Quick Summary: This guide explores how AI in insurance helps companies improve claims handling, customer experience, and decision-making. Readers will understand the real impact of AI in insurance industry practices, from fraud detection to faster underwriting. It also explains how adopting AI in the insurance industry can strengthen efficiency, accuracy, and long-term growth for insurers worldwide.

Every insurance leader wants fewer claim delays, better fraud control, and policies that fit each customer perfectly. AI in insurance now helps companies achieve those results through smarter data use and faster decision-making.

Research from Fortune Business Insights shows how strong this growth is. The global insurance analytics market stood at USD 14.50 billion in 2024, will reach USD 16.70 billion in 2025, and is projected to grow to USD 43.95 billion by 2032, with a CAGR of 14.8 percent.

These numbers show how insurers across the world depend on AI in insurance to improve efficiency and build trust with customers.

Across underwriting, claims, and customer service, AI systems read documents, flag irregularities, and personalize pricing faster than manual methods. Predictive analytics and automation help reduce fraud, improve accuracy, and make insurance easier for customers to manage.

This guide explains how AI in insurance works in 2025, what measurable results it creates, and how insurers can apply it confidently without wasting time or resources.

If you want to learn how to develop a custom artificial intelligence app step by step, read our detailed AI App Development Guide.

How Is AI in Insurance Relevant to the Industry?

Insurance businesses face rising claim volumes, complex risks, and constant pressure to deliver faster services. AI in insurance enables insurers to handle these challenges with accuracy and speed. It supports smarter decisions, improves operations, and strengthens customer confidence.

AI tools are now part of every major insurance process. They help analyze patterns in large datasets, detect fraud before losses occur, and personalize policy pricing. With data-driven intelligence, insurers can predict outcomes, automate repetitive work, and focus on building customer trust and business growth.

Across regions such as the USA, UK, and UAE, companies now invest in AI in insurance to manage risk efficiently and remain competitive in a rapidly evolving market.

Key Challenges the Insurance Industry Faces

1. Complex Risk Evaluation

Insurers depend on accurate risk evaluation to stay profitable. Manual analysis often misses subtle data trends hidden in claim histories, financial records, and lifestyle patterns. AI models analyze structured and unstructured data in seconds, revealing links between customer behavior and potential claim outcomes. This precision helps design fair policies and maintain strong risk control.

2. High Claim Volume and Fraud Control

Every day, insurers handle thousands of claims that require verification and document checks. Manual reviews slow down processing and increase administrative costs. AI systems read claim files, compare them with previous records, and flag suspicious activities. Faster and more reliable validation improves claim turnaround time and reduces fraud exposure.

3. Evolving Customer Expectations

Modern policyholders expect quick responses, transparent pricing, and personalized coverage. AI solutions such as chatbots and virtual advisors assist customers instantly with claim updates, policy queries, and renewal suggestions. Consistent service at any hour improves satisfaction and retention.

4. Regulatory Compliance

Compliance remains one of the most demanding areas for insurance operations. Each region has its own laws governing data use, privacy, and claim management. AI applications track regulatory updates, maintain audit trails, and ensure all activities align with current standards. These systems help insurers avoid penalties and maintain transparency.

Together, these challenges reveal why traditional methods can no longer sustain growth in the insurance market. Integrating AI in insurance enables companies to overcome these barriers with precision, speed, and stronger decision-making. For businesses planning to build such systems, understanding the AI app development cost helps ensure realistic budgeting and smoother adoption.

How AI in Insurance Solves These Challenges

1. Turning Data Into Actionable Insights

Insurers collect information from diverse sources such as customer records, connected devices, and claim archives. AI platforms organize this data and extract meaningful insights for decision-makers. Predictive analytics forecasts claim frequency, identifies risky patterns, and supports better strategic planning.

2. Enhancing Underwriting Accuracy

Underwriting involves evaluating applicant profiles and setting premium amounts. AI analyzes personal and behavioral data, credit reports, and past claim histories to assess real-time risk levels. Automated underwriting improves accuracy, reduces bias, and speeds up policy approvals.

3. Streamlining Claims Processing

AI simplifies claim management by scanning forms, documents, and images automatically. It confirms policy eligibility, checks claim consistency, and detects possible fraud. Automation shortens settlement cycles, lowers operational costs, and increases customer confidence.

4. Improving Customer Interaction

AI-based chat tools and self-service portals assist policyholders throughout their insurance journey. Customers receive personalized recommendations, timely reminders, and consistent support. This approach builds stronger relationships and increases brand loyalty.

5. Supporting Governance and Compliance

AI systems built for compliance monitor model behavior, record decisions, and highlight any deviation from approved standards. They maintain full transparency across departments, ensuring accountability and ethical AI usage.

Why AI Is a Strategic Advantage for Insurers

AI-driven automation improves accuracy, speeds up decisions, and helps insurers scale without compromising quality. Early adopters already report higher claim efficiency, better fraud detection, and stronger policyholder engagement.

As technology continues to advance, many insurers are also exploring Generative AI solution in insurance for faster document summarization, claim drafting, and customer communication. Integrating predictive and generative systems ensures every insurance process becomes more reliable, transparent, and customer-focused.

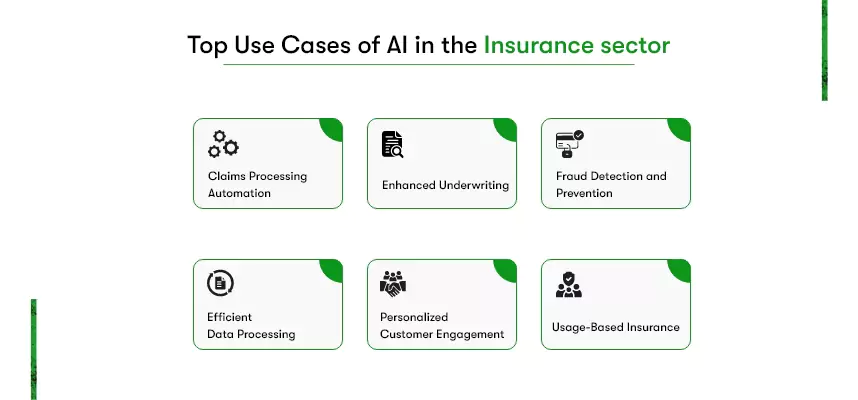

What Are the Top Use Cases of AI in the Insurance Industry?

AI in insurance helps insurers make faster, more accurate, and data-driven decisions. It simplifies claim management, improves underwriting, reduces fraud, and enhances customer experience.

Each use case delivers measurable results, increasing efficiency and building trust between insurers and policyholders.

1. Claims Processing Automation

AI in insurance automates claim evaluation by analyzing images, documents, and customer data. It verifies policy details, estimates damage, and detects missing information instantly. This speeds up settlements and eliminates manual paperwork, helping customers receive payouts quickly.

Faster claim cycles improve customer satisfaction and reduce administrative costs. Many insurers now integrate predictive models into their claim management systems to streamline operations and identify high-risk claims early.

2. Enhanced Underwriting

AI in insurance Industry tools assess risk more precisely than manual evaluations. These systems study financial records, behavioral patterns, and previous claims to recommend accurate premium values. Automated underwriting reduces human error and helps insurers create fair pricing structures for every policy.

Machine learning also enables dynamic policy adjustments. This means coverage and premiums adapt as customer data changes, ensuring continuous accuracy and fairness.

3. Fraud Detection and Prevention

AI in the Insurance Industry is highly effective at reducing fraudulent claims. Algorithms analyze claim data, identify unusual behavior, and flag suspicious cases before approval. Continuous monitoring protects insurers from major financial losses and improves transparency.

As more data becomes available, these AI systems refine their models to detect new fraud tactics faster. Insurers benefit from lower losses, improved compliance, and a more reliable reputation.

4. Efficient Data Processing and Insights

AI in insurance turns raw data into valuable insights. It processes massive datasets collected from applications, IoT sensors, and claims systems. Executives use this intelligence to design better policies, manage risks, and predict customer needs.

With real-time reporting and visualization, insurers can spot market trends early and make strategic decisions confidently. Data-driven operations also improve collaboration between departments and enhance overall productivity.

5. Personalized Customer Engagement

AI Use Cases in Insurance extend to customer service and engagement. Virtual assistants and chatbots guide users through claims, renewals, and coverage updates. Predictive analytics helps companies suggest relevant products to each customer based on behavior and history.

This continuous support strengthens relationships and increases satisfaction. Policyholders appreciate personalized attention and quick assistance without waiting for a human representative.

6. Usage-Based Insurance (UBI)

How Is AI Used in Insurance for UBI? AI models collect real-time data from telematics and IoT devices to calculate fair premiums. Driving speed, braking habits, and mileage help determine policy costs accurately. Responsible drivers benefit from reduced premiums and safer behavior.

7. Generative AI in Insurance

Generative AI in insurance improves communication and document management. It drafts claim summaries, policy statements, and training materials quickly. Teams save time and maintain consistent messaging without sacrificing accuracy.

Insurance companies also use these tools for knowledge sharing and risk simulations. This improves internal learning and speeds up response time for customer needs.

Partnering with reliable AI development services providers helps insurers design, deploy, and maintain these systems effectively.

These AI in insurance claims and other applications prove how technology drives real business results. Insurers that adopt AI solutions early achieve higher accuracy, faster service, and stronger customer loyalty across global markets.

How Do Insurance Companies Use AI in Insurance?

AI in Insurance helps insurers improve risk analysis, claim handling, and customer experience. Many companies now depend on data-driven tools to make decisions faster, ensure fair pricing, and deliver more accurate policy services.

Aegon

Aegon is a major life insurance and asset management company based in the Netherlands. It applies AI to study customer behavior and predict insurance needs. These insights help Aegon create policies that match individual requirements and enhance satisfaction.

The company also uses AI-powered chatbots to manage customer queries efficiently. This allows quick responses and consistent communication. With AI in insurance Industry tools, Aegon improves operational accuracy and provides reliable support to its growing client base.

Zilveren Kruis

Zilveren Kruis, or Silver Cross, is a leading Dutch health insurer serving more than five million people. It employs AI solutions to speed up claim reviews and reduce manual errors. The technology detects missing information early and ensures timely settlements.

Machine learning also helps the company recognize unusual claim activity to prevent fraud. Another use involves building personalized health coverage plans based on each client’s risk data. This precision supports trust, efficiency, and fairness within the AI in the insurance industry.

Both Aegon and Zilveren Kruis show how AI use cases in insurance lead to faster service, accurate pricing, and stronger customer relationships. Their success proves that AI can enhance business performance while maintaining transparency and reliability.

Why AI-powered Insurance Mobile App Development can be a game-changer for an Insurance Company?

Combining the strategic implementation of Artificial Intelligence (AI) with mobile app development can indeed be a game-changer for insurance companies. This transformation is exemplified by forward-thinking insurers like Aegon and Zilveren Kruis. They recognize the profound impact of AI-powered mobile apps on their operations and customer interactions. Here’s how the synergy of AI and mobile app development can revolutionize the insurance landscape:

Enhanced Customer Engagement and Personalization:

AI-driven mobile apps allow insurers to engage with customers on a highly personalized level. By analyzing user behavior and preferences, these apps can provide tailored policy recommendations, coverage options, and real-time updates, creating a more meaningful and customer-centric experience.

Streamlined Claims Processing:

Mobile apps equipped with AI simplify claims processing. Policyholders can quickly report and track claims, while AI algorithms assess claim validity, expediting the entire process. This efficiency also enhances customer satisfaction and loyalty.

24/7 Accessibility and Convenience:

With your mobile app, customers can access policy details, payment options, and customer support whenever and wherever needed.

Data-Driven Decision-Making:

AI within mobile apps can analyze customer data, enabling informed decision-making for companies. So, you can easily anticipate customer behavior, adapt products to individual needs, and optimize underwriting processes, ultimately improving operational efficiency.

Cost Efficiency and Speed:

Mobile app development using AI, particularly with tools like Flutter, significantly reduces costs and time-to-market. Companies can launch high-performing apps for both Android and iOS platforms simultaneously, reaching a broader audience in record time.

Consistency and Brand Image:

Opting for Flutter app development, you can also ensure consistent user experiences across different devices and screen sizes. This uniformity enhances your insurance company’s brand image and customer trust.

Robust Security:

Leveraging AI capabilities, you can also encrypt customer data, monitor suspicious activities, and offer biometric authentication to offer a secure insurance mobile app. Such security measures protect sensitive customer data, instilling confidence in policyholders regarding data privacy and integrity.

So, the convergence of AI and mobile app development has the potential to transform the insurance industry. Insurers adopting this synergy will certainly revolutionize customer engagement, streamline operations, and drive innovation. Because with this tech combo, it will be easier for insurers to meet the evolving needs and expectations of their customers.

Check out how much does it cost to develop a Smart Insurance app like GetSafe (the Netherlands’ emerging InsurTech app)

How does AI in Insurance improve mobile apps for insurers in 2026?

AI in Insurance makes mobile apps faster, smarter, and easier to use. Insurers guide customers through claims, policy changes, and payments with fewer steps. Apps deliver personalized offers, lower support costs, and keep operations compliant with strong audit trails and access controls.

Customer engagement and personalization

AI models study behavior and preferences. Apps suggest relevant coverage, reminders, and discounts. Policyholders see clear options and receive quick answers. Results include higher conversions and better retention across core segments in the AI in the insurance industry.

Claims self-service

Apps capture photos, read documents, and pre-fill forms. Models check policy limits and flag missing data. Customers track status in real time. Teams focus on edge cases while routine claims move faster. These flows reduce errors in AI in the insurance industry.

Underwriting support

Applicants share data once. AI reviews profiles, past claims, and verified signals. The app returns pre-approved limits or next steps within minutes. Underwriters get a complete view and spend time on complex risks, not repetitive checks. This is how AI is used in insurance for speed.

Policy servicing and retention

Apps handle endorsements, renewals, and payments without a call. Recommendations reflect risk changes and life events. Customers see clear pricing and choices. Fewer service tickets and fewer lapses mean better lifetime value, supported by AI in insurance claims workflows.

Security and compliance

Mobile apps enforce strong authentication and permission controls. AI detects unusual access and blocks risky actions. Logs record each decision for audits. These safeguards protect data and simplify regulator reviews. Teams avoid fines and keep trust.

Speed to market with Flutter

A single codebase ships to Android and iOS. Teams release features faster. AI SDKs and APIs connect to claims, pricing, and CRM tools. Consistent design raises usability scores and reduces maintenance. This pattern reflects mature AI use cases in insurance.

Analytics for decisions

Dashboards show claim cycle time, drop-off points, and feature adoption. Leaders test journeys and improve flows quickly. Insights guide pricing, fraud checks, and service design. Apps become the primary channel for engagement.

Where generative models help

Generative AI in Insurance drafts claim summaries, explains coverage, and prepares knowledge articles. Reviewers approve the final text. Teams save time while keeping language clear and consistent.

Well-designed apps powered by AI in insurance cut friction, lower costs, and raise satisfaction. Leaders gain a reliable channel for growth and service quality. To build such intelligent solutions efficiently, many insurers choose to hire AI developers who specialize in creating secure, scalable, and high-performing applications.

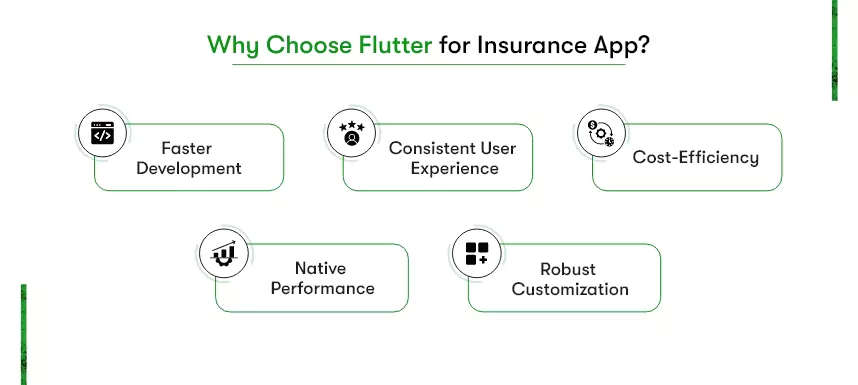

How does Flutter help insurance companies in their AI adoption journey?

Flutter is an open-source cross-platform app development framework, ideal for insurance companies to launch high-performing and feature-rich mobile apps. It’s renowned for its ability to develop natively compiled applications for mobile, desktop, and web from a single codebase.

Here are some of the benefits your insurance company can reap by choosing Flutter for mobile app development:

Faster AI App Deployment

Flutter allows development teams to create and deploy AI-powered insurance apps for Android, iOS, and web from one codebase. This shortens build cycles, speeds up updates, and enables rapid experimentation with AI in the insurance industry features.

Unified Experience Across Platforms

Consistency is vital for insurers managing complex workflows. Flutter ensures the same interface and performance across devices. Customers experience reliable claims, payments, and policy tracking within the same app ecosystem.

Cost and Maintenance Efficiency

Building and maintaining one Flutter codebase reduces expenses compared to managing separate platforms. Teams focus on AI improvements like fraud analytics and underwriting automation instead of repetitive code work. This aligns well with AI use cases in insurance such as predictive modeling.

Native Speed and Performance

Flutter apps perform at native speeds. AI-powered recommendations, chatbot responses, and fraud checks operate seamlessly without lag. Real-time updates keep customers informed of claim status and policy changes.

Custom AI Integration

Flutter supports integration with TensorFlow Lite, OpenAI APIs, and other ML libraries. Insurers can embed generative AI in Insurance for chat automation, report drafting, or personalized policy advice directly inside the app.

Using Flutter for AI in insurance ensures faster innovation, smoother performance, and better control over digital transformation. It helps insurers simplify development, improve engagement, and achieve measurable returns from their AI adoption journey.

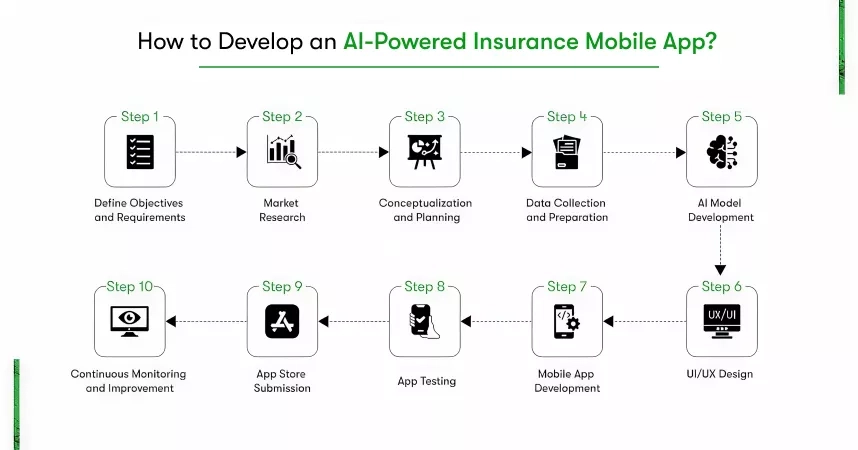

How to Develop an AI-Powered Insurance Mobile App in 2026?

By developing an AI-powered mobile app, your company embraces Digital Transformation in the Insurance sector (we have discussed this in detail here). This is a crucial investment that you want to be strategic.

Hence, you should hire experienced Flutter app developers and follow a holistic approach that may include the below steps.

1. Define Clear Goals and Features

Start by outlining what the app should achieve. AI in Insurance can automate claims, detect fraud, and personalize offers. Identify which features align with business goals, such as chatbots, risk scoring, or underwriting automation.

2. Conduct Market and Competitor Research

Analyze customer expectations, regional regulations, and competitor products. In the AI in the insurance industry, studying user feedback from top apps helps refine features before development begins. Research ensures the app matches both compliance standards and customer behavior.

3. Plan Architecture and Tech Stack

Create a roadmap that covers timelines, costs, and performance goals. Define the app’s structure and APIs for smooth integration with existing insurance systems. Flutter supports fast development cycles and cross-platform consistency, making it ideal for AI use cases in insurance.

4. Collect and Prepare Data

AI performance depends on clean, high-quality data. Gather customer profiles, claims history, and policy data securely. The dataset fuels predictive models that guide fraud detection, premium pricing, and customer risk assessments in AI in insurance claims.

5. Build and Train AI Models

Choose the right techniques, such as NLP for chatbots, machine learning for predictions, or image analysis for damage estimation. Each model should meet defined accuracy targets and integrate smoothly within the mobile app’s ecosystem.

6. Design an Intuitive Interface

User experience defines app success. Create simple navigation and clear policy dashboards. Every screen should guide customers through claims, renewals, or queries naturally. Consistent design builds trust and enhances adoption.

7. Develop the App with Flutter

Flutter enables native-quality apps for Android and iOS using one codebase. Its stability helps developers add AI modules without sacrificing speed. Integration supports personalization, real-time notifications, and chatbot automation, strengthening engagement in AI in insurance industry apps.

8. Test for Performance and Security

Run stress, security, and user acceptance tests. Ensure models give reliable results and comply with regional data privacy laws. Testing reduces the risk of policy errors and ensures smooth claim transactions.

9. Deploy and Optimize Continuously

Release the app after completing all validations. Monitor AI accuracy, customer feedback, and usage analytics. Update models and app features regularly to maintain relevance and compliance. This ensures steady performance and customer trust in how is AI used in insurance.

Developing an AI-based insurance app helps insurers combine automation, data analysis, and customer interaction in one platform. Each step contributes to faster claims, smarter underwriting, and measurable growth within the evolving ecosystem of AI in insurance.

Check out this guide on Insurance app development that discusses Features and Costs for a comprehensive understanding.

Secure Successful AI Adoption for Your Insurance Company with Kody Technolab

AI in Insurance is reshaping how insurers handle claims, predict risks, and engage with customers. At Kody Technolab, we help insurance companies simplify this adoption journey with secure, scalable, and ready-to-deploy AI solutions.

Our experts design custom tools that connect policy data, automate workflows, and improve decision-making. Each solution focuses on faster processing, stronger compliance, and higher customer satisfaction within the AI in the insurance industry.

With our proven expertise in Fintech app development, we bring deep technical knowledge to the insurance domain. From predictive modeling to fraud analytics, we bring real value to your digital strategy through AI use cases in insurance that deliver measurable impact.

Partner with Kody Technolab to unlock smarter operations, stronger customer trust, and higher business efficiency.

Ready to explore AI in Insurance for your company? Let’s build the next intelligent solution together.

FAQs

1. How can my insurance company start using AI without replacing current systems?

Start with one small project such as automating claim checks or customer support chatbots. Measure the results and expand later. Many companies use AI in insurance gradually to modernize operations without replacing their entire system.

2. What is the real cost of using AI in insurance industry projects?

The cost depends on project goals and the complexity of data models. Basic automation may start near $80,000, while advanced AI in insurance industry systems with risk analysis or fraud detection can cost up to $250,000.

3. How is AI used in insurance to protect customer data?

AI tools encrypt customer information, detect cyber risks, and ensure compliance with privacy rules. Using AI in the insurance industry helps companies maintain strong data protection while processing large volumes of sensitive information securely.

4. What are the most common AI use cases in insurance?

Top AI use cases in insurance include claims automation, personalized pricing, fraud detection, and customer engagement. For instance, predictive models help assess risk faster, while chatbots handle client queries within seconds.

5. How does AI in insurance claims improve accuracy and speed?

AI systems scan documents, images, and data to verify claims instantly. Using AI in insurance claims reduces errors, shortens processing time, and ensures fair payouts for both customers and insurers.

6. How long does it take to adopt AI in the insurance industry?

A small-scale pilot can go live in six to ten weeks. Full AI adoption across underwriting, claims, and fraud detection may take four to eight months, depending on the data readiness of each insurer.

7. How is generative AI in insurance changing daily operations?

Generative AI in insurance helps insurers write claim summaries, draft client messages, and generate underwriting reports automatically. It reduces manual work, enhances clarity, and shortens response time across teams. Many insurers now partner with a trusted Generative AI development company to build custom tools that streamline documentation, boost accuracy, and improve collaboration across departments.

Contact Information

Contact Information