Remember when brokers used to attend to each client individually before the app revolution? However, conventional services restrict businesses from realizing their full potential. The stock trading application has revolutionized the stock trading market. By developing a stock trading app like Robinhood, financial institutes make the stock market accessible from mobile devices. Traders can easily buy and sell assets and stocks on the go using a stock trading app.

Moreover, features like educational resources and goal planning in stock trading apps enable even rookie traders to make better investment decisions. Consequentially, with the popularity and demand, the stock trading app market is also on the surge. For example, according to the Fortune Business Insight reports:

The online trading platforms market was valued at $9.32 billion in 2022 and is projected to reach $15.34 billion by the end of the forecast period in 2030, up from $9.94 billion in 2023.

Robinhood, Acorns, and Stash are some of the famous and top finance applications that gained popularity by meeting their users’ needs. So, let us dive into the Robinhood app and understand the reasons behind its popularity and how much it costs to develop a stock trading app like Robinhood.

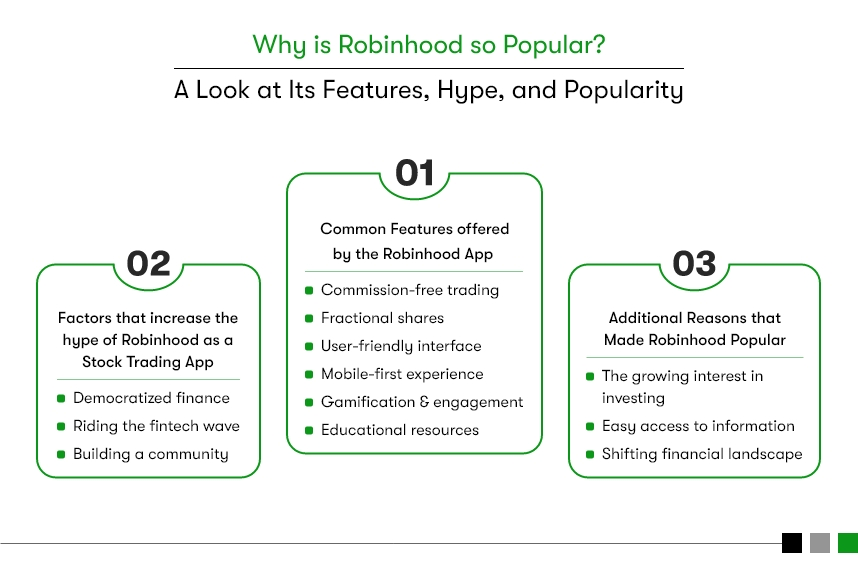

Why is Robinhood so Popular? A Look at Its Features, Hype, and Popularity

Robinhood has shaken up traditional brokerage patterns with its millions of users and stormed the investing world. But what is its driving force? Let’s explore the features, factors, and hype that have fueled Robinhood’s popularity:

Common Features offered by the Robinhood App:

- Commission-free trading: Robinhood removed the substantial fees that reduce clients’ returns. Its primary competitive advantage is zero-commission stock and ETF trading, which levels the playing field for all investors regardless of budgetary limitations.

- Fractional shares: With Robinhood, users can buy even fractions of shares paving the way for a diversified portfolio for everyone.

- User-friendly interface: Robinhood offers a sleek, intuitive design that makes buying and selling stocks easy, which ditches the intimidating jargon and complex layouts.

- Mobile-first experience: Trade on the go, anytime, anywhere. Robinhood developed an app for the mobile generation that offers seamless trading through the user’s smartphone.

- Gamification and engagement: Social elements, leaderboards, and confetti celebrations for completed transactions make investing enjoyable and engaging, which encourages users to stick with it.

- Educational resources: Robinhood offers a variety of resources to help beginner and experienced investors equally learn and make wise decisions.

All of these features have helped Robinhood gain hype in the market.

Factors that increase the hype of Robinhood as a Stock Trading App:

- Democratized finance: Robinhood made investing accessible to everyone who resonated with a generation priced out of traditional markets. Their user-centric approach challenged the elitist image of finance.

- Riding the fintech wave: Robinhood recognized that the financial technology sector was booming and aimed for an industry desiring low-cost, efficient results with customers’ mobile demands at first sight.

- Building a community: Social features and fun branding promoted a community atmosphere where everyone was like-minded investors rather than just users of the platform to trade.

Additional Reasons that Made Robinhood Popular:

- The growing interest in investing: The popularity of investing, especially among the younger generation such as millennials and Gen Z who are interested in having control over their finances was leveraged by Robinhood.

- Easy access to information: The internet and social media have provided users with financial information, which gave them the freedom to be in charge of their investments.

- Shifting financial landscape: The traditional brokerages were also criticized for charging high fees and highly confusing user interfaces that left a void in the market which was perfectly done by Robinhood. Robinhood found the void and fulfilled it by providing users with exactly what they needed in the app.

Robinhood’s success is not based on its features alone; it lies in the understanding of the target audience’s needs and desires to deliver a smooth, exciting, and empowering experience. They democratized finance, made investing available to all, and captured the spirit of a generation who were eager for financial freedom.

Prioritizing users first is the golden rule of app design. However, you must fully comprehend their needs before you create a single screen. The next section’s figures will help you better understand the market and the client’s needs.

Market Analysis: Data Reveals a Booming Stock Trading App Landscape

The data points directly: the stock trading app market is experiencing explosive growth, fueled by a surge in investor interest and opportunities mobile platforms offer. Here’s a breakdown of key findings that shed light on the booming market of stock trading apps and its driving force:

1. Robinhood’s Revenue Soars:

The transaction-based revenue of Robinhood reached $1.40 billion in 2021, which was much higher than the previous years. It’s a clear indication of the high adoption rate of Robinhood’s commission-free model as well as an expanding user base that actively trades through the app.

2. App Searches Skyrocket:

According to Google Consumer Insights, the app searches on investing and stocks increased by 115% year over year. This trend indicates a major consumer behavior change with mobile platforms emerging as the primary channel to get financial information and run investment activities.

3. Asset Management Apps Thrive:

According to SensorTower, the downloads of asset management apps in the US grew by a staggering 198% from one quarter to another during Q2 2021, reaching over 35 million downloads. This massive increase shows this market trend towards investment solutions focused on mobile devices.

Stock trading will definitely become more mobile in the future. Financial businesses can benefit from this dynamic industry and help democratize trading by offering accessible and interesting investment solutions by evaluating the data and spotting patterns.

How to Craft a Robinhood-like App in 5 Steps (Without Breaking the Bank): A B2B Guide

Developing a stock trading app like Robinhood can be a thrilling venture, but navigating the complexities can be daunting. So, let us outline 5 key steps for building your app while keeping costs in mind:

1. Define Your Scope:

- User Persona: Who is the target audience? Are they Novice investors, Seasoned traders, or newbies in the stock trading world? Your stock trading applications and wealth management software development will be shaped by your understanding of client requirements and preferences.

- Core Features: Prioritize commission-free trading, intuitive interface, fractional shares, and basic technical analysis tools. You can gradually expand the application features based on the budget and user feedback.

- Monetization Strategy: Strategizing the monetization is important to build a profitable application. Consider revenue models like premium subscriptions for advanced features, margin lending, or partner help with financial institutions.

2. Choose Your Development Approach:

- Native vs. Cross-platform: Based on the platform you choose to develop your stock trading app for, you can either opt for native or cross-platform app development. Native app development ensures superior performance but requires separate development for each platform (iOS and Android).

- Cross-platform: On the contrary, building a cross-platform app using Google-based SDK, Flutter accelerates the development process by allowing writing codebase once and using it to build both Android and iOS apps. This way, you can save up to 40% of development costs and time while ensuring the high-performance and intuitive UI of your trading app. Also, you do not have to be proficient in coding, you can easily hire a flutter app developer from a reputed fintech app development company.

3. Partner with the Right Stock Trading App Development Company:

To ensure you have the right technology partner to guide you throughout your stock trading app development journey, look for the below characteristics:

- Expertise: Look for an experienced team or hire fintech developers to build secure and scalable financial applications.

- Transparent Communication: Make sure the team follows clear communication and collaboration approaches throughout the stock trading app development process.

- Cost-Effective Solutions: Explore engagement models and choose one that suits your requirements. Basically, you find the pricing models like fixed fees, hourly rates, or hybrid models.

4. Navigate Regulatory Compliance:

While developing a stock trading app like Robinhood, you cannot afford to consider regulatory compliance to avoid any legal issues. What kind of regulations to consider? Let’s explore.

- Financial Regulations: Identify the pertinent laws and regulations that may apply to a given target market. For instance, each place comes with its own set of financial management guidelines and regulations. Gain knowledge of the relevant laws such as KYC/AML and FINRA licensing in your main countries.

- Data Security & Privacy: Put in place strong data security protocols and ensure adherence to regulatory frameworks governing privacy issues such as GDPR, and CCPA.

- Seek Legal Counsel: Seek professional legal advice or guidance to make sure that your app is compliant with all pertinent legislation and regulations.

5. Test & Launch with Confidence:

- Thorough Testing: To ensure that your app functions flawlessly and meets the needs of end-users, proper testing on various platforms is vital. This will help to identify any problems and ensure stability as well as functionality.

- Beta Testing: Before launching your app fully, consider beta testing to get valuable feedback from users and refine your app accordingly. This can help maximize user satisfaction and make necessary improvements.

- Phased Launch: Another strategy is to consider a phased launch, where you gradually roll out new features and functionalities. This can help with smoother adoption and give you time to fix any bugs or issues that may arise.

Even though prices can vary, you can create a successful app without going over budget by concentrating on important features and forming smart alliances. So, let’s understand how much it would cost to develop a stock trading application like Robinhood.

Estimating the Cost of Your Robinhood-like App: A Breakdown

Approximate Cost Range of Developing the Robinhood-like Stock Trading App Development or Finance App Development: $25,000 – $2,00,000.

Developing a stock trading app like Robinhood sounds exciting, but understanding the cost involved is crucial for budgeting and planning. The good news is, that you can optimize the cost of the application by keeping some crucial factors. Here’s a breakdown of the factors influencing the cost and how to build your app without breaking the bank:

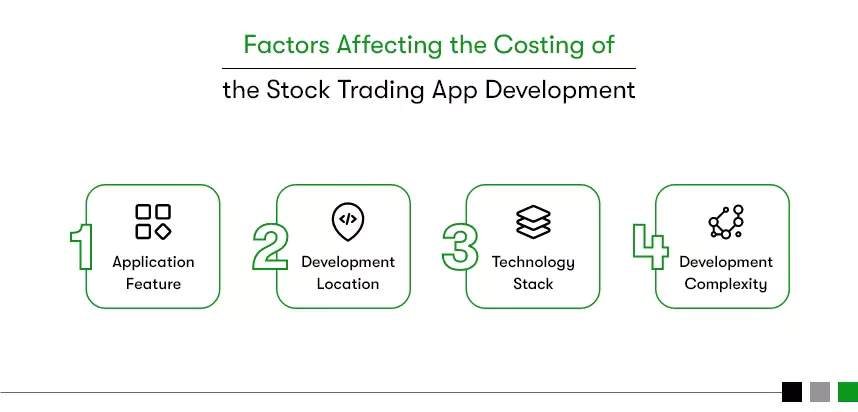

Factors Affecting Costing of the Stock Trading App Development:

- App Features: Basic features like portfolio management, watchlist, and stock trading functionality are essential but cost less compared to advanced functionalities like interactive UI/UX design, multiple payment gateways, and real-time market data analysis.

- Development Location: Outsourcing development to regions with lower developer rates can significantly reduce costs. However, you must also consider potential communication and quality control challenges.

- Technology Stack: Native app development offers superior performance but is generally more expensive compared to cross-platform app development. Choosing the right stack based on your budget and complexity needs is crucial.

- App Complexity: The number of integrations, security features, and data handling complexity all influence the development time and cost. Prioritize essential features and build gradually based on user feedback and budget constraints.

Here is the estimated cost of basic features development and implementation of stock trading application.

| Basic Features | Estimated Costs | Feature Description |

| Intuitive Dashboard | $2100 – $2200 | Dashboard provides a consolidated view of holdings, order history, and stock market performance to the users. |

| Dynamic Portfolio Tracker | $1500 – $2000 | It helps users to track investment performance, asset allocation, and real-time net worth. |

| Live Market Data | $10,000 – $20,000 | Live market data Delivers the real-time streaming of stock market data, including quotes, charts, and news updates to the users. |

| Personalized Watchlist | $2,500 – $3,500 | Personalized watchlists help clients with easy monitoring, creating, and maintaining personalized lists of favored assets. |

| Secure Synchronization | $1,500 – $2,000 | Seamlessly synchronize data across devices for on-the-go access. |

The estimated cost of the advanced capabilities that Robinhood offers and that you may incorporate into your app is as follows.

| Advanced Features | Estimated Costs | Feature Description |

| Interactive UI/UX | $12,000 | Gamified elements, intuitive navigation, and customizable dashboards. All these additional features help to grow the engagement of the users with your application. |

| Multi-Exchange Stock Trading Functionality | $15,000 – $20,000 | It gives access to multiple exchanges to the users for expanding their trading opportunities. |

| Get Rewards & Coupons | $15,000 | Incentivize user engagement with reward points, exclusive offers, and gamified challenges. |

| Advanced Analytics & Reports | $10,000 – $13,000 | Advanced analytics will provide in-depth market analysis tools, customized reports, and AI-powered investment insights. |

Equipped with these cost insights, you are all set to create a fintech app that revolutionizes the industry and allows users to put them in control. Learn more about how the pricing varies based on the features and locations in the next section. To better comprehend the cost difference between the US and India, let’s take a closer look.

Cost Comparison for Stock Trading Application Development in India vs the US:

Before starting the development of the stock trading app let’s get some overview of the costs associated with different functionalities, platforms, and development factors in both India and the US.

| Functionality | Key Features | Average Cost in India (USD) | Average Cost in the US (USD) |

| Basic Functionality: | Portfolio Management | $1,500 – $2,000 | $3,000 – $5,000 |

| Watchlist | $1,000 – $1,500 | $2,000 – $3,000 | |

| Live Market Data | $5,000 – $10,000 | $10,000 – $20,000 | |

| Secure Login & Authentication | $1,000 – $1,500 | $2,000 – $3,000 | |

| Advanced Functionality: | Multi-Exchange Trading | $10,000 – $15,000 | $20,000 – $30,000 |

| Real-time Analytics & Reports | $5,000 – $8,000 | $10,000 – $15,000 | |

| AI-powered Investment Insights | $8,000 – $12,000 | $15,000 – $25,000 | |

| Social Features & Gamification | $3,000 – $5,000 | $5,000 – $10,000 | |

| Platform: | Native iOS App | $25,000 – $35,000 | $40,000 – $60,000 |

| Native Android App | $20,000 – $30,000 | $35,000 – $55,000 | |

| Cross-Platform App | $15,000 – $25,000 | $25,000 – $40,000 | |

| Additional Factors: | Project Complexity | +10% – 20% | +15% – 25% |

| Team Size & Experience | +5% – 10% | +10% – 15% | |

| Maintenance & Updates | $2,000 – $5,000 per month | $4,000 – $8,000 per month |

The mentioned costings are the average costing figures and can vary depending on the feature complexity, team experiences, resource requirements, locations, and other factors. Don’t let cost be an excuse! Now, let us explore some practical tips on creating your cost-effective stock trading app.

Additional Tips for Cost-Effective Stock Trading Application Development:

Developing a first-class stock trading application does not necessarily involve unbelievable spending. Here are five key strategies to minimize expenses while maximizing value:

- Choose Technology Stack Smartly: Use cross-platform technology like Flutter and React Native to minimize the cost without compromising the quality on both IoS and Android.

- Prioritize features: Start with essential features and add advanced features later based on user feedback and budget.

- Use Open-Source Libraries: Make use of open-source libraries that are easily accessible for tasks like data parsing, authentication, and charting. By doing this, license costs and development time are decreased, freeing up funds for essential features.

- Consider outsourcing the developers: Hire the fintech app developers from a reputed fintech app development company or find a who has portfolios with these applications. Outsourcing the developers from countries with lower rates will save you lots of money.

- Phased development: Develop and launch the app in stages, adding features to the base version as you go. By using this method, you may avoid pulling all the money at once and instead spend it sensibly and on the necessary features.

Taking a strategic approach to your tech stack will allow you to build a strong and cost-efficient environment for your Robinhood-like app, ensuring an effective entry into the competitive fintech market.

Conclusion

The future of finance is mobile, and Robinhood’s success has proven it. They have also democratized investing and created a user-centric experience, thus paving the way for a new generation of stock trading apps.

Now it’s your time to become part of the revolution. If you are a traditional brokerage firm that needs to modernize or a fintech startup with vision, the custom stock trading app is your chance to find growth and a new wave of investors.

Kody Technolabs has consistently delivered secure and scalable fintech applications. We have a team of experienced developers who understand current technology and regulations. So, hit us up for any questions you have regarding stock trading app development or hiring experienced app developers.

Contact Information

Contact Information