Payment fraud prevention is a critical layer of protection for fintech platforms handling sensitive, high-speed transactions. Predictive analytics for payment fraud detection helps safeguard user trust, business continuity, and brand credibility.

According to Deloitte, in 2024, a Hong Kong–based finance employee joined a video call with people she believed were her company’s senior executives. Their voices and faces were familiar.

Following their instructions, she approved a $25 million transfer. Hours later, the company discovered that deepfake technology had generated the entire video meeting. The funds were lost.

This incident shows why every fintech company must rethink how to prevent payment fraud. Traditional tools detect red flags only after they have caused damage. Predictive analytics works differently. Predictive analytics learns behavior, detects patterns that don’t fit, and blocks suspicious activity before payments are clear.

This guide shows fintech leaders how to use predictive analytics to prevent payment fraud in real time, inside custom-built systems.

What Is Payment Fraud Prevention in Real-Time and Why Is It So Dangerous?

Real-time payment fraud occurs when fraudsters initiate, get approval for, and settle a transaction instantly, before your system can identify the threat, review the activity, or stop the transfer. The fraud completes in seconds and leaves no recovery window.

Similarly, the same real-time decisioning approach powers predictive analytics to reduce loan defaults by detecting risk patterns early in the credit cycle.

Why real-time payment fraud is dangerous for fintech platforms:

Why Real-Time Payment Fraud Demands Instant, Predictive Prevention

When fraudsters process a transaction through real-time payment rails, the funds leave the account instantly. There’s no window to review, verify, or reverse the payment. This is why teams must prevent payment fraud before they approve the transaction, not after.

Your fraud team can’t move fast enough.

Fraud analysts cannot stop transactions that settle in real time because they rely on alerts that come too late. Most fraud systems detect the issue too late. The transaction is already complete, and the attacker has received the money.

Rules can’t predict new fraud patterns.

Since static rules are based on known threats and fixed thresholds, fraudsters test and adapt quickly, making these rule-based systems unreliable. That’s why advanced teams adopt payment fraud prevention using predictive analytics, which identifies patterns that rules often miss.

Smart systems block based on behavior.

Predictive fraud prevention models analyze how each user typically behaves, including login times, device types, transaction speed, and payment frequency. When any activity falls outside the learned behavior pattern, the system blocks the transaction in real time.

You don’t just lose revenue; you also lose trust.

When a user becomes a victim of payment fraud, they are less likely to return to your platform. Beyond the lost funds, you face complaints, chargebacks, and brand damage. Failing to prevent fraud puts your growth and reputation at risk.

When fraudsters clear a transaction through a real-time payment system, the funds disappear instantly. Even a short delay means the fraud goes through. Fintech teams end up covering the cost while also facing pressure from users, partners, and regulators. This is where predictive analytics for fraud detection becomes essential.

How Does Predictive Analytics Improve Payment Fraud Prevention?

Predictive analytics is transforming how fintech platforms handle payment fraud prevention. Instead of reacting to fraud after it happens, predictive systems detect unusual behavior during the transaction itself. This shift allows businesses to stop payment fraud before money ever leaves the account.

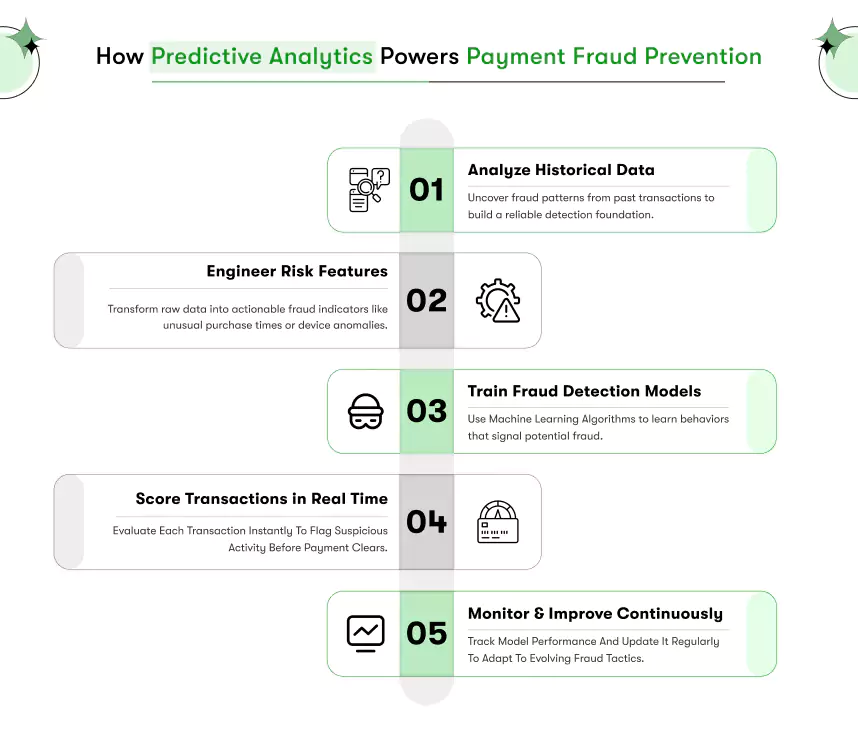

1. Historical Data Analysis

The process begins with analyzing historical transaction data to identify patterns associated with legitimate and fraudulent activities. Specifically, this includes examining transaction amounts, frequencies, geolocations, device information, and user behavior.

Predictive models analyze these behavior patterns to set a baseline for what normal activity looks like. When a transaction breaks from that baseline, the system flags it as potentially fraudulent. This enables real-time payment fraud prevention using predictive analytics.

2. Feature Engineering

Feature engineering involves creating new input variables (features) from raw data that can improve the performance of predictive models. For instance, calculating the average transaction amount per user, the time since the last transaction, or the number of failed login attempts can provide valuable insights.

These engineered features play a critical role in predictive analytics for payment fraud prevention, helping systems adapt to new fraud behaviors more effectively than static rules.

3. Model Training with Machine Learning Algorithms

Once you prepare the data, machine learning algorithms such as random forest, gradient boosting machines, or neural networks train to classify transactions as fraudulent or legitimate. These models learn complex patterns and interactions within the data, allowing them to make accurate predictions on new, unseen transactions. This step strengthens your strategy to stop payment fraud before you approve any transaction.

4. Real-Time Scoring and Decision Making

In a live environment, the system scores each transaction in real time based on the trained model’s predictions. It automatically declines or flags high-risk transactions for further review, while it allows low-risk transactions to proceed without interruption.

This real-time process is at the heart of how to prevent payment fraud in modern fintech applications.

5. Continuous Model Monitoring and Updating

Fraud patterns evolve over time, necessitating continuous monitoring and updating of predictive models. Predictive models stay effective by learning from new payment fraud cases and adjusting to shifts in user behavior.

Moreover, this feedback loop ensures accuracy and reduces false positives, keeping your payment fraud prevention engine aligned with emerging threats.

Predictive analytics is improving payment fraud detection and reshaping how fintech platforms handle real-time risk. When implemented correctly, it builds an adaptive defense system that responds to each transaction as it happens. This is the core of effective payment fraud prevention using predictive analytics.

The same data-driven approach also powers predictive analytics in credit scoring, helping platforms assess borrower risk with greater accuracy.

How Do Predictive Models Support Payment Fraud Prevention in Real Time?

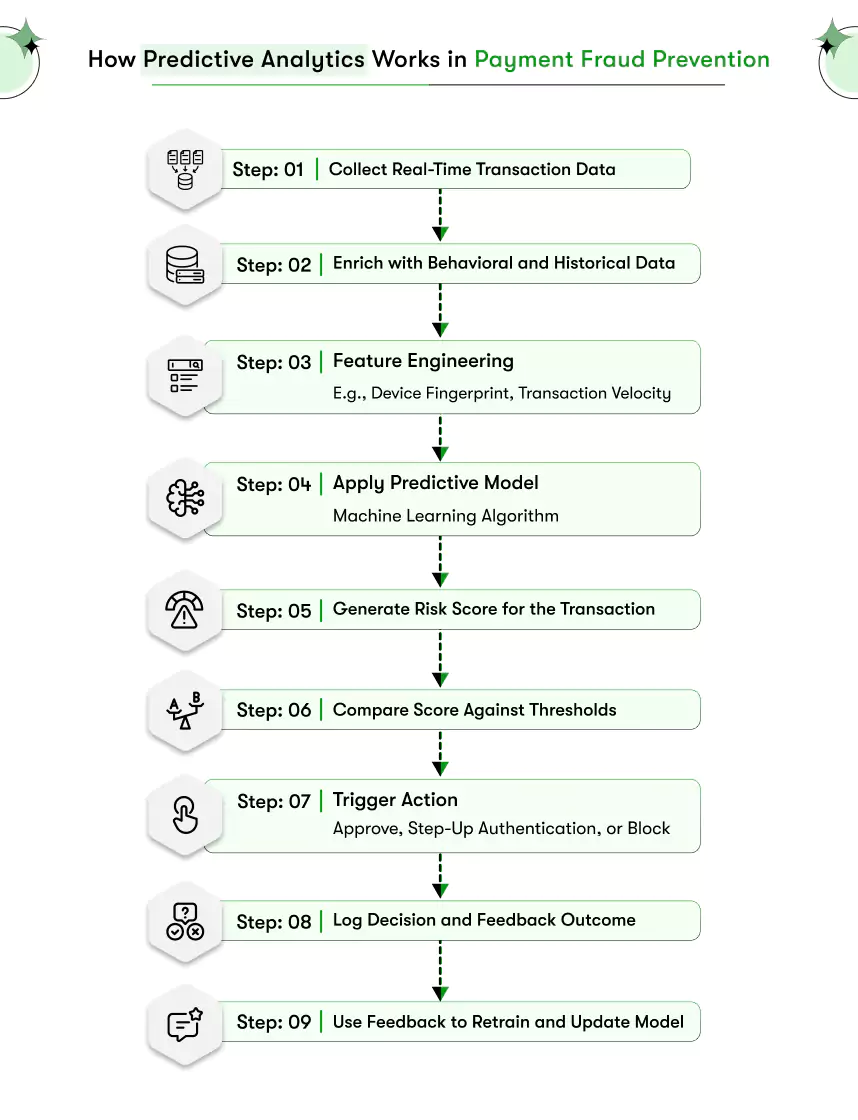

Predictive models used for payment fraud prevention process data in multiple stages before making any decision. Each stage runs in milliseconds, but the logic is built to examine intent, risk, and historical behavior before money moves.

Here’s how payment fraud detection using predictive analytics works step by step:

Step 1: The Transaction Enters the Scoring Engine

When a user triggers a payment, the predictive fraud system starts evaluating risk in real time. Here’s what happens behind the scenes:

The transaction is routed to the scoring engine:

This engine runs parallel to your core payment flow and activates instantly when a payment request is initiated.

Live metadata is captured:

The system collects contextual signals like device type, user ID, transaction amount, timestamp, IP address, and geolocation. Each data point is tied to a unique session.

The environment is verified in real time:

The system checks if the request matches the known behavior profile of the user, same device, usual time, familiar location, or introduces suspicious changes.

Risk evaluation begins instantly:

This is the point where predictive analytics for payment fraud prevention starts its decision-making logic. The system compares the transaction’s context to past patterns instead of just applying basic thresholds.

Step 2: The Model Retrieves the User’s Behavior Profile

Before scoring the transaction, the system checks whether the current activity aligns with how the user typically behaves.

Behavioral history is retrieved in real time:

The system pulls the user’s past payment behavior, such as usual transaction size, device fingerprints, preferred login hours, and typical geo-locations.

Recent session behavior is compared:

If a user logs in from a new device, initiates an unusually large transfer, or operates from an unfamiliar country, the system flags these deviations as risk signals.

Pattern mismatches raise the risk score:

Even if credentials are correct, unusual combinations (like a 2 AM high-value transfer from a new device) increase fraud probability.

This comparison powers intelligent detection:

At this stage, payment fraud prevention using predictive analytics evaluates not just the payment request, but the legitimacy of the behavior behind it.

Step 3: Real-Time Risk Features Are Generated

The model now converts transaction data and user behavior into detailed risk signals used to calculate fraud probability.

Raw data is transformed into intelligent features:

The system generates custom metrics like “first-time device,” “unusual transaction velocity,” “multi-location login,” or “previous session failed authentication.”

Features are contextual, not generic:

The system tunes these indicators to how the platform and user usually behave instead of relying on universal rules. That makes them more precise and less error-prone.

Risk signals are added to the current session:

The system includes these features in the transaction payload and evaluates them in real time.

This stage ensures subtle threats are caught early:

Feature generation is a core part of how to prevent payment fraud using behavioral signals instead of rigid filters.

Also, read our in-depth blog on Predictive Analytics in Fintech Guide to learn how your business can apply the same strategies step by step.

Step 4: The Predictive Model Assigns a Risk Score

Then, once the system has all the signals, it calculates a fraud risk score for the transaction using machine learning logic.

The score is based on patterns learned from past fraud cases:

The model uses labeled data from previous fraud instances to determine how likely this transaction is to be fraudulent.

Each signal is weighted based on predictive value:

For example, a device mismatch might carry more weight than an unusual login time if that factor has historically signaled fraud more often.

The score is calculated instantly:

The entire scoring process happens in real time, often within milliseconds, before the payment reaches final approval.

This score is the foundation of decision making:

Fintech teams use this logic to prevent payments fraud without slowing down trusted transactions.

Step 5: The Platform Executes a Decision Based on Risk

According to the score and policy thresholds, the system makes an instant decision on what to do with the transaction.

Low-risk transactions are approved immediately:

Trusted behavior patterns allow for frictionless processing to keep the user experience smooth.

Medium-risk transactions are routed to review or step-up authentication:

These transactions may trigger a one-time password, facial verification, or manual queue.

High-risk transactions are blocked or flagged:

If the score crosses a critical threshold, the system declines the transaction or sends it to the fraud team.

Decision routing protects without interruption:

This dynamic response model powers real-time payment fraud prevention with minimal friction for legitimate users.

Step 6: Outcome Is Logged and Fed Back Into the Model

Every decision, whether approved, flagged, or declined, feeds back into the system to keep the model updated and accurate.

Post-decision data is stored with the outcome:

The platform captures what happened: Was the transaction confirmed as fraud? Was it a false positive?

The model learns from the outcome:

Consequently, feedback improves future scoring, making the system more accurate over time and better tuned to platform-specific behavior.

False positives are reduced:

Continuous feedback helps reduce friction for good users while improving the system’s fraud-detection accuracy.

This loop keeps the system current and competitive:

Real-time learning is what separates traditional rule systems from predictive analytics for payment fraud prevention at scale.

Predictive models do more than just flag suspicious activity, they evaluate behavior, context, and transaction risk in real time. As a result, every decision improves the system’s accuracy and makes fraud prevention faster and more adaptive. This is how modern platforms apply predictive analytics for payment fraud prevention with precision and speed.

Predictive analytics in insurance uses a similar approach to assess claims risk and detect fraud before payouts.

How Can Fintech Leaders Implement Predictive Analytics for Payment Fraud Prevention?

Fintech leaders who want to strengthen their payment fraud prevention systems must treat predictive analytics as a strategic layer, not a plug-in tool. Additionally, implementation requires coordination between fraud teams, data teams, and product engineering.

Here’s how to implement payment fraud prevention practically:

1. Start With a Payment-Specific Data Audit

- Why it matters: Predictive models are only as good as the data they receive.

- Action step: First, audit existing payment transaction logs, session behavior, login histories, and device data. Then, ensure every data point is clean, structured, and tagged with time, status, and outcome.

- This foundational step supports effective payment fraud prevention using predictive analytics.

2. Design Risk Signals Tailored to Your Platform

- Why it matters: Fraud doesn’t look the same across all fintech products.

- Action step: To start, work with data scientists to create feature sets that reflect your platform’s unique risks; for example, “first-time top-up device,” “suspicious refund speed,” or “abnormal spend after inactivity.”

- These features are the building blocks of predictive analytics for payment fraud prevention that actually work.

3. Integrate Predictive Models With Your Payment Gateway

- Why it matters: Models need to run in real time, during the payment flow, not after.

- Action step: Embed the predictive scoring engine between the payment initiation point and the final transaction trigger. Use APIs or microservices to allow instant scoring and decisioning.

- This approach helps prevent payments fraud without blocking trusted users.

4. Build a Risk Decision Framework With Threshold Logic

- Why it matters: Not every high-risk transaction should be blocked, some may need further verification.

- Action step: Define three zones: approve, flag, and block. Set score thresholds for each zone and decide the business action (e.g., OTP, manual review, hard decline).

- This logic is essential for scaling payment fraud prevention with minimal disruption to the user experience.

5. Establish a Feedback Loop Between Fraud Outcomes and Model Training

- Why it matters: Fraud patterns evolve. Your system must learn continuously.

- Action step: Regularly feedback outcomes of approved, flagged, and declined transactions into the model training set, and then use this data to retrain models weekly or monthly depending on transaction volume.

- This is how high-growth fintechs approach how to prevent payment fraud effectively over time.

6. Monitor, Test, and Retrain Models Regularly

- Why it matters: A model that worked six months ago may not perform today.

- Action step: To begin, run regular A/B tests to compare old and retrained models. Then, monitor performance KPIs like false positives, false negatives, and decision speed. Finally, adjust features and thresholds as needed.

- Continuous refinement is what keeps payment fraud prevention accurate and scalable.

Predictive analytics in payment fraud detection is not a one-time switch; instead, it is a structured system that must be built and maintained with intent. Therefore, fintech leaders who apply predictive analytics with clear logic and disciplined data workflows can protect users, reduce losses, and build long-term trust.

How Much Does It Cost to Build a Predictive Analytics System for Payment Fraud Prevention?

Building a custom system for payment fraud prevention using predictive analytics involves multiple cost factors. Specifically, this section breaks down the practical development costs based on technology, complexity, and implementation stages. As a result, fintech leaders will find realistic estimates to help plan investments without overpaying for unnecessary tools.

Moreover, for deeper guidance, fintech predictive analytics consulting can help tailor cost-effective solutions based on platform goals and fraud risk profiles.

Cost Breakdown for Payment Fraud Detection Application Development Stage

Importantly, each stage of development plays a critical role in shaping the performance, accuracy, and scalability of a payment fraud prevention system. Moreover, the table below outlines realistic cost estimates for every core phase of implementation.

| Development Stage | Estimated Cost (USD) | Description |

| Requirement Gathering & Analysis | $5,000 – $15,000 | Understanding business goals, defining scope, and identifying key features. |

| UI/UX Design | $10,000 – $30,000 | Creating wireframes, prototypes, and user interface design for intuitive user experience. |

| Core Development | $75,000 – $100,000 | Backend, frontend, and AI/ML algorithm, machine learning implementation. |

| Third-Party Integrations | $10,000 – $50,000 | Connecting with APIs, payment gateways, or existing systems. |

| Testing & Quality Assurance | $20,000 – $40,000 | Unit testing, integration testing, and user acceptance testing (UAT). |

| Deployment & Training | $5,000 – $15,000 | Deploying to production environments and training users. |

| Maintenance & Upgrades (Annual) | $15,000 – $50,000 | Ongoing support, updates for new fraud patterns, and system improvements. |

Cost Breakdown by Technology for Payment Fraud Detection System Development

Different technologies play specific roles in detecting and preventing payment fraud. This breakdown shows how each component contributes to the system and what it typically costs to implement.

| Tech Component | Estimated Range (USD) | Purpose |

| Machine Learning (Model Building) | $12,000 – $20,000 | Model training, fraud pattern detection |

| Behavioral Analytics Module | $6,000 – $12,000 | Device + location-based scoring |

| Real-Time API Architecture | $8,000 – $15,000 | Fast scoring & decision engine |

| Cloud Infrastructure (AWS/GCP/Azure) | $500 – $1,000/month | Hosting, autoscaling, monitoring |

Breakdown by Complexity for Payment Fraud Detection Application Development

The overall cost of a payment fraud detection system depends heavily on its complexity. This section outlines realistic budget ranges for basic, mid-level, and advanced implementations.

| Complexity Level | Estimated Total (USD) | Details |

| Basic Build | $50,000 – $65,000 | Scoring engine + fixed logic + manual feedback loop |

| Mid-Level Build | $65,000 – $90,000 | ML scoring + adaptive learning + feedback integration |

| Advanced Custom Build | $90,000 – $110,000 | Full real-time detection, A/B testing, multi-model deployment |

Note: These costs are approximate estimates and may vary based on project scope, technology stack, and development partner.

Naturally, the cost of building a predictive analytics-based system for payment fraud prevention depends on your platform’s goals, data infrastructure, and required sophistication. Therefore, fintech leaders should focus on modular, scalable builds that align with real business risk. A well-planned system prevents fraud without overspending.

What Are the Top Mistakes to Avoid in Payment Fraud Prevention Using Predictive Analytics?

Fintech companies often invest in predictive analytics to secure their platforms but unknowingly make foundational mistakes during implementation. This section uncovers common real-world errors, how to avoid them, and examples of companies applying these solutions to strengthen payment fraud prevention using predictive analytics.

Mistake 1: Relying Only on Static Rules

Problem: Many fintech systems still depend on rule-based fraud detection. These rules are rigid and outdated quickly, which allows evolving fraud tactics to pass through unnoticed.

Solution: First, use adaptive machine learning models that evolve with real-time fraud behavior. This is the foundation of payment fraud prevention using predictive analytics. Consequently, these models detect fraud based on user behavior, not just fixed thresholds.

Real-World Example: Mastercard uses AI-driven risk scoring on over 160 billion transactions a year. Notably, their decision intelligence system detects anomalies in real time using predictive models to prevent payments fraud.

Mistake 2: Relying Fully on Automation Without Oversight

Fully automated systems create false positives. Legitimate users get blocked. Trust declines and support costs increase.

Solution: Assign medium-risk cases to human reviewers. Meanwhile, use automation to detect patterns and humans to make final decisions.

Example: ClearSale uses a hybrid fraud model. Predictive scoring is combined with manual review to increase accuracy.

Mistake 3: Training Models with Limited or Biased Data

Poor-quality data results in weak fraud signals. The model cannot detect patterns it has never seen.

Solution: To start, use a wide variety of data to train your fraud models. Additionally, include data from different devices, channels, and regions.

Example: Tookitaki improves payment fraud prevention using predictive analytics trained on global banking data. Their models stay current through ongoing updates.

Indeed, this approach reflects a broader shift toward predictive analytics in banking, where fraud detection, compliance, and credit risk are managed using real-time behavioral insights.

Mistake 4: Detecting Fraud Too Late

If fraud is detected after a transaction clears, recovery is unlikely. The financial loss becomes permanent.

Solution: Score every transaction in real time. Predictive systems must stop fraud before payment approval.

Example: Synchrony Financial prevents payments fraud by scoring transactions live. Their system blocks fraud with 90 percent accuracy.

Mistake 5: Ignoring Behavioral Biometrics

Traditional verification methods cannot stop account takeovers. Credentials alone are not enough.

Solution: Add behavioral biometrics to the fraud detection layer. Monitor typing patterns, device movement, and screen behavior.

Example: Mastercard uses device and behavioral data to detect fraud patterns. These signals support faster and more accurate prevention decisions.

To improve payment fraud prevention using predictive analytics, fintech leaders must build smart, flexible systems. Strong data, live scoring, and human review are key to stopping fraud before damage occurs. The companies mentioned above show how predictive models work best when supported by the right strategy.

Conclusion: Why Predictive Payment Fraud Prevention Matters Now

Payment fraud drains revenue, breaks user trust, and slows down growth. Fortunately, predictive analytics helps fintech leaders stop fraud by detecting suspicious behavior in real time. Smart systems flag risk before transactions clear, reducing false positives and improving approval speed. None of this happens by chance. It takes the right models, trained on the right data, built for the right workflows.

Kody Technolab builds predictive analytics systems for payment fraud prevention. Specifically, we create fraud detection engines that score every transaction with speed, accuracy, and business context. Every solution is built for your platform, risk level, and growth targets.

As a trusted fintech app development company, we combine deep industry knowledge with tailored AI solutions to help you move faster and safer. If you’re ready to build a stronger fraud shield, we’re ready to help.

Connect with Kody Technolab. Let’s build your fraud prevention system with precision, not guesswork.

Contact Information

Contact Information