Did you know that AI found its early foothold in the banking sector back in the 1990s?

It was during this time that banks started adopting rule-based systems for detecting fraud and assessing risks. Thanks to these pioneering AI systems, banks were able to identify suspicious transactions and proactively mitigate potential risks more effectively than ever before, outperforming traditional methods.

Fast forward to today, with the exponential growth of data and advancements in deep learning, AI’s capabilities in banking have skyrocketed. Modern AI systems can now process massive datasets, extract valuable insights, and even understand natural language. All these capabilities make AI a pivotal tool for German, Dutch, American, and all the banks in the world to stay competitive.

Artificial Intelligence is a technology that stimulates human intelligence capabilities of problem-solving and decision-making by using computers and machines.

To leverage the benefits of AI in banking to the fullest, however, banks must consider practical applications of AI instead of hype. Researching potential AI use cases in banking and understanding how to enable successful implementation should be the priority.

And that’s the agenda of this blog. From benefits, use cases, and trends to what the future of AI in banking looks like, we’ll dig as deep as we can so that you can strategize AI implementation into your digital banking transformation without any hesitation.

First up is,

What are the benefits of implementing AI in the banking industry?

Beyond the realm of sci-fi fantasies, AI’s real-world applications in banking have garnered attention for a good reason. The integration of AI technologies presents an unprecedented opportunity for banks to reimagine their operations. Enhancing decision-making processes and delivering highly personalized services to diverse clientele are only a few benefits of AI in banking.

Let’s explore more.

How does AI Improve Customer Experience in Banking?

Artificial Intelligence can help uplift your bank’s customer experience by allowing you to offer:

- Personalized Services and Recommendations: You can offer tailor-made financial products and services using AI-powered systems to analyze vast amounts of customer data to discern individual preferences. This personalized touch fosters stronger customer relationships, nurtures loyalty, and propels customer satisfaction to new heights.

- Enhanced Customer Support through Chatbots: Gone are the days of long wait times and delayed responses. You can now use AI-driven chatbots to engage customers in real-time, revolutionizing customer support. Promptly addressing inquiries and resolving routine issues, these virtual assistants ensure seamless interactions around the clock. Consequently, your customers will have a sense of satisfaction and confidence in choosing your bank.

How does AI Drive Increased Efficiency and Cost Savings in Banks?

Want to streamline your banking operations? AI has got you!

- Automated Processes and Operations: AI’s prowess in automating mundane and repetitive tasks has breathed new life into banking operations. From data entry to transaction processing, AI-powered automation optimizes internal processes, freeing human resources to focus on strategic endeavors and value-added activities.

According to a Deloitte report, 85% of the cost is spent over the top 20% of back-office work. While AI-powered automation can streamline labor-intensive tasks like compliance reporting, new customer onboarding, communications, and documentation.

- Fraud Detection and Risk Management: The ever-evolving landscape of financial risks demands a proactive approach. AI-powered algorithms tirelessly scour vast volumes of financial data, detecting unusual patterns and identifying potential risks in real time. As a stalwart guardian, AI helps banks stay vigilant and tackle fraud head-on, mitigating losses and bolstering security.

How does AI Foster Data-Driven Decision Making in Banking?

Artificial Intelligence is beneficial in analyzing data and inferring analytical decisions from the data. And that makes it invaluable technology for Banks.

- Predictive Analytics for Market Insights: AI’s predictive prowess offers invaluable foresight into market trends, empowering you to make data-driven decisions. Armed with market insights, you can craft targeted marketing strategies and identify potential business opportunities for your bank, propelling growth and resilience.

- Real-time Analysis of Financial Data: AI enables real-time analysis of financial data. So, by using AI in your banking system, you can swiftly respond to market fluctuations and dynamic customer demands. Consequently, your bank can gain a competitive edge in the ever-evolving finance industry.

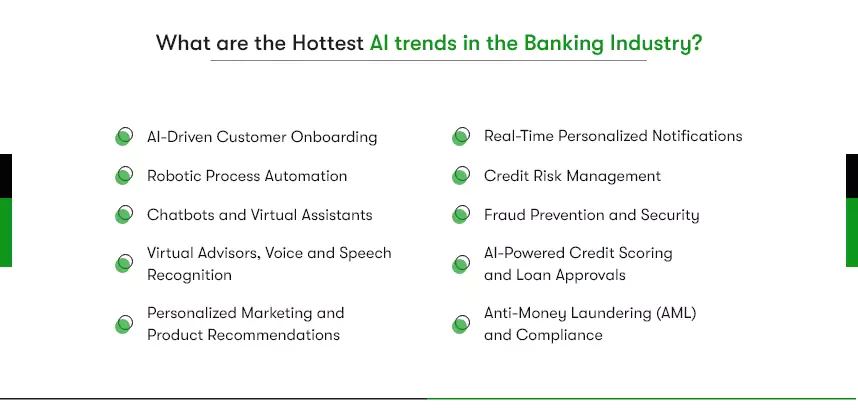

What are the hottest AI trends in the banking industry?

AI-driven onboarding, Chatbots, RPA, Compliance and AML, credit scoring, fraud detection, and more AI use cases in Banking trending. These AI trends help banks optimize their operations, enabling banks to offer enhanced customer experience while reducing effort and cost.

| What do Banks use Artificial Intelligence for in their operations? | |

| Fraud Detection | 57.6% |

| IT Operations | 54% |

| Customer Experience | 43.9% |

| Credit Scoring | 42.4% |

| Sales & Marketing | 40% |

AI-Driven Customer Onboarding

AI streamlines customer onboarding processes by automating identity verification, compliance checks, and document processing. This accelerates the onboarding journey, reducing the time it takes for customers to start using banking services and fostering a positive first impression.

Robotic Process Automation

RPA is an AI-driven solution to put time-consuming and repetitive tasks like documenting, verifying, etc., on autopilot mode. Software robotics in the RPA solution mimics back-office tasks using Artificial Intelligence. These bots then work tirelessly to process loan applications, verify documents, extract, and handle data entry faster, eliminating the chances of human errors.

Chatbots and Virtual Assistants

Integrating AI-powered chatbots and virtual assistants can optimize customer support and satisfaction. These intelligent agents can handle routine customer queries, such as balance inquiries, account transfers, and transaction history requests, instantly providing answers and resolving issues. By offering round-the-clock assistance, your bank ensures a hassle-free customer experience and reduces wait times for support, contributing to heightened customer satisfaction.

AI-Powered Credit Scoring and Loan Approvals

Adopting AI-driven credit scoring and loan approval processes can optimize lending decisions and decrease processing time. AI algorithms analyze vast data sets, including credit history, financial behavior, and income sources, to assess creditworthiness accurately. This results in quicker loan approval decisions and reduces the burden on bank personnel, enhancing operational efficiency and customer satisfaction.

Anti-Money Laundering (AML) and Compliance

Utilizing AI in AML and compliance efforts can optimize fraud detection and regulatory adherence. AI-powered systems can analyze large volumes of transaction data, flagging suspicious activities and potential money laundering patterns more efficiently than traditional methods. By automating AML processes, your bank can decrease manual effort, mitigate compliance risks, and reinforce its commitment to a secure and trustworthy banking environment.

Personalized Marketing and Product Recommendations

Employing AI for personalized marketing and product recommendations can enhance customer engagement and loyalty. AI algorithms analyze customer data, including transaction history, preferences, and behavior, to offer tailored product recommendations and targeted marketing campaigns. For example, a bank can use AI to send personalized credit card offers or investment opportunities to individual customers, increasing the likelihood of conversion and customer satisfaction.

Voice and Speech Recognition:

Implementing AI-powered voice and speech recognition systems allows your bank to offer voice-based banking services. Customers can perform transactions, check account balances, and get information through voice commands, providing a convenient and secure banking experience.

Virtual Advisors:

AI-based virtual financial advisors can provide customers with personalized financial planning and investment advice. These advisors consider a customer’s financial goals, risk tolerance, and market conditions to recommend suitable investment options and help customers achieve their financial objectives.

Fraud Prevention and Security:

AI can strengthen your bank’s security measures by detecting and preventing fraudulent activities in real time. AI algorithms can analyze unusual behavior patterns and identify potential threats, safeguarding your bank and customers from financial fraud.

Real-Time Personalized Notifications:

AI-powered systems can send real-time notifications to customers regarding their account activities, spending patterns, and upcoming bill payments. These personalized alerts enhance financial awareness, reduce overdrafts, and promote responsible financial management.

Credit Risk Management:

AI applications can help banks assess credit risk more accurately by analyzing customer data and financial indicators. This enables your bank to offer more competitive loan terms, reduce default rates, and optimize credit risk management practices.

What are the top AI use cases transforming the banking sector?

We see there are numerous AI applications in the Banking industry. But what AI application to adopt for specific problem-solving? Let us explore AI use cases in the context of different banking operations.

How to enhance Customer Service and Support using AI in banking?

By leveraging natural language processing in AI-powered chatbots, banks can ensure a seamless and human-like interaction for customers, improving overall customer experience. Besides, conversational AI agents can automate up to 80% of customer support tasks, including answering account balance inquiries, transaction history requests, bank statements, etc.

Evidently, AI-powered chatbots and virtual assistants can be a game-changer.

Furthermore, you can easily gain insights into your customer behavior and offer personalized services at the right time using behavioral AI. Behavioral AI combines artificial intelligence and machine learning techniques that can process a vast amount of customer data.

Analyzing customer browsing patterns, interactions, historical preferences, and social media activities through behavioral AI helps banks tailor accurate offerings. This AI solution also aids in fraud detection, churn prediction, and customer retention strategies.

How to use AI in banking for Risk Assessment and Fraud Detection?

Advanced algorithms and data analysis make it easy to analyze extensive datasets and identify potential risks or fraudulent activities. These algorithms continuously monitor transactions in real-time, flagging suspicious behavior for further investigation. Thereby fueling risk management with efficiency.

Likewise, AI-powered credit scoring models can assess creditworthiness more accurately, enabling banks to make informed lending decisions. Thus, with the proactive AI-powered approach, you can strengthen risk management and your bank’s security measures, preventing financial losses due to fraud.

How does AI help Optimize Credit Underwriting and Loan Processing for Banks?

AI can extract data from complex and unstructured documents, as well as learn from historical data. By accelerating background research and automating creditworthiness evaluation, AI reduces loan processing time, eliminating human errors and increasing efficiency. And if there is anything fishy with loan applicants, AI alerts you. So, you can offer suitable loan terms and reduce default rates.

It’s stated in a Deloitte report that a European bank achieved an increase of 30% in mortgage collection after replacing pure statistical regression with machine learning for credit analysis.

Underlying AI Technologies Used in Banking

Underlying AI technologies refer to foundational components, algorithms, and techniques that power various artificial intelligence applications. Machine learning, deep learning, NLP, computer vision, and more are used as underlying AI technologies to build smart Banking solutions.

However, digital banking can rely on various underlying AI technologies to enhance customer experiences, streamline operations, and provide personalized services.

Machine Learning (ML) in Banking:

The duo of Machine Learning and AI in banking is so powerful that it automates various operations, driving efficiency. For example,

- Predictive Analytics: Analyzing historical data swiftly, ML helps banks predict customer behavior, such as spending patterns and credit risk. So, banks can recommend personalized offerings for different customer groups.

- Fraud Detection: ML models analyze banking transactions in real-time to identify unusual patterns that might indicate fraudulent activities.

- Credit Scoring: Alternatively, ML algorithms assess a customer’s creditworthiness based on various factors, helping your banks determine loan eligibility and interest rates.

- Churn Prediction: ML algorithms and predictive analysis also allow banks to predict which customers are likely to switch to another bank. So, banks can take proactive measures to retain those customers.

Natural Language Processing (NLP) in Banking:

NLP is the fundamental technology that enables machines to understand, interpret, and generate human language. Through text analysis, machine translations, and sentiment analysis, NLP helps you strengthen bank customer support, maintaining a human touch.

Chatbots and Virtual Assistants: NLP-powered chatbots provide customer support, answer queries, and guide users through banking processes via natural language conversations.

Sentiment Analysis: NLP algorithms analyze customer feedback on social media and other channels to gauge customer sentiment and improve your banking services accordingly.

Robotic Process Automation (RPA) in Banking:

RPA works in conjunction with AI technologies to automate rule-based, repetitive tasks, reducing human errors and improving banking operational efficiency. RPA basically involves bots. Harnessing the power of AI, you can easily program these bots to understand documents, visualize screens, mimic human behavior, input data, click buttons, and more.

Ultimately, banks can use robotic process automation as per their requirements– to improve compliance, reduce human errors in administrative tasks, increase efficiency as bots can work 24/7, and more.

AI Biometric Authentication:

While offering omnichannel banking services, security becomes your first priority. So for robust security and fraud prevention, you can integrate AI with Biometric authentication. This integration also ensures an accurate identity verification process with convenience and engaging user experiences.

What are the Potential Challenges and Concerns for AI Adoption in Banks?

While AI offers tremendous opportunities for the banking industry, there are several challenges and concerns that banks must address during AI adoption:

1. Data Quality and Privacy: AI models heavily rely on data, and poor data quality can lead to inaccurate outcomes. Ensuring data accuracy and maintaining customer privacy are critical challenges. So, your banks must establish robust data governance frameworks and adhere to strict data protection regulations.

2. Model Bias and Fairness: AI models can inherit biases from historical data, leading to unfair outcomes. Hence, you need to be vigilant in identifying and rectifying biases to ensure fair treatment of all customers and comply with anti-discrimination laws.

3. Interpretability and Transparency: Complex AI models can be difficult to interpret and explain. Regulatory bodies and customers demand transparency in AI decisions. In that case, you can implement “explainable AI” approaches to provide clear justifications for AI-driven decisions.

4. Cybersecurity Risks: As AI becomes more prevalent, it becomes an attractive target for cyberattacks. To protect your AI banking system and the sensitive data it process, you must prioritize robust cybersecurity measures.

5. Talent and Expertise: High demand across industries makes it hard to acquire AI talents. Therefore, rather than investing resources in developing in-house expertise, partnering with specialized AI software companies can help overcome this challenge.

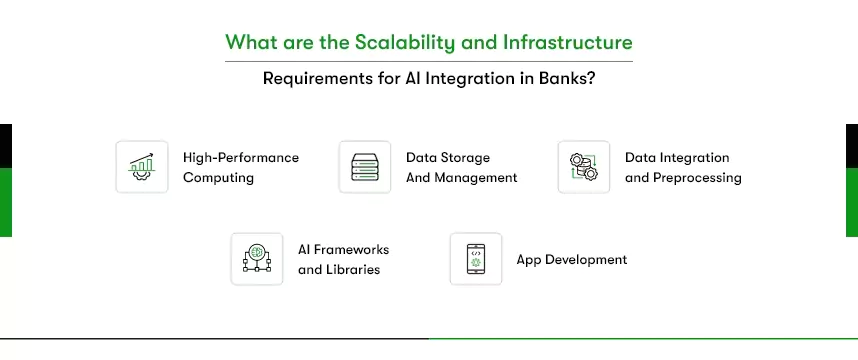

What are the Scalability and Infrastructure Requirements for AI Integration in Banks?

AI integration in banks demands robust scalability and infrastructure to handle the complexity and volume of data. Key infrastructure requirements include:

1. High-Performance Computing: AI requires significant computing power to process large datasets and execute complex algorithms. Hence, banks require to invest in high-performance servers or consider cloud-based solutions for scalability.

2. Data Storage and Management: Banks need reliable and secure data storage solutions to store vast amounts of structured and unstructured data. Data lakes and data warehouses are commonly used for this purpose.

3. Data Integration and Preprocessing: AI models thrive on clean, consolidated, and structured data. Data integration and preprocessing pipelines are essential to ensure data readiness for AI training and inference.

4. AI Frameworks and Libraries: Banks need access to AI frameworks and libraries, such as TensorFlow and PyTorch, to effectively develop and deploy AI models. If you don’t know which framework and where to use, consult our banking software experts.

5. App Development: Mobile and/or web apps are a crucial digital banking channel. Hence, integrating AI solutions into these platforms becomes mandatory to offer personalized experiences. But if your bank doesn’t have apps, developing a banking app should be your priority.

And when it comes to building apps for different platforms, such as the web, Android, and iOS, Flutter is a jack and master of all. Flutter cross-platform app development not only reduces development time and hassle but also development and maintenance costs.

How is AI Used in Banking in Germany and Netherlands?

One of the best banks in Germany, Commerzbank, saw potential in AI technology. They believed AI could help improve customer experiences and provide curated interactions that could strengthen brand trust. So, the German bank implemented conversational AI into their customer service segments.

Consequently, the implementation of AI chatbots for customer support turned out to be successful for Commerzbank. They were able to reduce customer response time as well as their churn rate.

Another bank from Germany that pull off AI applications in their operations is Deutsche Bank. In Dec 2022, the bank announced its partnership with NVIDIA to build AI applications for risk assessment, fraud detection, and boosting efficiency.

“AI, ML, and data will be a game changer in banking, and our partnership with NVIDIA is further evidence that we are committed to redefining what is possible for our clients,” said Christian Sewing, CEO of Deutsche Bank.

ABN AMRO, the Netherlands’ third largest Dutch bank and market leader, has been using conversational AI–Anna since 2017. The bank uses chatbots for both commercial and private customers. In the last quarter of 2021, Anna provided 90% of 250,000 customers.

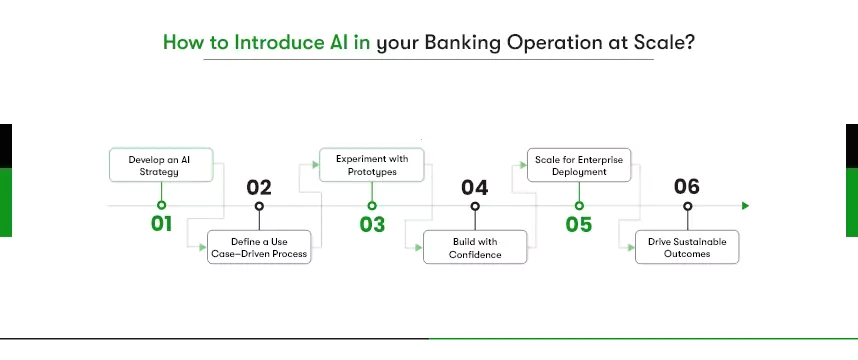

How to introduce Artificial Intelligence in your Banking operation at scale?

To introduce AI at scale in your banking operations, you must first develop a comprehensive AI strategy. Then prioritize business value-driven use cases, experiment with prototypes, and proactively address risks and ethics.

Introducing Artificial Intelligence (AI) at scale into your banking operations involves a strategic approach to harness its potential effectively.

Step 1: Develop an AI strategy

To truly integrate AI within your banking operations, it’s essential to shift from merely utilizing AI capabilities to becoming an AI-driven institution. This involves crafting a comprehensive AI strategy that not only focuses on what AI can achieve but also addresses the intricacies of execution.

Step 2: Define a use case–driven process

Instead of concentrating on isolated AI solutions, prioritize use cases that deliver tangible business value. Diversify your investments in various AI capabilities, ensuring that each chosen use case aligns with your strategic goals and contributes meaningfully to your banking operations.

Step 3: Experiment with prototypes

The transition from conceptual discussions to practical implementation by developing prototypes. These prototypes lay the foundation for strategic alignment, allowing you to visualize how AI can fit seamlessly into your banking operations and how it aligns with your institution’s objectives.

Step 4: Build with confidence

Shift your approach from a reactive mindset to a proactive one, emphasizing risk assessment and ethical considerations. As you progress, explore new partnerships to enhance your AI capabilities while ensuring a balanced convergence between AI technologies and your banking operations.

Step 5: Scale for enterprise deployment

Elevate the importance of AI talent within your organization from a “nice-to-have” to a “must-have.” Embrace adaptive technology and operating models that foster agility across your banking operations. This shift will enable you to scale AI deployment while maintaining flexibility.

Step 6: Drive sustainable outcomes

Go beyond the initial implementation phase and focus on continuous improvement. Discover ways to enhance your AI capabilities and extract additional business value from your deployed applications. By cultivating a culture of ongoing advancement, your banking operations can sustainably benefit from AI’s transformative potential.

What does the future of AI in banking in Germany and the Netherlands look like?

85% of IT executives in the banking sector have a clear strategy for adopting AI for new product and service development.__ survey.

In the upcoming years, AI will continue to push the boundaries of improvements in the banking sectors of Germany and the Netherlands. The adoption of this transformative technology in your digital banking transformation unlocks unparalleled opportunities.

The AI-powered approach will enable your banks to elevate customer experiences, drive operational efficiency, and set the stage for a dynamic and customer-centric future. No matter how strategic your AI approach is, you will need a team of experts to ensure smooth and efficient implementation.

Kody Technolab’s approach to AI development is underpinned by a well-defined process. Our process starts with discovery and analysis, data collection, and preparation. We develop and train models and conduct rigorous testing and validation. This process ensures the delivery of high-quality, customized AI solutions that align with the specific requirements of banks.

Contact Information

Contact Information