Blog Summary: This blog explores how RPA in banking is revolutionizing financial operations by automating routine tasks, improving compliance, and enhancing customer experience. It explains what RPA is, how it works, and the measurable benefits it brings to banks. You’ll also discover key real-world use cases, success stories from global banks, 2026–2033 market forecasts, and how Kody Technolab helps financial institutions implement intelligent automation at scale.

Can RPA in banking be a game changer for the financial sector? Stiff competition from emerging FinTech, ensuring compliance with evolving regulations, and meeting rising customer expectations all at once is overwhelming for the banks in the USA. Besides, failure to balance these demands can hinder a bank’s growth and jeopardize its very existence.

But how can a bank bogged down under routine tasks turn the tables and come out on top of the competition?

The answer is simple: Robotic Process Automation (RPA)

Recent industry reports project that the global market for RPA in banking and financial services will grow from $8.62 billion in 2025 to $18.9 billion by 2033. North America leads with a forecast CAGR of 22.5 %, while Asia-Pacific (APAC) will see the fastest expansion at 25.3 %. These numbers prove that RPA in banking industry applications are becoming central to efficiency and innovation across the automation in the banking sector.

About 80% of finance leaders have adopted or plan to adopt robotic process automation in banking sector operations. Robotic process automation in financial services is a technology that can automate a bank’s mundane and repetitive tasks with the help of software bots. Implementing this technology allows banks and financial institutions to enhance efficiency and boost productivity across departments.

If you’re planning for Digital Banking Transformation, here’s the guide you need!

As the banking process automation market continues to expand through 2030, driven by AI and ML development, financial institutions that adopt RPA early will gain a clear competitive advantage.

What is RPA, and how can you use it for your benefit? Let us help you figure it out. We’ll also dive into the challenges banks face while adopting robotics in banking and how to overcome them.

So, buckle up. Here we go!

What Is RPA in the Banking Industry and How Does It Work?

RPA in banking refers to the use of software robots to automate repetitive, rule-based processes within financial institutions. These bots perform digital tasks such as data entry, transaction validation, and report generation with precision and speed. In essence, robotic process automation in the banking industry allows banks to streamline manual workflows, improve accuracy, and enhance efficiency across departments.

RPA systems combine Artificial Intelligence (AI) and Machine Learning (ML) with traditional software engineering to handle end-to-end banking operations. Robotic process automation in financial services helps institutions handle high-volume workloads like compliance checks, document verification, and reconciliation while minimizing human errors.

Banks are increasingly deploying RPA in the banking sector for critical operations such as customer onboarding, Know Your Customer (KYC) verification, loan processing, and fraud monitoring. From 2026 onward, analysts expect rapid growth in hyper automation and cognitive RPA, enabling bots to make intelligent decisions in real time.

As technology evolves, AI in banking will drive process automation beyond transactional work toward predictive analytics, personalized offers, and continuous compliance management marking a new era for robotics in banking and its contribution to financial stability and innovation.

Let’s explore what benefits banks that implement robotic process automation in the banking sector can achieve.

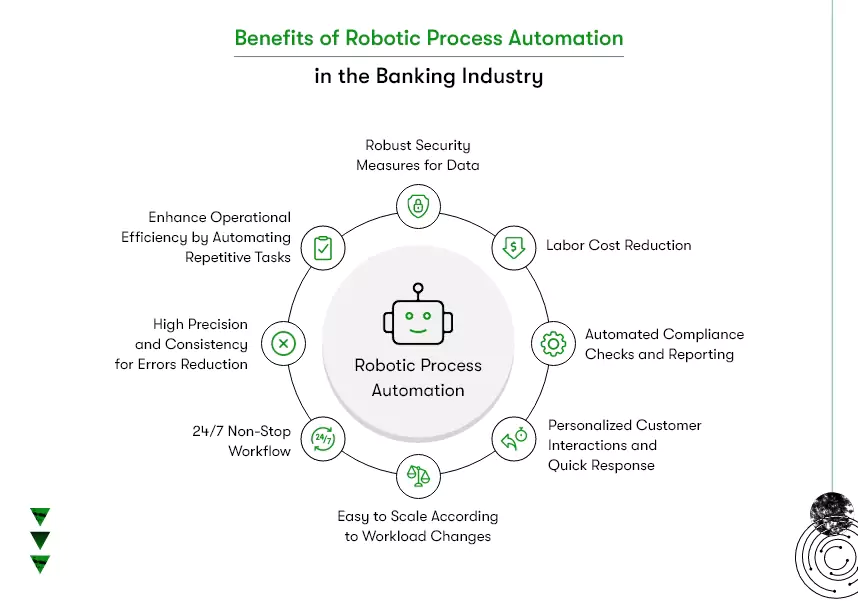

Top Benefits of Robotic Process Automation in the Banking Industry

Considering the implementation of robotic process automation in banking is a strategic step that can deliver measurable improvements across every department.

With the global market for RPA in banking projected to cross $8 billion by 2033, efficiency, precision, and scalability are becoming standard expectations in the automation in banking sector.

1) Enhance Operational Efficiency by Automating Repetitive Tasks

RPA in the banking industry eliminates manual intervention in time-consuming operations like data entry, document verification, and transaction processing. The technology shortens turnaround times, minimizes bottlenecks, and allows staff to focus on customer-centric initiatives.

2) High Precision and Consistency for Error Reduction

Automation ensures uniform data handling. Robotic process automation in banking sector executes every step consistently, reducing costly human errors and maintaining accurate records critical for audits and compliance.

3) 24/7 Non-stop Workflow

Bots run continuously without breaks, enabling banking process automation to maintain uninterrupted performance for functions such as transaction monitoring, statement reconciliation, and overnight reporting.

4) Easy to Scale According to Workload Changes

Unlike traditional operations limited by staff capacity, robotics in banking solutions scales instantly to meet fluctuating demands. For example, during peak loan or account-opening seasons, without compromising service speed or quality.

5) Personalized Customer Interactions and Quick Response

AI-driven RPA bots enhance engagement by combining automation with Natural Language Processing (NLP). They deliver instant responses, suggest relevant products, and ensure consistent experiences across channels. A practice becoming widespread in robotic process automation in financial services.

6) Automated Compliance Checks and Reporting

RPA in banking simplifies compliance management. Bots validate transactions against AML and KYC policies, generate reports, and maintain real-time audit trails, reduce exposure to penalties, and improve regulatory trust.

7) Labor Cost Reduction

By automating repetitive functions, banks cut operational costs while reallocating human expertise toward advisory and strategic roles. This measurable saving strengthens return on investment for every robotic process automation in banking industry projects.

8) Robust Security Measures for Data

Modern RPA tools are built with strict access controls and encryption frameworks. As cyber-threats grow, these features safeguard sensitive customer information and reinforce digital-trust initiatives across the automation in the banking sector.

Ultimately, RPA adoption enables financial institutions to achieve greater accuracy, compliance assurance, and operational agility; critical advantages for banks preparing for AI-driven growth through 2026 and beyond.

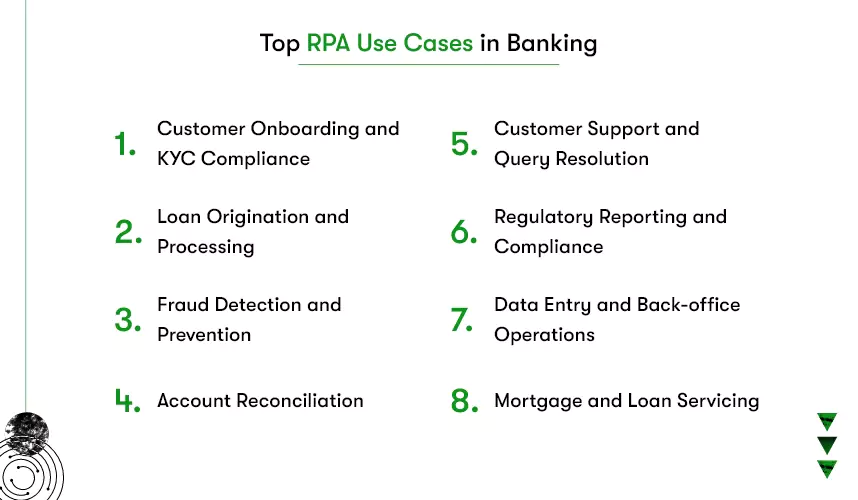

How is RPA Used in Banking and Financial Services?

According to a study, a typical bank with 125,000 customers that on-boards 3 % of new customers and expands services for another 6–7 % each year could see one-time savings of $100 million during onboarding and another $100 million every three years from automation of monitoring processes.

Leveraging the benefits of RPA in banking can dramatically enhance efficiency, compliance, and customer satisfaction. Below are major robotic process automation in financial services use cases transforming how banks operate.

1) Customer Onboarding and KYC Compliance

A bank spends about $52 million annually on KYC compliance and onboarding. RPA in banking sector reduces these expenses by automating customer data collection, validation, and document verification.

- Bots automatically cross-reference records with regulatory databases and update CRM systems.

- Robotic process automation in the banking industry ensures error-free data capture and speeds up KYC approvals from days to minutes.

2) Loan Origination and Processing

Traditional loan approval may take 40 days or more. Through automation in the banking sector, RPA bots extract data from applications, evaluate credit scores, and auto-populate loan documents.

- RPA in the banking industry helps verify borrower background instantly and reduce errors in loan documentation.

- Banks achieve faster turnaround times and better customer retention.

3) Fraud Detection and Prevention

Over 90% of financial organizations report rising fraud cases each year. Robotics in banking supports real-time transaction monitoring to spot anomalies.

- Bots analyze transaction patterns and flag unusual activity.

- Integration with AI models enhances risk prediction accuracy.

- Robotic process automation in financial services reduces losses by detecting fraud before impacting customers.

4) Account Reconciliation

Manual reconciliation often slows month-end closing. RPA in banking matches transactions, detects mismatches, and generates error-free reports.

- Bots validate data across multiple systems.

- Banking process automation shortens reconciliation cycles from days to hours.

5) Customer Support and Query Resolution

Banks receive thousands of queries every day. Robotic process automation in the banking sector uses AI-driven chatbots and virtual assistants in banking to resolve routine requests instantly and escalate complex cases to agents.

- NLP-based bots handle balance inquiries, account updates, and service requests.

- Continuous availability improves satisfaction and brand trust.

6) Regulatory Reporting and Compliance

Regulations around AML, ESG, and data security are evolving rapidly. RPA in banking industry automates data aggregation and report submission across jurisdictions.

- Bots collect and validate records from core systems.

- Automation in the banking sector ensures timely, accurate filings and audit readiness.

7) Mortgage and Loan Servicing

Manual processing of mortgages is time-consuming and prone to errors. Robotic process automation in banking automates document collection, payment tracking, and communication reminders, enhancing compliance and customer experience.

8) Data Entry and Back-Office Operations

Banking process automation handles repetitive data entry tasks with precision and speed. It reduces administrative burden and allows teams to focus on strategic projects.

- Bots validate and migrate records across legacy systems.

- RPA in banking sector minimizes errors and improves data consistency organization wide.

By 2028, banks that combine RPA with AI-based analytics will achieve up to 40% faster processing across front, middle, and back-office functions, creating new standards for efficiency in robotic process automation in the banking industry.

Real-World Case Studies of RPA in Banking Industry

Robotic process automation in the banking sector has already delivered measurable results for several global institutions.

According to a Gartner report, nearly 80% of finance leaders have already implemented or planned to implement RPA in their operations, highlighting how automation is redefining compliance, KYC, and fraud prevention in financial services.

To understand this transformation in action, let’s explore a few case studies showing how global banks are using RPA in banking to streamline operations and strengthen efficiency.

Bank of America

The second-largest bank in the USA, Bank of America, has long pursued technology-driven modernization. Since 2010, the bank has invested more than $25 billion in digital systems and internal cloud platforms to improve agility.

Challenge: Millions of daily customer transactions and complex compliance requirements created operational bottlenecks. Manual processes in customer service, document verification, and regulatory reporting slowed response times and increased costs.

Solution: The bank deployed RPA in banking industry operations across multiple departments. Hundreds of software bots were developed to automate transaction checks, onboarding, and internal reconciliation processes. These bots are integrated with AI-driven analytics to ensure data accuracy and compliance traceability.

Results:

- Saved hundreds of thousands of work hours annually by automating routine back-office activities.

- Reduced manual interventions by over 40%, improving turnaround time for account services and loan processing.

- Increased customer satisfaction through faster query resolution and improved error-free reporting.

- Enhanced risk control and transparency across its banking process automation framework.

Bank of America’s approach demonstrates how robotic process automation in banking can scale from isolated tasks to enterprise-wide digital transformation.

KeyBank

KeyBank, one of the largest U.S. regional banks, serves retail, commercial, and investment clients across several states.

Challenge: The loan origination process relied heavily on manual document reviews and multi-step data validation, leading to lengthy approval cycles and inconsistent risk assessments.

Solution: KeyBank implemented robotic process automation in financial services to streamline its loan-processing lifecycle. RPA bots now extract borrower information, validate supporting documents, and cross-check data with regulatory databases. These automations seamlessly integrate with the bank’s credit analysis system, reducing dependence on manual verification.

Results:

- Loan approvals became 60% faster, cutting processing time from weeks to days.

- Automated data validation eliminated common errors in credit assessment.

- Compliance accuracy improved through real-time audit trails generated by automation in banking sector solutions.

- Operational teams were reallocated to advisory roles, enhancing customer engagement.

KeyBank’s success highlights the power of RPA in the banking sector to improve accuracy, compliance, and customer experience simultaneously.

Citibank

Citibank, a global institution operating in more than 90 countries, faced challenges in fraud detection and regulatory compliance as transaction volumes surged post-digitization.

Challenge: Manual fraud monitoring created delays and inconsistent alert handling. Compliance teams were overburdened by repetitive screening tasks.

Solution: Citibank adopted robotics in a banking framework powered by AI-enhanced RPA. Bots continuously analyze transaction data, customer behavior patterns, and geolocation information to flag anomalies in real time. The system also integrates with Citibank’s AML (Anti-Money Laundering) platform to automate case creation and escalation workflows.

Results:

- Detected suspicious activities 30% faster, reducing potential fraud exposure.

- Lowered false-positive rates in AML monitoring by 25% through data-driven decisioning.

- Strengthened compliance consistency across markets by standardizing regulatory checks.

- Built greater customer trust through quicker fraud resolution and secure robotic process automation in banking industry protocols.

Citibank’s transformation underscores how combining AI and RPA enable proactive risk management and real-time fraud prevention for global financial institutions.

Together, these examples show that robotic process automation in banking is more than cost reduction; it is the foundation for smarter, more resilient financial operations. With the global RPA in banking market projected to surpass $18 billion by 2033, forward-thinking institutions are already shaping the next decade of digital banking innovation through automation.

How Kody Technolab Implements Banking Process Automation Solutions

The future of RPA in the banking industry looks increasingly promising as automation becomes the foundation for intelligent financial operations. By 2030, the RPA in banking and financial services market is projected to be a cornerstone of global banking efficiency, reaching nearly $19 billion in value, driven by continuous AI integration, compliance automation, and customer-centric workflows.

Robotic process automation in banking has evolved from a back-office tool into a strategic enabler that accelerates transformation, minimizes human error, and ensures 24/7 process continuity. Banks adopting automation in banking sector solutions now gain more than efficiency; they achieve resilience, transparency, and scalability that define the modern financial enterprise.

However, the true impact of automation depends on the right implementation partner. That’s where Kody Technolab Ltd comes in.

Kody Technolab helps financial institutions harness the power of robotic process automation in financial services with solutions engineered for precision, compliance, and measurable business growth. Our expertise covers every stage, from consulting and process discovery to full-scale deployment and long-term optimization, ensuring smooth integration into existing systems.

Here’s how we add value:

- Tailored Automation Strategy: We assess your operations and build a roadmap aligned with your regulatory and performance goals.

- AI-Driven RPA Development: Our engineers deliver secure, scalable banking process automation systems using advanced AI, OCR, and cloud-native frameworks.

- Compliance-First Architecture: Every deployment adheres to AML, GDPR, and KYC standards for seamless audits and trusted governance.

- Continuous Optimization: Post-deployment analytics ensure sustained ROI and improved customer experiences.

Kody empowers banks to move beyond repetitive processes and build intelligent automation ecosystems that redefine operational excellence and customer trust. The time to act is now, so start your RPA journey with a partner that delivers measurable results and future-ready banking innovation. Hire Fintech Developers who deliver measurable results and future-ready banking innovation.

FAQs

1. What is RPA in banking?

RPA in banking refers to the use of software bots to automate repetitive tasks such as data entry, KYC verification, and report generation. It improves accuracy, reduces manual effort, and speeds up financial workflows.

2. How does RPA benefit the banking sector?

RPA enhances efficiency, accuracy, and compliance while reducing costs. It enables 24/7 operations and frees employees to focus on higher-value strategic work.

3. What processes can be automated with RPA in the banking industry?

Processes like customer onboarding, loan processing, fraud detection, and regulatory reporting can all be automated. This helps banks achieve faster turnaround times and stronger compliance.

4. Is robotic process automation in financial services secure?

Yes, RPA systems include access controls, encryption, and audit trails that safeguard sensitive data. When properly configured, they enhance both data security and compliance readiness.

5. What is the difference between RPA and AI in banking?

RPA automates rule-based tasks, while AI adds intelligence analyzing data, making predictions, and learning from patterns. Together, they enable intelligent automation for advanced decision-making.

6. How can banks measure ROI from RPA implementation?

Banks can track metrics like cost reduction, processing speed, and error rate improvements. These indicators show how robotic process automation in the banking sector improves efficiency and profitability.

7. Why should financial institutions partner with experts like Kody Technolab for RPA?

Kody Technolab provides end-to-end banking process automation solutions built around compliance, scalability, and measurable results. Their expertise ensures seamless implementation and long-term value for financial institutions.

Contact Information

Contact Information