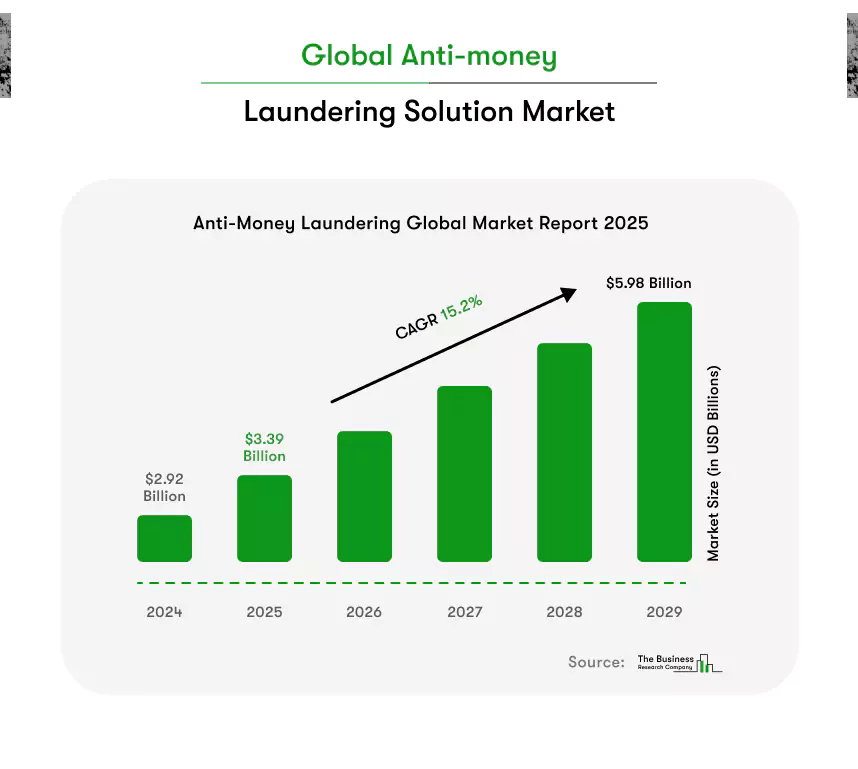

Predictive analytics for KYC and AML helps you detect laundering patterns early, reduce false alerts, and keep your compliance team focused. Most fintech firms still rely on rule-based compliance engines. These outdated systems overwhelm analysts with irrelevant alerts and rigid rules.

Traditional compliance tools rely on fixed logic. Rule-based engines flag transactions that exceed set thresholds, known keywords, or specific transaction types. But criminals don’t follow those rules. Unusual behavior often goes undetected because the system wasn’t trained to recognize it.

When suspicious activity happens, analysts are forced to catch it manually. That slows everything down. High-risk activity may not get flagged until it causes damage.

In 2022, cyber-enabled investment scams drained $3.3 billion from U.S. citizens. That marked a 127% spike in just one year. (Source)

You can’t rely on outdated systems to deal with modern laundering risks. AML compliance solutions in fintech now demand smarter, faster tools.

The rest of this guide will walk you through how predictive analytics improves fintech KYC and AML systems.

What Are AML and KYC Processes in Fintech?

AML and KYC processes in fintech refer to the systems used to identify customers and prevent illegal financial activity like money laundering. These processes verify user identities, assess risk, and monitor transactions to ensure regulatory compliance.

In fintech, speed and security often clash. Traditional financial institutions may take days to verify a customer. Fintech platforms need to do it in minutes. That’s why fintech firms rely on digital KYC onboarding flows and automated AML checks. These systems scan customer details, cross-check watchlists, and flag anomalies during the signup and transaction processes.

But here’s the problem: most of these tools still rely on static logic. If someone uploads a valid document but behaves erratically afterward, the system might miss the red flag. Most compliance engines only check fixed points, not how users behave after onboarding.

Predictive analytics for KYC and AML changes this. It lets your system adapt in real time based on how users behave, not just what they submit.

Now that you understand how AML and KYC processes work in fintech, let’s explore what predictive analytics means in compliance.

What Is Predictive Analytics in AML and KYC Compliance?

Predictive analytics in AML and KYC compliance refers to the use of data models to detect suspicious behavior and prevent regulatory violations before they occur. These predictive systems help fintech firms reduce false alerts and catch real threats early by analyzing behavioral patterns in real time.

Traditional compliance tools rely on fixed logic. Rule-based engines flag transactions that exceed set thresholds, match restricted names, or follow known laundering patterns. But when criminals change tactics, static rules fall short.

For example, a user who stays just under reporting limits or spreads money across smaller accounts may bypass detection completely.

- Predictive analytics fixes what static rule-based systems miss. Machine learning models track user behavior in real time. These models monitor changes in device usage, login location, transaction timing, and fund movement.

- Behavioral patterns give compliance teams clearer signals to identify and act on real risks.

- Predictive analytics for KYC and AML gives fintech businesses flexibility, speed, and stronger monitoring. These systems reduce manual review work and support smarter, faster decisions under regulatory pressure.

- Fintechs also apply predictive analytics in credit scoring to assess borrower risk more accurately using behavioral and transactional data. Integrating both use cases creates a unified view of customer risk across lending and compliance.

Now let’s break down how predictive analytics for AML compliance fits into real fintech workflows.

How Does Predictive Modeling Transform Anti-Money Laundering Efforts?

Predictive modeling for anti-money laundering refers to the use of behavior-driven algorithms to detect suspicious activity before money laundering completes. These models uncover hidden risks that static rule-based systems often fail to detect in time.

Traditional AML tools rely on predefined logic. They flag large transactions, block restricted countries, and scan names against sanctions lists. But traditional AML tools don’t help. Criminals exploit them by staying just under thresholds or routing money through less obvious paths.

Predictive models work differently. These systems analyze live user behavior and identify hidden risk patterns based on how users interact, not just what they do at a single moment.

Here’s what predictive systems actively monitor:

Device and location mismatch

Predictive models detect inconsistencies when a user logs in from one location but initiates a transaction from a completely different region within a short time frame.

Transaction velocity

If multiple small transactions are made rapidly to stay below reporting thresholds, the system flags that behavior as suspicious.

Connected accounts

The system identifies patterns where unrelated users send funds to the same destination account, which may indicate layering or funneling tactics.

Shared technical footprints

When different accounts operate from the same device ID or IP address, predictive analytics reveals potential links between those users that may suggest collusion.

AML detection using predictive analytics helps compliance teams focus only on real risks. Instead of wasting hours on hundreds of false alerts, your analysts review high-priority cases backed by behavioral context.

Once a laundering method is confirmed, the system updates its logic to flag similar patterns in future, even if slightly modified.

Modern fintech KYC and AML analytics integrate predictive intelligence directly into your compliance workflow. Similar to how predictive analytics in banking improves credit risk and fraud detection, these models bring real-time precision to compliance operations.

When combined with KYC automation with predictive analytics, your team gets fewer alerts, sharper detection, and faster decisions, all without compromising speed or accuracy.

Predictive modeling for anti-money laundering turns compliance from a slow, reactive checklist into a smart, real-time shield against evolving threats.

How Predictive Analytics Improves KYC in Fintech

Predictive analytics improves KYC in fintech by analyzing user behavior to verify identities, detect inconsistencies, and reduce onboarding fraud in real time. These models go beyond document checks to understand how users behave, not just who they claim to be.

In most fintechs, KYC begins with static checks. Users upload documents, take selfies, and fill out forms. But fraudsters know how to bypass these steps using synthetic identities or stolen data. Traditional systems approve them based on surface-level inputs.

Predictive analytics strengthens this process. It tracks how users interact with your platform from the first second:

- Do they hesitate while typing personal information?

- Is the device location inconsistent with the claimed address?

- Does the typing rhythm match natural user behavior?

Each behavior is compared with historical fraud patterns. Using predictive analytics for fraud detection, the model identifies suspicious activity, increases the user’s risk score, and flags the case before approval.

Here’s how predictive KYC improves both onboarding and security:

Behavior-led identity validation

The system evaluates user intent based on actions, not just uploaded data.

Early detection of fake or stolen identities

Predictive analytics identifies subtle mismatches in behavior and input patterns that traditional KYC tools often overlook.

Adaptive risk scoring

Every user action, including form filling, navigation speed, and login behavior, feeds into a continuously learning model.

Real-time onboarding control

Genuine users move through faster, while suspicious ones are escalated for manual review.

How predictive analytics improves KYC in fintech comes down to one thing: context. The goal isn’t to block more users, but to approve the right ones quickly and confidently.

Predictive analytics helps fintechs reduce onboarding friction for good users and quietly stop fraud before it enters the system.

Many companies now rely on fintech predictive analytics consulting to design tailored models that fit their specific risk and compliance goals. This ensures every decision is both data-driven and regulation-ready.

How Predictive Analytics for KYC and AML Is Automating Compliance Processes

Technology assists in automating AML and KYC processes by replacing manual compliance checks with intelligent systems that verify identities, monitor behaviors, and detect suspicious patterns in real time. These systems reduce delays, cut human error, and scale compliance without growing headcount.

Here’s how automation actually works, and which technologies make it possible:

1. AI-Powered Identity Verification

Technology involved: Computer vision, Optical Character Recognition (OCR), and biometric validation

Instead of having a human review ID documents and selfies, AI tools automatically verify the authenticity of user-submitted documents. They scan passport or license details, match faces to selfies using facial recognition, and detect liveness to prevent spoofing. This enables real-time, secure onboarding for low-risk users without any manual steps.

2. Machine Learning Models for Behavioral Monitoring

Technology involved: Supervised learning, anomaly detection algorithms, and predictive analytics

Machine learning tracks how users behave on your platform, how they type, how quickly they fill forms, what device they use, and where they log in from. These models compare current behavior to expected patterns and flag anything unusual. For example, if a user submits a clean ID but logs in from five locations within minutes, the system raises a risk alert automatically.

3. Real-Time Transaction Pattern Analysis

Technology involved: Stream processing, risk scoring engines, graph analytics

Real-time transaction pattern analysis monitors the flow of funds across accounts continuously. It detects suspicious behaviors like layering (breaking large sums into smaller transactions), rapid fund movement, or circular transfers between connected accounts. The system analyzes transaction histories as they happen and scores the risk level for compliance teams to act on.

4. Automated Sanctions and Watchlist Screening

Technology involved: AI-matching engines, fuzzy logic, and sanctions API integrations

Technology automates customer screening by continuously checking names, aliases, and associated entities against sanctions lists, politically exposed person (PEP) databases, and adverse media sources. This process doesn’t just run once at onboarding, it repeats during the customer lifecycle, minimizing the risk of a compliance miss.

5. End-to-End Workflow Automation

Technology involved: Robotic Process Automation (RPA), case management tools, and custom rule engines

When high-risk activity is flagged, workflow tools automatically route the case for manual review, log analyst decisions, and trigger follow-ups. SAR reports (Suspicious Activity Reports) can also be generated pre-filled based on data, saving time and ensuring audit readiness.

KYC automation with predictive analytics combines all of these technologies into one intelligent framework. The result is a compliance system that thinks, adapts, and scales with your fintech business.

How Predictive Analytics Helps You Comply With Global AML and KYC Regulations

Predictive analytics for KYC and AML supports fintechs and financial institutions by identifying high-risk behaviors, enhancing customer verification, and improving compliance workflows across every regulatory framework. These systems adapt in real time to evolving threats, which makes them essential under modern AML laws.

Let’s break down how predictive analytics maps directly to AML/KYC compliance across the most regulated financial regions in the world.

United States (BSA, USA PATRIOT Act, AMLA)

U.S. AML laws demand real-time transaction monitoring, dynamic customer due diligence, and immediate escalation of suspicious activity. Regulations like the Bank Secrecy Act and the Anti-Money Laundering Act (2020) focus heavily on SAR filings, beneficial ownership transparency, and risk-based reviews.

How predictive analytics helps:

- Predictive models assign live risk scores based on real-time user behavior.

- The system detects structuring, mule activity, and unusual account movements before thresholds are crossed.

- Predictive analytics flags login mismatches, rapid device switching, and abnormal transaction speeds instantly.

- Compliance teams get clear alert logs with behavioral context for accurate SAR filing.

This ensures you’re not just filing reports, you’re filing the right ones, backed with context.

European Union (6AMLD, EU AML Package)

Under the 6th Anti-Money Laundering Directive, fintechs must prove they’ve taken proactive, data-driven steps to prevent money laundering, cybercrime, and financing of terrorism. The EU AML Authority (AMLA) further enforces consistency and accountability across all member states.

How predictive analytics helps:

- Predictive analytics enhances onboarding by generating behavioral risk profiles during the first user interaction.

- Predictive analytics detects complex fraud patterns, even when users stay below reporting thresholds or bypass traditional rule checks.

- The system triggers dynamic escalation workflows based on real-time behavior across multiple countries and regulatory environments.

- Predictive analytics also supports EU audit requirements by maintaining full traceability of alerts, decisions, and risk score changes.

AML detection using predictive analytics is critical here because the EU now mandates more than just static checks, they want institutions to prove they understand user risk as it evolves.

United Kingdom (MLR 2017, Economic Crime Act)

UK compliance laws prioritize ongoing monitoring and audit-ready documentation. The Money Laundering Regulations 2017 and Criminal Finances Act require that firms escalate risk in real time, not just at onboarding.

How predictive analytics helps:

- Predictive analytics tracks post-onboarding behavior changes, including device switching and unusual login locations.

- Behavioral models flag activity that doesn’t match declared income or known customer patterns.

- The system records every alert with a clear timeline, actions taken, and outcome.

- Predictive analytics enables faster response during FCA audits and compliance reviews.

This aligns with KYC automation with predictive analytics, which eliminates guesswork and keeps fintechs compliant across risk reviews.

United Arab Emirates (Decree No. 20, DFSA AML Rulebook)

UAE compliance frameworks emphasize risk-based AML policies, especially in high-risk sectors like crypto, real estate, and cross-border finance. Institutions must report anomalies to the UAE FIU within strict timelines.

How predictive analytics helps:

- Predictive analytics analyzes transaction paths in real time to detect layering, smurfing, or mule account activity.

- The system evaluates risk across connected accounts or linked crypto wallets based on shared behaviors and flow patterns.

- Predictive models automatically escalate unusual peer-to-peer activity for review by compliance teams.

- This approach strengthens alignment with DFSA rules inside Dubai’s DIFC financial jurisdiction.

These capabilities support the UAE’s Cabinet Decision No. 10, which requires active rather than passive monitoring of financial behaviors.

Global: FATF 40 Recommendations

All of the above regions adopt standards set by the Financial Action Task Force (FATF). Their 40 Recommendations require customer due diligence, ongoing monitoring, and effective suspicious transaction reporting.

How predictive analytics helps:

- Predictive analytics detects emerging risk based on behavior patterns, even before rule violations occur.

- The system assigns dynamic risk scores that update continuously as user behavior changes.

- Predictive models flag suspicious fund movement between accounts, even when transactions stay below reporting limits.

- The platform generates full audit trails with timestamps and decision logs to support FATF reporting requirements.

Predictive analytics helps you catch fraud, strengthen compliance, and align your tech stack with global regulatory expectations. It gives your team the clarity, speed, and control needed to stay ahead of audits and operate with full confidence.

Predictive analytics for KYC and AML empowers you to stay ahead of compliance. It helps you act faster, catch real risks early, and build lasting trust with regulators and customers alike, all while keeping your operations smooth and scalable.

What Are the Key Benefits of Using Predictive Analytics for KYC and AML Compliance?

Predictive analytics for KYC and AML improves risk detection, reduces manual effort, and strengthens compliance across every customer interaction. These systems use live behavior to assess risk, helping fintechs prevent issues before they escalate. For a deeper understanding, our Predictive Analytics in Fintech Guide explores how these technologies are transforming compliance and risk management.

Let’s explore the most valuable benefits your compliance team gains with predictive analytics.

1. Real-Time Risk Scoring

Predictive models assign dynamic risk scores based on behavior, device use, and transaction flow. These scores adjust as users interact.

Predictive analytics for KYC helps your team prioritize cases faster and detect suspicious behavior earlier in the process.

2. Transaction Monitoring with Context

Transaction size is no longer enough. Predictive analytics tracks velocity, frequency, and relationship patterns to catch laundering tactics.

AML detection using predictive analytics surfaces risks like structuring or funneling that may go undetected with static rules.

3. Smarter Fraud Detection

Machine learning models learn from historical fraud cases. They flag subtle signs like mirrored transactions or delayed repayments.

Many lenders also use predictive analytics to reduce loan defaults by identifying risky behavior patterns early.

With fintech KYC and AML analytics, you can act before damage occurs, without relying on threshold-based triggers.

4. Scalable Regulatory Adaptation

As regulations evolve, predictive models update automatically using new data and patterns. No manual rewrites are needed.

Predictive modeling for anti-money laundering ensures your system stays aligned with FATF, BSA, and EU directives at scale.

5. Faster, Leaner Compliance Operations

Predictive systems surface only relevant alerts, reducing review time and improving case quality with complete behavioral context.

Using KYC automation with predictive analytics, your team works faster, resolves cases smarter, and scales without adding headcount.

6. Improved Customer Experience

Low-risk users get approved instantly. Predictive models recognize trusted behavior and reduce unnecessary verification steps.

Predictive analytics for KYC and AML allows you to stay compliant without slowing down the customer journey.

7. Fewer False Alerts, More Targeted Reviews

Predictive analytics reduces alert fatigue by learning what normal looks like for each customer.

It flags only meaningful anomalies and filters out low-risk behavior patterns.

AML detection using predictive analytics improves case accuracy and allows analysts to spend time where it counts.

8. End-to-End Audit Readiness

Every alert, risk score change, and decision is logged with timestamps for full audit visibility.

Fintech KYC and AML analytics makes regulatory reporting easier with traceable logic across every case and customer.

Every benefit of predictive analytics for KYC and AML moves your compliance process forward including faster decisions, sharper detection, and fewer manual roadblocks. When your system understands behavior, not just data, your team works smarter, scales confidently, and stays aligned with every regulation that matters.

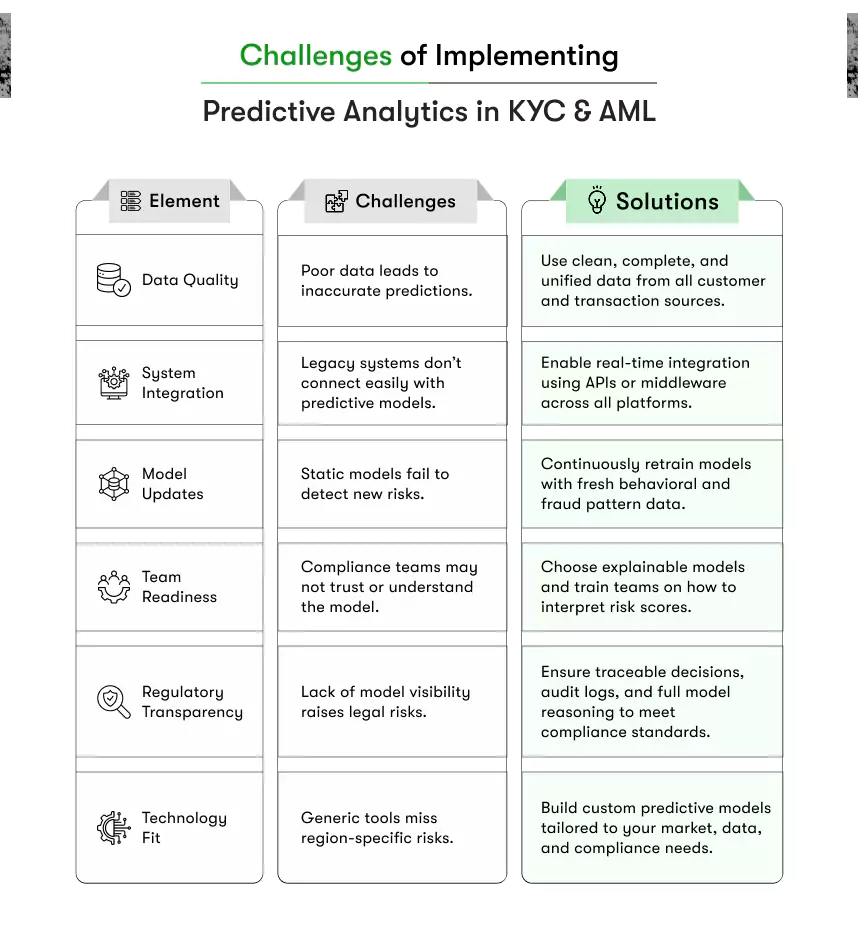

What Are the Challenges and Considerations When Implementing Predictive Analytics in KYC and AML?

Implementing predictive analytics for KYC and AML requires careful planning, clean data, and the right technology partner. While the benefits are clear, success depends on how you handle integration, data quality, and ongoing model training.

Let’s explore the most important challenges and what fintech leaders should consider before moving forward.

1. Data Quality and Availability

Predictive analytics models depend on clean, consistent data. If your customer or transaction data is fragmented or outdated, risk scoring becomes unreliable.

Predictive analytics for KYC only works when data flows from every touchpoint like CRM, onboarding, payment history, and beyond.

2. Integration with Existing Systems

Legacy rule engines, CRMs, and transaction platforms may not easily connect with AI-driven models. Without smooth integration, teams end up working in silos.

To see the real value of AML detection using predictive analytics, your system must pull data from across departments in real time.

3. Model Training and Continuous Updates

Predictive models are not one-time setups. They need regular retraining using updated behavioral trends, fraud patterns, and regulatory shifts.

Predictive modeling for anti-money laundering must evolve constantly to detect emerging risks and stay compliant with FATF and regional laws.

4. Compliance Team Readiness

Analysts need to understand how models work and how risk scores are generated. Without that, trust in the system suffers.

Fintech KYC and AML analytics platforms must include explainability, audit logs, and visibility into model reasoning.

5. Regulatory Alignment and Transparency

Regulators may expect clarity around how predictive models make decisions. Black-box systems create compliance risks if they cannot explain outcomes.

KYC automation with predictive analytics should support traceability, case justification, and full reporting transparency across jurisdictions.

6. Choosing the Right Technology Partner

Off-the-shelf tools may lack the flexibility or regional awareness your fintech operation needs. Custom models trained on your data work better.

Partnering with a trusted fintech app development company ensures your predictive analytics systems are tailored to your workflows, compliance needs, and business goals.

A strong partner helps you design systems aligned with your goals and regional AML laws. That is key to making predictive analytics for KYC and AML truly work.

Implementing predictive analytics for KYC and AML is not just about adopting a tool, it is about building a smarter, future-ready compliance system.

With the right data, team, and technology partner, your fintech business can overcome every challenge and unlock the full potential of predictive compliance.

Case Studies: Predictive Analytics for KYC and AML in Fintech Compliance

Predictive analytics for KYC and AML is helping fintechs streamline compliance, reduce fraud, and meet complex regulatory standards with speed and precision. Let’s assume how different companies are succeeding across the US, UK, and UAE.

1. A US-Based Digital Payments Company Cuts Onboarding Time by 80%

Let’s assume a digital payments company in the United States was dealing with long onboarding delays and mounting compliance costs. Under FinCEN’s Bank Secrecy Act (BSA) and the USA PATRIOT Act, they were required to verify users quickly while maintaining full audit trails.

They used predictive analytics to assess behavioral signals like device fingerprinting, typing rhythm, and form-fill speed. The system scored risk in real time and escalated only flagged users.

As a result, onboarding time dropped from 10 days to under 48 hours, and the team processed 3x more applications without expanding headcount, all while staying fully compliant with US AML laws.

2. A UK Remittance Platform Detects Laundering Through Predictive Monitoring

Let’s assume a money transfer platform based in the United Kingdom was struggling to track laundering patterns across borderless transfers. Under the Money Laundering Regulations 2017 and oversight by the FCA, the firm needed strong AML measures and clear audit logs.

They deployed predictive modeling to monitor device switches, flow velocity, and abnormal transaction chaining. The system flagged suspicious activity, such as unrelated users funding the same account within short time windows.

This helped reduce false positives and brought clarity to the compliance team, allowing them to satisfy UK regulators while catching fraud earlier.

3. A UAE Crypto Exchange Automates KYC Without Slowing Down

Let’s assume a crypto trading exchange in the UAE, operating under Federal Decree Law No. (20) of 2018 and DFSA regulations, wanted to speed up onboarding without compromising AML controls.

They implemented predictive analytics for KYC to monitor login locations, IP anomalies, device consistency, and wallet behavior. Risk scores were generated instantly, and only high-risk cases were routed to analysts.

This led to a 70% drop in manual reviews and allowed the exchange to grow confidently while staying fully aligned with UAE AML law.

4. A UK Lending App Reduces False Positives Using Behavior-Based Scoring

Let’s assume a digital lending platform in the UK was overwhelmed with false fraud alerts due to a rigid rule-based AML system. Under the Criminal Finances Act 2017 and FCA guidelines, they needed a more intelligent approach.

They used predictive analytics to study borrower behavior, repayment timing, and shared device signals. The system learned what typical usage looked like and flagged only real risks.

Manual reviews dropped by 65%, approval decisions were faster, and the audit process became smoother, without compromising security or regulatory alignment.

These stories reflect what’s possible when fintechs align smart technology with regional compliance. Predictive analytics for KYC and AML is not just improving efficiency, it’s helping teams meet regulations confidently, reduce fraud, and scale faster in markets like the US, UK, and UAE. The results also highlight how Fintech Mobile App Development plays a central role in turning these capabilities into scalable, real-world solutions.

Getting Started: Roadmap to Implementing Predictive Analytics for KYC and AML

Predictive analytics for KYC and AML is most effective when deployed with a clear plan. This roadmap gives fintech leaders a practical sequence to follow, from readiness to real-time outcomes.

Similar planning frameworks are also used in predictive analytics in insurance to manage risk and improve decision-making across policy lifecycles.

Step 1: Identify High-Impact Use Cases

Start by pinpointing the compliance areas causing the most friction. Is it delayed onboarding, rising false positives, or low fraud detection accuracy?

Focusing on one core use case gives your team a measurable goal and ensures the model adds immediate value.

Step 2: Build a Unified Behavioral Data Layer

Gather and centralize data from multiple sources, onboarding forms, transaction logs, device sessions, CRM records, and ID verifications.

Predictive analytics for KYC depends on behavioral signals like login frequency, form-fill time, and location shifts.

Clean, timestamped data lays the foundation for smarter risk prediction.

Step 3: Design a Risk Scoring Framework

Work with your compliance team to define what “low,” “medium,” and “high” risk looks like, based on customer profiles and past incidents.

This ensures that AML detection using predictive analytics produces output your analysts can actually use to escalate or approve.

Step 4: Integrate Risk Insights into Daily Workflows

Do not just generate risk scores, put them to work.

Embed predictive outputs into your existing tools, dashboards, or case review queues. Your team should be able to see risk ratings and behavioral context in the systems they already use.

This is how fintech KYC and AML analytics delivers real-time operational impact.

Step 5: Establish a Feedback and Retraining Loop

Create a feedback pipeline where analysts flag false alerts, missed risk, or edge cases.

Feed that data back into the model to retrain and improve accuracy. This keeps predictive modeling for anti-money laundering adaptive to emerging patterns and regulatory shifts.

Step 6: Document Everything for Audit and Explainability

Regulators will ask how your system makes decisions. Keep documentation on your model logic, data sources, thresholds, and escalation rules.

KYC automation with predictive analytics must be transparent, auditable, and explainable, not just accurate.

A successful implementation of predictive analytics for KYC and AML starts with clear priorities, clean data, and connected workflows. When your system scores risk in real time and your team acts on it with confidence, Payment Fraud Prevention also strengthens, making compliance faster, sharper, and scalable, exactly how modern fintechs need it to be.

Conclusion: How Predictive Analytics for KYC and AML Drives Smarter Compliance

Modern fintech compliance requires more than just rule-checking. It demands systems that move fast, think ahead, and adapt instantly. Predictive analytics for KYC and AML gives fintech leaders that control. Predictive models help compliance teams detect risk early, reduce false positives, and align with changing regulations in every market.

Delaying this transition increases exposure and limits scalability. Fintechs that lead with behavior-driven systems are not only preventing fraud, they are building trust with regulators, partners, and customers.

Kody Technolab Ltd helps fintech companies design, develop, and implement custom predictive analytics systems for end-to-end KYC and AML compliance. Through specialized Fintech predictive analytics consulting, the team ensures every solution fits your data, workflows, and regional obligations, whether under FinCEN, FCA, DFSA, or FATF frameworks.

Now is the time to upgrade your compliance engine. Predictive intelligence is no longer optional, it is the foundation of safe, scalable growth.

Contact Information

Contact Information