Is investing in a banking CRM solution worth it to foster relationships between your financial institution and customers? Let us make it simple for you.

Do you know Wells Fargo, right? One of the top five banks in the United States with over 70M customers offering a variety of financial products and services for about 171 years now!!

Doesn’t it make you wonder how they manage millions of customers and trillions of dollars of assets? Wouldn’t they face challenges in managing customer data and providing personalized experiences? With so many products and services, how do they ensure clear communication with each customer with relevant information and offers?

It wasn’t easy for them either.

Such challenges, which can lead to decreased customer satisfaction, lower retention rates, and lost revenue opportunities are mutual among banks and financial institutions.

But rather than drowning in the sea of hurdles coming up with the company’s growth, Wells Fargo embraced the technology– Custom CRM Software for Banks.

By implementing a customized CRM software solution, banks, and financial institutions can streamline their customer-facing processes, improve customer experiences, and drive revenue growth. Wells Fargo is an example!

So, now let us embark on the expedition to explore more about Banking Customer Relationship Management Software Development. And see how it can be a great investment for the Bank or financial institution’s growth.

What is Banking CRM software?

Banking CRM software is a special tool that helps banks and financial companies to take good care of their customers. It helps finance businesses remember important information about their customers, like their names and what they like, so they can offer them better service.

Such software also helps the banks to make more money by finding new ways to sell things to their customers that they might need. It’s like a superhero tool that helps banks make their customers happy and earn more money!

“Financial institutions have a wealth of data, but without a comprehensive view of the customer, it’s difficult to deliver personalized experiences that drive loyalty and growth. CRM technology is the foundation of customer-centric banking, allowing banks to build deeper relationships with their customers and create differentiated experiences that set them apart from the competition.” — Marc Benioff, CEO of Salesforce.

Why should a bank or financial institution integrate the Banking CRM solution?

Well, the Banking CRM solution helps banks and financial institutions to keep track of all their customers’ information, from personal details to their banking transactions. With this information, you can provide personalized services to customers, such as customized banking products, targeted marketing campaigns, and efficient customer support.

Moreover, the Banking CRM solution also helps banks and financial institutions to identify potential customers who may need their services in the future. That means you can reach out to these customers and offer them the right products and services at the right time.

So, if a bank or financial institution wants to make their customers very happy and grow their business, they should definitely integrate the Banking CRM solution!

Banking Customer Relationship Management Software Use Cases

CRM has been a hot topic in the banking and even Fintech sector for it makes business operations smooth and more effective. You are most likely to see finance businesses using CRM:

To simplify customer relationship management storing all customer data in one place.

For example, you can easily see all the information you need about a customer, including their account history and personal details, without having to search for it across multiple systems or files.

To understand their customer needs and preferences to offer personalized services and experiences.

For example, by applying the appropriate model to the data, you can analyze customers’ needs and recommend products and services that are tailored to their specific financial situation and goals.

To automate customer-facing processes, including marketing and sales to save time and resources.

For example, within CRM, you can use automation to send targeted marketing messages to specific customers at the right time and with the right message, without having to manually send each message.

To identify new business opportunities.

For example, with data analysis, CRM allows you to identify products or services that are popular among your customers or to see which types of customers are most likely to be interested in certain products.

To increase revenue and stay ahead of the competition, at the same time provide excellent customer service.

For example, since you offer personalized experiences and efficient services, you can attract and retain more customers, which can ultimately lead to increased revenue and growth for your business.

Benefits of Banking CRM Software Development

Implementing banking CRM software is like having a personal assistant that never forgets anything and knows everything about your customers. Banks and financial institutions can streamline their operations, provide personalized experiences to their customers, and boost their revenue using the software solution. In fact, it’s a secret weapon that giant banks like Wells Fargo use to gain a competitive edge in the financial world.

In addition to competitive advantages, it offers plenty of benefits as well!

- Improved customer experience and satisfaction

Banking CRM software helps to provide a personalized experience to customers by keeping track of their preferences, behavior, and history. Banks can offer customized products and services and target customers with relevant offers, improving customer satisfaction.

- Increased customer retention and loyalty

By providing personalized services and resolving customer issues promptly, banking CRM software helps increase customer satisfaction, leading to improved retention and loyalty.

- More efficient customer data management

With a centralized system for customer data, banks can access information quickly and easily, reducing the time required to resolve customer issues. This increases the efficiency of the bank’s operations and improves its overall performance.

- Enhanced sales and marketing strategies

CRM software can help banks to identify sales opportunities, track leads and follow up on them. This leads to higher conversion rates and increased revenue.

- Better cross-selling and upselling opportunities

Banking CRM software helps financial institutions better understand their customers’ needs and preferences, enabling them to identify cross-selling and upselling opportunities.

- Reduce expenses

CRM software can reduce costs by automating tasks and increasing productivity, leading to a lower cost per transaction.

- Accurate decisions with Data Analytics

Analyzing customer data, CRM software can provide valuable insights, helping banks to make informed decisions, identify trends, and forecast future behavior.

Key Features of Banking CRM Software Development

So, after understanding the importance and benefits of banking customer relationship software, let us analyze the top features. These features are recommended by finance business analysts to make any CRM successful.

Customer Data Management: Efficiently manage customer data to provide personalized experiences and targeted marketing.

Lead Management: Track and manage leads from acquisition to conversion, ensuring a streamlined sales process.

Communication and Collaboration Tools: Provide tools for internal communication and collaboration among teams to improve customer service.

Analytics and Reporting: Access to analytics and reporting tools to analyze customer behavior and trends, and make data-driven decisions.

Automated Workflows: Automate routine tasks, such as follow-up emails, appointment scheduling, and document generation.

Integration with Third-Party Systems: Integrate with other systems, such as payment gateways, accounting software, and social media platforms.

Security and Compliance: Ensure the system is secure and compliant with data protection regulations such as GDPR and CCPA.

Mobile-Friendly: Allow customers to access their accounts and make transactions via a mobile app or responsive website.

Marketing automation: Automate marketing campaigns, such as email and social media, to reach customers with targeted messaging and offers.

Scalability: Ensure the system can accommodate growth and the addition of new features and functionalities over time.

Read Also: How to Create a Banking App in 2023?

Why develop a custom CRM solution when many off-the-shelf CRM systems are available?

Salesforce, Microsoft, HubSpot, and many software companies offer ready-made custom CRM solutions for banks and financial institutions. But such CRM cannot beat the custom Customer Relationship Management Software you build from scratch for specifically your Bank or Finance business. Let’s see the top reasons why building custom banking CRM software is more favourable.

Customization

By building their own CRM, banks and financial institutions can tailor the solution to their specific needs, workflows, and processes. You can choose which features to include and which to exclude, ensuring that the CRM fits your business requirements precisely.

Competitive Advantage

A custom CRM solution can provide banks and financial institutions with a competitive advantage over other businesses that use off-the-shelf CRM software. By creating a solution that is unique to your business, you can differentiate yourself from competitors and provide a more personalized experience for your customers.

Scalability

Building a custom CRM solution allows banks and financial institutions to create a platform that can be scaled as the business grows. You can add or remove features as needed, and the solution can adapt to changes in the business environment.

Data Security

Ensuring the security of sensitive customer data is a challenge for Financial institutions, which shouldn’t be risked by using third-party CRM. By building your own CRM solution, however, your can ensure that data is protected according to your specific security protocols and compliance regulations.

Cost-effectiveness

Although building a custom CRM solution may require an initial investment, it can be more cost-effective in the long run. Whereas, ready-made CRM solutions often require ongoing subscription fees or per-user licenses, which can add up over time. Thus, with a custom CRM, banks and financial institutions have more control over their expenses and can avoid unnecessary costs.

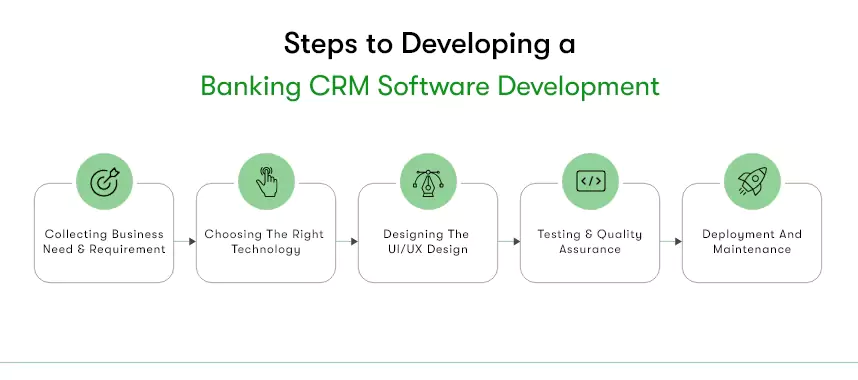

Steps to Developing a Banking CRM Software

Now, would you let this technological advantage slip through or would you create a custom Banking CRM solution? You, of course, won’t be foolish to turn down the opportunity to delight your customer and increase your bottom line, would you?

Thus, why not gain a little understanding of Banking CRM software development as well so that no one can trick you?

If the voice in your head says, “hell, yeah,” we can begin!

Collecting business needs and requirements

The first step is always crucial and developing a Banking CRM software has no exception. At this phase, you must take the time to gather all the necessary information related to the software requirements and what you expect it to do. Here is a brief list to keep in mind:

- Identify the business goals and objectives for implementing a CRM solution

- Determine the types of data to be collected and managed

- Understand the various customer touchpoints and interactions

- Define the reporting and analytics requirements

- Consider regulatory compliance and security needs

Once you have collected all the requirements, you can move on to the next step of choosing the right technology and platform.

Choosing the right technology and platform

The second step is even special to developing Banking CRM software where you select technology and platform. For example, use ReactJS for frontend, NodeJS for backend, MongoDB for managing databases, AWS for cloud hosting, and so on.

The technology stack that you pick determines the software’s performance, scalability, and compatibility with other systems. Hence, do not take this action without experts if you are indecisive or new to technology. (no offense)

But here are factors you consider to make the right choice:

- (check) Integration capabilities with other software systems

- Security and data protection requirements

- Customization options to fit your unique finance business needs

- Scalability to handle the growing number of users and data

- User-friendliness for easy adoption and usage

Choosing the right technology and platform can have a significant impact on the software’s effectiveness and ultimately, your business success. So, take your time and make an informed decision!

Designing the user interface and user experience

Now that you have identified the business needs and requirements and chosen the right technology and platform, it’s time to focus on designing an intuitive and user-friendly interface that provides an exceptional user experience. Here’s what you should consider during this phase:

- Understanding your users and their needs, behaviors, and preferences.

- Creating wireframes and prototypes to visualize the layout, content, and flow of the interface.

- Incorporating design elements such as colors, typography, and imagery to make the interface visually appealing and brand-consistent.

- Ensuring that the interface is responsive and accessible across different devices and platforms.

- Testing the interface with real users to gather feedback and make necessary improvements.

Remember, a well-designed interface can make all the difference in engaging your users and driving the adoption of your Banking CRM solution.

Developing the software with iterative testing and quality assurance

Now that you have your business needs identified, the technology and platform selected, and the user interface and user experience designed, it’s time to start the development process. This step involves building the software while incorporating feedback from stakeholders, testing for bugs and issues, and ensuring quality and security standards are met. Here’s how you can approach this step:

- Break the software development process into smaller tasks or sprints for easier management and tracking.

- Use agile development methodologies to facilitate flexibility and adaptability to changes during the development process.

- Conduct regular testing and quality assurance to catch any issues and ensure the software functions as intended.

- Collaborate closely with the development team to address any challenges or changes in requirements that arise during the process.

Speaking of the development team, you must know that most companies hire dedicated Fintech developers over an in-house team nowadays. So, don’t worry about hiring as many agencies offer their carefully curated and experienced developers for hire on contract or hourly.

Deployment and ongoing maintenance

Congratulations, you’ve made it to the final step of the Banking CRM software development process! Once your software is developed, it’s time to deploy it and start using it to improve your customer relationships and drive revenue growth. Here are the key steps to follow:

- Determine the deployment strategy that best suits your business needs

- Train your staff on how to use the software effectively

- Continuously monitor and analyze the performance of your software

- Conduct regular maintenance and updates to ensure optimal performance and security

Note: implementing a banking CRM solution is an ongoing process, and you must continuously adapt and improve your software to meet your business needs and your customers’ expectations.

By following these steps, you’ll be well on your way to creating a custom CRM solution that will set your bank or financial institution apart from the competition.

Best Practices for Banking CRM Software Development

Your banking CRM software development may take several months to complete and be ready to launch. Meanwhile, some other things must be taken care of so you won’t have to face any dilemmas afterward.

- Ensure data security and compliance with regulations

Banks and financial institutions deal with sensitive customer data, so it’s crucial to ensure that the software is designed with robust security measures in place to protect this data. Additionally, the software should be compliant with relevant regulations such as GDPR and HIPAA.

- Prioritize customer-centric design and functionality

Design the software with the user in mind, making sure that it is intuitive and easy to use for both customers and employees. This can be achieved by conducting user research and testing throughout the development process.

- Integrate with existing systems and processes

Integrating a new system can be a challenging task, especially in the banking and finance industry where legacy systems and processes are deeply rooted. Therefore, it is important to ensure that the new Banking CRM solution can seamlessly integrate with existing systems and processes.

- Prioritize scalability and flexibility

As the bank or financial institution grows, the CRM software should be able to scale and adapt to changing business needs. This means using a flexible architecture and technology stack that allows for easy integration with other systems and future updates.

- Continuously evaluate and improve the software

Once the CRM software is deployed, it’s important to continuously monitor its performance and gather feedback from users. This helps to identify areas for improvement and ensure that the software is providing maximum value to the bank or financial institution.

How much does banking CRM software development cost?

Banking CRM software development cost can vary depending on the features and complexity of the software. It’s like buying a car – a basic model will be cheaper than a luxury model with more advanced features.

Custom software development requires a team of skilled developers, project managers, and quality assurance testers to work together to create a tailored solution for your business needs. This can add to the cost but also ensures that the solution meets all your unique requirements.

On average, the cost of developing banking CRM software can range from $50000 to $100,000. Nevertheless, it’s important to work with a reputable software development company that can provide a detailed cost estimate and work with you to prioritize features and functionality to fit within your budget.

Build Customer Relationships and Boost Your Bottom Line!

Developing a custom Banking CRM software solution can be a game-changer for banks and financial institutions looking to stay competitive in today’s market. Understanding the key features, best practices, and cost considerations involved in CRM software development, now you are all set to create a system tailored to your unique needs and customer base.

If you want to gain more knowledge before enrolling in any banking CRM software Development Service, connect with our expert today. We are a leading fintech app development company and contributed to the global Fintech market with various custom software, and our team would be happy to serve you as well!

Contact Information

Contact Information