AI’s journey through industries has been nothing short of remarkable. It started by optimizing financial services, making transactions faster and more secure. Then, it ventured into healthcare, improving diagnoses and treatment plans. Now, AI is knocking on the doors of the insurance sector, offering transformative possibilities.

With its data-driven capabilities and predictive analytics, AI is redefining the way insurance companies assess risk, process claims, and interact with customers. The potential impact of AI on insurance is profound, promising greater efficiency, enhanced customer experiences, and more competitive offerings.

The evolution of AI across these industries serves as a testament to its versatility and transformative potential. In this guide, we’ll focus on how AI shapes the insurance landscape in the Netherlands and Germany, providing valuable insights for CTOs, CEOs, and product managers from the insurance sector navigating digital transformation with AI.

How is AI Relevant to the Insurance Industry?

AI is not just a buzzword but a real game-changer for insurance companies in the Netherlands and Germany. Let’s take a closer look at the unique challenges insurers face and how embracing AI will help.

Unique Challenges of the Insurance Sector

The insurance industry operates in a dynamic environment with its own set of challenges:

Risk Assessment Complexity: Insurance relies heavily on accurately assessing and pricing risks. The vast amount of data required for this task can be overwhelming.

Claims Processing Burden: Processing claims efficiently while minimizing fraud is a perennial challenge for insurers.

Customer Expectations: Modern customers expect personalized services, quick responses, and seamless experiences.

Regulatory Compliance: Insurance companies must adhere to stringent regulations to protect both themselves and their clients.

Key Drivers Behind AI Adoption in the Insurance Industry

Now, let’s explore how Artificial Intelligence assists Insurers in overcoming these challenges.

Data Deluge: With mountains of data to analyze, AI becomes the insurance industry’s data detective. It helps uncover hidden insights and makes sense of the data chaos.

Enhanced Risk Assessment: AI’s predictive prowess is like having a crystal ball. It allows insurers to see into the future (figuratively) and assess risk with remarkable accuracy.

Claims Efficiency: Automating claims processing with AI reduces paperwork, speeds up claims settlements, and detects fraud more effectively.

Customer-Centric Approach: AI-powered chatbots and virtual assistants bring a human touch to customer interactions, even at 3 AM. Thus, Insurance companies improve customer interactions, delivering personalized services around the clock.

Regulatory Compliance: Artificial Intelligence can navigate the complex landscape of regulations like a seasoned guide. It helps insurers stay on the right side of the law, ensuring the safety and security of both data and clients.

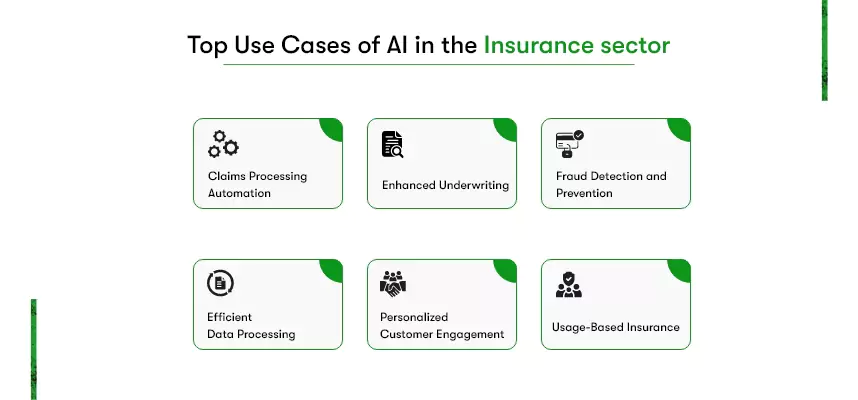

What are the top use cases of Artificial Intelligence in the Insurance sector?

From streamlining claims to enhancing underwriting and combating fraud, insurers use this futuristic technology in multiple ways. Let’s explore these practical applications of AI in the insurance sector, examining how it’s transforming various aspects of the insurance business.

Claims Processing Automation

AI automates the assessment of insurance claims. It uses technology to quickly analyze photos, videos, and data to determine the extent of damage or loss. Thus, using AI in claim processing reduces the time it takes to settle claims.

Faster claim processing means policyholders receive their payouts more quickly, alleviating stress during challenging times. To implement this, insurers need to integrate AI image recognition technology into their claims processing systems.

Enhanced Underwriting

AI helps insurance companies make better decisions when assessing risk. Because Artificial Intelligence can analyze large amounts of data in real-time, simplifying determining the cost and terms of an insurance policy. So, your insurance company can ensure, offering fair and accurate pricing.

Fraud Detection and Prevention

By employing Artificial Intelligence algorithms to continuously monitor claims for anomalies, insurers can eliminate fraudulent risk. Because AI acts as a fraud detective, spotting unusual patterns and behaviors in insurance claims. It helps identify potential fraudsters by comparing data and detecting inconsistencies.

Efficient Data Processing

Processing a vast amount of data to infer valuable insights to personalize insurance services for customers is challenging. However, AI-powered data analytics tools can efficiently organize and extract valuable insights from extensive data sets. It helps insurance companies make informed decisions by turning data into actionable information and tailoring communication and services to individual needs.

Personalized Customer Engagement

Employing AI-driven chatbots and virtual assistants, insurance companies can provide round-the-clock support to policyholders. They answer questions, assist with claims, and offer personalized services, enhancing the overall customer experience. Thereby, you can also reduce the workload on human customer support teams.

Usage-Based Insurance (UBI)

UBI products are tailored to individual behavior and usage patterns. AI algorithms analyze policyholders’ behavior data like driving habits and mileage collected through IoT devices and determine premium costs. Thus, UBI reduces risk assessment uncertainty, enabling insurers to offer fair premiums, attract safer drivers, and optimize underwriting.

These AI use cases illustrate how Artificial Intelligence technology is transforming the insurance industry, making it more efficient, customer-focused, and capable of adapting to evolving risks and customer needs.

How do Insurance Companies in the Netherlands use Artificial Intelligence?

In the rapidly evolving landscape of insurance, Dutch companies are not behind in harnessing the power of Artificial Intelligence (AI). Let’s take a closer look at AI in Insurance examples. We examined how insurance companies Aegon and Zilveren Kruis in the Netherlands leverage AI to enhance their operations and customer experiences.

AEGON:

Aegon N.V. is a multinational life insurance and asset management company headquartered in the Netherlands. The company empowers its clients to make self-conscious decisions for a healthy financial future.

Use of AI in Aegon:

Aegon uses AI for predictive analysis, which helps it anticipate customer behavior and product needs. This enhances policy customization and drives customer satisfaction. Furthermore, the company employs AI-driven chatbots for customer service to handle client inquiries efficiently, making the process timely and systematic.

Zilveren Kruis:

Zilveren Kruis, also known as the Silver Cross, is a Dutch health insurance company. It provides health insurance to more than five million people and is constantly working towards improving the health care system.

Use of AI in Zilveren Kruis:

Zilveren Kruis uses AI to improve the processing time of claims, which enhances their customer service. They utilize machine learning algorithms to identify and prevent potential fraud cases, improving overall operational efficiency. AI applications also assist them in creating personalized insurance packages based on individual health risk profiles, ensuring tailored coverage for each client.

Besides AI use cases, these companies also share something in common, i.e., Mobile Apps. Both insurers ensure their customer can avail their services hassle-free by offering user-friendly Android and iOS mobile apps.

Why AI-powered Insurance Mobile App Development can be a game-changer for an Insurance Company?

Combining the strategic implementation of Artificial Intelligence (AI) with mobile app development can indeed be a game-changer for insurance companies. This transformation is exemplified by forward-thinking insurers like Aegon and Zilveren Kruis. They recognize the profound impact of AI-powered mobile apps on their operations and customer interactions. Here’s how the synergy of AI and mobile app development can revolutionize the insurance landscape:

Enhanced Customer Engagement and Personalization:

AI-driven mobile apps allow insurers to engage with customers on a highly personalized level. By analyzing user behavior and preferences, these apps can provide tailored policy recommendations, coverage options, and real-time updates, creating a more meaningful and customer-centric experience.

Streamlined Claims Processing:

Mobile apps equipped with AI simplify claims processing. Policyholders can quickly report and track claims, while AI algorithms assess claim validity, expediting the entire process. This efficiency also enhances customer satisfaction and loyalty.

24/7 Accessibility and Convenience:

With your mobile app, customers can access policy details, payment options, and customer support whenever and wherever needed.

Data-Driven Decision-Making:

AI within mobile apps can analyze customer data, enabling informed decision-making for companies. So, you can easily anticipate customer behavior, adapt products to individual needs, and optimize underwriting processes, ultimately improving operational efficiency.

Cost Efficiency and Speed:

Mobile app development using AI, particularly with tools like Flutter, significantly reduces costs and time-to-market. Companies can launch high-performing apps for both Android and iOS platforms simultaneously, reaching a broader audience in record time.

Consistency and Brand Image:

Opting for Flutter app development, you can also ensure consistent user experiences across different devices and screen sizes. This uniformity enhances your insurance company’s brand image and customer trust.

Robust Security:

Leveraging AI capabilities, you can also encrypt customer data, monitor suspicious activities, and offer biometric authentication to offer a secure insurance mobile app. Such security measures protect sensitive customer data, instilling confidence in policyholders regarding data privacy and integrity.

So, the convergence of AI and mobile app development has the potential to transform the insurance industry. Insurers adopting this synergy will certainly revolutionize customer engagement, streamline operations, and drive innovation. Because with this tech combo, it will be easier for insurers to meet the evolving needs and expectations of their customers.

Check out how much does it cost to develop a Smart Insurance app like GetSafe (the Netherlands’ emerging InsurTech app)

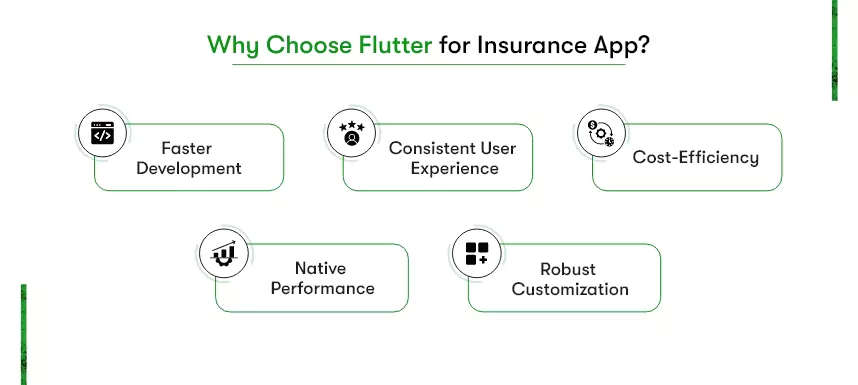

How does Flutter help insurance companies in their AI adoption journey?

Flutter is an open-source cross-platform app development framework, ideal for insurance companies to launch high-performing and feature-rich mobile apps. It’s renowned for its ability to develop natively compiled applications for mobile, desktop, and web from a single codebase.

Here are some of the benefits your insurance company can reap by choosing Flutter for mobile app development:

Faster Development: Flutter’s “write once, run anywhere” approach significantly reduces development time. Insurance companies can launch apps for both Android and iOS platforms simultaneously.

Consistent User Experience: Flutter ensures a consistent and visually appealing user interface across different devices and screen sizes, contributing to a cohesive brand image.

Cost-Efficiency: Developing and maintaining a single codebase with Flutter leads to cost savings compared to managing separate codebases for Android and iOS.

Native Performance: Flutter apps offer native performance and speed, providing a smooth and responsive user experience.

Robust Customization: Insurance companies can easily customize app features, including AI-powered functionalities, to meet their specific requirements and customer needs.

That said, by combining the power of AI use cases with Flutter, you can be at the forefront of innovation in the insurance industry.

How to develop an AI-Powered Insurance Mobile App? Step-by-step analysis!

By developing an AI-powered mobile app, your company embraces Digital Transformation in the Insurance sector (we have discussed this in detail here). This is a crucial investment that you want to be strategic. Hence, you should hire experienced Flutter app developers and follow a holistic approach that may include the below steps.

Define Objectives and Requirements:

Start by clearly defining the app’s objectives, target audience, and the specific AI features you want to incorporate, such as chatbots, predictive analytics, or claims processing automation.

Market Research:

Conduct thorough market research to understand customer needs, competitor offerings, and emerging trends in the insurance industry.

Conceptualization and Planning:

Create a comprehensive project plan, including timelines, milestones, and budget estimates. Define the app’s architecture and choose the development framework.

Data Collection and Preparation:

Gather and prepare the necessary data for AI integration. This may include customer data, historical claims data, and other relevant information.

AI Model Development:

Develop AI models tailored to your app’s requirements. This may involve machine learning algorithms, natural language processing (NLP), or computer vision, depending on the app’s functionality.

User and User Experience (UI/UX) Design:

Design an intuitive and user-friendly interface that ensures a positive user experience. Focus on easy navigation and accessibility.

Mobile App Development:

Utilize a mobile app development framework like Flutter to build the app. Integrate AI models seamlessly into the app’s architecture.

Testing and Quality Assurance:

Rigorously test the app for functionality, security, and performance. Conduct user testing to collect feedback and make necessary improvements.

Deployment and App Store Submission:

After quality assurance, deploy the app on app stores (Google Play Store and Apple App Store), ensuring it complies with all relevant guidelines and regulations.

Continuous Monitoring and Improvement:

Once the app is live, continuously monitor its performance, user feedback, and AI model accuracy. Regularly update the app to fix bugs and enhance features.

Check out this guide on Insurance app development that discusses Features and Costs for a comprehensive understanding.

Secure successful AI adoption for your Insurance company with Kody Technolab!

In the dynamic landscape of the insurance industry, the adoption of Artificial Intelligence is not just a choice; it’s a strategic imperative. As Kody Technolab, a pioneering force in digital transformation, we understand the evolving needs and aspirations of insurance companies in the Netherlands. We’ve witnessed how AI has revolutionized insurance operations, enhancing customer engagement, streamlining processes, and fostering innovation.

By partnering with Kody Technolab, you gain access to a dedicated team of specialists committed to harnessing AI’s potential to drive your insurance company forward.

With our proven track record in Fintech app development, you can confidently embrace AI, delivering exceptional customer experiences, streamlining operations, and fostering innovation.

Be at the forefront of the insurance industry’s evolution with Kody Technolab—a trusted ally that understands the unique demands of your insurance business.

Contact Information

Contact Information