From data numbers to more futuristic features, a rapid evolution of Predictive

Analytics accelerates insurance businesses toward a more customer-centric approach. With technology in hand and moving beyond guesses, companies have improved their marketing and service dimension into a better and more personalized approach.

According to a survey, the global insurance analytics market is expanding at 15.1% CAGR and is expected to hit USD 20.6 by 2026.

The evolving customer trends and rising competition make AI a game-changer in the insurance industry. The industry is on the verge of seismic and technology-driven shifts. Hence, focusing on AI and predictive analytics could position insurers to embrace a shine in the competitive arena. In fact, As per Deloitte,

67% of insurers plan to increase investments in data analytics technologies in the coming years.

Predictive Analytics can be highly valuable across insurance operations by connecting with the right audience, improving customer experience, and reducing operational expenses. Integrating Predictive Analytics is also a part of digital transformation in insurance. Allowing you to implement proper strategies, fill gaps in your services, and add value to all stakeholders involved.

So, let’s keep rolling and understand how predictive analytics benefits insurers and customers.

What is Predictive Analytics? What difference does it add to the traditional insurance market?

Everyone loves knowing their future and planning accordingly, and business is no different. Predictive Analytics has a strong foothold in myriad industries, be it

Netflix or enterprise-level businesses, empowering them to serve their customer 10x better. The influx of Predictive Analytics in Insurance Industry brings a significant breakthrough to the table that is a win-win for end-users and companies.

Backed with historical data, AI, and machine learning algorithms, PA in Insurance is a way to increase profit and mitigate risks. It’s a data-centric approach to predicting the future and making smarter insurance product and service decisions.

Predictive Analytics solutions coupled with machine learning and artificial intelligence bring tangible advances in risk assessment, fraud detection, claims management, policy optimization, and much more. In pursuit of securing and ensuring the safety of people, it’s crucial to offer protection against the risk of losses.

Insurance companies need to make data-driven decisions and stay ahead on a competitive edge. Hence, instead of adhering to old-school marketing, PA is key to excelling in optimizing resources, leveraging technologies, and driving well-informed decisions. Predictive Analytics excels at all these factors and takes center stage in scaling the insurance business.

Role of Predictive Analytics in Insurance

Data is the bread and butter of insurers. And data-driven decisions always take precedence. Instead of blind marketing, gaining insights into business-critical metrics serves as a guiding force. Be it pricing to risk assessment or building long-term relationships with customers, Predictive Analytics in Insurance allows you to uncover the untouched market and explore opportunities.

Businesses used to rely on a fixed pricing model in the traditional approach, and the concept of “one-size-fits-all” was a thing of the past. But now, with the integration of machine learning and predictive Analytics, you can tailor policies and better serve customers with a personalized pricing approach.

Predictive Analytics does not magnify just “ONE” or “TWO” elements; it undertakes numerous factors and predicts the most accurate and relevant results.

The buzzword or approach isn’t new; it has been practiced for some time now, and insurance companies have already bagged benefits. Legacy and Insurtech adapted Digital Transformation in AI and made strides towards better sales and underwriting processes. Besides, these companies also witness improvements in their business through user-friendly applications, lower monthly premiums, accelerated insurance underwriting, and much more.

McKinsey predicted that across functions and use cases, AI investments would shoot up to a whopping $1.1 trillion in annual value for the insurance industry. The power of AI integration is huge, but it still requires a human touch to command direction and extract the best data supremely.

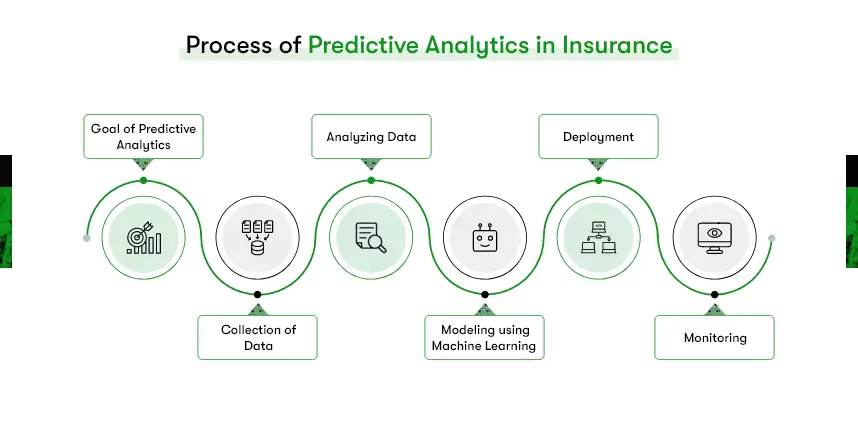

Process of Predictive Analytics in Insurance

It’s an easy feat to turn from descriptive to predictive; all you need is a data scientist, data analyst, powerful tools, and an Insurance app development team by your side. Collaborating with experts and professionals catalyzes growth and success.

Here are the six primary stages of the predictive analytics process.

- Understanding and Defining the Goal of Predictive Analytics

- Collection of Data

- Analysing Data

- Modeling using Machine Learning

- Deployment

- Monitoring

Understanding and Defining Requirements

Understanding the intricacies of each aspect helps you drive towards better goals and focused solutions. Before diving into the realm, you need to identify what you want to achieve. Map out your goal – whether it is to catch the frauds, make better decisions, or improve the end-point of customers. Once you are aware of things, you can churn the data efficiently and step in towards value-driven goals.

Once the dataset is analyzed, the next step is to identify the most appropriate KPIs to measure the success. The KPIs are like scorecards for your goals; they help you evaluate what data collection is worth. If the predictive model does not work and aligns with your requirements, you have the option of tweaking the initial stages instead of walking too far.

Collecting Data

Data is a goldmine. Clutter is definitely everywhere. However, you must gather the information from various sources like apps, devices, social media, and more, and treasure it into a “data lake.” Thanks to Insurtech, you don’t have to rely on manual processes as it automatically brings the data from different resources.

FYI – If you are intrigued with “What is Insurtech “, let’s decode it for you. Insurtech is a powerful duo, an umbrella term for Insurance and technology to harness various elements of Insurance, including policy management, claim process, risk assessment, and customer engagement.

A core element of Insurtech is accumulating data and turning paper documents into digital ones. When you have everything at your fingertips, you will make better decisions and reach out to new dimensions granularly.

Analysing Data

You can’t just hop in with data to your data Analytics system. Human intervention to investigate and ensure the relevant data is crucial. Before using the data, ensure its quality; organize clutter in stacks of similar traits, which helps to check the details and understand it better.

The process is similar to unraveling a puzzle. All the data is consolidated in a single source digital format – from accumulating data clusters to processing it, removing duplicates, and more. If the data sets as per your goals, we can keep it, let it go. Collecting data and making it optimal undertakes numerous factors that need to be assessed.

Modelling

After acquiring data, the next step is to build predictive models integrating skills and machine learning techniques. The process involves transforming raw data into a curated set of factors that would be used in the model.

Grouping and categorizing data into appropriate models could help in efficient predictions and chalking out the right decisions. Once the model is ready, next is integrating the practical real-time applications to know the results.

Monitoring

The process of recording and evaluating isn’t enough. The data is integrated into real-time applications and monitored frequently. The next stage is to gauge and assess the performance of the predictive analytics model. Whether it meets the end goals, delivers performance and results when deployed, or turns into unfavorable results.

Monitoring should be constant and timely. You can’t build the model and leave it in Auto-pilot mode. Instead, you need to self-drive in frequent intervals and tweak with chances if needed. If the model or plan isn’t delivering notable results, it’s time to revamp it.

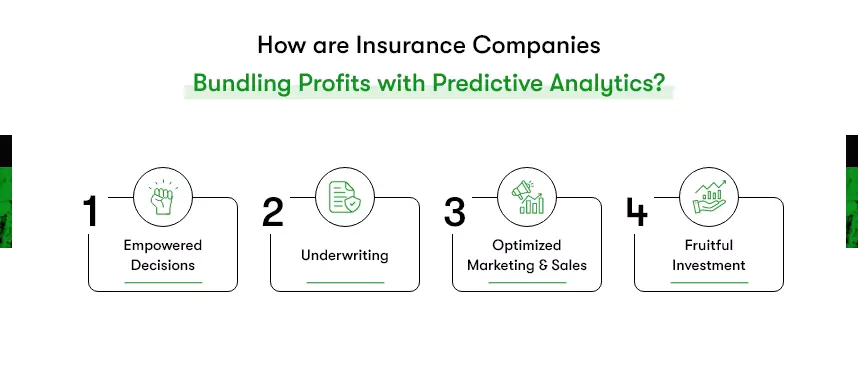

How Are Insurance Companies Bundling Profits with Predictive Analytics?

Predictive Analytics acts as helpful, competent assistance for insurance companies. It replaces old, cumbersome methods that insurers usually used in the past to calculate risks, premiums, and policies. With the manual mode being time-consuming and tedious, this is a streamlined, polished, and valuable process that favors increased profitability and customer retention rates.

The benefits of predictive analytics in insurance are many; from deep digging into records and understanding the unhealthy/healthy lifestyle to the probability of inherited disorders, predictive analytics helps steer smarter decisions. An insurance company can offer personalized policy plans by assessing many factors.

Empowered Decisions

Among numerous “ifs” and “probabilities,” PA holds the power of concrete decision-making in the insurance industry. Predictive Analytics in Insurance enables companies to empower their final decision. The models provide faster and easy-to-understand results, with better risk assessment. The process helps them attract more customers, understand their pain points, and build trust and satisfaction with insurers.

Predictive Analytics aids companies in understanding customer behavior, and they can spot customers who are not happy with their Insurance or are planning to shift. By identifying potential barriers or gaps, an insurance company can push its boundaries and follow the practices to magnetize customers and nurture them with better experiences.

So, overall, it’s a potential solution to spot the opportunities, fill the gaps, and deliver more personalized and accurate customer service.

Underwriting

The underwriting process works as a ripe opportunity for insurance companies when looking for AI and machine learning use cases. AI and ML systems are underwritten based on risk predictions, third-party data, and publicly available datasets. With increased automated underwriting, the manual process slashes, and the companies can gain maximum benefits.

The challenge begins with achieving maximum automation and bringing out-of-the-box solutions, ensuring smooth Robotic process automation that is ready to deploy.

Willis Towers Watson reported that 67% of companies have reduced expenses in underwriting policies with Predictive Analytics, and 60% have shown sales and profitability.

Traditional underwriting methods involve manual assessments, historical data, and more. With predictive analytics, the process is simple.

The process ensures error-free calculations and more efficient underwriting, providing accurate and timely risk assessment.

Optimized Marketing and Sales

Numerous dominant players in the market have leveraged their goals of marketing and sales goals by harnessing the power of AI and predictive analytics. Predictive Analytics in Insurance can help target their potential needs. AI simplifies understanding customers’ behavior intent through patterns and historical data.

Conjugating the correlations of multiple factors helps in understanding the intricacies of the customer and how to pitch them accordingly. With predictive analytics, companies and marketers would drive customer acquisition and retention.

Fruitful Investment

With relentless commitment to drive operational excellence, insurers and companies are embedded with setback attributes associated with manual processes and errors. To optimize value for stakeholders, Predictive Analytics could turn out to be a better option.

Identifying fraud upfront means fewer chances of chasing criminals for payments while reducing legal costs. Also, a lot of manual effort goes into risk management by underwriters, which could elevate errors. Deployed with minimal upfront investment, predictive analytics enhances ROI and reduces operations costs, which leads to significant savings.

Read Also: Insurance App Development: Best Way to Leverage Billions $ Market of InsurTech.

Future Forward Approach – 10 Use Cases Technology and Predictive Analytics Could Reshape the Insurance Landscape.

1. More brilliant decisions on pricing and policies

The insurance market is a battlefield. A customer journey might look smooth, streamlined, predictive, or constructive. But the grass is always greener on the other side. With insights into PA, you would chalk out the best possible pricing and policies that are well-suited for consumers.

It has been noted that buyers don’t rely on the superiority of products or services. Instead, they decide on their experience with your brand. With predictive analytics in insurance, you can measure their requirements, patterns, insights, data, and histories and carve a path to an ideal pricing strategy and an improved experience.

These multiple elements would empower and steer their route toward the purchase funnel. No more “one-size-fits-all”; bringing a custom-centric and well-suited business approach is key to sustaining business.

Imagine you were selling 70-year-olds some unrealistic and impractical benefits like accident coverage, vaccination coverage, newborn coverage, and more. This approach would be ineffective and fail to address the genuine needs of customers. A tailored insurance solution that aligns with their specific requirements would help in better customer acquisition and retention.

2. Generating Leads through Personalized Experience

Building a solid customer base and establishing a rapport is an aspiration for many. With AI predictive analytics, this turns dreams into reality. Combining the dynamic duo brings high-intent insurance leads that improve the customer experience, operational excellence, and tailored plans that meet customer needs.

Armed with a better understanding, changing behaviors, and maturing analytics, you could make out actionable strategies that are faster and more accurate. Having the right strategy and a better understanding of data would help you explore new horizons in the insurance industry.

3. Streamlined Insurance Claim Process

The insurance lifecycle, a billion-dollar industry, is prone to fraud. The claim process is document-intensive and nerve-wracking. With multiple formats, sourcing from various channels and processing claims require excessive manual intervention. With RPA in insurance, the claim processing speed can increase by up to 75% compared to humans. Furthermore, integration of NLP and OCR technology can accelerate the process of extracting data and input, claim errors, discrepancies, and fraudulent claims.

Adapting to digital technologies, integrating AI tools, and utilizing Predictive Analytics mitigate the chances of fraud.

For example, UnitedHealth Group integrated a sophisticated predictive analytics approach to avoid fraudulent claims and shake their financial losses. They analyze and dig down to understand patterns, anomalies, and discrepancies that may indicate fraudulent activities.

They also use chatbots to process claims quickly, verify policy details, and use AI algorithms to peek into the early stages of fraud, if any.

Companies like Cape Analytics integrate satellite imagery, which is a blend of machine vision, to assess insurance underwriting. This technology does not need any physical inspection to make the overall process more efficient and effective.

4. Early fraud detection

Using old-school methods to catch red flags and detect insurance fraud isn’t working anymore. Estimatedly, there is a $40 billion loss per year, or approximately 10% of all payouts, as per insurance fraud.

AI and predictive analytics can work as forensic tools to pinpoint patterns and behaviors of fraudulent activities. Cutting off the cost of fraud deduction would improve the bottom line of insurance companies, while they would be better able to manage the vulnerabilities.

Fraud detection would diminish the chances of data exploits, and they would proactively manage vulnerabilities. By scrutinizing data and identifying patterns, AI can forecast potential threads and accelerate risks. Whether it’s filing a claim, assessing risk, spotting discrepancies, or understanding customers’ behaviors, predictive analytics can help combat internal fraud and application manipulation.

5. Avoid Losing Customer

By analyzing customers’ purchase behavior and patterns, insurers can determine what’s cooking in their minds. Sometimes, they are seeking lower coverage plans, while others are planning to upgrade. Some are exploring different ways to invest in better projects.

There is a further need for every customer. To understand their behaviors, needs, and requirements, the support of predictive analytics could help you get better results.

Predictive analytics in insurance also gives you insights and helps you measure customer satisfaction. Consequently, using these insights, you can tailor effective strategies.

6. Identifying Outlier Claims

Detecting outliers or anomalies is a core problem in insurance. The early detection of irregularities is crucial in insurance for multiple reasons. Identification not only helps in fraud prevention and risk assessment but also contributes to the refinement of predictive models and the optimization of operational processes.

PA in insurance churns out data using AI, ML, and statistical models to identify patterns indicating future events or behavior. Predictive analytics works as a detective that looks for patterns or warning signs that show these could be expensive outliers.

It sends advanced alerts and notifications to claim specialists, deciphering that it could be a red flag or that they need extra attention to cut down on these outlier claims. The overall process ensures the industry’s resilience and strengthens its success.

7. Understanding and Leveraging the Products

Predictive analytics can provide a blueprint and roadmap to build a business from foundation to flagpole. From understanding the products and services of your company to how they could be best optimized and benefiting your customers, this tool helps you with everything.

In business, biases, misinterpretation, and insufficient methods could lead to wrong business paths or misaligned strategies. By harnessing technology and empowering analytics, you could put a company ahead of the competition by shaping well-conceived strategies and uncovering new potential revenue streams. These modern strategies help improve the quality of products and services and cultivate a better relationship with profitable customers.

By predicting what customers are going to need based on data, trends, and previously deployed schemes, you could navigate a path of continual improvement and stay responsive in a dynamic market landscape.

8. Meet Customers Unmet Needs

Predictive, as touted, is a crystal ball. Staying proactive in the industry is critical to success. Combining predictions with pro-activeness opens numerous opportunities. The crystal ball could give you powerful insights into unmet needs or what a customer is actually looking for.

It provides a better picture of what could be the next grand move or what could be the best action to take before getting to the customers.

To stay ahead in the competitive arena, understanding customers and their insights is a real game changer. Predictive analytics in insurance helps overcome this challenge.

9. Untap Potential Market

The insurance market is huge! We really meant huge. The customers are in every nook and cranny. All you need is to give them the right services and a customized approach. But this isn’t as easy as it seems. They are available on multiple platforms, from scrolling on social media to googling “best insurance policy” and more. With predictive analytics in insurance, your problem of hunting for them ends, and you know where to put your efforts.

10. Comprehensive Understanding of Customers

Understanding the customer profile opens doors of opportunity. By understanding the customer journey map, a business can tailor services, policies, pricing plans, marketing strategies, engagement, conversion rates, and much more. With data consolidated into a single viewpoint, you can make smoother and more efficient operations.

With predictive analytics, you get a complete picture of the customer from scratch to the endpoint. So, instead of guesswork, it’s time to innovate your insurance services.

In a nutshell,

Predictive analytics has already boomed the industry. It is not a new method, but it is a bedrock for potential future markets. It is time to ditch the traditional approaches, drive adoption, and steer your wagon in an optimistic and futuristic tech stack. All you need is to hire the right developers and a team that can help strategic assets work.

From presumptions to predictions, from “what-if” to “what-is,” change your perspective with predictive analytics.

Read to Shape the Future of the Insurance Industry. Let Kody be your partner!

Predictive analytics in insurance hold tremendous promise for the future. It can potentially not only transform the business of insurers but also improve customer acquisition and retention. From solving major, lengthy processes to streamlining processes with a personalized approach, it leads to better outcomes. Being in the healthcare industry, all these are must-haves to thrive in the competitive arena. If you are ready to make strides and outperform the competition, it’s time to invest and hire Flutter developers.

Our super-sophisticated experts add value and a sustainable approach to your projects. With hands-on experience and a knack for cutting-edge technology, we have built a strong foundation for successful project execution in custom software development. Whether it’s the health industry or insurance, if you’re looking to stay ahead of the game with predictive analytics, don’t hesitate to reach out.

Contact Information

Contact Information