Many banks argue they need sufficient technology budgets for their digital transformative success. But in reality, they invest resources in digital banking transformation and still struggle to execute them properly.

Consequences?

Germany records 88.62% bank cost-to-income with the 4th Global rank, while the Netherlands has 61.15% in 2021.

For your information, the global bank cost-to-income ratio based on 113 countries is 54.8%.

The reason behind this dramatic difference can be the slow adoption of the opportunities offered by technology. Or not leveraging technology correctly. Take the example of N26.

How much do you think N26, like banking app development costs?

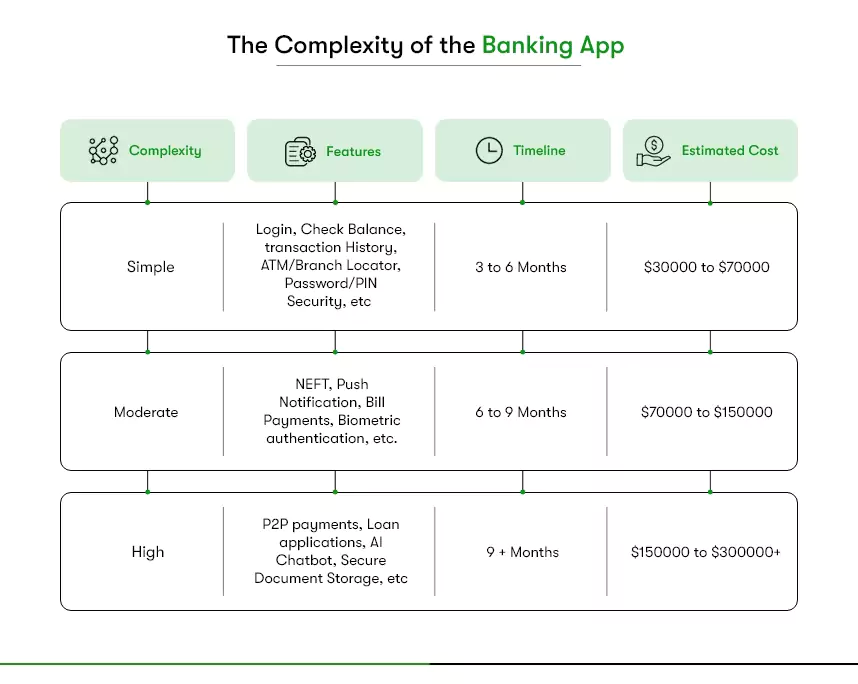

Mobile banking app development can cost anywhere between $30k to $300k. It depends on features, the app’s complexity, technology, development rates, security measures, etc.

By the way, N26 is a digital-only featured in Forbes World’s Best Banks of 2022. The irony? The neo-bank is from Germany.

While banks are busy arguing for the technology budget, neo-banks like N26 are getting ahead of the curve. The whole business model of N26 relies on mobile technology.

Do banks with existing IT systems also need to embrace mobile technology?

After analyzing Revolut, NuBank, N26, and other virtual banks’ evolution, it becomes clear that it’s decade-old legacy IT applications that pile up technical debt in banks. This technical debt causes challenges in digital banking transformation, making it costlier to fix problems that potentially will affect banks in the future.

Therefore, we have curated this guide on how much it costs to develop a banking app.

This guide will help you steer your bank’s digital transformation budget planning. So you can also make an app like N26 and set your bank free from technical debt once and for all.

Speaking of N26, we’ll look into N26’s business model and how it became a bank. But first, let us see what factors affect the cost of developing a banking app as it will help you plan your budget efficiently.

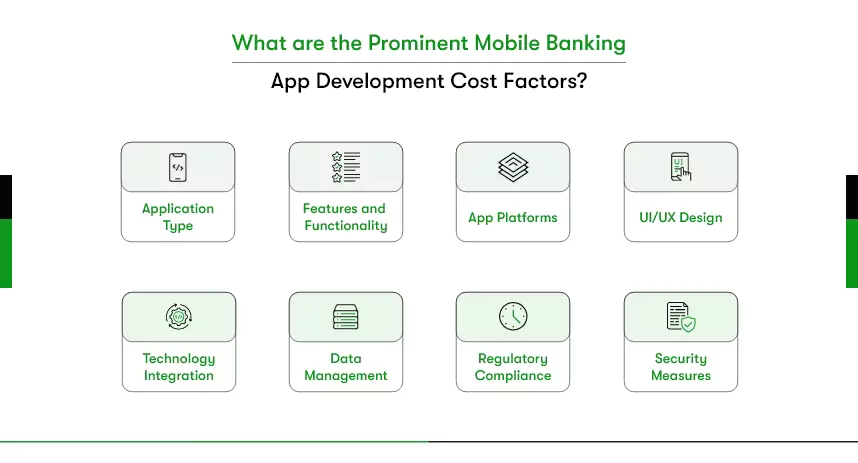

What are the prominent mobile banking app development cost factors?

The banking app development cost is volatile and subject to differ based on a few crucial factors. For example, what features you want to offer, customer experience level in your app, security measures, compliances to adhere to, and technology to use.

Let’s understand each one in simple words.

App Type: The complexity of features and services, like essential banking functions versus investment tools, directly impacts the development effort and cost involved.

Features & Functionality: More features require additional coding and testing time, increasing development costs. For example, incorporating money transfers, bill payments, and customer support features will contribute to higher expenses.

App Platforms: Developing for multiple platforms (iOS and Android) separately increases development time and cost compared to using a cross-platform framework like Flutter. Using Flutter for banking app development offers technical advantages, including streamlining both platforms in one go.

UI/UX Design: Creating an intuitive and visually appealing user interface demands design expertise, which can add to the overall cost.

Technology Integration: Implementing advanced technologies like AI and ML in Banking apps requires specialized skills, contributing to higher development costs.

Backend & Frontend: Utilizing a unified framework like Flutter for both frontend and backend development can lead to time and cost savings compared to using different tools.

Data Management: Storing and managing customer data securely, whether through on-premises servers or cloud solutions, carries associated costs for infrastructure and maintenance.

Regulatory Compliance: Ensuring the app complies with banking regulations involves thorough development, testing, and documentation, which increases the overall cost.

Security Measures: Implementing robust security measures, like encryption and authentication, requires additional development time and resources, impacting the cost of the app.

Evolution of N26 as a Digital-first Bank

N26, a trailblazing digital bank, launched in 2013 and launched its first banking product in early 2015. Originating from a prepaid card concept for teenagers, N26’s visionary founders quickly grasped the potential to reshape traditional banking. Their comprehensive digital banking solution, encompassing cards, an app, and deposit accounts, aimed to meet the evolving needs of tech-savvy customers.

What is fascinating about N26 is that despite having a full European banking license, it has no branches. Aiming to redesign banking for the 21st century, N26 is available on desktop, iOS, and Android platforms instead.

N26’s unparalleled journey hinges on customer-centricity, agility, and innovation. Their approach garnered early adopters’ excitement, resulting in a waiting list of 50,000 prospects before the banking product’s official launch. Currently, the digital-only bank has about 7 million customers across 24 markets.

This paradigm shift (coupled with their commitment to a transparent and profitable business model) positions N26 as a compelling example for banks seeking digital transformation in the modern financial landscape.

N26’s tipping point!

However, since customers rapidly embrace mobile banking, it wasn’t easy for N26 to scale and maintain secure and fast transactions. Not to mention, the regulatory compliances are the same for digital-only banks as traditional banks.

So, N26 found a technology partner to keep up the pace of releasing updates and features in Android and iOS apps. With the partnership, the neo-bank reduced its build time by 50% along with testing times, increasing the app store release frequency.

Leveraging the technology partner’s expertise, N26 can quickly test the market with new products, staying ahead of the curve in the market. This partnership will not only reduce the cost and risk for N26 but also help it to meet customer expectations. And while they don’t have to babysit mobile app development processes, focusing on strategizing compliant features becomes easier.

You see, the benefits of hiring the right developers for banking app development are immense! It’s time to dive into the N26 business model, as promised.

Understand the Cost to Develop an App like N26

According to Business of Apps, N26 made an estimated €120 million in revenue in 2021, a 66% increase on the previous year.

“We group our goals into three clusters: customer satisfaction, growth, and, finally, monetization,” says Maximilian Tayenthal, co-founder and co-CEO, in the interview with McKinsey.

So, what precisely the business model of N26 is?

N26 Business Model:

N26 stands out in the banking industry by providing transparent and comprehensive services through mobile banking. It offers a free online bank account in just 8 minutes, enhanced security with 3D Secure, spending insights, bill splitting, budgeting tools, insurance coverage, easy mobile transfers, and no transaction fees on global card payments.

N26’s value proposition revolves around convenience, security, and customer-centric features, setting a high standard in a heavily regulated industry.

Subscription Models:

As for making money, N26 offers various subscription plans tailored to users’ preferences. The plans include:

- Standard Plan: Offers essential mobile banking services for free, including up to 3 withdrawals, spending insights, and account security. Customers with the free plan only get a virtual debit card.

- N26 Smart Plan: Priced at €4.9/month, it adds features like Spaces subaccounts, extra withdrawals, and partner offers. Spaces subaccounts allow customers to round up every card transaction to the nearest euro, saving the difference in the space. With the Smart plan, customers can also choose the color of their physical debit card.

- N26 You Plan: Priced at €9.9/month, it includes travel, mobility, and winter sports insurance, including all the benefits of the Smart plan.

- N26 Metal Plan: Priced at €16.9/month, it offers car rental, phone insurance, extra withdrawals, and a dedicated support line, along with a metal card.

N26 has many other revenue streams apart from the above subscription plan, for example:

- By offering overdrafts of up to €10,000, N26 makes money by charging 8.9% of interest on the same.

- N26 also offers up to €25,000 loans for education, startups, or furniture with a payback period of 6-60 months without paperwork. In return, the neo-bank charges interest on the loan amount starting from 1.99%.

- Like many other banks, N26 also uses customers’ cash deposits in the financial market or to provide loans and earn interest.

So this is how N26 and probably other mobile-first banks can streamline their revenue, earning the maximum return on their mobile app development investment.

Feature Analysis:

N26’s features include a free bank account with quick setup, secured funds protection, real-time spending insights, bill splitting, personalized budgeting tools, and convenient mobile transfers. Offering various services that make banking transparent, easy, and efficient, N26 bridges the gap between traditional banking and modern customer needs.

Features are one of the banking app development cost-deciding factors. Hence, you need to be careful and particular about what features you want to introduce in your banking app. It won’t only affect the customer journey and experience but also impacts the development cost.

How to overcome the deadly Challenges of the banking app development cost?

After considering what factors affect the banking app development cost and understanding how to secure return through N26’s example, it’s time to prepare for the challenges.

Building a banking app while managing costs requires addressing several challenges and employing strategic solutions:

Technology Selection:

Selecting the right technology that balances functionality and cost can be daunting.

Prioritize platforms like Flutter that allow cross-platform development, minimizing the need for separate codebases. This reduces development time and expenses.

The Complexity of the Banking App:

The number of features, screens, integrations, and technical intricacies define the level of the app’s complexity. The higher the complexity, the costlier the banking app development. For example

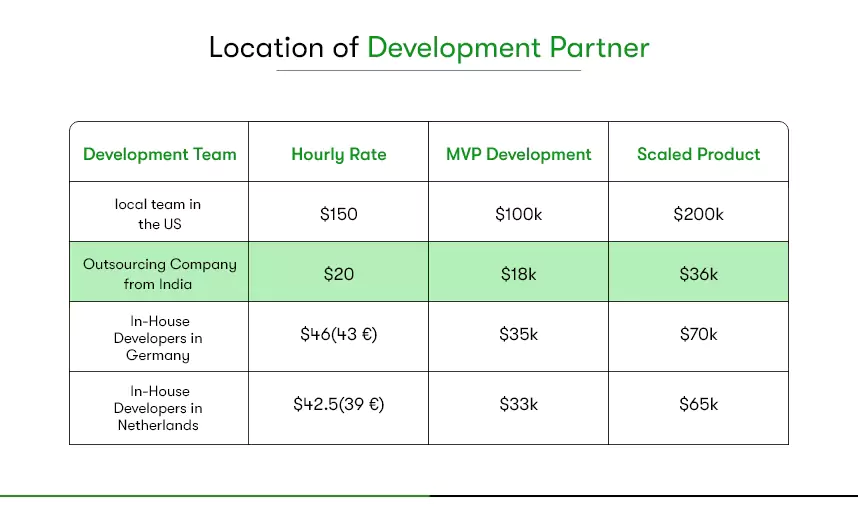

Location of Development Partner:

The location of your development partner can significantly impact the overall cost of your banking app project. Developers’ rates vary based on geographical regions, and engaging a development team from an area with high labor costs can increase expenses.

As you see, the best solution is to consider outsourcing development to regions with a lower cost of living and competitive developer rates without compromising on quality. This approach can help you save costs while ensuring the expertise needed for your project.

Navigating Regulations:

Navigating complex banking regulations in Germany and the Netherlands can be overwhelming and costly.

Work closely with legal experts to ensure compliance with GDPR, PSD2, and AML regulations. Proactively addressing compliance will help you reduce the risk of costly penalties.

Security and Privacy:

Building a secure app that safeguards user data requires significant attention and investment.

Implement stringent security measures from the outset, including encryption and two-factor authentication. Investing in security helps prevent costly breaches that can harm finances and reputation.

Scalability Planning:

Ensuring your app can handle growth without excessive costs is a challenge.

Embrace scalable cloud infrastructure to accommodate user growth. This approach allows you to scale your app’s resources as needed, preventing performance issues without inflating expenses.

Prudent Cost Management:

Balancing feature development and costs can be tricky.

Prioritize features that align with core user needs and industry requirements. Avoid feature overload that increases development time and expenses without proportional value.

By addressing these challenges and adopting strategic solutions, you can navigate the complexities of banking app development while ensuring cost efficiency. This approach aligns perfectly with the insights provided throughout this guide, empowering you to create a successful banking app that delivers value without exceeding your budget.

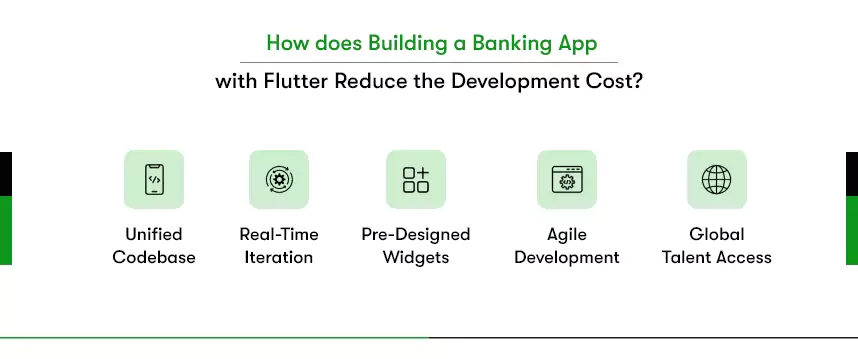

How does Building a Banking App with Flutter reduce the development cost?

Flutter, the cross-platform app development framework, cuts development time and cost by allowing banks to build multiple apps from a single codebase. Besides, its unique widget library and features enable the creation of consistent UI/UX, enhancing customer satisfaction by making the app engaging. The list of benefits of building a banking app with Flutter is extensive.

Unified Codebase: Flutter’s unified codebase streamlines both iOS and Android app development. This means shared development efforts for a banking app, reducing the costs required for separate platforms.

Real-Time Iteration: Flutter’s “hot reload” speeds up testing and debugging. This quickens development cycles, minimizing expenses. This translates to rapid testing of real-time transaction updates for a banking app.

Pre-Designed Widgets: Flutter’s widgets expedite UI design, cutting design costs. Creating a financial dashboard in a banking app becomes swifter with these pre-designed elements.

Agile Development: Flutter’s fast development cycle accelerates feature launches, a competitive edge that lowers long-term costs. Responding to market shifts with new online banking features is efficient.

Global Talent Access: You can ensure quality security features at manageable costs by hiring skilled Flutter developers, especially from regions like India. For banking apps, this means robust security without high expenses.

Therefore, Flutter is an ideal technology choice for banking app development. By harnessing Flutter’s advantages, you can achieve cost-efficient excellence, deliver enhanced user experiences, and stay competitive.

How much would you spend on your mobile banking app development?

The best-performing euro-area banks have reportedly increased their IT spending by about 60% compared to 10% by other banks. However, the investment seems quite a lot but has proven worthwhile.

Investing in mobile technology guarantees to yield positive returns for banks. However, you must ensure your banking app project lands in the right hands to avoid common pitfalls because you don’t want to spend thousands of dollars just to pay more to correct the mistakes made during the first investment.

That’s why you need a reliable technology partner like us. As a pioneering Flutter banking app development company, Kody Technolab boasts veteran Flutter developers with significant finance app development experience. Our team dedicatedly works as an extended team for our client ensuring complete confidentiality.

Contact Information

Contact Information