You must have seen many innovations in the finance sector and different ways to borrow and lend money over time. But now, you are in an era of exceptional invention, where the Buy Now Pay Later business model has emerged as a game-changing loan solution.

These Fintech apps have made shopping a breeze and put financial freedom at everyone’s fingertips, disrupting the traditional banking and loan system. According to a report,

“360 million people used Buy Now Pay Later Services Worldwide in 2022.”

The same report reveals,

- 31% of Americans utilized BNPL services in 2021.

- In the United Kingdom, over 17 million people had used BNPL services by November 2021, implying an average usage of 3.6 times per month.

- While in Australia, 38% of the population embraced BNPL apps, reporting 5.9 million active customers and AUD 12 billion in spending during the financial year 20-21.

These insights prove that the usage of Buy Now Pay Later platforms is bound to increase along with its popularity. It might even become a preferred alternative payment method for consumers in a short time, especially, because it’s also gaining traction as a POS – Point Of Sales financing.

And if you can see through it, the Buy Now Pay Later app is not only transforming how we shop but also impacting various industries. For example, merchants and retailers are witnessing increased sales and customer satisfaction by incorporating BNPL options. On the other hand, investors and entrepreneurs are eyeing the potential of this market as banks are slow and not bold enough to compete.

However, for anyone who wants to enter this market, it’s crucial to understand the BNPL business model and how BNPL apps make money.

So, let’s delve deeper so that you can make informed decisions, mitigate risks, and seize the BNPL market opportunities.

Understanding the Buy Now Pay Later Business Model

The Buy Now Pay Later business model, basically, is a credit service that allows customers to split their transactions into smaller, interest-free installments. It divides a $50 to $1000 purchase into four or six installments at checkout.

The first installment is usually due at checkout, paid as a down payment. In contrast, the others are due in two-week intervals. If a borrower doesn’t keep up with these installments, however, BNPL lenders tend to charge late fees.

For example, Klarna is a well-known Swedish BNPL app. If a user misses a payment, the app offers a 10-day grace period and sends reminders to pay. After the grace period, when the payment is still pending, the app applies a $7 late payment fee to the next installment.

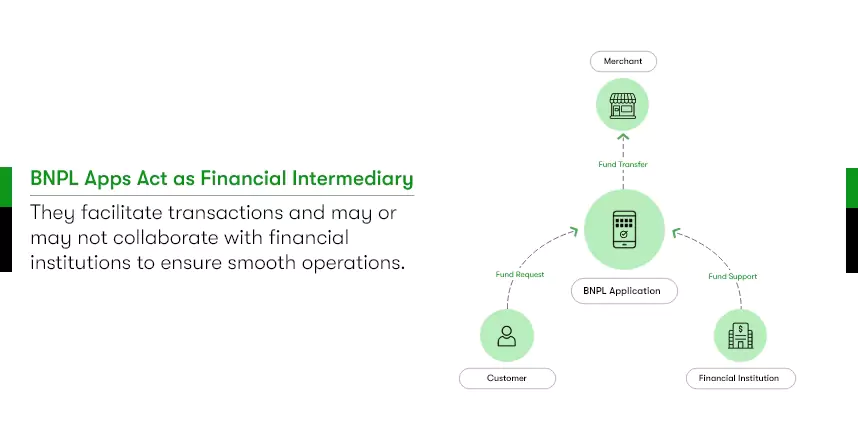

Despite its business model, a BNPL app acts as a financial intermediary at its core. It bridges the gap between customers, merchants, and financial institutions.

Customers use the app to make purchases and defer payments. Whereas merchants gain access to a broader customer base by offering Buy Now Pay Later services. Above all, BNPL service providers facilitate transactions and collaborate with financial institutions to ensure smooth operations.

If you are looking for information on B2B BNPL, then you should also read: B2B Buy Now, Pay Later Solution & How it works!

Who are the key stakeholders in the BNPL Business Model?

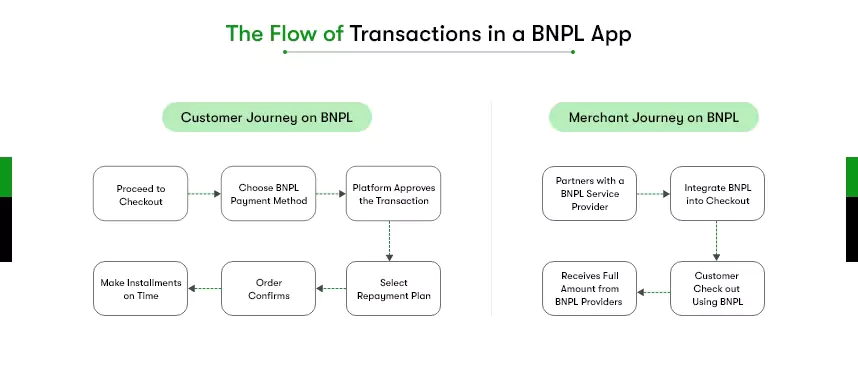

In the BNPL business model, three key stakeholders are involved in a transaction: the consumer, the merchant, and the BNPL service provider. By understanding the perspectives of these key stakeholders, we gain insights into the dynamics of the BNPL business model.

Consumer:

The consumer, or the buyer, is a crucial stakeholder in the BNPL ecosystem. They are individuals who make purchases using the BNPL option. For consumers, BNPL provides an attractive way to access credit, even for those with a lack of credit history or a poor credit score (in some cases).

The option of interest-free payments during a specified period reduces the psychological risk associated with taking on debt, making it an appealing alternative to traditional credit options.

Merchant:

The merchant refers to the seller or the business that offers goods or services to consumers. Typically, merchants partner with BNPL service providers to offer their customers the option to pay for their purchases in installments.

Integrating BNPL into the checkout process increases their average ticket size as well as reduces cart abandonment rates. Because consumers are more likely to make larger purchases when they have the flexibility to spread out payments.

BNPL Service Providers:

BNPL service providers play a critical role in the ecosystem, acting as intermediaries between consumers and merchants. All the risk of non-repayment from consumers is on them.

Furthermore, payment processors are responsible for enabling smooth transactions between consumers and merchants by paying the full amount to the merchants upfront. They then collect the installment payments from consumers over time.

BNPL service providers may or may not have another stakeholder in their ecosystem– Financial Institute. In many cases, service providers partner with finance companies or financial institutions to facilitate the payment for the customers.

What are the core elements of the BNPL ecosystem?

There is always a way to make any business competent enough to survive the cut-throat competition. In the Buy Now Pay Later case, you can work on the core components of its business model that play a huge role in the profitability of a BNPL business.

Market Segments:

Identify and target market segments that are most likely to generate revenue and have a demand for BNPL services. You can analyze consumer demographics and shopping trends to identify industries or niches where BNPL can provide significant value.

Pricing Strategies:

You need to develop pricing strategies that can strike a balance between attracting customers and generating profitability. So, consider factors such as interest rates, late payment fees, and merchant fees to come up with competitive pricing while ensuring sustainable revenue generation.

Higher Approval Rates:

You can increase approval rates for BNPL transactions by optimizing underwriting processes. Start by refining risk assessment algorithms, analyzing a wider range of data points, and leveraging advanced analytics to make more accurate credit decisions. Your higher approval rates automatically attract more customers and drive transaction volumes.

Partner with Finance Companies:

You can secure access to funds for financing BNPL transactions by collaborating with finance companies or lending institutions. Such partnerships will allow you to provide the necessary capital to support your BNPL business. Besides, it splits the risk and enhances credibility with customers and merchants.

Create a Mobile App:

Developing a user-friendly and intuitive mobile app that allows customers to access your BNPL services conveniently is a big Yes. Moreover, you can build an intuitive app that lets customers browse through online storefronts without leaving the app. This way, you can empower customers to use BNPL at merchants where this solution is not integrated at checkout.

For example, customers who shop within the Klarna app can use Klarna’s BNPL service at Amazon. However, Amazon doesn’t have Klarna at its checkout.

Robust Backend Infrastructure:

Now that you are working hard to drive more conversions ensure you have a strong backend. You need a robust backend infrastructure to handle the volume of transactions, data storage, and processing requirements. While building your Buy Now Pay Later application, ensure high availability, scalability, and data security to support a seamless and reliable platform.

Successful implementation of these components enhances profitability and contributes to building a sustainable and thriving BNPL business.

How does Buy Now Pay Later make Money?

Compared with traditional loans, BNPL loans generate less revenue for lenders as they are basically interest-free. But Buy Now Pay Later (BNPL) business models have proven profitable when bound with the right revenue streams.

There are multiple ways a BNPL app can make money. For example, predefined late payment charges, flat per transaction fee, merchant commission, and so on. Partnering with finance institutions and charging on payment through credit card, BNPL apps may earn an additional revenue.

So, let’s explore in detail how BNPL companies make money and generate profit.

Primary Revenue Streams for BNPL Services

Late Payment Fees:

Late payment fees and penalties are one of the main revenue sources for BNPL providers. When customers fail to make timely payments, they may incur additional charges.

For example, if a customer buys something of $60 using Afterpay and fails to repay on time, Afterpay charges an initial $10 late fee.

Flat Transaction Fees:

BNPL firms charge a flat fee for each transaction made through their platform. This fee is a fixed amount per transaction, regardless of the transaction value. It provides a straightforward revenue stream for the BNPL firm and can be used to cover operational costs and generate profit.

Merchant Fee:

As a BNPL service provider, you can charge transaction fees to merchants for offering your BNPL platform as a payment option. These fees may be a percentage of the transaction value and/or a fixed amount per transaction.

For instance, Sezzle, a popular BNPL service, charges merchants a $0.30 flat fee plus a 6% transaction fee for each sale made through their platform.

Busted Loans:

If the customer fails to repay the BNPL loan within the agreed-upon terms, the platform may restructure the loan as a traditional installment loan. Hence, the loan becomes subject to interest charges.

Additional Revenue Streams

Merchant Fees and Commissions:

In addition to transaction fees, BNPL providers may earn revenue through merchant fees and commissions. Merchants offering BNPL as a payment option pay a certain percentage of the transaction value as fees or commissions to the BNPL provider.

For example, Zip Co, an Australian BNPL company, generates revenue through merchant fees for facilitating BNPL transactions.

Interchange Fees:

Interchange fees come into play when a customer uses a credit card for a BNPL transaction. Basically, the card network applies this fee to process the transaction. However, as a BNPL firm, you may receive a portion of these interchange fees as revenue for enabling the transaction and acting as an intermediary between the merchant, customer, and credit card network.

Partnerships with Financial Institutions:

You can also partner with financial institutions, such as banks or lending institutions, to offer financing options. This can be revenue-sharing agreements where you receive a portion of the interest or fees generated from the financing arrangements.

For instance, Affirm, a prominent BNPL platform, partners with banks to provide installment loans and earns revenue through shared interest charges.

How to Ensure the Financial Viability and Sustainability of Your BNPL Business?

When Klarna, Affirm, and other pay-over-time service providers’ valuations dropped, the demand for BNPL was still soaring. The question arose: “Is the Buy Now Pay Later Business Model Sustainable?”

Well, during BNPL’s hyper-growth in 2021, such fintech players were valued based on growth, and profitability was overlooked. Today’s market scenario is different. Profitability has become a key value driver for creating Buy Now Pay Later business model.

Not to worry, as high-interest rates and inflation hikes force customers to rely on BNPL solutions to balance their finances. All you need, however, is to focus on risk management and Customer acquisition and retention.

Let’s discuss how you can do it.

Risk Management and Underwriting to maintain a Healthy Buy Now Pay Later Business Model

Technology and Lending:

Unlike Banks, as a BNPL provider, you might have to rely on outside investment to offer finance to your customers. The moment the funding from outside halts, you won’t be able to operate any longer. On the other hand, banks are increasingly partnering with BNPL platforms to fill the void of the technology solution.

You take advantage of this situation and strengthen your BNPL business model. Offer a white-labeled solution to banks and traditional lenders to keep your platform afloat!

Address Relevant Risks:

BNPL service providers have to be proactive to address potential risks that might scare their customers away. Building robust compliance procedures, reducing risks and credit decision models, and developing effective fraud prevention and collection capabilities are some of the steps you can take.

Manage Financial Risks:

No matter how cautious you are, there will be some customers trying to get away without paying back. That said, the BNPL model in itself is a Credit Risk. Such financial risk is crucial to consider as it can negatively impact lenders. And no lending means no operation.

So, you must establish appropriate algorithms to assess creditworthiness, set viable credit limits, and make your loan terms and conditions clear and transparent to customers.

Focus on Customer Acquisition and Retention for Profitability

Targeted Advertising:

Reach out to potential customers who would benefit from BNPL services through targeted advertising campaigns on digital platforms and social media.

Rewards and Incentives:

Offer discounts, cashback, and exclusive deals to attract and retain customers to use your BNPL services for their next shopping. Implement a loyalty program that rewards customers for their usage and timely payments, converting them into loyal customers.

User-Friendly Experience:

Create an easy and seamless experience for customers across all touchpoints. Simplify the onboarding process, provide clear information, and ensure a smooth checkout to enhance customer satisfaction and encourage repeat usage.

Steps to Establish Your Own Buy Now Pay Later Business

No doubt, starting a BNPL business requires careful planning and execution. In addition to all the knowledge you gained on the BNPL business model, note these steps to strategize your BNPL business.

Conduct Market Research:

Start with understanding the market demand, competition, and target audience. Identify which niche has more demand for BNPL solutions but limited providers. Don’t forget to define your USP.

For example, Tabby, a popular BNPL app in the Middle East, is known for its user-friendly interface and strong partnerships with local merchants.

Build Strategic Partnerships:

Collaborate with merchants, retailers, and e-commerce platforms to secure partnerships. Establish strong relationships with financial institutions for backend support and funding options.

For example, look at Affirm, which has partnered with major retailers like Walmart and Peloton to offer BNPL options to their customers.

Develop a Technology Platform:

Hire a custom mobile app development or BNPL app development service provider to build a robust and user-friendly BNPL platform. Brainstorm and add essential features like seamless onboarding, transaction processing, repayment management, and customer support.

Take inspiration from Afterpay, another popular BNPL app offering a simple and intuitive mobile app experience for customers and merchants.

Implement Risk Assessment Systems:

Set up underwriting and risk assessment systems to evaluate customer creditworthiness and ensure responsible lending practices. This helps minimize default risks and maintain a healthy loan portfolio.

Acquire Customers:

Employ targeted marketing strategies to reach potential customers. You can leverage digital channels, social media, and partnerships to raise awareness and attract users to your BNPL platform.

Learn from the marketing campaigns of Quadpay, known for its influencer collaborations and social media engagement.

Monitor and Adapt:

Continuously monitor the market landscape, customer feedback, and industry trends. Adapt your business strategy and technology platform to stay ahead in this dynamic industry.

By following these steps and staying agile, you can surely lay the foundation for a successful BNPL business!

Check out this blog for a comprehensive view of Buy Now Pay Later App Development.

Hit the Market with your own Buy Now Pay Later Platform Now!

Through BNPL, consumers gain access to credit, merchants benefit from increased sales, and BNPL service providers manage the risks and facilitate the payment process, in turn being rewarded with any kind of financial fee.

After understanding the Buy Now Pay Later business model, you can now strategize customer acquisition, BNPL components, risk management, and revenue resources. And consequently, your BNPL business’s sustainability and profitability will keep increasing.

Still, before you venture into the viral BNPL space, take time to analyze the market, competition, and regulatory landscape. You can also take an expert’s consultation. With proper guidance, you can confidently navigate the BNPL industry and unlock its potential for success!

Contact Information

Contact Information