobile

The BNZ app, offered by the Bank of New Zealand, allows users to manage their money on the go. Key features include the ability to view account balances and transaction history, transfer money between accounts, pay bills and credit cards, open and close accounts, link accounts to Eftpos or credit cards, and more.

Revenue 2021-22: $3.13B

12) Austria – Bank Austria MobileBanking

The Bank Austria MobileBanking app, also known as the Internet banking app, allows users to conduct their banking business via smartphone at any time and location. Key features include a financial overview, financial manager, account information and account statements, bank transfers, trading, order archive, and limits management. The app offers high-security standards and the option of biometric authentication to protect user privacy.

Revenue 2021-22: €115M

13) Singapore – DBS digibank

The DBS digibank mobile app, formerly known as DBS iBanking and DBS digibank, offers a convenient and secure way to manage your finances on the go. You can view your account balances, transfer money, pay bills, apply for new accounts and credit cards, and more, all from your smartphone.

14) UAE – HSBC UAE

HSBC’s mobile banking app, which allows customers to manage their accounts securely from their mobile device, has achieved a No. 1 ranking in the UAE Apple app store’s Finance category within 48 hours of launch. It is available to customers who are registered for Personal Internet Banking with HSBC.

15) Spain – BBVA Spain | Online Banking

The BBVA mobile banking app for Spain allows customers to manage their personal finances easily and intuitively. Customers can also activate push notifications to control the movements and payments of their cards, turn their cards on and off to protect their money, and even ask Blue, a virtual assistant if they have any questions.

Revenue: $6.95B

16) Ireland – Ulster Bank RI

The Ulster Bank app allows customers to manage their finances on the go, with features such as checking account balances and transactions, transferring money, and paying bills. Users can also make payments of up to €1000 without a card reader and withdraw cash from ATMs without a debit card. The app also offers additional features like sending money securely to others, giving customers greater control over their finances.

Revenue: $959M

17) India – Kotak

The Kotak Mobile Banking App offers banking services on the go, including opening a digital bank account and access to over 250 features for existing customers, such as bill payment, investing, shopping, and more.

Revenue 2021-22: $7.4B

18) Russia – Tinkoff

Tinkoff is a mobile banking app that has been recognized as the Best Mobile Bank App in Russia. The app offers various features that allow users to easily manage their finances on the go, including applying y for Tinkoff Bank’s products and scheduling appointments with bank representatives through the app.

Revenue 2021-22: $63B

Pro tip: You can use the mobile banking applications mentioned above in your competitive analysis to come up with something out-of-the-box to offer in your app.

What about the Mobile Banking App Cost?

We have discussed the nitty-gritty details of mobile banking app development, so how can we miss out on the cost part?

To be blunt, the cost to create a banking app starts from $20k and can go all the way up to $100k.

The reason behind the dramatic number is visible to the naked eye. Actually, the cost to build a mobile banking application varies greatly depending on a number of factors, including the complexity of the app, the number of features included, and the platform (iOS or Android) on which it will be developed.

If we ballpark, the cost to develop a basic mobile banking app can range from $50,000 to $150,000. While a more complex app with additional features may cost upwards of $500,000 or more. Other factors that can affect the cost include;

Platform:

The cost of developing an iOS and Android app can differ significantly. Generally, it is more expensive to develop for iOS due to the need to use Mac hardware and the stricter app review process.

Complexity:

The more complex the app, the more expensive it will be to develop. This includes factors such as the number of features, the number of screens, as well as the need for integrations with other systems.

Design:

The design of the app also affects the cost. A more complex design, with custom graphics and animations, will be more expensive to develop than a more straightforward design. On the other hand, simplifying some complex features can also take significant time and cost.

Third-party APIs:

If the app needs to use third-party APIs, such as for payment processing or social media integration, this can also add to the development cost.

Location:

The location of the development team can also affect the cost. Developers in countries with a lower cost of living may charge less than those in more expensive areas. For example, Indian mobile app developers are way more cost-efficient than the USA and also bring remarkable experiences. If you are in doubt, please understand how to choose an app development company first.

Maintenance:

Even after launching the app, you need to maintain the app, which makes ongoing maintenance and updates a vital factor in budget planning. Furthermore, an app with many features will require more maintenance and updates, which can add to the overall cost.

Security Compliance:

Never forget mobile app security and regulations that should be considered and implemented during banking app development to secure sensitive data and users’ personal information. You might need specific certificates or licenses to operate the app.

How Kody Technolab can Contribute to Digitizing your Bank with Innovation

Before wrapping this up, I want you to leave with some words of wisdom. If you are considering developing a mobile banking app, then start by finding your “WHY” before anything. Why do you need to build a mobile banking app?

Then observe the current trends and technology used by other banking and finance applications in the market. If you can dig out the purpose behind each tech and trend boom, nothing will stop you from making your banking app successful.

Don’t do everything by yourself is the new norm, and you should respect it. Hire an experienced team of finance app development, share your idea with them, and build a masterpiece no one could surpass.

Lastly, no destination can be reached without challenges. So, do not expect everything to go as you planned, and always be for unexpected roadblocks.

That’s that. You understood the assignment, and I think it’s time you take the next step, i.e., consult with experts about your banking app concept.

FAQ

How does a mobile banking app work?

- Users create an account by providing personal information and linking their bank accounts.

- They use their mobile device to log in to the app using a unique user ID and password.

- The app lets users view account balances, transaction history, and other account information.

- Users may perform a variety of transactions, such as check deposits, money transfers, bill payments, etc., and can set up alerts and notifications for account activity and balances.

- The app uses encryption and other security measures to protect user information and transactions.

- The app can also provide detailed analytics and information about spending habits and financial management.

- Some apps also allow users to apply for loans or credit cards or to invest in stocks.

What are the crucial steps of mobile banking app development?

To simplify the mobile banking app development process, we can break it down into below steps:

- Market research and planning;

- Define features and functionality;

- Hiring a development team;

- UI/UX design;

- Wireframe/Prototype user testing;

- Frontend and backend programming;

- Testing and deployment.

How much does it cost to build a mobile banking app?

The mobile banking app development can cost anywhere between $20k to $100k depending on the below factors;

- Platforms (Android/iOS)

- UI/UX design Complexity

- App features

- Third-party APIs

- Location

- Maintenance

- Regulations

What is the average development time for mobile banking apps?

It takes about 4-5 months on average to build a moderate mobile banking app and nine months at least to build a more complex one.

How should I go about my banking app development?

If you do not have any foggiest idea about the mobile app development team, please take our free consultation to understand the basics from our experts. We will ensure you will be able to make firm decisions after the talk with us. Teaming up with us or not will be up to you.

Contact Information

Contact Information