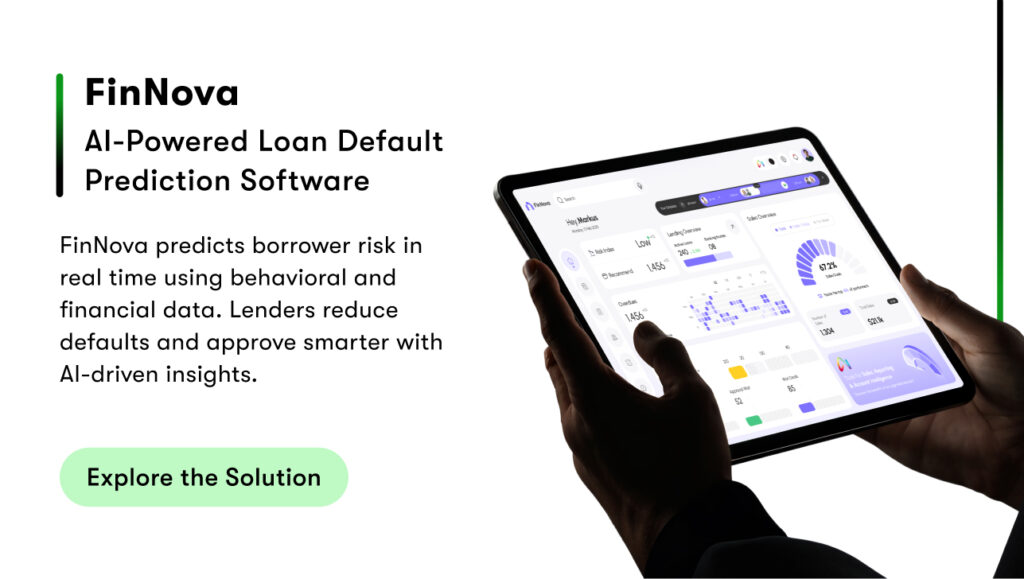

Your fintech platform just approved a credit request. Three weeks later, the user failed to pay back the credit, which directly hurt your business financially. Predictive analytics in fintech can help avoid such outcomes by assessing risk more effectively.

There were no obvious red flags. The user’s profile looked normal. But their data held subtle signs: irregular deposits, delayed payments, and wallet activity that didn’t match their usual pattern.

Predictive analytics in fintech helps you catch those signs, before the loss happens. It digs deeper than standard checks. It spots early risk signals that rule-based systems overlook.

And that’s exactly why fintech businesses are racing toward this shift.

Here’s the proof: the global AI in fintech market is projected to skyrocket from $13.5 billion in 2024 to $58.7 billion by 2034, with a steady CAGR of 15.9% (Future Market Insights). That kind of growth doesn’t happen around buzzwords, it happens when the technology works.

In this guide, you’ll learn exactly how to apply predictive analytics, and how to choose a custom software partner who can build fintech systems that catch risks before they cost you.

What is Predictive Analytics in Fintech and Why It Matters?

Predictive analytics in fintech is the use of past user data, behavior, and machine learning to help financial platforms make better decisions, reduce risk, and act before problems happen.

Fintech teams lose money when they act too late. A fraud gets through. A loan gets approved that shouldn’t. A valuable customer leaves without warning.

That’s where predictive analytics comes in.

Predictive analytics uses AI and machine learning to find hidden patterns in user behavior. It sees unusual changes, like spending spikes, income drops, or risky transfers, and tells your system to flag it early.

This helps fintech platforms:

- Block fraud before it happens.

- Approve safer loans.

- Catch unhappy users before they leave.

- Personalize what users see based on how they behave.

This matters because fintech isn’t about reacting after the damage is done. It’s about stopping loss before it starts, and spotting opportunities before they’re gone.

But this only works if the system fits your product. That’s why fintech companies need a custom software partner who can build models that understand your business, not someone offering generic tools.

If your platform can’t see ahead, it’s already behind.

How Predictive Analytics in Fintech Is Used Across Financial Workflows

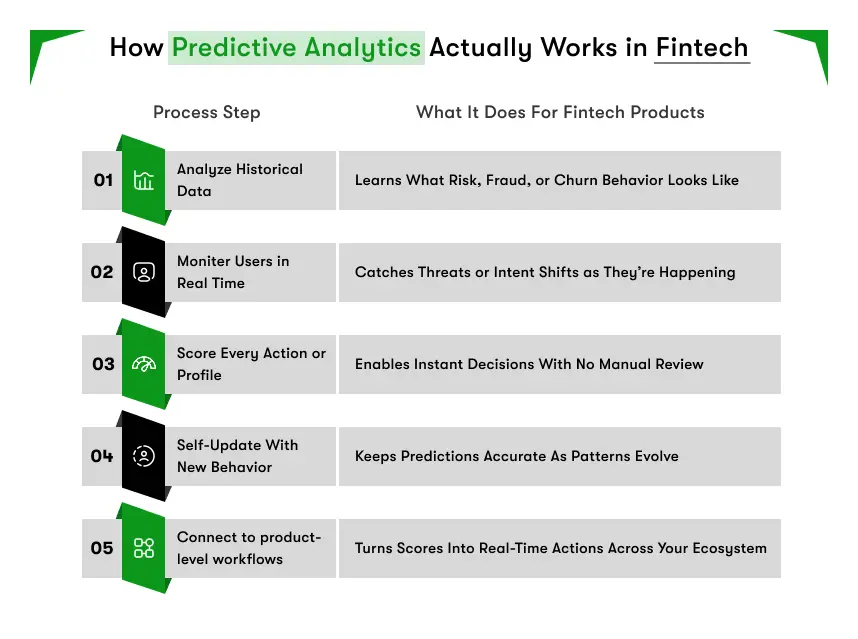

Most people know what predictive analytics can do. But not enough talk about how predictive analytics in fintech actually works inside real financial platforms.

Predictive analytics doesn’t sit in a dashboard. It lives inside the product, learning, scoring, adapting, and acting. Every second.

Here’s exactly how it works.

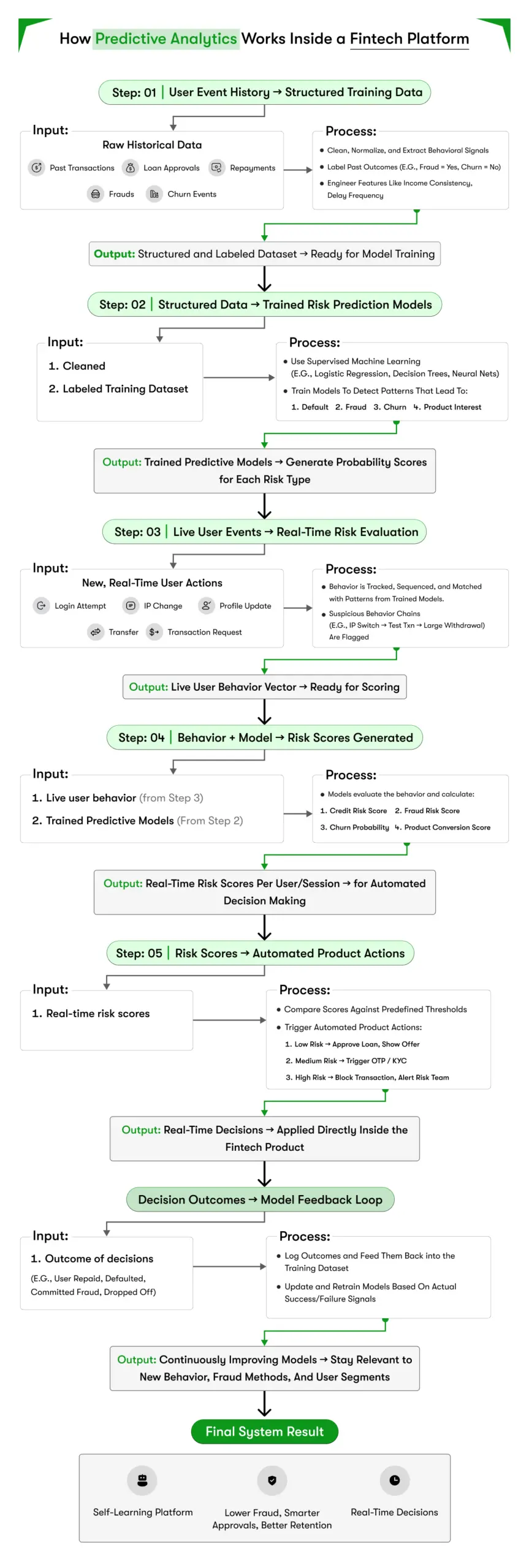

1. Predictive models are trained using historical user behavior

Every fintech platform has users who repay, users who default, and users who commit fraud. The system studies them all.

AI predictive analytics in fintech starts by processing your historical user data, every loan, transaction, failure, and churn event.

Here’s what the system looks for:

Late payments across multiple billing cycles

Users who consistently pay late often show early signs. The model marks these patterns as high-risk behavior over time.

Irregular income flow over time

If a user’s income drops or becomes unstable, it often leads to delayed payments or defaults. The system learns to recognize this.

Suspicious wallet movements like frequent transfers to new accounts

Fraudsters tend to move money through new or unlinked accounts. Repeated activity like this raises the user’s risk score.

These are not one-time flags. Predictive analytics in fintech connects them to deeper outcomes, then applies that learning to every new user that comes in.

This is how financial systems reduce approval risk, by predicting outcomes before they happen.

2. Predictive analytics tracks users in real time

Fraud rarely comes as a surprise. The signs show up earlier, in the user’s behavior. But legacy systems miss them.

Predictive analytics in fintech monitors every action a user takes in real time and checks for risk patterns as they happen.

Let’s break that down.

Logs in from a new IP address

This could mean the user has changed locations, or that someone else is trying to access the account. The model checks if this IP is common for fraud.

Changes their phone number

Fraudsters often update contact details to prevent alerts. A predictive model sees this as part of a suspicious sequence, especially if it’s followed by other risky moves.

Sends a small test transaction

A small transfer is often used to test if the account is active and unprotected. This is a red flag, not because of the amount, but the intent.

Then attempts a large withdrawal

This is a hit. Predictive analytics connects this step with the earlier behavior, and flags it before funds leave the platform.

These steps may seem harmless alone. But together, they form a known fraud pattern. And AI predictive analytics in fintech doesn’t wait. It blocks or delays the transaction, alerts your risk team, or asks for additional verification, instantly.

This is how fintech platforms stop fraud before it happens, using live behavior, not just past data.

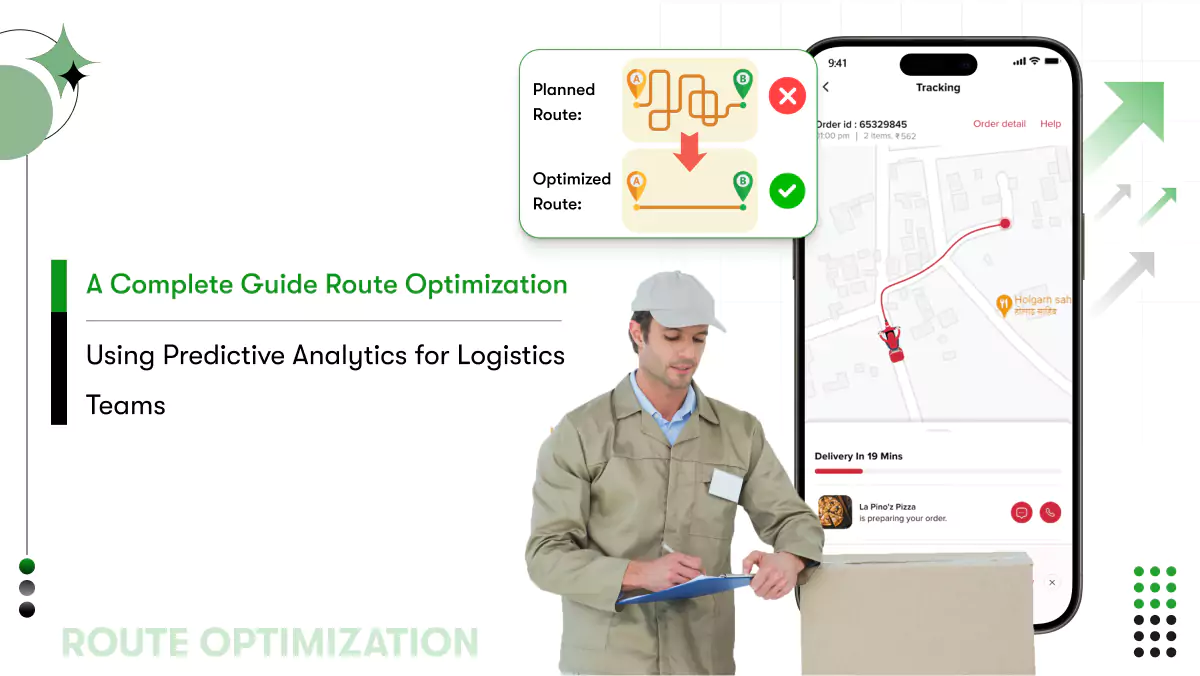

How Predictive Analytics in BNPL Works Step-by-Step Inside a Real Fintech System

3. Each action or user is scored automatically

No user action goes unchecked. Predictive analytics for financial services assigns scores in real time based on behavior, risk, and intent.

The system uses these scores to drive instant decisions.

Approve or deny the transaction

If the risk score is high, the transaction is paused, declined, or flagged, before it completes.

Trigger step-up verification

The system can ask for an OTP, ID re-check, or facial verification if behavior seems abnormal.

Offer a product

If a user browses savings content repeatedly, predictive scoring can trigger a personalized upsell or nudge to act.

Alert a risk officer

If patterns match past fraud cases, the system notifies a human to intervene or review the case urgently.

These decisions happen quietly, while the user interacts with your product. This is how fintech platforms scale smart decisions without manual bottlenecks.

4. Predictive models updates itself continuously

User behavior is never fixed. It evolves. Your system has to keep up.

AI predictive analytics in fintech doesn’t stay static. It self-adjusts based on the new data it sees every day.

Here’s how it works:

When a new user segment enters the platform

Let’s say freelancers or gig workers join in volume. Their income patterns are different. The model learns and adjusts risk scoring.

When scammers try new techniques

If fraud patterns shift, like using multiple low-risk transactions instead of one large one, the model adapts and flags this behavior.

When product usage changes after a feature update

If churn behavior or engagement patterns change, the model retrains automatically to reflect the new normal.

User behavior constantly evolves, and what was risky yesterday might be normal today. That’s why fintech predictive analytics consulting focuses on building self-learning models that adjust to new patterns, without manual updates, keeping your platform accurate, secure, and relevant in real time.

In such dynamic environments, leveraging changelog best practices becomes essential to track feature rollouts and align analytics with real-world changes in user behavior.

5. Predictions are connected to product actions

A prediction only matters if it’s used. Predictive analytics in the fintech business connects insights directly to how your product works.

Here’s how it integrates:

Your credit engine to approve or reject loans

A risk score can override or adjust approval logic, reducing default rates.

Your KYC system to trigger additional verification

If risk patterns spike, the system can ask for extra ID checks before continuing.

Your marketing workflows to personalize offers

Predicted product interest drives what offer shows up next, in-app, SMS, or email.

Your support system to prioritize high-risk accounts

Users flagged as potential churn or fraud are pushed to the top of the support queue.

Loan approvals, verification steps, and offers aren’t handled manually; they’re triggered live by model logic in real time. Whether it’s smarter decisions or predictive analytics for fraud detection, these models work inside your product, quietly reducing risk and guiding every user interaction.

Every pattern learned, every action scored, every prediction applied; all working behind the scenes to lower your risk, increase retention, and protect your revenue.

And none of that works without building a system that fits your logic, your users, and your goals.

That’s why fintech companies don’t settle for off-the-shelf tools. They partner with custom software development experts who build predictive systems that think like the business.

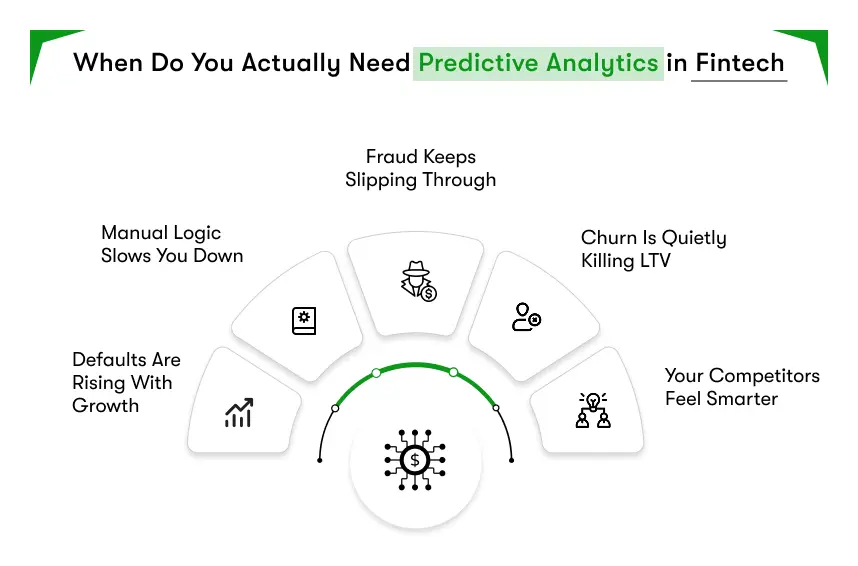

When Do You Actually Need Predictive Analytics in Fintech?

Not every fintech platform needs predictive analytics from day one. But if your product is making live decisions about users, money, or risk, then this is no longer a “nice to have.” It’s a revenue-critical system.

The moment your decisions affect fraud loss, default rates, churn, or user satisfaction, it’s time to stop relying on manual rules, static scoring, or human guesswork.

Here are the real-world signs that show you’re ready, or even overdue, for predictive analytics.

1. Your fraud losses are growing despite good security

You already have authentication, transaction limits, and basic fraud rules. But somehow, fraud is still slipping through.

Why?

Because modern fraud patterns don’t match old rules. They evolve.

Predictive analytics in fintech doesn’t wait for fraud to repeat. The system learns from early signals such as strange login behavior, micro-transfers, or location mismatches, and takes action before real damage occurs. If your fraud loss is rising even with safeguards in place, the trend is your signal to act.

If your fraud loss is rising even with safeguards in place, that’s your signal.

2. Your loan approvals are fast, but defaults are rising

Growth is great. But if loan approvals are followed by an increase in missed repayments or defaults, you’re taking on hidden risk.

Behavior-based models look deeper than a credit score. They detect things like:

- Irregular income flow

- Repetitive borrowing across apps

- Sudden changes in spending patterns

AI predictive analytics in fintech helps you approve more users without increasing default risk.

If revenue from lending is getting eaten up by losses, you need smarter models.

3. Your churn rate is hurting LTV

Some users don’t leave with a complaint. They don’t cancel or contact support. They just disappear quietly.

That kind of silent churn eats into your revenue, and most of the time, you notice it too late.

Predictive analytics in fintech helps spot drop-off signals early by monitoring behavior patterns like:

- Slower logins

- Less time spent in key features

- Ignored messages or push notifications

The system can trigger a win-back offer, send personalized messaging, or alert support, all before the user fully disengages.

This same intelligence supports risk and compliance too. For example, predictive analytics is enhancing KYC & AML by identifying unusual activity early in the customer journey.

If your LTV is shrinking and you don’t know why, this is your signal to stop guessing and start predicting.

4. Your product team is buried under manual rules

Your team keeps writing new logic to handle exceptions such as approval rules, fraud triggers, risk scores, or eligibility logic.

But every update creates more code, more edge cases, and more cleanup later.

Predictive analytics for financial services replaces this manual load. It analyzes behavior in real time and improves automatically.

If your product feels hard-coded and hard to maintain, predictive systems make it scalable again.

5. Your competitors are offering smarter, faster experiences

You can already feel the shift. Competitors are moving faster. They approve loans instantly, personalize every offer, stop fraud early, and support users before problems even show up.

They’re using data in ways that feel invisible but work powerfully. If you don’t close that gap soon, it won’t just cost you users, it could cost you trust in the market.

Predictive analytics in fintech business helps your product move from reacting to staying ahead, and that’s exactly what users expect now.

You don’t need predictive analytics because it’s a trend. You need it because the pressure is real, from fraud, user churn, late payments, and growing expectations.

If your platform is growing but decisions are getting slower, riskier, or more expensive, that’s your moment to act. And the best time to fix it is before it starts costing more.

Predictive Analytics for Personalized Banking: Enhancing User Experience and Product Adoption

Most fintech products still rely on fixed journeys. All users receive the same onboarding emails, the same feature prompts, and the same product offers. But in real usage, no two users behave the same way. This lack of personalization leads to missed opportunities, lower product adoption, and silent user drop-offs that directly impact revenue.

Predictive analytics in banking changes that. It watches what users actually do, identifies intent behind those actions, and delivers product responses that are timely, relevant, and highly specific to each user.

Below are real examples showing how behavior, prediction, and action work together to drive value.

Example One: A user opens a savings account but never deposits

The system notices a user who has signed up, created a savings account, but has not made any deposits after forty-eight hours.

Prediction: The user may be confused, distracted, or unsure of the next step.

Action: The system sends a personalized in-app message with a first-deposit reward or launches a simple, step-by-step visual guide explaining how to fund the account.

Business impact: Higher activation rates, reduced cold-start users, and better onboarding flow performance.

Real App Reference: Chime

Chime automatically nudges new users to activate their savings by offering round-up rewards and easy automation.

- Prediction: User is confused, distracted, or unsure of next steps.

- Action: Trigger a personalized guide or first-deposit reward.

- Impact: Higher activation rates, lower cold-start users.

Example Two: A user regularly empties their account before payday

Behavioral patterns show that a user receives a salary at the start of each month but frequently drains their balance by mid-month and gets multiple card declines toward the third week.

Prediction: The user may be facing short-term liquidity issues or poor expense forecasting.

Action: The platform offers a small pre-approved credit line, introduces a budgeting tool, or suggests cash flow reminders tailored to this timing.

Business impact: Improved engagement with credit or financial wellness tools and increased user reliance on your ecosystem.

Real App Reference: Dave / EarnIn

These platforms monitor account activity and offer short-term cash advances or budgeting insights when users approach zero balance.

- Prediction: Signs of short-term liquidity stress.

- Action: Offer a micro-credit line or spending forecast tool.

- Impact: Improved retention and engagement with financial wellness tools.

Example Three: A user frequently checks the loan feature but never applies

The system identifies that a user has visited personal loan pages several times, spent time reading eligibility criteria, but has not clicked the apply button.

Prediction: The user is likely interested but hesitant due to fear of rejection or an unclear process.

Action: The system automatically offers a soft eligibility check, shows a real-time approval simulation, or shares a success story from a similar user profile to build trust.

Business impact: Higher conversion on loan products and reduced drop-off from warm leads.

Real App Reference: Upstart / SoFi

Platforms like SoFi use soft credit checks and quick simulations to reduce friction for hesitant applicants.

- Prediction: User is interested but fears rejection or complexity.

- Action: Trigger a soft eligibility check or surface similar user approvals.

- Impact: Higher loan conversion rates with fewer drop-offs.

Example Four: A user suddenly stops using the investment feature

This user had previously been using an automated investment tool but has paused activity without explanation.

Prediction: The user may have lost confidence in market performance or become confused by volatility.

Action: A timely message is triggered explaining current market trends, or the system offers a quick advisory chat or educational video to re-engage interest.

Business impact: Lower churn among higher-value users and increased trust in long-term product value.

Real App Reference: Wealthfront / Betterment

These apps track when investment activity declines and send re-engagement nudges or personalized market insights.

- Prediction: Loss of trust, confusion due to market shifts.

- Action: Trigger contextual messaging or a human support offer.

- Impact: Lower churn from high-value investors.

What Happens When Personalization Is Missing in Your Banking App?

Without predictive personalization, users receive generic recommendations. Offers feel irrelevant. Features are ignored simply because they are shown at the wrong time. High-intent users leave because no one recognizes their signals. Retention efforts come in too late to be effective.

This is not just a UX problem. It is a business loss you cannot always track. Predictive analytics solves it by ensuring the right offer, message, or feature appears at the exact moment the user is most likely to act.

In fintech, personalization is no longer a luxury. It is a core product expectation. Predictive analytics does not guess. It observes. It predicts. And it executes based on actual user behavior.

This is how fintech products increase adoption, retain more users, and grow revenue without guessing or adding friction.

Predictive analytics for personalized banking is how modern platforms stay relevant, useful, and trusted.

How Fintech Companies Use Predictive Analytics to Reduce Loan Defaults and Improve Investment Outcomes

Every loan issued is a risk. And not all users who qualify on paper behave the same once the money hits their account. Traditional approval models rely heavily on credit scores and static criteria. But that is no longer enough.

Predictive analytics in fintech changes the way platforms assess risk and protect revenue. It goes beyond credit history and looks at how a person behaves before, during, and after they take a loan.

This is how fintech companies are reducing default rates, without slowing down approvals.

Behavior signals before loan approval

Before approving a loan, predictive models analyze data like:

Application speed

Submitting forms too quickly may indicate users are skipping important details.

Low engagement before applying

Minimal interaction with product info can signal unclear intent or low confidence.

Device inconsistency

Frequent switching or reset patterns may suggest unreliable or risky usage behavior.

Self-declared detail gaps

Mismatched income or employment claims compared to platform-wide behavioral patterns.

Behavior similar to past drop-offs

Models spot common actions tied to users who previously disengaged after approval.

These are behaviors credit scores do not reflect. Predictive analytics in fintech scores these patterns in real time and flags risky applicants automatically, without adding delay to the process.

If the behavior shows high risk, the system can offer a smaller amount, require an additional check, or decline the request altogether.

This lowers default risk from day one, without hurting the user experience.

Post-loan behavior tracking

Risk does not stop at disbursement. Some users start showing repayment risks within days.

Predictive models continue to monitor:

- Login frequency after loan disbursement.

- Early balance depletion.

- Disengagement with repayment reminders.

- Transaction behavior showing financial stress.

These signals allow the platform to act before a missed repayment happens.

For example, the system can send an early nudge, freeze additional services, or route the user to support for a restructuring option.

This is what makes predictive analytics a live engine, not a one-time scoring tool.

AI-Powered Predictive Models for Investment and Wealth Management

Loan risk is one side. User growth and asset management is the other. Fintech companies are now using the same predictive approach to help users grow their wealth, not just manage their debt.

AI predictive analytics in fintech analyzes a user’s financial behavior, investment preferences, and market interaction patterns. By leveraging predictive models for investment, it recommends personalized wealth-building strategies tailored to each individual’s financial journey.

This includes:

- Detecting which users are most likely to pause or withdraw investments during volatility

- Identifying low-engagement investors who might benefit from advisory nudges

- Recommending asset allocations based on personal spending behavior and risk appetite

- Flagging unusual transaction trends that could affect portfolio stability

These models adjust automatically, without human input. They ensure that every suggestion, every portfolio adjustment, and every educational message is context-aware, timely, and aligned with the user’s actual goals.

For fintech platforms offering investment features, this level of personalization directly improves product stickiness, lifetime value, and wallet share.

Loan risk and investment growth are two sides of the same product journey. One protects your business. The other helps your users build long-term trust and value.

Predictive analytics in fintech powers both, by watching behavior, predicting outcomes, and triggering smart actions at every step.

It is not just smart data. It is smart timing. And in finance, timing and data is everything.

The Role of AI and Predictive Analytics in Credit Scoring and Risk Assessment

Traditional credit scoring looks backward. It evaluates users based on past repayment behavior, credit utilization, and historical loan data. While this works to some extent, it leaves serious blind spots. Many users who look good on paper still default. Others, who lack credit history, never get a chance.

This is where AI predictive analytics in fintech brings a real shift in how lending decisions are made. It analyzes user behavior in real time and uses that data to assign risk levels more accurately than static scoring models.

Here is how fintech platforms are applying this technology today:

Goes beyond traditional credit history

Predictive models include how a user interacts with your platform, how they respond to loan terms, their transaction behavior, and even how consistently they complete onboarding tasks.

Scores users in real time

The system continuously monitors what users are doing, not just what they submitted. Based on their actions, risk scores are updated immediately and used to guide approvals or rejections.

Detects intent and reliability early

Subtle behaviors such as skipping repayment explanations, rushing through application forms, or hesitating on verification steps often reflect intent or uncertainty. These signals help the model estimate real repayment behavior.

Helps approve new-to-credit users safely

Many users do not have a formal credit history but still show stable behavior patterns. Predictive models help qualify these users based on real usage instead of excluding them due to missing data.

Reduces risk before a loan is even disbursed

With early pattern recognition, fintech platforms can catch signals that suggest potential fraud, likely churn, or misuse before the transaction happens. This protects revenue and improves portfolio quality from day one.

This entire approach is known as predictive analytics in credit scoring. It is not just about scoring users more efficiently. It is about understanding who they are, how they behave, and what they are likely to do next, all with the goal of making safer, faster, and fairer credit decisions.

How Much Does Predictive Analytics in Fintech Cost?

Building predictive analytics into your fintech product is not a one-size-fits-all investment. The cost varies based on what you’re trying to predict, the kind of data you have, how fast decisions need to be made, and how deeply it integrates into your product.

Beyond the model itself, you’re also investing in the technology ecosystem that powers it, from infrastructure and data pipelines to deployment tools and automation.

Here’s a breakdown of what influences the cost and technology stack:

1. Scope and Complexity of the Model

A basic model may predict loan defaults based on past transactions. A more advanced one might monitor live user activity, adjust risk scores in real time, and trigger product actions automatically.

- Basic statistical models are cheaper and faster to build

- AI-driven models using machine learning cost more but bring higher precision and adaptability

2. Data Infrastructure and Readiness

The cost also depends on where your data is and how usable it is.

- Platforms with clean, centralized data systems reduce cost and complexity

- Platforms using fragmented or unstructured data need more engineering work to make data model-ready

Common tools used:

- Data lakes and ETL pipelines (AWS Glue, Apache Airflow)

- Warehousing platforms (Snowflake, BigQuery)

- Data cleaning and transformation tools (dbt, Python scripts)

3. Real-Time Decisioning Capability

If you want predictive analytics to drive real-time decisions, like instantly flagging fraud or showing personalized product offers, you’ll need infrastructure that supports low-latency responses.

Technology required includes:

- Real-time model serving (TensorFlow Serving, AWS SageMaker, Vertex AI)

- Scalable APIs and microservices architecture

- Message queues or event-driven systems (Kafka, Pub/Sub)

4. AI & Machine Learning Technology Stack

Here’s what most fintech companies use to build and run predictive systems:

| Component | Common Technologies |

| Model development | Python, Scikit-learn, XGBoost, PyTorch |

| Feature engineering | Pandas, Spark, dbt, Jupyter Notebooks |

| Training environments | SageMaker, Google Vertex AI, Azure ML |

| Deployment | Docker, Kubernetes, Flask APIs |

| Monitoring & updates | MLflow, Prometheus, custom dashboards |

These tools help keep your models accurate, scalable, and production-ready.

Even in adjacent industries like predictive analytics in InsurTech, similar technologies are being used to enable real-time decision-making and improve user-level accuracy.

5. Ongoing Maintenance and Optimization

Predictive systems need ongoing support. User behavior evolves. Fraud patterns change. Your model must be retrained, monitored, and tuned continuously.

- You’ll need data scientists, MLOps engineers, and cloud infrastructure support

- AutoML platforms can reduce cost, but complex use cases still require custom models

Cost Range Overview (Estimated):

| Scope of Work | Approximate Cost (USD) |

| Basic analytics setup (static models) | $10,000 – $25,000 |

| Custom predictive scoring engine | $30,000 – $70,000 |

| AI-powered behavioral prediction | $80,000 – $150,000+ |

| Full product integration (real-time) | $100,000 – $250,000+ |

| Ongoing maintenance and optimization | $2,000 – $10,000/month |

Note: Actual pricing depends on team skill, system complexity, and data maturity.

You are not just paying to build a model. You are building an intelligence layer for your fintech product, one that protects revenue, drives adoption, and reduces loss in real time.

Investing in predictive analytics in fintech is not a tech upgrade. It is a business strategy.

Done right, it pays for itself by catching risk before it costs you and unlocking user behaviors before they disengage.

Conclusion

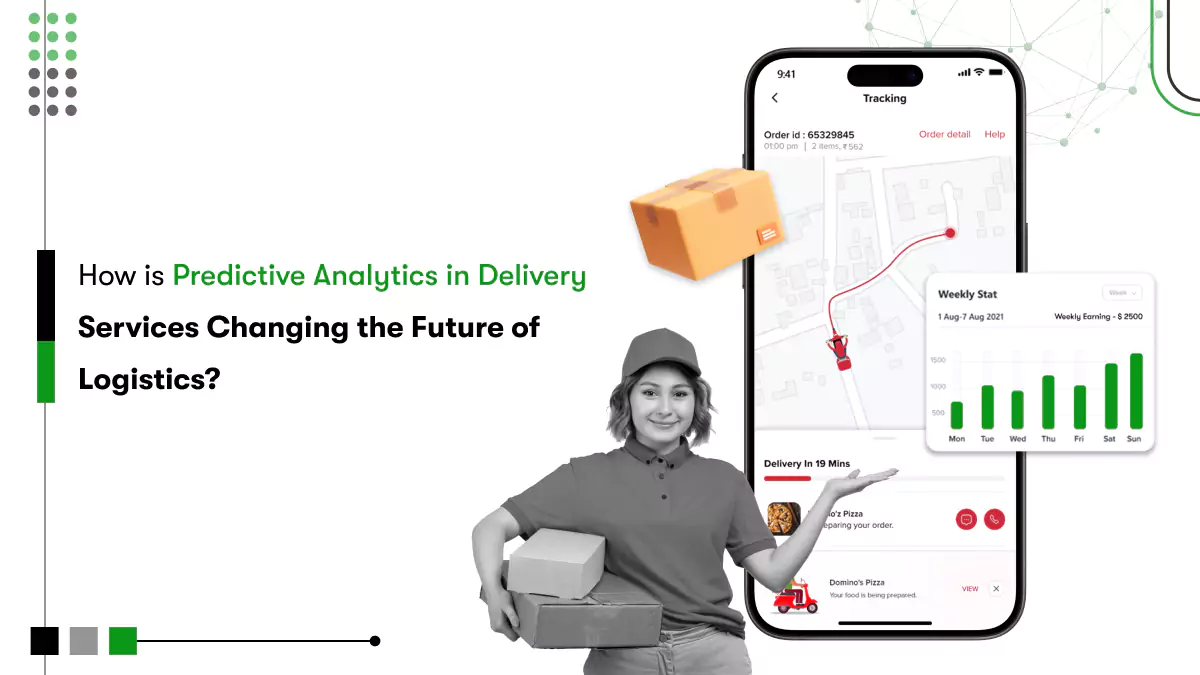

Predictive analytics is no longer a future trend, it’s the foundation of fintech products that scale with confidence. From lowering default risk and preventing fraud to boosting retention and driving smarter product adoption, the difference lies in how well your systems understand behavior, context, and timing.

But great results don’t come from tools. They come from teams that understand the business behind the data.

At Kody Technolab Ltd, we don’t just build apps, we build intelligent, data-driven fintech products that think ahead. As a trusted fintech app development company, we design custom predictive analytics solutions that align with your product, users, and growth strategy, not generic plug-ins or rigid platforms.

If you’re ready to make faster, smarter, more predictive decisions inside your product, our team is ready to help you make it real.

Contact Information

Contact Information