Consumers aren’t waiting in line for financial services anymore; they’re swiping, tapping, and expecting results in seconds. The surge in fintech mobile app development isn’t about trends. It’s about survival in a market where user attention is the most valuable currency.

The numbers prove it: After a sluggish 2022, global finance app installs shot up 45% in 2023, and momentum hasn’t slowed. In Q1 2024, installs grew another 36% year-over-year, while app sessions jumped 23%. Banking apps alone saw 82% growth, and crypto apps exploded with a 196% surge; clear signals that mobile is the battlefield for financial innovation.

If you’re planning to build a fintech app, understand this- your users won’t tolerate friction, delays, or outdated interfaces. This fintech app development guide unpacks what works, what doesn’t, and how to build something that won’t just launch but last.

Want to turn data into real-time decisions and predictive insights? Learn how to use Predictive Analytics in Fintech.

Whether you’re building your first product or scaling globally, this isn’t just fintech application development; it’s your ticket into the future of finance.

What Factors Are Fueling the Rise of Fintech Mobile App Development?

Fintech is no longer a side project. It’s the core infrastructure for how the world moves money. And while user demand has never been higher, the pressure to innovate efficiently has never been sharper.

In 2024, global fintech investment hit $95.6 billion across 4,639 deals, marking the lowest level since 2017. But the volume of deals tells a different story; the industry is maturing. Investors are more selective, and funding is flowing toward companies with real traction, scalable models, and most critically, mobile-first products.

The Americas led with $63.8 billion, of which $23.4 billion came from VC-backed fintech. EMEA followed with $20.3 billion, and Asia-Pacific with $11.4 billion. (siegemedia)

This pullback isn’t a red flag; it’s a filter. The market is done funding ideas. It’s prioritizing execution. And in 2025, execution means creating products that operate with real-time intelligence, seamless UX, and device-native functionality. Which is exactly what fintech mobile app development enables.

Fintechs that succeed now are solving not just “how to digitize finance,” but how to make it faster, smarter, and more human. That’s where tools like predictive analytics in banking come into play, transforming raw data into personalized user journeys, fraud detection, and smarter credit decisions.

So, before you even start listing features or choosing tech stacks, ask yourself this: is your fintech strategy mobile-first? Because in this market, anything less is just an MVP with no future.

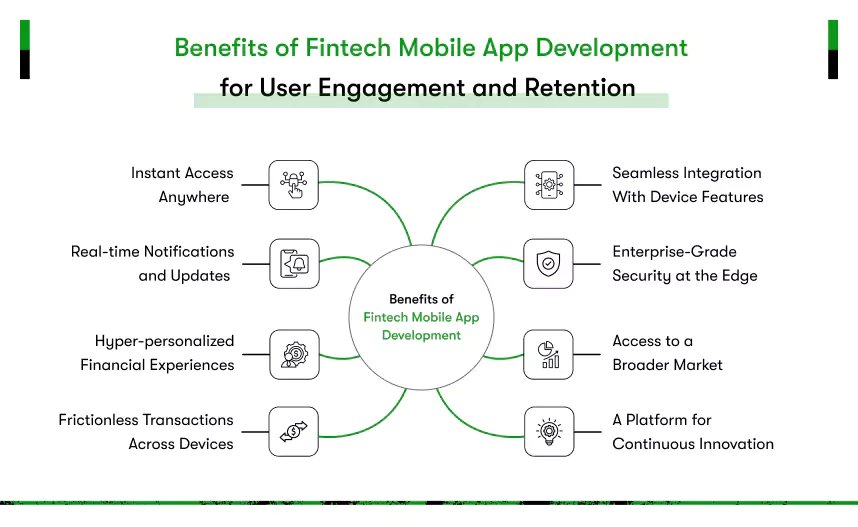

What Are the Core Benefits of Fintech Mobile App Development for User Engagement and Retention?

Fintech mobile app development isn’t just about going digital; it’s about rebuilding financial services for mobile-native behaviors. Users expect immediacy, control, and personalization. Fintech apps that deliver those win loyalty. Those that don’t? They get uninstalled.

Here’s how smart fintech application development can lock in user engagement and retention:

1. Instant Access Anywhere

A mobile-first experience ensures that users can check balances, transfer funds, or apply for loans without visiting a branch or desktop site. The value is clear; convenience = conversion.

- 24/7 access to financial services

- Fewer support calls or in-person visits

- Ideal for remote or underbanked populations

2. Real-time Notifications and Updates

Push notifications keep users informed in real-time; from transaction alerts to investment fluctuations. These features build trust and reduce reliance on manual tracking.

- Fraud alerts

- Payment reminders

- Market movements and offer notifications

3. Hyper-personalized Financial Experiences

Using behavioral data, your app can deliver contextual offers, advice, and content. This level of customization turns your app from a utility into a financial partner.

- AI-driven product recommendations

- Adaptive UIs based on usage patterns

- Location-based services

4. Frictionless Transactions Across Devices

A well-built mobile app streamlines transactions with one-tap payments, biometric logins, and intuitive flows. This reduces user drop-offs and increases conversion rates.

- Face/fingerprint authentication

- Tap-to-pay and scan-to-pay

- Instant P2P transfers

5. Seamless Integration With Device Features

Leverage native capabilities like GPS, camera, and contacts to reduce friction and elevate usability.

- KYC with document scanning

- Spending insights based on location

- Contact-based transfers

6. Enterprise-Grade Security at the Edge

Mobile devices support robust security tools like biometric access, tokenization, and two-factor authentication which is the core to building user trust.

- End-to-end encryption

- Risk-based authentication

- Real-time fraud detection

7. Access to a Broader Market

With mobile penetration nearing saturation, fintech apps now reach users traditional banks struggle to serve. A dual-platform approach using Flutter or other cross-platform frameworks helps scale faster without ballooning development costs.

- Global reach, local compliance

- Support for underserved and unbanked populations

8. A Platform for Continuous Innovation

From embedded finance to Buy Now Pay Later app development, fintech apps offer flexibility to add new features that directly address emerging user needs and business models.

- Launch new features without rebuilding from scratch

- Integrate APIs from third-party providers easily

- Add modules like crypto, BNPL, or robo-advisors

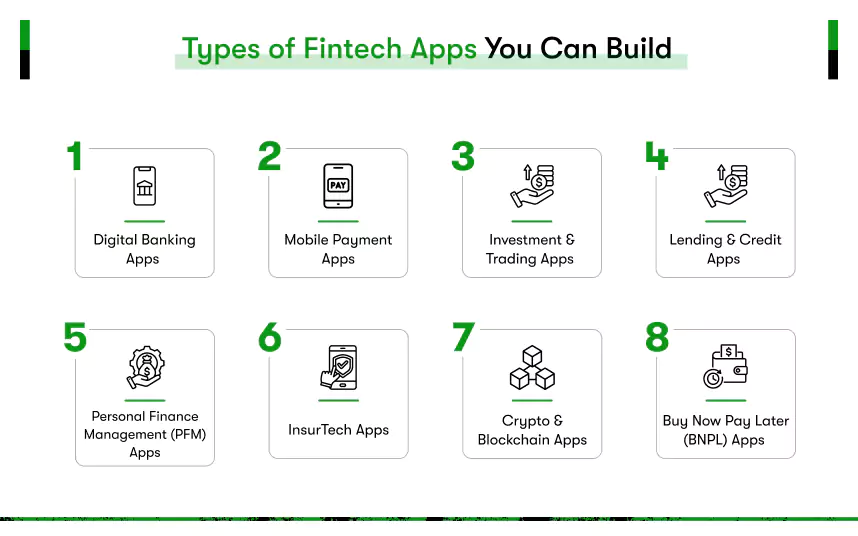

What Types of Fintech Mobile App Development Can You Build in 2025?

As of 2024, 64% of global consumers use at least one fintech service; up from just 16% in 2015. That’s nearly two-thirds of the world actively engaging with digital banking, mobile payments, crypto platforms, or personal finance tools. The rise isn’t just technological; it’s behavioral.

Consumers are building financial habits around their phones, not their banks.

In this landscape, choosing the right category for your fintech mobile app development strategy becomes a make-or-break decision. The type of app you build shapes how you acquire users, solve real problems, and stand out in a crowded market.

Let’s break down eight high-performing fintech app types and what they mean for your product roadmap.

1. Digital Banking Apps

- Trend insight: The era of branch banking is over. Customers now expect a full suite of services in their pockets like opening accounts, taking out loans, managing cards; all with zero friction.

- Market proof: Challenger banks like N26 (Europe) and Nubank (Latin America) gained millions of users in just a few years, driven by lean UX and transparent pricing.

- User appeal: Instant onboarding, zero international fees, AI-managed budget tools.

- Business potential: Banks or startups can build fintech apps to integrate lending, savings, and investments into a singular mobile ecosystem.

- Tech challenges:

- Compliance: Must adhere to KYC, AML, PSD2/3, GDPR.

- Scalability: Backend systems need to manage millions of real-time transactions.

- AI for personalization: Custom dashboards, spending nudges.

- Choose this if you want to replace the traditional bank branch with a mobile-first banking ecosystem.

2. Mobile Payment Apps

- Trend insight: With contactless payments becoming the norm, mobile wallets are replacing physical cards; even in markets like India, Africa, and Europe.

- Market proof: Alipay and WeChat Pay dominate in China; Apple Pay pushes Apple ecosystem dominance globally.

- User appeal: Tap to pay, instant P2P, digital receipts.

- Business potential: Enable merchants and users with streamlined, secure payments.

- Tech challenges:

- Regulatory: PCI DSS, PSD2, local licensing.

- Security: Tokenization, biometric login, fraud detection.

- Integration: Mobile wallets, retail systems, API-first banking.

- Choose this if you want to simplify payments for users and earn via transaction fees or merchant partnerships.

3. Investment & Trading Apps

- Trend insight: Mass retail participation is rising. Micro-investing and fractional shares lowered entry barriers.

- Market proof: Robinhood’s market cap redefines wealth access; eToro adds social trading for millennials.

- User appeal: Real-time quotes, fractional ownership, commission-free trading.

- Business potential: Capture assets under management, earn through subscriptions or margin.

- Tech challenges:

- Compliance: SEC, FINRA, GDPR for EU users.

- UX: Live charting, portfolio analytics, seamless trading flow.

- APIs: Integration with exchanges and pricing feeds.

- Choose this if you want to democratize investment with slick UX and accessible strategies.

4. Lending & Credit Apps

- Trend insight: The fintech lending market is exploding, both for individuals and small businesses.

- Market proof: LendingClub and Klarna secured billions in loans digitally.

- User appeal: No-collateral instant loans with transparent terms.

- Business potential: Revenue from interest, origination fees, and P2P lending spreads.

- Tech challenges:

- Risk modeling: Alternative data, machine learning for credit scoring.

- Regulatory: Credit laws, fair debt practices, financial disclosures.

- UX: Simple forms, fast disbursal, clear repayment terms.

- Choose this if you aim to disrupt loan access with speed and precision underwriting.

5. Personal Finance Management (PFM) Apps

- Trend insight: Users need financial clarity. PFM apps deliver holistic oversight across accounts.

- Market proof: Mint, YNAB, PocketGuard become finance hubs for millions.

- User appeal: Automated categorization, debt tracker, goals with reminders.

- Business potential: Upsell with personalized financial product recommendations.

- Tech challenges:

- Aggregated data: Integration with multiple banks via APIs.

- Security: Permissions, encryption, session controls.

- AI & UX: Spending insight machine learning, nudges for savings.

- Choose this if your vision is to help users organize their financial lives holistically.

6. InsurTech Apps

- Trend insight: Mobile-savvy consumers expect insurance the same way they get coffee: on their phones.

- Market proof: Lemonade and Root built insurance with zero paperwork; AI-based claims.

- User appeal: Instant quotes, transparent pricing, image/voice claims.

- Business potential: Partner with carriers or build proprietary risk models.

- Tech challenges:

- Telematics & AI: Rare event modeling, fraud detection.

- Regulatory: Insurance licensing across jurisdictions.

- UX: Chatbots for claims, real-time underwriting.

- Choose this if you’re innovating in claims efficiency or targeting niche insurance segments.

7. Crypto & Blockchain Apps

- Trend insight: Crypto isn’t just speculation; it’s an ecosystem for banking, remittance, lending, and DeFi.

- Market proof: Coinbase IPO and Binance’s global treasury are proof of market viability.

- User appeal: Wallets, tokens, dApps, staking, yield farming.

- Business potential: Revenue via trade volume, custody fees, DeFi partnerships.

- Tech challenges:

- Security: Private key storage, hardware integration.

- Compliance: KYC, AML for digital assets.

- Interoperability: Layer 2 solutions, liquidity pools.

- Choose this if decentralization, transparency, and digital asset control are your vision.

8. Buy Now Pay Later (BNPL) Apps

- Trend insight: BNPL isn’t just consumer credit—it’s embedded in retail, gaming, travel, and healthcare.

- Market proof: Klarna, Afterpay, and Affirm now handle billions in GMV.

- User appeal: Instant financing, transparent terms, no interest (in many cases).

- Business potential: Merchant fees, late fee revenue, repeat purchases.

- Tech challenges:

- Risk scoring: Real-time credit decision making.

- Regulatory scope: Usury laws vary; compliance is key.

- Integration: Ecommerce plugins, POS APIs.

- Choose this if you want to integrate finance at point-of-sale and increase conversions.

How to Strategically Choose the Right Fintech Mobile App Development Model?

Choosing the right type of app is about strategic fit, more than just trend-chasing. Your choice determines not only what features to build but how to acquire users, monetize them, scale efficiently, and comply with ever-evolving financial regulations.

Here’s how to make the right call:

1. Validate the Core Financial Problem You’re Solving

Too many fintech apps fail because they chase features instead of solving a pain point. Start by identifying what users are trying to overcome, like lack of liquidity, poor financial visibility, high transaction fees, or exclusion from traditional banking.

- Example: Chime didn’t just launch another bank; they solved the frustration around overdraft fees and paycheck delays.

- Actionable Tip: Use interviews, surveys, and usage data to map friction in your users’ financial lives. Then build your app type around solving that friction directly.

2. Assess Regulatory Complexity and Risk Exposure

Some fintech models are heavily regulated such as insurance, lending, crypto, while others like PFM and budgeting face fewer legal hurdles. Your category defines your compliance burden and your exposure to risk.

- Crypto wallets must comply with KYC, AML, and licensing across every jurisdiction they serve. That’s cost-intensive.

- PFM apps, by contrast, can focus on UX first while layering in optional compliance over time.

Choose a category aligned with your legal tolerance and funding runway. The more regulated your space, the more upfront investment you’ll need in legal, infrastructure, and audits.

3. Forecast Your Monetization Model from Day One

Every fintech app needs a path to sustainable revenue. Your app type influences whether your revenue comes from:

- Transaction fees- mobile payments, BNPL

- Interest margins- lending

- Assets under management- investments

- Subscriptions- PFM, credit monitoring

- Affiliate/referral models- insurance, financial products

Key question to ask yourself; is your business model volume-based, margin-based, or value-added? Make sure your app type supports that engine.

4. Match the Tech Stack to Your Use Case and Ambition

Each app category comes with different technical requirements. Building a digital bank? You’ll need robust security, core banking integrations, and scalable APIs. Launching a credit scoring tool? You’ll need advanced analytics, alternative data pipelines, and explainable AI.

- Startups should consider modular architecture. Build core functionality, then integrate APIs as the product matures.

- Cross-platform frameworks like Flutter can cut time-to-market for MVPs while supporting multi-device scalability.

Your app’s tech stack should reflect your risk level, launch urgency, and scale goals.

5. Think Beyond Launch: Can You Expand This Model?

Every fintech app starts with a single problem, but success depends on long-term evolution. The best models are extensible by design.

- BNPL apps can evolve into credit builders or budgeting tools.

- Crypto apps can integrate staking, NFTs, or remittance features.

- Banking apps can layer savings, lending, and insurance.

Ask yourself: Does this model give me room to grow, or will I hit the ceiling fast?

Think in product roadmaps, not just MVPs. Choose an app type that supports your next five launches, not just your first.

What Are the Most Common Challenges in Fintech Mobile App Development and How Can You Overcome Them?

Over 90% of fintech startups fail within the first five years, and the leading causes are rarely product related. It’s regulation, security, infrastructure, and user trust that kill momentum; regardless of how great the idea is.

For any founder or team exploring fintech mobile app development, ignoring these pitfalls is not an option. These aren’t edge cases; they’re patterns. And the sooner you design for them, the faster you’ll scale without breaking.

1. Regulatory Complexity and Non-Compliance

Regulation isn’t red tape; it’s survival. Fintech products touch money, identity, and data, which makes them regulatory landmines if mishandled.

Case in point:

- Wonga, once a top UK payday lending app, was fined for irresponsible lending and eventually collapsed under compensation payouts, becoming a cautionary tale in fintech compliance.

- Wirecard, a global payments firm, lost billions due to accounting fraud and weak regulatory oversight, triggering a global credibility crisis for the fintech ecosystem.

Your move:

- Bake compliance into your development process from day one.

- Consult local experts for each region you operate in.

- Automated KYC, AML, and reporting with RegTech APIs to reduce manual exposure.

2. Security Failures That Erode Trust Instantly

Fintech is fundamentally about trust. The moment users suspect their money or data isn’t safe, they leave, and regulators follow.

Case in point:

In 2019, Capital One suffered a data breach exposing 100M+ customer records. The breach didn’t sink the company, but it triggered regulatory action and massive trust erosion.

Your move:

- Use end-to-end encryption and multi-factor authentication.

- Store sensitive data off-device and minimize data collection.

- Run regular penetration testing and real-time monitoring for threat detection.

3. Operational Inefficiencies and Scalability Breakdowns

Many fintechs build for MVP, not for growth. But when usage spikes or new markets open, weak operational foundations crumble.

Case in point:

- YapStone struggled with internal inefficiencies that limited growth.

- Moven, one of the earliest digital banks, shut down its banking operations due to monetization and scale challenges, even with early traction.

Your move:

- Build modular, scalable infrastructure using containerized services.

- Automate customer onboarding, support, and reporting where possible.

- Monitor ops metrics early like ticket volumes, transaction errors, onboarding drop-offs.

4. Poor Product-Market Fit and Adoption Failure

A beautiful product that no one uses is just a failed investment. In fintech, misaligned features or unclear value props lead to silent app abandonment.

Case in point:

- Beenz.com, a pioneer in digital currency, burned through VC cash but never found meaningful user traction.

- Boo.com, while not fintech, shows how overbuilt UX without user validation can collapse fast.

Your move:

- Validate user demand before development, not after.

- Use focus groups, MVPs, and feedback loops to shape core features.

- Watch for warning signs: low retention, high CAC, unclear user behavior patterns.

5. Broken Integrations with Banking Infrastructure

Most fintech apps don’t work in isolation; they rely on banking-as-a-service platforms, payment processors, and data aggregators. A fragile link can take your product down.

Case in point:

In 2024, Synapse collapsed, locking over $265 million in user deposits across more than 100,000 accounts. The problem? Weak integrations with partner banks and poor system oversight.

Your move:

- Use proven middleware or banking-as-a-service providers with real-time uptime monitoring.

- Build backup rails and manual failsafes for high-risk processes like withdrawals and KYC.

- Vet partners for regulatory history and audit compliance.

6. Failure to Personalize and Predict User Behavior

Today’s fintech users expect more than access; they want insight. Apps that feel static or irrelevant don’t stick.

Case in point:

Many early PFM tools failed not because of poor tech, but because they showed data without context or advice.

Your move:

- Integrate behavioral analytics to surface spending patterns, risk triggers, and habits.

- Offer predictive insights such as low-balance alerts, credit trend shifts, and tailored investment nudges.

- Explore how predictive models for investment can shape personalized financial journeys.

7. Cultural Disconnects and Lack of Localization

Fintech is global, but its users are local. An app designed for U.S. users may feel tone-deaf in Germany or untrustworthy in Indonesia.

Case in point:

Even N26, a European digital banking leader, faced backlash in its expansion efforts due to compliance shortfalls and customer support mismatches in new markets.

Your move:

- Localize language, currencies, time zones, and even customer support hours.

- Use flexible design systems that allow modular updates for cultural shifts.

- Leverage Flutter’s internationalization features to scale multi-region deployments without bloat.

Fintech application development is hard; it’s high-risk, high-regulation, and ruthlessly competitive. However, if you understand the challenges beforehand and solve them up front; you won’t just launch, you will last. And if you’re looking to de-risk the process from the ground up, hire fintech developers who understand compliance, scalability, and market fit from day one.

How Can You Approach Fintech Mobile App Development Like N26 or Mollie?

Not all fintech apps are built in the same way. N26 and Mollie represent two fundamentally different fintech business models; digital banking and payment infrastructure.

Here’s how their approaches to fintech mobile app development diverge across critical areas:

| Category | Digital Bank (e.g., N26) | Payment Infrastructure (e.g., Mollie) |

| Core Purpose | Offer full-service banking directly to consumers via mobile | Enable merchants to accept digital payments across channels |

| Target Users | Retail customers (B2C) | Online merchants & platforms (B2B) |

| Key Features | Account creation, money transfers, savings, spend analytics, card controls | Multi-method checkout, payment APIs, fraud detection, real-time settlement |

| Revenue Model | Interchange fees, subscriptions, loan interest, premium tiers | Transaction fees, volume-based pricing, value-added services |

| Compliance Needs | Heavily regulated: PSD2/PSD3, KYC, AML, GDPR | PCI DSS compliance, AML, merchant verification (KYC/KYB) |

| Tech Stack | Core banking platform, secure backend, AI for personalization, Flutter for UI | API-first architecture, cloud-native backend, payment orchestration engine |

| Security Focus | Data privacy, secure onboarding, biometric login, fraud alerts | Tokenization, real-time fraud scoring, secure API access |

| Scalability Challenge | Managing real-time user activity & high compliance load | Processing large-scale, multi-country transactions with sub-second latency |

| UX Priorities | User trust, clarity, frictionless mobile-first design | Developer experience, fast merchant onboarding, clear reporting tools |

| Ideal for | Startups building challenger banks or digital financial hubs | Platforms offering embedded finance or launching merchant payment services |

| Growth Path | Add lending, investing, insurance modules | Expand payment methods, currencies, and geographies |

If you’re looking to build a fintech app, your model determines everything; from tech stack to user experience to how you monetize. Know your playbook before you write a single line of code.

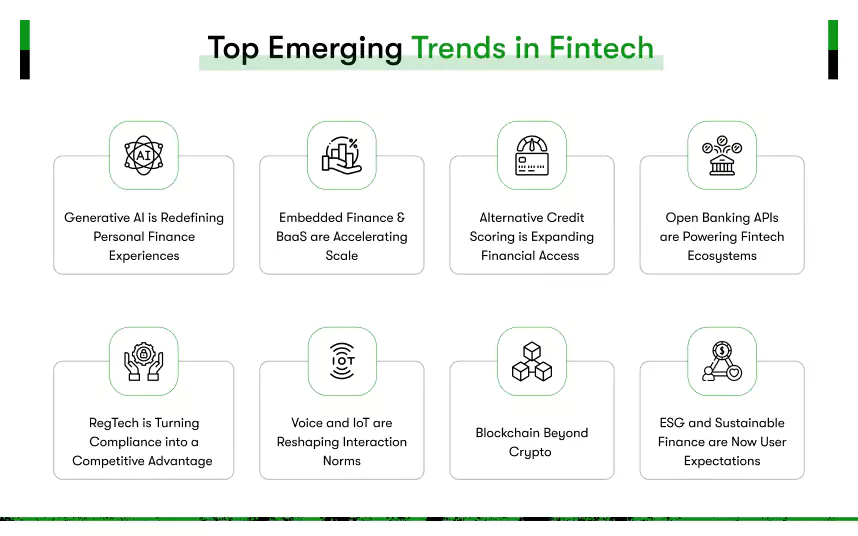

What Are the Emerging Trends Shaping Fintech Mobile App Development in 2025?

In 2025, fintech is moving faster than ever fueled by emerging technologies that are reshaping user expectations and industry standards. To stay ahead of the curve in fintech mobile app development, here are the trends that matter most:

1. Generative AI Is Redefining Personal Finance Experiences

Fintech apps aren’t just showing balances; they’re talking back. With GPT-style assistants, apps now deliver conversational budgeting, real-time financial advice, and hyper-personalized product recommendations.

What this means for your app:

- Replace static menus with chat-first onboarding and help flows

- Use AI to personalize spending insights, investment tips, and alerts

- Automate 70% of support interactions without human reps

To implement this in your fintech mobile app development, you’ll need access to structured financial data and strong privacy governance, but the payoff in retention and upselling is real.

2. Embedded Finance & BaaS Are Accelerating Scale

Instead of building a banking app, many companies are embedding financial tools into existing platforms; thanks to Banking-as-a-Service (BaaS) providers and payment APIs.

Real-world use cases:

- eCommerce sites offer BNPL directly in checkout flows

- Creator platforms embed instant payouts and micro-insurance

- Gig apps offer integrated credit lines or savings vaults

This is the backbone of scalable mobile app development for fintech letting you partner, not build from scratch. With the right API stack, you can launch in months, not years.

3. Alternative Credit Scoring Is Expanding Financial Access

Traditional credit models exclude millions. Modern credit scoring app development now uses alternative data like rent payments, phone usage, and utility history to assess risk.

Why it works:

- Approves underbanked users who’d otherwise be rejected

- Lowers default rates using behavioral and real-time insights

- Supports explainability for critical under tightening regulations

If you’re building a lending or fintech application development product, integrating this capability could be the key to higher approvals and better returns.

Don’t miss our deep dive into credit scoring app development to learn how micro-lenders and BNPL platforms build smarter risk engines that improve approval rates and lower defaults.

4. Open Banking APIs Are Powering Fintech Ecosystems

With PSD3 and global open banking mandates expanding, fintechs can now access user banking data with consent to offer better insights, faster onboarding, and cross-platform services.

What this enables:

- Instant account aggregation and spending overviews

- Direct payment initiation (goodbye credit card fees)

- Data-based upselling for loans, credit cards, and savings products

For any fintech application development, open APIs reduce friction and deepen user engagement without duplicating infrastructure.

5. RegTech Is Turning Compliance into a Competitive Advantage

Regulatory complexity is rising, but RegTech solutions help fintechs stay agile by automating KYC, AML checks, and audit trails.

Key advantages:

- Faster onboarding with automated identity verification

- Real-time compliance monitoring

- Reduced legal costs and audit risk

Bake RegTech into your stack early to avoid tech debt when entering new markets.

6. Voice and IoT Are Reshaping Interaction Norms

Fintech is no longer limited to screens. Voice assistants, wearables, and IoT devices enable finance access via voice commands and ambient alerts.

Examples:

- Voice-authenticated transactions

- Smartwatches showing real-time spend limits

- IoT-linked insurance for homes and vehicles

UX isn’t just visual; it’s behavioral. Design for context, not just clicks.

7. Blockchain Beyond Crypto

Blockchain is being used for more than tokens like cross-border payments, audit trials, and smart contracts in lending and insurance.

Key uses:

- Real-time transaction settlement

- Transparent, tamper-proof ledgers

- Decentralized identity management

For apps handling high-trust, high-volume transactions, blockchain offers integrity with transparency.

8. ESG and Sustainable Finance Are Now User Expectations

Users, especially Gen Z; want their money aligned with their values. Fintech apps are now adding carbon tracking, ESG scoring, and green investment tools.

Why users care:

- Visibility into spending impact

- Opportunities to invest in sustainable assets

- Ethical banking alternatives

Layer ESG insights into your fintech product to increase stickiness and attract value-conscious users.

What This Means for Your Build

- Prioritize AI-first Architecture- Plan for ML integration from day one. Data pipelines should enable real-time scoring, predictive nudges, and personalized UI flows.

- Choose the right partners- Whether you’re building a Credit Scoring App or digital bank, integrations with strong RegTech, BaaS, and open banking providers are critical.

- Design mobile-native UX- Imagine fluid UIs that support voice, biometric authentication, smart notifications, and immediacy because your users will compare you to epic experiences.

- Iterate quickly- Trends evolve fast. Adopt microservices and feature flags to test new features with low risk and parlay winner experiences globally.

These emerging trends are not optional enhancements; they’re table stakes in modern fintech mobile app development. Build with them in mind now, and you’ll be prepared to lead in user retention, compliance, and revenue while others play defense.

How Much Does Fintech Mobile App Development Cost in 2025?

The cost of fintech mobile app development in 2025 depends on what you’re building, how complex your infrastructure is, and who’s building it. Whether you’re launching a digital bank, a payment gateway, or a credit scoring platform, here’s how to break down the numbers.

Core Factors That Influence Cost

App Type and Feature Complexity

- A basic PFM or budgeting app may start at $50,000–$100,000.

- A full-featured mobile banking or lending platform can easily cross $150,000+.

Technology Stack

- Using Flutter or React Native for cross-platform saves 30–40% in dev time.

- Advanced stacks involving blockchain, AI, or machine learning add significant cost.

Security & Compliance

- GDPR, PSD3, PCI DSS, and KYC/AML all require secure architecture, audits, and third-party integrations, often adding $30,000–$50,000 depending on geography.

Backend Infrastructure & APIs

- Costs scale with volume, uptime requirements, and third-party API licensing like BaaS and open banking. Expect to spend $20,000–$50,000+ on scalable backend setup.

How much does the emerging tech cost

| Technology | Estimated Additional Cost | Use Case |

| AI / ML | $25,000–$100,000+ | Chatbots, fraud detection, personalized recommendations |

| Blockchain | $30,000–$200,000+ | Cross-border payments, secure ledgers, smart contracts |

| Predictive Analytics | $15,000–$75,000 | Credit scoring, personalized offers |

| RegTech Tools | $10,000–$50,000 | KYC/AML automation, compliance workflows |

Development Team Models

| Model | Cost Range | Pros | Cons |

| In-house team | $150,000+/year | Full control, long-term team | High overhead, slower scaling |

| Freelancers | $50–$150/hour | Flexible, lower cost for small projects | Less reliability, limited scope |

| Dedicated Development Partner | $50,000–$250,000+ (project-based) | Specialized fintech skills, end-to-end support | Must vet partner carefully |

Expect to budget $50,000–$350,000 for a robust MVP of a fintech app in 2025, with scaling costs rising as you integrate AI, blockchain, or expand internationally. For a detailed breakdown by app type, region, and technology, check out our guide on Fintech App Development Cost.

But cutting corners early, especially on security or compliance, will cost far more later.

What’s Your Next Move in Fintech Mobile App Development?

By now, it’s clear, building a fintech app in 2025 is as much about strategy and execution as it is about technology. From choosing the right product model; digital bank, payments, lending, or PFM, to integrating AI, open banking, and predictive analytics, success lies in getting the fundamentals right.

You’ve seen what works. You’ve seen what fails. Now it’s time to act.

Whether you’re refining your product-market fit, scaling securely, or launching globally, your fintech app needs a team that understands both the technical demands and regulatory nuances of the industry.

That’s where Kody Technolab Ltd comes in.

As a trusted Fintech App Development Company, we help startups and enterprises design, build, and scale compliant, user-centric, high-performance fintech applications; end to end. With deep expertise in mobile-first UX, scalable architecture, and global financial compliance, we don’t just code; we co-build your growth strategy.

Contact Information

Contact Information