From banking to sending and receiving money locally, many financial services are now accessible right from a smartphone. The driving force behind this revolution? Mobile application development.

Today, you can apply for and receive loans online, pay credit card bills, settle utility payments, and even trade stocks; all from a mobile app.

Since COVID-19, the FinTech industry has flourished like never before. Entrepreneurs in the finance sector are investing in mobile apps to automate processes and improve customer satisfaction. P2P Loan App Development is at the forefront, allowing businesses to offer seamless money transfer services across borders.

FinTech’s Growing Popularity: The Stats Speak for Themselves

A survey by Plaid and The Harris Poll found:

- 59% of Americans now use FinTech apps to manage their money more than they did before COVID-19.

- 73% say FinTech is the “new normal.”

- 57% say these apps save them time, 42% say they save money, and 37% feel they reduce the stress of financial management.

Seeing this shift, major financial institutions are heavily investing in technology-driven solutions. The FinTech boom is giving startups a competitive edge over traditional banking systems.

Major financial institutions have perceived the power of merging technology with their services. Ultimately, financial organizations are investing heavily in technology-driven solutions. This revolution not only replaces the traditional way to offer and consume financial services.

It also allows FinTech entrepreneurs to compete with their orthodox counterparts.

If you are more into mobile payment apps like Venmo, PayPal, or Square’s Cash App, we have good news for you. Quarter by quarter, mobile payment users are increasing, whether it’s merchant purchases or peer-to-peer payments. It goes without saying that Digital Payment is the most used FinTech service. With the growing demand for seamless transactions, money transfer app development has become a key focus in the industry. Young generations actively use money transfer apps for many purposes, making it essential for businesses to invest in innovative solutions.

Cash App made $16.2 billion revenue in 2024, a 13.2% increase on the previous year. (Business of Apps)

Even with offering online transactions to customers for free, digital payment service providers earn billions. FinTech apps with payment features earn through commission on bills payments, service fees, and other value-added services.

Why Should You Build a P2P Payment App?

If you’re looking to develop an app like Cash App, Venmo, or PayPal, here’s some good news, mobile payment adoption is skyrocketing.

Young consumers, businesses, and freelancers rely on digital payments for transactions, making P2P payment apps a high-revenue opportunity.

Even though these apps offer free transactions for users, they generate billions in revenue through:

- Commission on bill payments

- Service fees for instant transfers

- Value-added services (e.g., crypto trading, stock investing)

Square’s Cash App Statistic and features inspiring others to make an app like Cash Application

The app has crossed 100 million downloads,

There are around 36 million active users monthly using Cash App for their regular transactions,

The Cash app could produce over $5.9 Billion in revenue in 2020,

From the total revenue, the Cash app has made a profit of about $1230 million in 2020,

Over seven million users of the app use the unique service offered by the app, which is— the Cash card to draw money from the Cash App balance and leverage discount deals,

Square’s Cash App is currently available in the US and the UK,

The app also allows to buy, sell, store, and withdraw BITCOIN,

Users can also buy and sell stocks commission-free.

Users can also get their paycheck up to two days early using the same bank account to pay bills using the Cash app balance.

Wow! Bitcoin, stock, and whatnot. But how does the Cash App work?

- First, you need to register and create a user account on the app.

- The next thing you want to do is link your existing bank account debit card to the Cash App. If your account is connected, you can add your funds to your Cash App account to carry out any transactions.

- Now you can send or receive money from other Cash App users by entering their email address, phone number, or “$Cashtag” (user ID).

- Enter the amount you want to pay or request and tap.

- Hit the “activity button” to check transaction details and “my cash” to see money deposited into your Cash App account.

You can also fill a form and get your paycheck deposited into your Cash App Account.

If we talk about what makes it different from others, it is the Cash Card that can be used at brick-and-mortar retail locations to ATMs to withdraw cash. Plus, it doesn’t apply any fee on peer-to-peer transactions and offers a referral bonus to invite others to join the app.

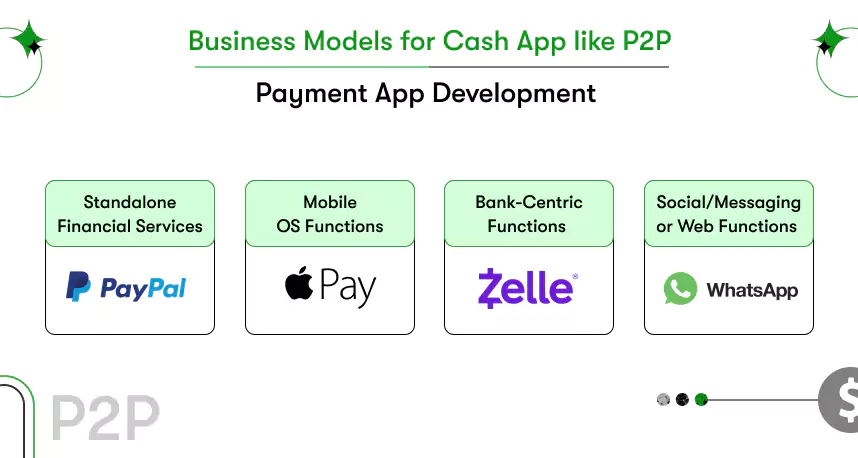

Business models for Cash App like P2P payment app development

When you start a digital business, you need to draft a business model. The business model keeps you on track throughout your app development journey. It includes market research, demand for your solution, value proposition, revenue streams to adopt, and more. Whether you’re focusing on P2P payment app development or loan lending app development, understanding users’ pain points is crucial. By doing so, creating a seamless user journey and defining project requirements becomes much easier.

Speaking of different types of the business model for P2P payment, you can consider the following models:

Standalone Financial Services

PayPal, Square Cash App, Alipay, Venmo, and many more apps are established on this business model. Such apps empower users to carry out P2P/C2B transactions with or without terminating accounts and debit/credit cards.

Mobile OS Functions

Major brands like Apple Pay, Android Pay, and Samsung Pay employ this type of business model. It permits money transfer inside the brand’s own product ecosystem. The model also includes device-based thumbprint authentication and card tokenization for enhanced protection and comfort of use.

Bank-Centric Functions

Zelle, Dwolla, clearXchange, and many other apps are based on this model. This kind of app deals with users’ bank accounts directly. It collects from and deposits the amount into a bank account instantly instead of depositing it in a currency account.

Social/Messaging/Web Functions

Whatsapp, Facebook, Snapchat, and WeChat allow users to send and receive money like Venmo and Square Cash App. You can also create one and allow its integration into social media platforms.

Essential Features to Build a P2P Payment App

Once you finalize your app’s purpose, it’s time to outline features for a smooth user journey. Here are the must-have components for peer-to-peer payment app development:

- User Registration & Login

- Link to Bank Account

- FaceID/TouchID Security

- Virtual Visa Debit Card

- Digital Wallet

- Unique ID for Transactions

- Send & Receive Money Instantly

- Send Bills & Invoices

- Buy & Sell Bitcoin

- In-App Messaging

- Check Account Balance

- OTP Verification for Secure Transfers

- Instant Notifications

- QR Code Scanner for Payments

- Quick Payment Initiation

- Transaction History & Insights

- AI-powered Chatbot for Support

Want to enhance your FinTech app? Check out our guide on AI in FinTech for automation and fraud prevention solutions.

How much does it cost to develop an app like Cash App?

The cost to build a P2P payment app depends on several factors, including the number of features, development time, and the expertise of the development team.

On average, the cost ranges from $10,000 to $15,000; however, the cost can depend on various factors:

- Number of Features & Complexity

- Development Time & Team Expertise

- Developer Location & Hourly Rates

- Platforms (iOS, Android, or Both)

- Technology Stack

- Backend & API Requirements

- Admin Panel & Security Features

Start Your Peer-to-Peer Payment App Development Journey with Kody Technolab

The digital payments industry is booming, and now is the perfect time to create a P2P payment app. Whether you’re an entrepreneur or a business looking to develop an app like Cash App the key is to integrate security, convenience, and advanced financial services.

When it comes to P2P payment app development, choosing the right tech partner is crucial, and Kody Technolab stands out as a trusted FinTech app development company. With years of expertise in building secure, scalable, and feature-rich payment solutions, Kody Technolab ensures seamless transactions, top-notch security, and user-friendly interfaces. Their team of skilled developers, UI/UX designers, and FinTech experts follows a customized development approach tailored to your business needs.

Whether you want to develop an app like Cash App, integrate AI-powered fraud detection, or enable crypto transactions, they provide end-to-end solutions that meet compliance standards. Their agile development process ensures faster time-to-market while maintaining high-performance and security protocols. Plus, their transparent pricing and post-launch support make them a reliable partner for long-term success.

If you’re looking to build a P2P payment app that is innovative, secure, and future-ready, Kody Technolab is the right choice!

Contact Information

Contact Information