The FinTech industry faces a pressing concern: the need to strike a balance between technological advancement and meeting the demands of customers. This dual challenge is a pain point for finance businesses aiming to remain competitive in an AI-driven world.

Now that AI in Fintech emerges as the catalyst, redefining the rules of the game, it’s crucial for every finance business to take a leap into Artificial Intelligence. AI can empower Fintechs to offer personalized customer service, automate operations, enhance security, and more (ahead in the blog).

That makes leveraging AI in Fintech like killing two birds with one stone –

i) gain a competitive advantage by creating and offering personalized finance products,

ii) meet customer demands with high satisfaction.

However, the adoption of AI in the Fintech Industry requires careful planning.

Understanding AI applications in Fintech, implementation, and potential challenges will help you confidently navigate this complex landscape. As experts in the intricate fusion of AI and Fintech, we have created this guide just to help you understand everything about AI in Fintech.

How does AI impact the Fintech Industry?

FinTech, the amalgamation of finance and technology, represents the revolutionary marriage of financial services with cutting-edge technological innovations.

AI, short for Artificial Intelligence, encompasses a spectrum of technologies such as Machine Learning, Deep Learning, Natural Language Processing (NLP), and more. Machine Learning enables systems to learn and improve from experience without explicit programming, while Deep Learning mimics the human brain’s neural networks for complex pattern recognition. NLP empowers computers to understand and process human language, enhancing customer interactions and data analysis.

The fusion of AI and FinTech is about enabling smarter, faster, and more intuitive financial interactions. With each algorithmic decision and predictive insight, AI paints the future of FinTech in hues of efficiency and user-centricity.

FinTech encompasses a broad range of domains, and AI is not sparing any for good. AI in the Fintech industry has already started to disrupt all the below finance domains.

Banking: AI transforms customer interactions, powering personalized banking experiences.

Insurance: AI enhances claims processing and underwriting through data-driven insights.

Loans: AI-driven credit assessment expedites loan approvals while minimizing risks.

Personal Finance: AI-powered apps offer tailored financial guidance and budgeting.

Electronic Payments: AI secures and streamlines electronic payment processes.

Venture Capital: AI-driven analytics aid in identifying lucrative investment opportunities.

Wealth Management: AI refines investment strategies for optimized wealth growth.

Now, let’s get you ready to delve into the heart of AI’s influence on the FinTech landscape.

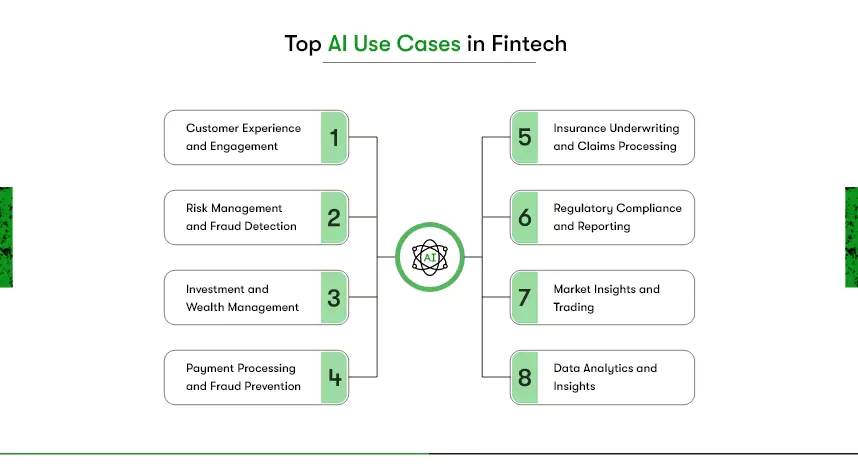

Top AI Use Cases in Fintech

Fintechs can use AI to deliver unique value, transform their operation models, set competitive dynamics, as well as expand into uncharted territory. However, the specific use cases of AI in Fintech include personalizing customer support, fraud detection, risk management, automating repetitive processes, and more.

Customer Experience and Engagement:

- Personalized Services: AI tailors financial recommendations and products based on individual customer profiles, enhancing user experiences.

- Chatbots and Virtual Assistants: AI-powered chatbots provide instant customer support and answer queries, improving customer engagement.

Risk Management and Fraud Detection:

- Credit Assessment: AI algorithms analyze vast data sets to evaluate creditworthiness, enabling faster and more accurate loan approvals.

- Fraud Detection: AI detects unusual transaction patterns, identifying potential fraudulent activities and minimizing risks.

Investment and Wealth Management:

- Robo-Advisors: AI-driven robo-advisors provide automated investment advice and portfolio management, catering to individual risk profiles.

- Predictive Analytics: AI models forecast market trends and provide investment insights, aiding decision-making for wealth management.

Payment Processing and Fraud Prevention:

- Payment Automation: AI can automate payment processes, streamlining electronic transactions and reducing errors.

- Anomaly Detection: It’s easy for AI to identify unusual payment patterns, assisting in real-time fraud prevention and secure electronic payments.

Insurance Underwriting and Claims Processing:

- Risk Assessment: InsureTechs can use AI to assess applicants’ risk profiles using historical data and real-time information for accurate underwriting.

- Claims Automation: AI expedites claims processing by automating the evaluation of data and documents to determine claim legitimacy and payout amounts.

Regulatory Compliance and Reporting:

- AML and KYC: Artificial Intelligence in Fintech can also assist in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes by analyzing customer data for compliance.

- Regulatory Reporting: AI automates the generation of regulatory reports, ensuring accurate and timely submissions.

Market Insights and Trading:

- Algorithmic Trading: AI-powered algorithms can execute trades based on market data and predefined strategies, optimizing trading outcomes.

- Sentiment Analysis: Trading apps can also leverage AI to analyze news, social media, and market data to gauge market sentiment and inform trading decisions.

Data Analytics and Insights:

- Data Processing: AI processes and analyzes large volumes of financial data, extracting actionable insights for informed decision-making.

- Predictive Analytics: AI models forecast market trends and customer behavior, enabling data-driven strategies.

These AI use cases underscore the transformative impact of artificial intelligence on different aspects of the FinTech industry, ushering in new efficiencies and possibilities.

Current Landscape of AI in FinTech (2023)

According to the World Economic Forum and the Cambridge Center for Alternative Finance, 85% of Financial service providers use Artificial Intelligence in some form.

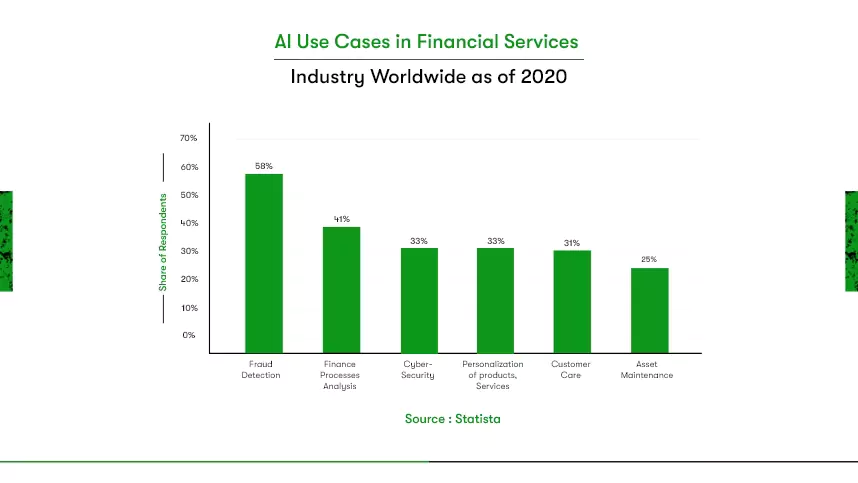

We analyzed what exactly Fintechs use AI for across their organizations and services. And we found,

Now, let us see Artificial Intelligence adoption in action.

What are High-Valued Fintech Unicorns from Europe Using Artificial Intelligence?

The number of Fintechs is progressively growing across Germany and the Netherlands, and so is the AI adoption. According to Statista, N26 from Germany and Mollie from the Netherlands are the fourth and eighth leading Fintech unicorns as of April 2023, respectively. And both unicorns also leverage Artificial Intelligence across their organizations and services.

We have already discussed N26 and the cost of developing a similar digital banking and Fintech app that you can check out to extend your research.

So, now let us see some emerging Fintech startups built on Artificial Intelligence in Germany and the Netherlands.

Omni:us is a Berlin-based leading intelligent insurance claim automation provider founded in 2015. The unique combination of claim expertise and Artificial Intelligence enables seamless integrations within existing or legacy insurance systems. The AI-powered claims decision automation Omni:us reported a 35% reduction in process cost for insurance companies.

Trade Republic is a German-based financial technology company that operates as a mobile app for investing in stocks, exchange-traded funds (ETFs), and cryptocurrencies. It offers commission-free trading, making it popular among retail investors who want to invest in the financial markets without incurring traditional brokerage fees.

Ayden from Amsterdam, the Netherlands, is a Fintech platform that offers end-to-end payment solutions, data-driven insights, and financial products to help businesses. The leading B2B payment platform uses AI and ML to detect and reduce online fraud at scale.

What are the Challenges, and how to Overcome them for smoother AI Applications in Fintech?

Though Artificial Intelligence has the power to automate and enhance finance services and products, you might face challenges with implementation. Hence, we have curated the list of common challenges of AI implementation in Fintech with potential solutions.

Regulation and Compliance

Adhering to strict financial regulations while implementing AI solutions can be challenging, leading to legal uncertainties. You can confront the challenge by collaborating closely with legal experts and regulators to ensure compliance according to your target country.

Alternatively, develop an AI system that incorporates compliance rules and can provide transparent audit trails.

For example, develop AI algorithms for automated KYC (Know Your Customer) processes that ensure regulatory compliance by verifying customer identities and flagging suspicious activities.

Data Privacy and Security

Safeguarding sensitive financial data using AI techniques in Fintechs can be difficult, risking breaches and privacy violations.

Implement robust encryption, secure data storage, and strict access controls to address this. Use privacy-preserving AI techniques like federated learning.

Bias and Fairness

Avoiding bias in AI systems that make financial decisions is crucial to prevent unfair treatment of certain groups.

So, regularly audit and assess AI models for bias. Also, consider implementing debiasing techniques and provide transparency in decision-making.

For example, implementing algorithms that correct for gender or ethnicity bias in credit scoring and ensure fair lending practices.

Data Quality and Availability

Obtaining reliable and diverse financial data for AI training can be challenging, especially for newer FinTech companies. This can be overcome through reliable partnerships to access quality data sources and investing in data cleansing and preprocessing.

For example, you can partner with established financial data providers to access historical market data for training predictive trading algorithms.

Customer Trust and Adoption

You want to upgrade your apps with AI. However, your customers might resist and find trusting in AI-driven financial services challenging. To tackle this situation, you need to communicate the benefits of AI clearly, ensuring transparency and providing education about how AI enhances services.

For example, If you want to develop an AI-powered investment app, make it user-friendly and engaging. It should explain investment decisions in simple language, fostering trust among users.

Scalability and Integration

Not ensuring that AI systems can handle increased transaction volumes and integrate seamlessly with existing infrastructure can cost your Fintech a fortune. To escape this challenge, you must pay attention to the scalability of your AI architecture. Alternatively, consider cloud-based solutions and collaborate with AI technology experts.

Regulatory Sandboxes and Innovation Hurdles

Navigating regulatory sandboxes and transitioning innovations to full-scale deployment in Fintech can be a hurdle. But by proactively engaging regulatory sandboxes as per your target countries, documenting sandbox experiments thoroughly, and demonstrating successful outcomes, Fintechs can stream AI innovation.

For example, in collaboration with the Dutch Central Bank, ABN AMRO tested the Tikkie chatbot within the regulatory sandbox framework. This allowed the bank to experiment with AI-driven technology while ensuring compliance with financial regulations.

Technology Stack Selection

Establishing an innovative Fintech requires a harmony of technology stack. AI technology offers numerous benefits. Still, you need app development frameworks, payment gateways, and frontend and backend technologies to create a proper Fintech platform from scratch.

If you want to choose one technology that covers everything, Flutter is the answer! Flutter is a cross-platform app framework backed by Google, facilitating app development for multiple platforms using a single codebase. For example, you can build the web, iOS, and Android apps simultaneously using Flutter.

The best part of Flutter app development is that it works as both frontend and backend technology. Additionally, its package and plugin libraries enable efficient integration of AI and ML technologies as well as payment gateways.

For more information on Flutter Fintech app development, feel free to connect with our industry expert.

Talent Shortage

Attracting and retaining skilled AI professionals in a competitive job market is a significant challenge. Besides, hiring and nurturing in-house AI professionals can break the bank. In this case, collaborating with an outsourcing AI development company is a smart choice.

For example, Kody Technolab is an emerging name in providing assured AI and ML development solutions at competitive prices. What’s more? We understand project requirements may vary. Hence, we offer flexible engagement models for clients to choose from.

What does the Future of AI in Fintech look like?

Recently, Ernst & Young Global Limited reported,

Over half (51%) of Europe’s financial services CEOs have already integrated AI into their capital allocation, with 43% planning to do so within the next year.

Nearly three-quarters (71%) of financial services CEOs say AI is used within their strategic operations.

Besides, Statista estimated that the number of Fintech users in Europe will exceed 990 million by 2027 from 841.5 million in 2023.

All these surveys and research make it pretty clear that AI in Fintech has become a prominent technology. Also, because Fintech users are growing, so, finance companies must be agile in their offers. And Artificial Intelligence has proven its worth in the industry.

Soon, the adoption of Artificial Intelligence in Fintech and traditional finance institutes will become necessary. And those who would embrace AI today will be scaling their business effortlessly without worrying about last-minute adoption.

How does Kody Technolab help Finance Technology businesses with AI?

Kody Technolab is your trusted partner in AI-driven innovation for Finance Technology businesses. With our deep industry knowledge, custom AI solutions, and data-driven insights, we empower you to enhance customer experiences, optimize processes, and mitigate risks.

From personalized chatbots to fraud detection algorithms, we tailor AI applications to your unique needs while ensuring regulatory compliance. As pioneers in Fintech mobile app development, we’re committed to driving your growth and success in the evolving landscape.