Predictive analytics credit scoring reveals patterns that traditional credit reports overlook. It detects risk signals hidden in user behavior, not just payment history. This matters when evaluating new borrowers or identifying early signs of fraud.

Many lenders and fintech platforms still use outdated scorecards. Outdated scoreboard models miss behavioral shifts, like device hopping, inconsistent login patterns, or hidden financial activity. Legacy systems weren’t built to read these signals.

AI-driven models analyze real-time data to assess creditworthiness. AI-driven systems adapt to new behaviors, making risk decisions faster and more accurate.

This guide explains how predictive analytics strengthens credit scoring and risk assessment. You’ll learn what to track, how to model behavior, and what tools to consider, so your risk strategy doesn’t fall behind the market.

How Predictive Analytics Credit Scoring Transforms Traditional Models Like FICO

You’ve probably used FICO scores, or systems built around them, to evaluate borrower risk. FICO is a number based on how well someone paid off credit cards, loans, or bills in the past. Lenders looked at that score and decided: approve or reject.

And for a while, the traditional credit scoring system worked. But that’s not your customer today.

FICO was built in the 1950s. So FICO does not read your gig worker’s income from multiple apps. FICO does not track your borrower who pays rent, subscriptions, and shopping bills through digital wallets. It does not catch fraud signals when someone switches devices mid-loan application.

Traditional models can’t see behavior in motion. They don’t track what’s happening right now. And when you’re lending in real time, that blind spot can cost you. This is where predictive analytics for fraud detection becomes essential, helping you catch risk signals as they happen, not after the damage is done.

Why Traditional Credit Scoring Needed to Evolve?

Credit behavior has shifted but most legacy models have not. Here is why traditional scores are falling behind:

- Traditional credit scoring relies only on past financial data and ignores present context.

- They fail to detect real-time changes in how a person earns, spends, or repays.

- They exclude thin-file borrowers who do not have formal credit histories.

- They miss behavioral fraud indicators such as device switching or geo-mismatches.

- They treat every borrower the same by applying rigid formulas.

What Does AI Credit Scoring Actually Do?

AI models do not wait for a borrower to miss payments before flagging risk. They observe how people behave across digital touchpoints and score risk based on patterns, not just past outcomes.

Here is how it works:

- AI systems monitor real-time user activity, including transaction patterns and payment cycles.

- These models assess behavior using digital signals like app usage, time of access, or login location.

- Each credit score is dynamic and adjusts based on ongoing actions, not just a credit report snapshot.

- The model self-updates as new data flows in, without requiring manual input.

- Outcomes are tracked to help the model learn and refine future predictions.

In short, predictive analytics in credit scoring helps businesses assess borrowers more intelligently, based on behavior, not assumptions.

This shift from FICO to AI is not about using more data. It is about reading the right signals, responding faster, and managing credit risk with clarity and confidence.

How Predictive Analytics Credit Scoring Actually Works Behind the Scenes

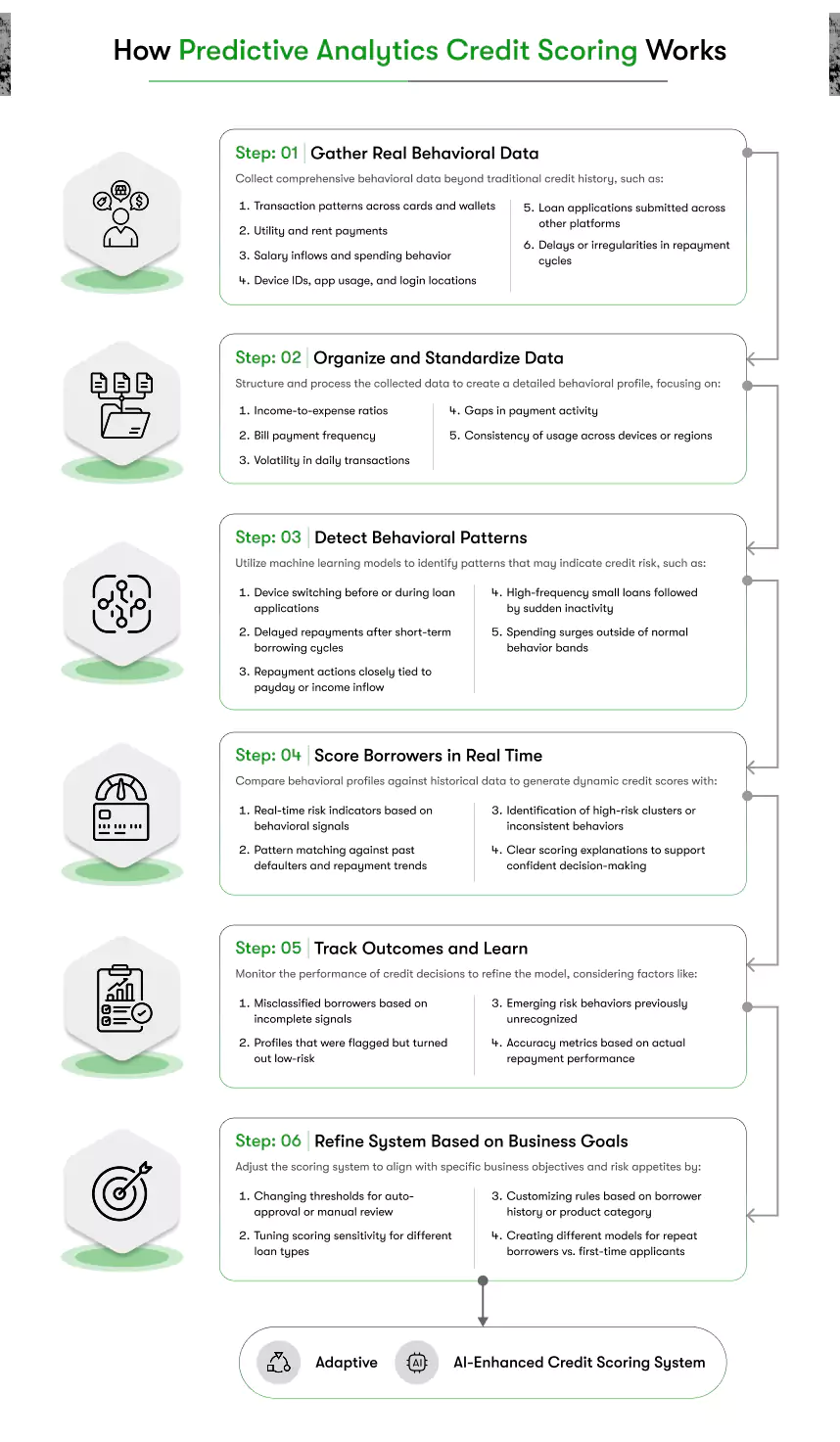

AI-based credit scoring is not here to replace your risk logic; it enhances it by adding real-time behavioral insights and adaptive intelligence to the decision-making process. Here’s how it works from start to finish.

Step 1: You gather real behavioral data, not just credit history

AI-based credit scoring starts by expanding what counts as relevant data. Instead of relying solely on credit reports or repayment history, AI-based credit scoring pulls in signals from how a person actually behaves with money in real life.

You feed in data like:

- Transaction patterns across cards and wallets.

- Utility and rent payments.

- Salary inflows and spending behavior.

- Device IDs, app usage, and login locations.

- Loan applications submitted across other platforms.

- Delays or irregularities in repayment cycles.

Once you feed data into an AI-driven credit scoring system, it begins processing and analyzing the borrower’s behavior. The more behavior-rich the data, the more accurately the system can assess credit risk.

Step 2: The system organizes and standardizes everything for decision-making

Once data is collected, it needs to be structured. The system doesn’t just store values, it reshapes them into formats that uncover meaning. What you get is a detailed behavioral profile that models can actually work with.

- Income-to-expense ratios.

- Bill payment frequency.

- Volatility in daily transactions.

- Gaps in payment activity.

- Consistency of usage across devices or regions.

This is not just cleaning data. It’s preparing risk signals the system can compare and score. You define what matters, AI simply listens for it, at scale.

Step 3: The model detects patterns that humans can’t

Now the model begins to learn from the input data. Instead of focusing on scores or predefined labels, the model analyzes actual borrower behavior. The model identifies recurring patterns, like those that have historically led to defaults, late payments, or strong repayment habits, even when traditional credit reports reveal no warning signs.

- Device switching before or during loan applications.

- Delayed repayments after short-term borrowing cycles.

- Repayment actions closely tied to payday or income inflow.

- High-frequency small loans followed by sudden inactivity.

- Spending surges outside of normal behavior bands.

This pattern recognition happens across thousands of past borrowers. The model learns what behavior tends to lead to repayment, and what doesn’t.

Step 4: It scores each borrower in real time based on current behavior

When an applicant is assessed, the system doesn’t just check a box, it compares the full behavioral profile to thousands of historical patterns. The score is not just a number. It’s a reflection of real-time risk, matched with past outcomes.

- Does the applicant match a known high-risk behavior cluster?

- Are they showing traits similar to past defaulters?

- Are the signals consistent or conflicting with repayment behavior?

The system then generates a dynamic credit score, updated in real time, and gives you risk markers, not just a number.

It compares the current applicant’s behavior to thousands of similar past profiles. Not based on labels, but patterns. If 80% of borrowers with similar signals defaulted within 60 days, that’s a red flag. And the system knows it.

You’re not just approving based on rules. You’re making informed risk calls based on real-world patterns.

Step 5: You track outcomes to teach the system what’s working

AI systems don’t just score, they learn. Every approval, default, or early repayment feeds into the model to improve future accuracy. This feedback loop helps the model separate real risk from temporary noise.

- Borrowers who were misclassified based on incomplete signals.

- Profiles that were flagged but turned out low-risk.

- Emerging risk behavior the model didn’t recognize earlier.

- Accuracy metrics based on actual repayment performance.

By feeding these results back in, the model adjusts its understanding. It starts learning what’s signal, and what’s noise.

Step 6: You refine the system based on your business goals and risk appetite

The model is not the final decision-maker, you are. AI gives you the tools to adjust scoring strategies based on your lending priorities, product goals, and target segments. You stay in control while the system gets sharper.

- Change thresholds for auto-approval or manual review.

- Tune scoring sensitivity for different loan types.

- Customize rules based on borrower history or product category.

- Create different models for repeat borrowers vs first-time applicants.

AI-based credit scoring doesn’t just improve approval speed. It strengthens your risk lens, gives you visibility into behavior trends, and helps your business grow with more confidence, one smarter decision at a time. This is the kind of transformation businesses achieve through effective fintech predictive analytics consulting.

How AI and ML Revolutionize Risk Assessment and Credit Scoring

You don’t need more credit data. You need smarter ways to understand it. That’s where AI and machine learning help. They give you the power to understand risk earlier, more accurately, and in real time.

Here’s how this shift works for your credit scoring process.

1. You stop guessing and start predicting risk before it appears

Old credit scores only show what happened in the past. Predictive analytics credit scoring looks at how a borrower behaves today and tells you what might happen next. This helps you take action before small signs turn into big losses.

2. You can score new borrowers, even with no credit history

Many borrowers don’t have long credit records. That doesn’t mean they’re risky. Machine learning credit scoring models look at behavior patterns and compare them with similar borrowers from the past. You can make smart decisions, even with limited data.

3. You can spot fraud behavior while it’s happening

A traditional system might miss small red flags. But AI in credit scoring catches unusual patterns like logging in from a new location or switching devices during an application. These patterns often point to fraud, and AI flags them right away.

4. You speed up decisions without losing accuracy

With predictive analytics tools credit scoring, your team can review thousands of applications quickly. These models don’t just give a score, they also explain why a borrower was approved or denied. That means fewer delays and better experiences for good customers.

5. You adjust your scoring strategy as your business changes

Borrower behavior is always changing. Your scoring system should change too. With AI, you can retrain the model when needed. This helps you match the model to new products or shifts in your risk policy.

This is how you integrate AI and predictive analytics credit scoring into your long-term strategy.

6. You understand patterns that static data can’t reveal

Sometimes, spreadsheets don’t tell the full story. For example, you may find that customers who repay in small amounts are more reliable than those who pay in one large sum. AI makes those insights visible.

This is one reason why companies rely on predictive analytics in credit scoring to guide decisions.

AI and machine learning change how you evaluate risk, making your decisions faster, more consistent, and based on real behavior. If you want your risk strategy to scale, you have to adapt this shift towards AI & ML to make smarter decisions.

The Real Power of Predictive Analytics in Credit Risk Management

You don’t manage credit risk by reacting to it; you manage it by seeing it before it becomes a problem. That’s where the real power of predictive analytics in credit risk management shows up. As highlighted in this Predictive Analytics in Fintech Guide, it’s not just about scoring a borrower. It’s about helping you spot invisible risk, prevent losses, and strengthen the long-term health of your lending portfolio.

Here’s how predictive analytics gives you control where it matters most.

1. You identify early signs of potential default

Predictive models spot patterns that usually come before repayment issues. This could be things like frequent small loan applications, changes in payment timing, or new device logins during the loan term. These signs don’t show up on a credit report, but they’re early warnings that you can act on.

This is how predictive analytics credit scoring helps you stay ahead of risk, not behind it.

2. You prevent high-risk approvals without blocking good borrowers

Most traditional systems either approve too loosely or deny based on incomplete data. Predictive models add nuance. They consider digital behavior, payment consistency, and even usage context, so you don’t lose good borrowers, or let high-risk ones slip through.

This creates balance in your approval pipeline without slowing it down.

3. You reduce manual intervention and inconsistencies

When decisions depend on human judgment alone, risk varies by the reviewer. Predictive scoring models create a consistent framework for credit assessment. Your risk team can then focus on exceptions and edge cases, not every single file.

That’s how predictive analytics tools credit scoring improve both accuracy and efficiency.

4. You adapt faster when markets shift

Let’s say borrower behavior changes during a downturn. Or fraud patterns evolve. With predictive analytics, your model updates with new inputs. It doesn’t wait for quarterly reviews or external reports. It adjusts in real time, so your risk logic stays relevant, even when conditions change fast.

This level of agility is what makes predictive analytics in credit risk management truly powerful.

5. You gain visibility across your entire credit funnel

It’s not just about scoring individual borrowers. Predictive systems help you spot trends in applications, repayments, fraud risks, and defaults across your entire portfolio. That means you’re not just fixing problems, you’re designing smarter strategies to avoid them in the first place.

Predictive analytics in banking doesn’t replace your credit team, it enhances their ability to make clear, data-backed decisions. If your risk strategy feels reactive or scattered, this is your path to making it sharper, faster, and more future-ready.

Tools and Models That Drive Predictive Analytics in Credit Scoring

When you implement predictive analytics credit scoring, the real strength lies in the tools and models that power your system. These are the components that determine how well you assess risk, how quickly you make decisions, and how effectively you adapt to changing borrower behavior.

This section covers two core areas. First, the tools that enable scoring. Second, the models that actually produce results.

Tools That Make Predictive Analytics in Credit Scoring Work

You do not have to build from scratch to start using predictive scoring. A range of platforms, services, and tools are available that make implementation faster and more efficient.

Here are some tools commonly used in credit scoring systems:

- Cloud-based analytics platforms such as Azure ML, AWS SageMaker, or Google AI allow you to train, deploy, and monitor your models securely.

- Customer data platforms (CDPs) collect and organize user data from mobile apps, websites, banking software, and other sources into one centralized environment.

- Low-code AI platforms including H2O ai and DataRobot help your team create and manage scoring models without heavy development.

- Open-source libraries like scikit-learn, LightGBM, and XGBoost are used by technical teams to develop highly customized and efficient models.

- Credit decisioning engines such as Zest AI and Lendflow allow you to combine credit rules, scoring logic, and explainable AI in your credit workflow.

Models That Actually Drive Risk Intelligence

Once your tools are in place, you need the right model to turn raw data into insights. Machine learning credit scoring models work by identifying trends in historical data and using them to assess risk for new applicants.

These are some of the most widely used models in credit scoring:

- Logistic regression is simple and transparent. It remains a reliable choice for baseline risk modeling.

- Decision trees and random forests are great for segmenting borrower behavior into clear risk groups.

- Gradient boosting models such as LightGBM or XGBoost offer high accuracy and can handle large, messy datasets effectively.

- Neural networks are best used for complex borrower behavior, particularly when analyzing large volumes of unstructured data.

- Clustering algorithms like K-means help identify borrower personas by grouping similar patterns across portfolios.

Choosing the Right Stack for Your Business

The tools and models you select depend on your business type and credit product. A company offering microloans will require a different approach than a lender managing long-term personal loans.

Before you invest, make sure your team or technology partner can explain:

- Which models are being used.

- How the model is trained and validated.

- How risk decisions are explained internally.

- How your specific rules are built into the scoring logic.

This approach helps you maintain control over credit decisions while letting the models improve accuracy and speed.

Predictive analytics tools and models are more than technical infrastructure. They are the core of how your business sees risk, scores borrowers, and builds a smarter lending process. The stronger your stack, the more confidently you can scale.

Challenges in AI-Driven Credit Scoring and How to Overcome Them

Adopting AI for credit scoring gives you speed, accuracy, and deeper insights. But getting there is not always simple. Whether you’re considering credit scoring app development or already using predictive analytics credit scoring, you need to be prepared for a few practical challenges and know how to solve them without slowing down your operations.

Here are the most common roadblocks and the best ways to overcome them.

1. Not All Data Is Useful for Predictive Scoring

AI thrives on data, but not all data improves your scoring model. Using inconsistent, outdated, or irrelevant data can actually reduce model accuracy. You may end up misclassifying good borrowers or missing early signs of risk.

How to solve it: Start by defining what you want to predict. Then collect behavior-rich, relevant data such as transaction timing, repayment trends, device usage, and borrower actions. Always validate sources before adding them to the model training process.

2. Explaining Scores to Risk Teams or Regulators Can Be Difficult

AI in credit scoring often involves complex models that are hard to explain. This creates friction during audits, internal reviews, or compliance checks. If your team cannot explain why a score was generated, trust can break down.

How to solve it: Use explainable AI tools and partner with vendors who support score transparency. Choose models that offer clear risk markers, scoring rationale, and decision logs that your team can review at any time.

3. Models Can Drift Over Time Without Feedback

Even the best machine learning credit scoring models degrade if they are not retrained with fresh data. This leads to lower prediction accuracy and an increase in false positives or negatives.

How to solve it: Set a schedule for regular model evaluation. Use feedback loops that track loan performance, defaults, and repayments. Feed these results back into the model to help it stay aligned with current borrower behavior.

4. Biases Can Creep into the Model

If your training data reflects historical bias, such as approvals skewed by geography or gender, your AI model will carry that bias forward. This can lead to unfair scoring and legal exposure.

How to solve it: Audit your training data for balance and diversity. Regularly test models for bias and set thresholds to flag risky behavior in the scoring logic. Prioritize fairness and compliance from the start.

5. Integration with Legacy Systems Can Slow Progress

Even if your AI model is ready, integrating it with your current underwriting platform or loan management system might create delays. Without a clean integration, you may not be able to operationalize scoring in real-time.

How to solve it: Choose API-ready solutions that can plug into your current systems. Work with tech partners who understand how to bridge new AI tools with your existing infrastructure without disrupting daily operations.

Every innovation brings challenges, but with the right setup, AI credit scoring becomes an advantage, not a complication. If you plan ahead, prioritize transparency, and align the tools to your business, these obstacles become opportunities to build a stronger risk strategy.

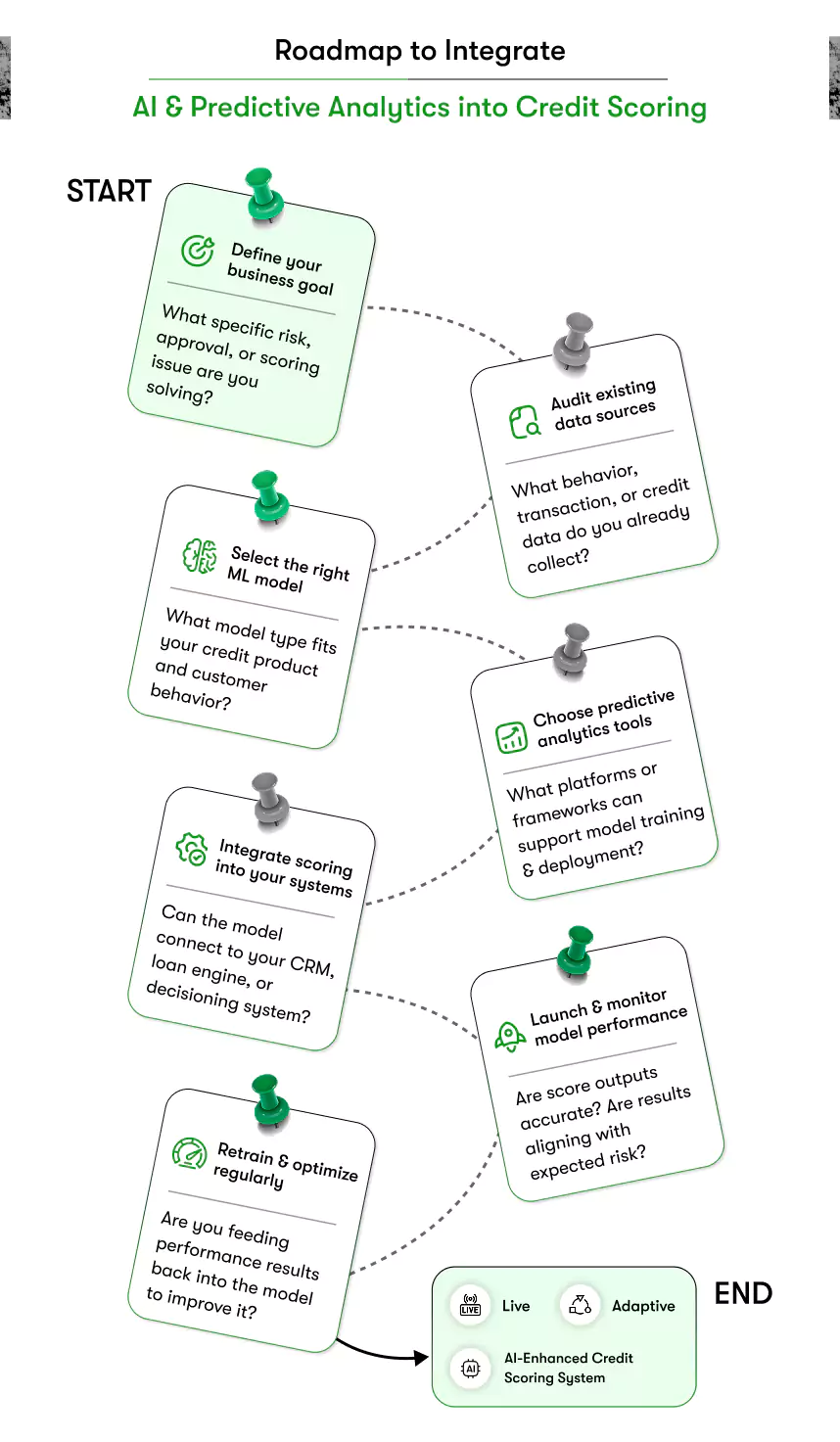

Roadmap: How to Integrate AI and Predictive Analytics into Your Credit Scoring

If you’re planning to move away from rigid scorecards and adopt smarter decisioning, you need a clear, actionable plan. Integrating AI and predictive analytics credit scoring into your system is not just about using new tools, it’s about aligning your risk logic, data flow, and decision-making process to work with models that learn and adapt.

Here’s a six-step roadmap you can follow to make the transition smooth, strategic, and future-proof.

Step 1: Define the Problem You’re Trying to Solve

Before touching technology, be clear about your goal. Are you trying to reduce defaults, improve approvals for thin-file borrowers, catch fraud, or speed up underwriting?

You must define what “better credit scoring” looks like for your business. This gives your model purpose and your team direction.

Step 2: Audit the Data You Already Have

AI models only work if your data is relevant and reliable. You don’t need big data, you need the right data.

Start by reviewing what you collect today across your app, CRM, payment systems, and other touchpoints. Check for gaps, inconsistencies, or missing behavior indicators.

Step 3: Choose the Right Model for Your Business

There is no universal model. For short-term loans, microfinance, or BNPL, you may want fast-learning, lightweight models. For long-term products, you might need something more layered.

Work with experts to choose or build machine learning credit scoring models that match your product type, risk appetite, and customer base.

Step 4: Select Tools That Fit Your Stack

Your AI model will need the right platform to run. This could be a cloud service, a credit decisioning tool, or a low-code AI platform.

Make sure the tools you choose support automation, explainability, and easy integration with your current systems.

Step 5: Integrate AI Without Breaking Existing Systems

This is where most projects slow down. You need your AI scoring engine to work with what’s already live, whether that’s your underwriting platform, CRM, or loan management system.

Choose API-first tools and work with developers who understand both your legacy architecture and your risk workflows.

Step 6: Monitor, Learn, and Retrain Regularly

Once live, your model is not finished. It’s learning every time you approve or reject an applicant.

Set up regular reviews of how the model performs. Feed outcomes back in to improve scoring accuracy and keep the system aligned with real-world behavior.

This is where predictive scoring becomes a long-term advantage, not just a short-term upgrade.

Adopting AI credit scoring is not about switching platforms, it’s about shifting how you understand borrower risk. With the right roadmap, you can make your credit scoring faster, smarter, and aligned with the way today’s customers behave.

Conclusion

AI and predictive analytics are now core to building smarter, faster, and more accurate credit scoring systems. If you want to reduce risk, approve good borrowers faster, and make confident lending decisions, adopting predictive analytics credit scoring is the way forward.

But implementation isn’t just about tools or models. It’s about aligning your business goals, integrating the right technologies, and continuously learning from outcomes. The real transformation happens when strategy, data, and execution work together.

Kody Technolab, a leading fintech app development company, helps fintechs, lenders, and insurance providers build custom AI-powered credit scoring solutions tailored to their products, workflows, and risk logic. From model selection to system integration, we deliver secure, scalable, and explainable credit scoring systems that grow with your business.

Ready to build a smarter credit scoring system? Let’s talk.

Contact Information

Contact Information