Quick Summary: AI in stock trading helps businesses improve accuracy, speed, and risk control. This blog explains the main methods, business advantages, common challenges, and a step-by-step roadmap for adoption. Read on to see how trading firms can apply AI effectively. With practical insights, the blog guides leaders toward building trading systems that deliver sustainable growth.

Stock trading has moved from instinct-driven calls on a trading floor to instant decisions shaped by artificial intelligence. AI in stock trading now defines how markets move and how firms compete.

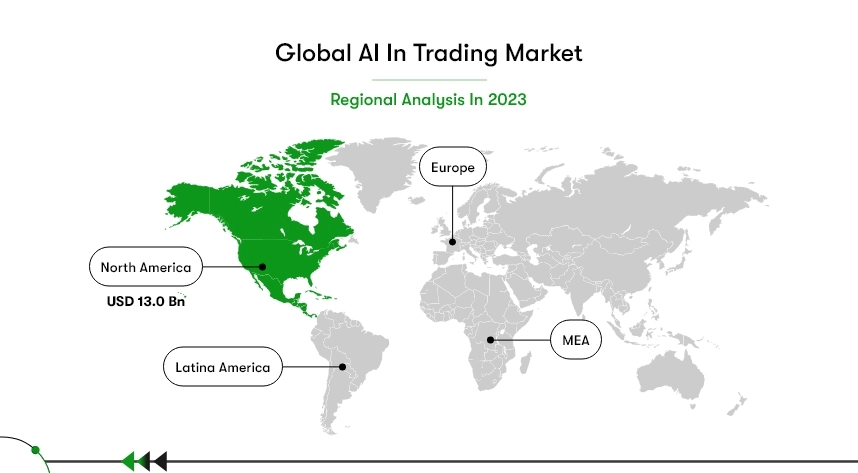

In 2023, the global AI trading market reached $18.2 billion. Forecasts put it at $50.4 billion by 2033, with a 10.7% CAGR, says market.us.

Those investments fund algorithmic systems, data infrastructure, and advanced model research at trading firms. Artificial intelligence in stock trading guides strategy by delivering faster signals, automating execution, and tightening risk controls.

AI in trading analytics uses predictive models, machine learning, and sentiment tracking to process market signals. It executes trades in microseconds, optimizes portfolios, and strengthens returns. Firms that adopt these capabilities gain speed, insight, and measurable advantages in volatile markets.

The challenge is direct: how will you apply AI in stock trading to protect performance and achieve sustainable growth?

What is AI in Stock Trading?

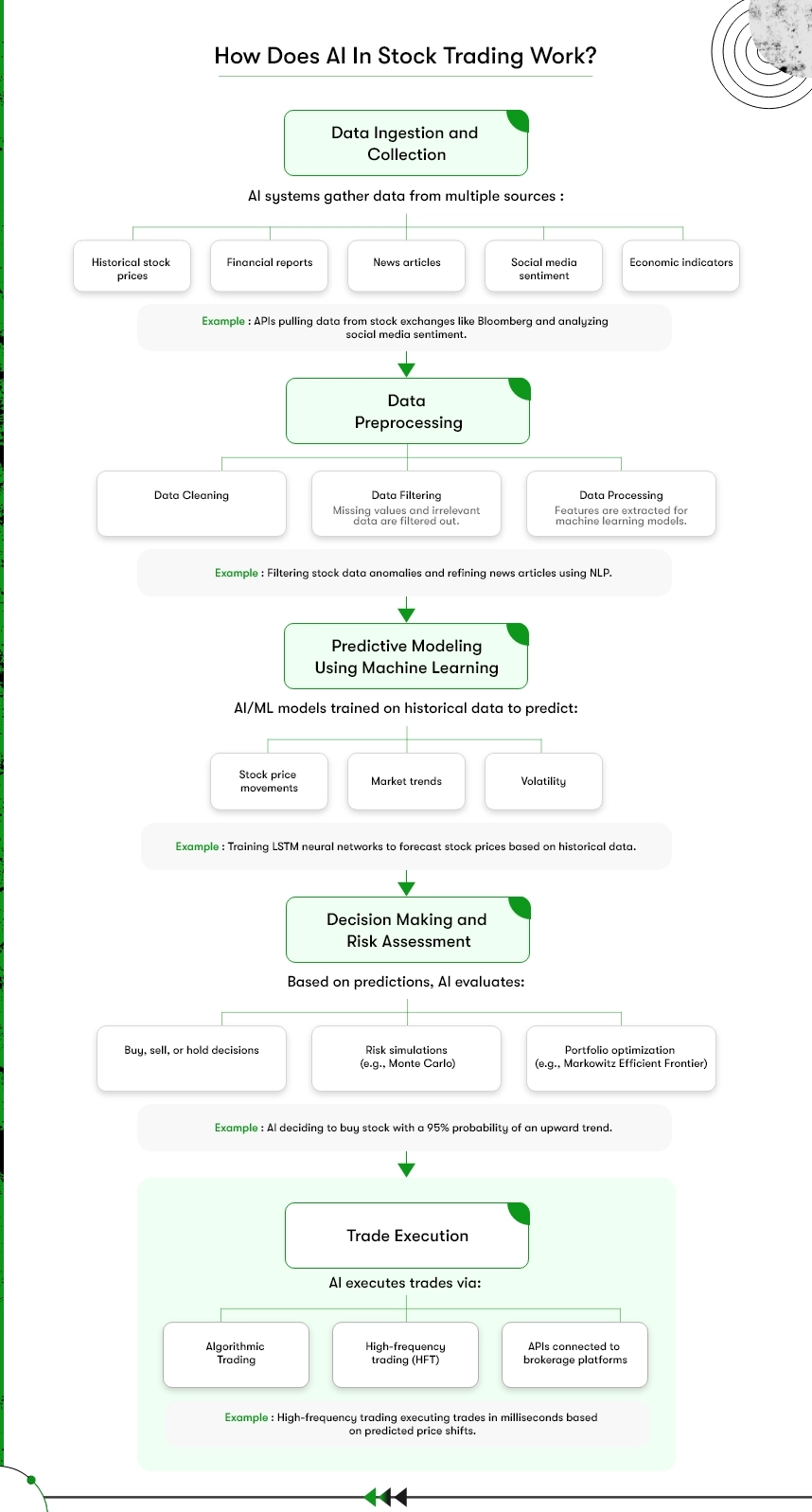

AI in stock trading uses artificial intelligence to analyze large market datasets, predict price movements, and execute trades instantly. It applies machine learning, predictive models, and sentiment analytics to improve trading strategies, reduce risks, and deliver higher accuracy for investors.

AI in stock trading applies predictive models and machine learning to process millions of data points in seconds. Artificial intelligence in stock trading adapts to new information, forecasts volatility, and executes trades faster than human reaction, improving accuracy and reducing risks.

Neural networks and sentiment analytics expand its scope. These tools interpret news, investor behavior, and global signals. The use of AI in trading ensures smarter strategies, stronger portfolios, and measurable gains for fintech firms, consultancies, and investment agencies.

How does AI in Stock Trading Deliver Results?

AI in stock trading delivers results by integrating data, testing strategies, controlling risks, ensuring compliance, and scaling execution. It improves accuracy, eliminates emotional bias, and helps fintech firms, consultancies, and agencies achieve growth through faster, more consistent trading performance.

1. Data Integration Across Silos

Firms often manage fragmented data across research desks, execution systems, and external feeds. This separation creates blind spots and delays in decision-making. AI consolidates historical prices, market signals, and real-time updates into one framework. Leaders design strategies using a unified, trusted data foundation.

2. Strategy Simulation Before Real Capital

AI allows leaders to test strategies before deploying them. Historical and real-time data validate performance under multiple conditions. This reduces costly trial-and-error and saves resources. Firms applying AI in trading analytics gain confidence by refining models before committing capital to live markets.

3. Adaptive Risk Controls

Markets can become volatile within minutes. AI dynamically adjusts exposure and rebalances portfolios without delay. This protects firms from sudden drawdowns. The use of ai in trading enables proactive management, ensuring portfolios remain resilient during unpredictable financial conditions.

4. Compliance-Ready Reporting

Regulators demand transparency and full documentation. AI records every trade, decision path, and timestamp with accuracy. This simplifies audits and strengthens accountability. Leaders adopting the use of ai in trading meet compliance requirements faster while earning greater client confidence.

5. Scalable Deployment

AI adoption is most effective when gradual. Firms start with pilot strategies, refine workflows, and then expand into multiple markets. This phased rollout lowers operational risks. Enterprises exploring how ai is changing trading scale responsibly while improving long-term performance outcomes.

AI in stock trading has moved from theory into daily practice for enterprises seeking measurable market advantage. Firms that centralize data, simulate strategies, control risk, ensure compliance, and expand gradually gain sustainable performance improvements.

Leaders focused on protecting capital and strengthening strategy accuracy must now explore how ai can help in trading.

Real-World Use Cases of AI in Stock Trading

Leaders often want proof that AI in stock trading produces tangible results. The following examples show how global firms apply AI to improve execution, manage risks, and deliver measurable business outcomes.

Norway’s Sovereign Wealth Fund – Cutting Costs Through Smarter Execution

Norway’s $1.8 trillion oil fund deploys AI to analyze internal trading flows and optimize execution strategies. The system identifies opportunities to internalize trades instead of routing them through external brokers, reducing fees and slippage.

Early results saved nearly $100 million annually, and the fund expects annual savings to reach about $400 million once the system scales.

Large enterprises can replicate this approach by piloting AI-driven cost analysis before committing to full-scale deployment.

Voleon Group – Machine Learning Models Driving Returns

The Voleon Group, a U.S.-based quantitative asset manager, applies machine learning to design trading strategies. Their models continuously refine themselves against live market data, uncovering patterns that traditional quant methods miss.

The firm has sustained competitive returns even during volatile market conditions, showing that adaptive AI models can strengthen both resilience and profitability.

Businesses adopting a similar strategy can use ML algorithms to test, learn, and improve trading signals before deploying them at scale.

AllianceBernstein – Faster Research and Stronger Risk Controls

AllianceBernstein uses AI to streamline equity research and improve portfolio risk management. Proprietary tools summarize earnings calls, scan regulatory filings, and track sentiment across markets in minutes, cutting research time dramatically.

AI clustering techniques also expose hidden correlations between holdings, helping managers avoid unintended risk concentrations.

Firms that implement comparable research tools can free analysts from repetitive tasks while improving oversight of portfolio exposures.

Hudson River Trading – Capturing Micro-Opportunities with Speed

Hudson River Trading, a high-frequency trading firm, applies AI to execute thousands of trades each second across multiple markets. The systems monitor order books, price movements, and liquidity in real time to capture micro-opportunities unavailable to manual traders.

During periods of market stress, AI algorithms automatically adjust order sizes and spreads to control exposure while protecting margins.

Enterprises investing in faster execution systems and low-latency data pipelines can use similar strategies to gain consistent incremental profits that add up at scale.

Each example proves that AI in stock trading delivers measurable value. Firms gain cost savings, faster research, stronger risk management, and improved execution speed. Leaders who pilot AI solutions in targeted areas build a foundation for sustainable adoption. To learn how these strategies can be implemented effectively, explore our AI app development guide before your competitors gain the advantage.

If you are unsure how to get started with AI in stock trading, consider partnering with our AI development services to design a clear and practical roadmap.

Artificial Intelligence in Stock Trading: Leading Technologies Driving Results

Artificial intelligence in stock trading relies on machine learning, NLP, predictive analytics, RPA, and deep learning. These technologies analyze complex datasets, automate execution, and deliver real-time insights that help enterprises strengthen strategies, improve accuracy, and gain measurable competitive advantage.

Machine Learning (ML)

Machine learning powers most AI-driven trading strategies. Algorithms process vast datasets, studying market behavior and historical records to identify actionable patterns.

Models improve as new information arrives. Over time, they adapt to changing conditions, producing sharper predictions and consistent execution.

Enterprises using ai in stock trading leverage ML to replace instinct with precise, data-driven insights that scale effectively.

Natural Language Processing (NLP)

Markets react quickly to news, sentiment, and reports. NLP converts unstructured information from media, filings, and global news into actionable trading signals.

These systems process articles faster than analysts, identifying risks and opportunities within seconds. NLP helps firms anticipate market movements with speed unmatched by manual research.

Artificial intelligence in stock trading enables leaders to capture early signals hidden in language-driven data and act immediately.

Predictive Analytics

Predictive analytics focuses on forecasting specific market movements. Models use historical data to project near-term price trends and volatility levels.

These forecasts help firms reduce reliance on instinct and adopt measurable, evidence-based decisions.

Consultancies exploring AI in trading analytics improve client outcomes through accurate, real-time forecasts that strengthen portfolios and trading discipline.

Deep Learning

Deep learning extends the power of ML. Neural networks process complex datasets with multiple layers, uncovering correlations missed by simpler systems.

This increases prediction accuracy and expands coverage across diverse asset classes.

Leaders adopting how AI is changing trading benefit from advanced modeling that improves execution quality and strengthens competitive positioning.

AI in stock trading depends on multiple technologies working together as a single system. When machine learning, NLP, predictive analytics, RPA, and deep learning are aligned, enterprises achieve speed, accuracy, and reliability that human-driven strategies cannot match.

Firms that integrate these technologies position themselves ahead of competitors and prepare their portfolios for growth.

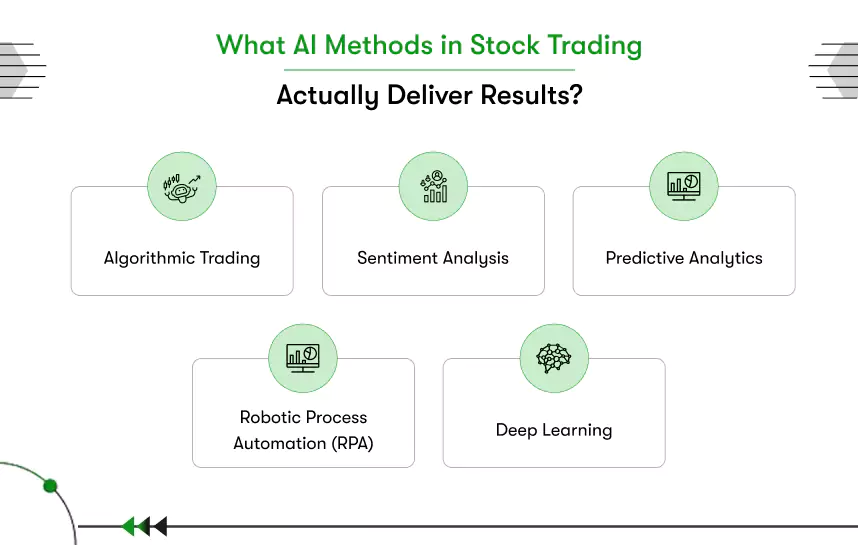

What AI Methods in Stock Trading Actually Deliver Results?

AI methods in stock trading include algorithmic trading, sentiment analysis, predictive analytics, robotic process automation, and deep learning.

These approaches automate execution, forecast trends, and process large datasets, enabling trading firms to increase accuracy, reduce risks, and strengthen portfolio performance.

Algorithmic Trading

Algorithmic trading automates the process of placing and executing orders under strict predefined rules. AI algorithms monitor order books, spreads, and prices in real time. Orders are split into smaller parts to minimize slippage. Enterprises applying ai in stock trading achieve faster execution and reduced market impact.

Sentiment Analysis

Sentiment analysis converts text into measurable signals for trading decisions. Natural language processing reviews news headlines, earnings calls, and social updates instantly. Market tone is scored and mapped to specific securities. Firms using artificial intelligence in stock trading capture opportunities faster than analysts relying on manual research.

Predictive Analytics

Predictive analytics estimates direction, volatility, and price levels before trades are executed. Models study historical data and live inputs to produce forecasts. Portfolios rebalance automatically according to probability scores. Leaders applying AI in trading analytics improve strategy discipline, reduce emotional bias, and strengthen portfolio stability.

Robotic Process Automation (RPA)

Robotic process automation eliminates repetitive trading tasks that waste resources and increase risk of errors. Automated systems reconcile trades, update records, and generate compliance reports instantly. Analysts are freed to focus on strategy. Enterprises adopting the use of AI in trading reduce costs while increasing operational efficiency.

Deep Learning

Deep learning extends machine learning through advanced neural networks. Multi-layered systems analyze order flows, market depth, and alternative data. Complex connections missed by traditional models become visible. Leaders adopting how AI is changing trading enhance prediction accuracy and broaden coverage across multiple asset classes.

AI methods in stock trading vary in maturity and impact, but each addresses a critical trading challenge. Algorithmic execution improves speed, sentiment analysis decodes market tone, predictive analytics enhances foresight, RPA boosts efficiency, and deep learning strengthens forecasts.

The following section explores how ai can help in trading through practical use cases and steps enterprises can adopt to achieve measurable business results.

How AI in Stock Trading Is Changing Strategies for Investors and CEOs

In 2023, the algorithmic trading segment dominated the market with an impressive 37.1% share, driven by its efficiency, speed, and capacity to handle vast datasets beyond human capability.

This is only the beginning of how Artificial Intelligence in stock trading is revolutionizing the entire landscape.

But let’s look forward. How is AI going to change our trading completely? The impact will be much more profound, and every trading firm, fintech business, and investment company must be ready to leverage this technology.

1. More Innovative & Personalized Strategies:

With AI, you will no longer react to market changes but instead predict them. Imagine the system being more intimate with your trading preference because it learns and adapts.

Whether AI is integrated into predictive models for investment strategy or AI apps are used for stock trading, one thing is clear: more than ever, personal data-driven insights will make you decide faster with increased accuracy.

2. Enhanced Decision-Making Power:

AI does not just look at numbers; it looks at everything, from news reports to social media sentiment. This holistic approach keeps businesses ahead of the market shift by using tools that instantly process vast amounts of data.

Knowing how to leverage AI in the markets, especially in trading stock, gives business owners an edge through their ability to analyze in real-time more information than a human team ever could.

3. Fully Automated Trading Ecosystems:

Imagine a world where AI handles your entire trading operation. From market analysis to trade execution, AI-powered platforms make decisions faster and more effectively than human traders.

For those looking to build their systems, stock trading app development or efforts to develop a trading app like Robinhood can integrate AI at the core to fully automate trading, minimizing risk and maximizing returns.

4. Evolving Fintech and Trading Platforms:

The future of fintech app development will revolve around AI integration. Building AI-powered stock trading apps that facilitate trades and anticipate trends will become the norm.

Think of AI as your 24/7 trading partner—never sleeping, constantly analyzing, and continuously improving your trading strategy.

AI dominates the future of the stock market. More trading businesses will enroll in AI technology, and trading dynamics will change to make it an efficient yet highly competitive marketplace.

5. AI-Driven Market Movements:

Artificial intelligence in trading stocks will not be a tool but a forcer of the markets, guiding responses of businesses.

So, where is your business headed? AI will drive the future of trading, and those who adopt the technology early will stay ahead of the curve. Whether it’s building advanced trading apps or developing smarter investment strategies, partnering with expert AI development services can help you harness this revolution shaping the stock trading industry.

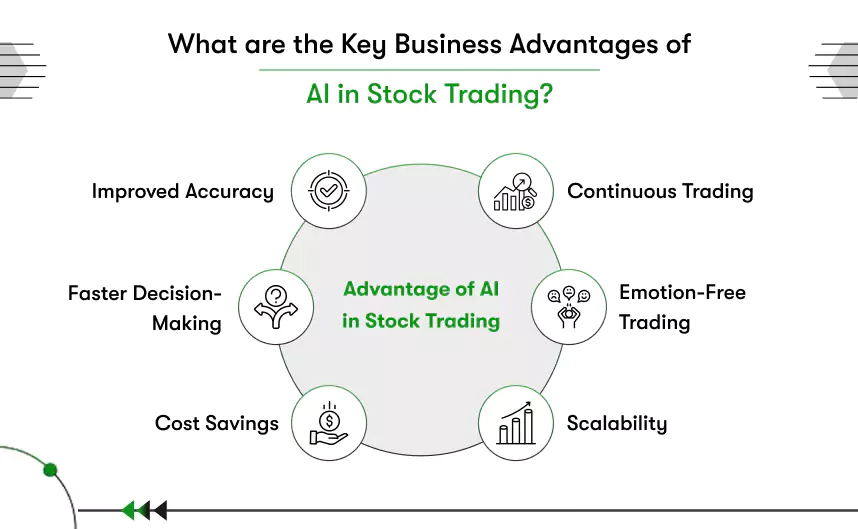

What Are the Key Business Advantages of AI in Stock Trading?

The business advantages of ai in stock trading include improved accuracy, faster decision-making, lower costs, continuous operation, emotion-free execution, and scalability. Firms that adopt AI trading systems gain efficiency, manage risks better, and outperform competitors across volatile financial markets.

Improved Accuracy

Stock trading decisions often fail when built on limited information. AI analyzes vast datasets including historical prices, real-time market feeds, and sentiment signals. Algorithms process inputs instantly, identifying actionable patterns. Firms applying artificial intelligence in stock trading achieve higher precision and reduce costly errors.

Faster Decision-Making

Speed separates profitable trades from missed opportunities. AI systems evaluate multiple markets within milliseconds. Analysts gain faster recommendations supported by live conditions. Companies applying AI in trading analytics act quickly, capturing opportunities before rivals and building a measurable competitive advantage.

Cost Savings

Manual processes raise operational costs and slow down execution. AI automates repetitive functions such as trade entry and reporting. Firms streamline operations, reducing reliance on large analyst teams. Adopting the use of AI in trading lowers expenses while maintaining consistent performance.

Continuous Trading

Markets operate across time zones, but human traders cannot remain active around the clock. AI platforms monitor conditions and execute orders continuously. Systems identify opportunities overnight or during off-hours. Enterprises exploring how AI is changing trading maintain round-the-clock market presence and responsiveness.

Emotion-Free Trading

Human judgment often suffers from impulsive decisions and emotional bias. AI operates on data-driven models and predefined strategies. Portfolios remain consistent during volatility without subjective influence. Leaders who examine how AI can help in trading safeguard capital with discipline and objectivity.

Scalability

Growth in trading volume often increases complexity and risk. AI handles larger workloads without reducing efficiency. Firms expand portfolios confidently while maintaining control over execution. Enterprises applying how to use AI for stock trading scale operations strategically without inflating risk.

What Are the Top AI Challenges in Stock Trading and How Can Leaders Overcome Them?

The top AI challenges in stock trading include data security, volatility, bias, over-reliance, and compliance. Business leaders overcome them with cybersecurity, hybrid oversight, high-quality data, balanced decision-making, and continuous regulatory alignment.

Challenge 1: Data Security Risks

AI in trading requires access to massive datasets, including sensitive financial records. That dependency increases exposure to breaches and cyberattacks. Every unprotected endpoint creates vulnerabilities that can compromise operations and damage client trust.

Solution: Leaders should implement advanced security protocols including encryption, multi-factor authentication, and AI-driven threat detection. Frequent audits identify weak points before attackers exploit them. Firms applying artificial intelligence in stock trading need dedicated teams focused on governance and infrastructure protection.

Challenge 2: Market Volatility and Unpredictability

AI models excel at processing historical data, but unexpected crises create patterns that algorithms may not recognize. Economic shocks or geopolitical events can push predictions off course, leading to incorrect signals or poorly timed executions.

Solution: Combine automation with human oversight. AI tools can analyze and respond instantly, but traders must step in when uncertainty rises. Enterprises applying AI in trading analytics adopt hybrid strategies, allowing humans to intervene during volatility and safeguard portfolio performance.

Challenge 3: AI Bias from Incomplete or Skewed Data

AI systems only perform as well as the data they train on. Poor-quality, incomplete, or biased inputs generate flawed forecasts. Faulty models reduce accuracy and expose firms to significant financial losses during execution.

Solution: Use diversified, high-quality datasets sourced from multiple channels. Periodic audits uncover hidden biases before they harm predictions. Business leaders integrating use of AI in trading should continuously refresh data pipelines and validate training sources against current market conditions.

Challenge 4: Over-Reliance on AI Automation

The efficiency of AI often tempts firms to remove human judgment. Sole reliance on automation risks missing subtle signals or contextual insights. Strategic human input remains essential for interpreting nuances in complex markets.

Solution: Position AI as a partner, not a replacement. Automation delivers speed, but human intuition adds depth. Executives exploring how AI is changing trading should implement workflows that blend algorithmic precision with strategic human decision-making.

Challenge 5: Regulatory and Ethical Concerns

Global regulators are closely watching AI adoption in trading. Rapid deployments that ignore compliance raise risks of fines or restrictions. Ethical questions around transparency and market manipulation also shape how stakeholders perceive AI-driven operations.

Solution: Establish compliance frameworks aligned with evolving laws. Engage with legal experts to assess AI models regularly. Leaders adopting how AI can help in trading build trust by documenting processes, ensuring transparency, and addressing ethical standards proactively.

Every challenge in AI-driven stock trading comes with a clear path forward. Leaders who balance technology with human oversight, strengthen security, and maintain compliance unlock AI’s full potential. Understanding the AI app development cost also helps these firms plan smarter investments, turning potential risks into measurable market advantages.

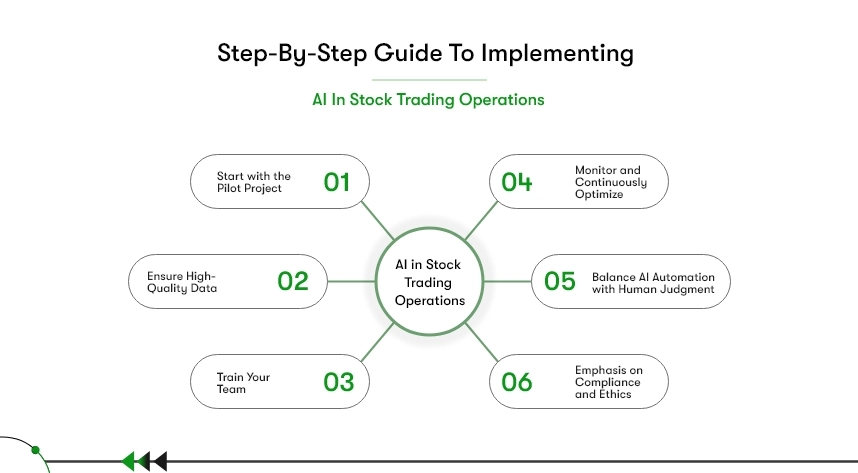

A Step-by-Step Guide to Implementing AI in stock trading Operations

Implementing AI in stock trading requires structured steps: begin with pilots, secure quality data, train teams, optimize continuously, balance automation with judgment, and ensure compliance. Leaders following these steps build sustainable, scalable, and profitable AI-driven trading operations.

Step 1: Start with a Pilot Project

Jumping directly into full-scale AI adoption exposes firms to unnecessary risk. Pilot projects allow controlled testing in targeted areas such as algorithmic trading or sentiment analysis. Early insights reduce errors and strengthen strategies. Firms applying artificial intelligence in stock trading refine models gradually before scaling up operations.

Step 2: Ensure High-Quality Data

AI systems cannot outperform the data they process. Incomplete or outdated records lead to inaccurate signals and flawed trades. Leaders must prioritize regular data audits and cleansing across all sources. Firms investing in strong pipelines improve predictions and build resilience. Executives integrating AI in trading analytics achieve better accuracy and reduce costly mistakes.

Step 3: Train and Upskill Teams

Technology alone will not drive sustainable results. Teams must understand how to interpret AI insights and act on them quickly. Upskilling ensures that human decision-makers remain central to trading operations. Many enterprises also partner with external experts. By outsourcing to fintech developers, businesses gain custom AI trading platforms tailored to their goals. The use of AI in trading becomes both practical and scalable with skilled teams in place.

Step 4: Monitor and Continuously Optimize

Markets evolve constantly, and static algorithms lose effectiveness over time. Continuous monitoring ensures models adapt to new events and volatility. Regular updates improve performance while protecting profitability. Enterprises exploring how AI is changing trading commit to optimization as a permanent discipline, not a one-time exercise.

Step 5: Balance Automation with Human Judgment

AI delivers speed and precision, but human oversight remains critical. Traders and analysts must validate AI signals, especially during unexpected market swings. Strategic judgment ensures well-rounded decisions. Leaders considering how AI can help in trading maintain a hybrid approach, combining automated execution with human experience.

Step 6: Emphasize Compliance and Ethics

Rapid AI adoption in trading raises scrutiny from regulators and stakeholders. Failure to follow compliance standards risks penalties and reputational damage. Leaders should embed transparency, document processes, and work with legal advisors. Enterprises applying how to use AI for stock trading build trust and safeguard client relationships by aligning technology with regulatory expectations.

Successful AI integration in stock trading starts with pilot projects, reliable data, and trained teams. Leaders who combine automation with human oversight, ensure compliance, and hire AI app developers with fintech expertise build trading systems that scale profitably and withstand market volatility.

Take the Lead in Stock Trading with AI: Partner with Kody Technolab Today

Markets are moving faster than human judgment can keep up. Firms using AI are executing trades in milliseconds, reducing operational costs, and managing risks more effectively. The gap between adopters and late movers is widening every week.

Kody Technolab helps financial enterprises close that gap. We build trading systems powered by AI that forecast market trends, execute with precision, and stay aligned with compliance frameworks. Every solution is designed to fit business goals and scale without adding unnecessary risk.

If you’re ready to innovate faster, you can hire AI developers from Kody Technolab to build intelligent trading platforms that deliver measurable returns within the next quarter.

Frequently Asked Questions About AI in Stock Trading

1. How reliable is AI in stock trading?

AI in stock trading is highly reliable when trained on high-quality, diversified data. It processes large datasets faster and more accurately than human analysts. However, reliability depends on continuous monitoring, proper data governance, and integration with human oversight.

2. Can AI completely replace human traders?

No. AI handles data analysis, prediction, and execution at speeds no human can match. But human oversight remains critical for interpreting context, managing unexpected volatility, and making strategic decisions. The most effective models combine automation with human judgment.

3. What are the risks of using AI in stock trading?

Key risks include biased data, system over-reliance, and exposure to cyber threats. AI can misinterpret unusual events outside its training set. Firms reduce risk by diversifying data sources, combining AI with trader oversight, and securing infrastructure with advanced cybersecurity protocols.

4. How much investment does AI in stock trading require?

Investment depends on scope. Pilot projects such as algorithmic trading modules cost significantly less than building enterprise-wide AI platforms. Most firms start small and scale. Partnering with fintech experts like Kody Technolab helps align investment with ROI and growth goals.

5. Is AI-driven trading compliant with regulations?

Yes, AI can be compliant if systems are designed with regulatory standards in mind. Enterprises must maintain audit trails, ensure transparency in model decisions, and monitor outputs. Partnering with compliance-focused developers ensures that AI adoption stays within legal boundaries.

6. How quickly can my firm see results from AI in trading?

Pilot projects typically show measurable results within three to six months. Full-scale platforms may take longer, depending on integration complexity. Firms often see improvements in trade execution speed, cost reduction, and forecasting accuracy in the first year of deployment.

7. Why should I partner with Kody Technolab for AI in stock trading?

Kody Technolab builds AI trading systems tailored to enterprise needs. Our team designs predictive analytics engines, automated execution frameworks, and compliance-focused platforms. We align every solution with your strategy and risk frameworks, ensuring AI adoption delivers measurable and sustainable growth.

Contact Information

Contact Information