Insurance apps have emerged as the bridge between traditional insurance practices and the expectations of modern consumers. They offer a window into the world of insurance that is accessible at the fingertips. Insurance apps streamline the entire process from policy management to claims processing, making it more user-friendly and efficient.

Besides, mobile is the first channel people use to research Insurance services, and spend 90% of their smartphone usage time on apps. That makes Insurance app development the ultimate solution for insurance companies looking to expand their reach.

However, as the demand for these apps surges, a pressing question among insurers emerges: How much does it cost to develop an insurance app?

This question takes center stage in our exploration. And we will take the example of GetSafe, a rising Dutch insurance app, inspiring its fellow insurers in the Netherlands.

So, if you’re intrigued by the idea of revolutionizing the insurance experience in the Netherlands through cutting-edge technology, stay with us. Before we uncover the cost and intricacies of developing an insurance app, let’s delve into GetSafe and how it meets the high expectations of the dynamic insurance market.

Make sure you understand the concept of Digital Transformation in Insurance inside out!

How does GetSafe make Digital Insurance safe for policyholders?

Getsafe is not just an insurance company; it’s a trailblazer in the world of digital insurance. Founded in 2015 by Christian Wiens (CEO) and Marius Simon (CTO), Getsafe started as an insurance broker but quickly transitioned to building its own digital insurance products as an MGA (Managing General Agent). In 2021, Getsafe achieved a significant milestone by obtaining its own insurance license, cementing its position as a digital insurer.

Here are some key facts and figures that highlight Getsafe’s inspiring impact and reach:

500,000+ Customers: A substantial customer base, with 75% of customers purchasing insurance for the first time, speaks volumes about Getsafe’s appeal.

EUR 120 Million Funds Raised: Getsafe has garnered substantial support from investors, including family offices, Swiss Re, Earlybird, CommerzVentures, BtoV, GFC, Partech, and Capnamic.

1 Out of 3 Customers: Remarkably, one in every three customers has more than one policy with Getsafe, indicating high customer satisfaction and trust.

Expanding Markets: Getsafe has rapidly expanded its footprint, serving customers in four markets: Germany (since 2017), the UK (since 2020), Austria (since 2022), and France (since 2023).

Exceptional Ratings: Getsafe’s commitment to excellence is reflected in its 4.9-star rating, making it one of the best-rated insurance apps in the industry.

Powered by a unique technological platform, Getsafe simplifies insurance, making it straightforward, fair, and accessible. By integrating smart bots and automation, Getsafe eliminates the complexity and manual paperwork.

As we explore the cost of developing an insurance app like GetSafe, it’s essential to remember the strides made by innovative companies like GetSafe in revolutionizing the insurance landscape. Their success stories serve as beacons of inspiration for insurers looking to adapt to the changing times and meet the evolving needs of their customers.

How much does it cost to develop an insurance app like Getsafe?

Getsafe has set a high standard for quality and innovation in the insurance industry. The cost of developing an insurance app like Getsafe can range from $50000 to $300,000 or more. Because app developers and software companies in the Netherlands charge from $80 to $150 per hour.

On the contrary, if you outsource your project from India, the cost starts at $30000 to $100000. Given the development rates in India range from $30 to $50, which is way more cost-effective than in the Netherlands.

However, various other factors like complexity, features, and technology choices also affect the development time and thereby, the overall cost.

Let us calculate the average hours taken to accomplish each Insurance app development life cycle phase.

Planning and Business Analysis (2-3 weeks = 80 to 120 hours): A strong foundation is crucial, where experts dive deep into understanding your business requirements and target audience.

Design (3-6 weeks = 120 to 240 hours): Design experts craft user-centric experiences, ensuring intuitive interfaces that enhance the overall user journey.

Development (8-12 weeks = 320 to 480 hours): This is where concepts turn into reality. Developers write code, build databases, and create policy management and claims processing features.

QA Testing (2-3 weeks = 80 to 120 hours): Rigorous quality assurance is essential to ensure reliability and security.

Preparation for Launch (1 week = 40 hours): Final checks and optimizations prepare the app for a successful launch.

You can calculate the average cost by multiplying the total hours by the hourly rate of your developers. However, keep in mind that these are rough estimates. The total hours and costs can vary based on project complexity. More advanced features and integrations may extend insurance app development time and costs.

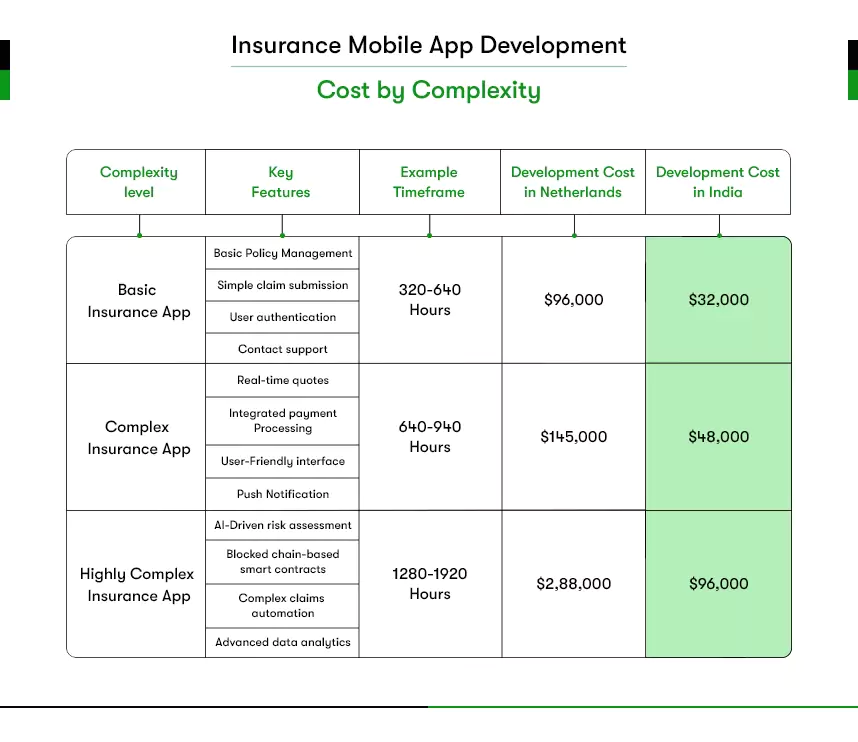

Insurance App Development Cost by Complexity

The app complexity is among the most influential factors in the insurance app development cost structure. However, the complexity of an insurance app is defined by the depth and breadth of its features and functionality. So, let’s explore the various complexity levels and the features that characterize them:

Since GetSafe contains AI chatbots, automation, machine learning, and big data analytics features, it falls under highly complex apps. And to build an Insurance app like GetSafe, you should choose features and technology carefully, keeping your budget in mind. Because technology is another app development cost dominant factor.

Know more about Artificial Intelligence’s impact on the Insurance industry.

Technology stack and their impacts on the cost

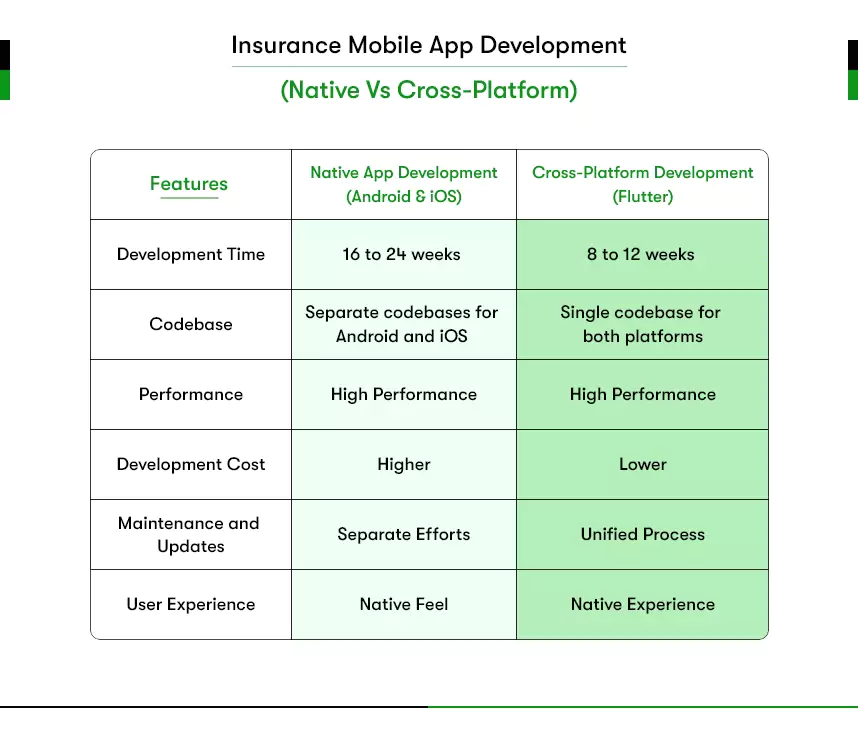

The choice of technology stack consists of frontend and backend technologies, databases, APIs, and more play a vital role in cost determination. For native development on Android and iOS, you’ll typically need separate development teams and codebases, which can increase costs. Cross-platform development using technologies like Flutter, however, can be a cost-effective alternative.

Before comparing Native vs. Flutter cross-platform app development, let’s look into what your technology stack should look like.

BACKEND DEVELOPMENT

- Programming Language: The choice of programming language can impact development speed and costs. Popular options include Python, Ruby, and Java.

- Database: The type of database, such as MySQL, PostgreSQL, or NoSQL databases like MongoDB, affects data management and scalability.

- Framework: Frameworks like Django, Ruby on Rails, or Express.js can expedite development, reducing costs.

FRONTEND DEVELOPMENT

- Mobile or Web: Deciding between a mobile app (iOS and Android) or a web app affects the technology stack. To develop an Insurance app natively, use Swift/Obj-C for iOS and Kotlin/Java for Android. For a cross-platform approach, frameworks like Flutter or React Native can be cost-effective.

- UI/UX Design: Investing in user-friendly design can improve the user experience and engagement. Design tools like Sketch, Figma, or Adobe XD are commonly used.

APIs AND INTEGRATIONS

- Third-party APIs: Integrating external services for payment processing, geolocation, or document verification can add complexity and cost.

- Security: Implementing robust security features is essential in the insurance sector but may require additional development effort.

CLOUD SERVICES

- Hosting: Choosing cloud platforms like AWS, Azure, or Google Cloud impacts hosting costs and scalability.

- Serverless: Serverless architectures can reduce operational costs but may require more development time.

It’s crucial to strike a balance between technology choices, ensuring the app meets your business goals while managing development costs effectively. Additionally, you want to hire experienced developers and project managers who help you make informed decisions that align with your budget and objectives.

Now that you understand the complete technology stack and its purposes, it’s time to understand how cost-effective hiring Flutter developers are.

Insurance Mobile App Development (Native Vs. Cross-Platform)

Are you afraid of numbers? Let’s calm your budget anxiety by revealing tips to slash the cost of developing an insurance app like Getsafe.

How to Reduce the Cost of Developing an Insurance App Like Getsafe

Using open-source cross-platform technologies Flutter:

You can significantly reduce insurance app development costs using Flutter, Google’s open-source UI toolkit. It’s an excellent choice for fintech and insurance apps due to its fast development cycle and lower cost than native app development. It offers numerous cost-saving benefits, such as:

- Code Reusability: Reuse components and widgets, minimizing redundant coding efforts.

- Consistent UI: Create a consistent user interface across platforms without extra customization.

- Extensive Widget Library: Leverage pre-designed UI components, reducing custom design work.

- Third-Party Integration: Seamlessly integrate third-party services, cutting development time and costs.

- High-Performance Graphics: Build visually appealing apps with excellent graphics and animations.

- Maintenance Efficiency: Apply updates and bug fixes uniformly to Android and iOS versions.

Consider Hiring a Dedicated Team of Developers:

Opting for an outsourcing company or a dedicated team of fintech app developers can be a cost-effective choice. Because outsourcing allows you to access a diverse talent pool from around the world, often at competitive rates. For example, Fintech app development rates in the Netherlands range from $80 to $150. However, you can hire experienced developers from countries like India at $30 to $50 per hour.

Moreover, you can avoid the overhead costs of maintaining an in-house team, such as office space, equipment, and benefits. Besides, outsourcing companies often have specialized expertise in app development, guaranteeing efficient and high-quality work. You can also scale your development team up or down based on project needs, optimizing costs further.

Prioritizing must-have features over nice-to-haves:

Instead of rushing to develop a feature-rich insurance app and risking your investment, prioritize your app features. First, list out essential features and create an MVP– Minimum Viable Product. After successfully launching your MVP, you can keep upgrading your app by adding advanced features. Here’s the recommended list of features:

| MVP Features | Advanced Features |

| Policy Management | Personalized Recommendations |

| Payment Management | Real-Time Underwriting |

| Claims Management | Health and Wellness Programs |

| Policy Documentation | Gamification |

| Contact Us | Social Media Integration |

| FAQs | Virtual Assistant |

| Branch Locator | Educational Content |

| Online Quote | Blockchain-Based Secure Storage |

| Account Management | Predictive Maintenance |

| Push Notifications | Integration with IoT Devices |

Why choose Kody Technolab for a Cost-effective yet Quality Insurance app development service?

By working with emerging Fintechs worldwide, we have gained a reputation as a leading Fintech app development solution provider. Our dedication to cost-efficiency is rooted in a strategic approach that optimizes resources without compromising quality.

With an extensive portfolio in Fintech, we bring a deep understanding of the insurance industry’s intricacies, allowing us to identify precisely where cost savings can be achieved without sacrificing performance or security. In addition, our commitment to transparent communication ensures that you have complete control over project costs, with no hidden surprises.

At Kody Technolab, we not only develop apps; we craft affordable, high-quality solutions that empower your insurance business to thrive. Choose us to achieve your cost-effective insurance app vision without compromise. Your success, our expertise – a winning combination.

Contact Information

Contact Information