To build a secure mobile wallet app or to start developing a reliable mobile wallet app, you first need to understand its basics. A mobile wallet app is a type of payment service provider. It works like sending and receiving money using a mobile app. The world has witnessed that wallet apps have turned out to be one of the fastest-growing digital products in the last quarter of 2017. The current reports of the Indian market suggest a 16% rise in mobile payment, which is confirmed by the RBI.

Payment apps like Paytm, PayPal, and Google, are dominating the market at the moment. And hence, there is a huge market to serve with your services and generate revenue that is unlimited. So, if you are committed to Building a Secure Mobile Wallet App, you must keep on reading this blog further. It will cover the most crucial elements of Mobile wallet app development, especially in 2023.

Moreover, before you hire Mobile App Developers or any Mobile wallet app development Company, you must understand how the process works. This guide includes elements like the need to develop a Mobile Wallet Application, industries that benefit from it, Mobile App Development Company, and more. It further covers aspects like must-have or advanced app features, app execution and tracking, the way the app works, and the cost of the App Development in 2023.

So, let’s get into it without wasting time:

What does the concept of a virtual or digital wallet mean?

A virtual, digital, or e-wallet is a digital version of a physical wallet that you use to store and manage your money digitally. It is essentially an app that you can download and install on your smartphone or tablet that lets you make payments, send money, receive money, and manage your finances all in one place.

With a virtual wallet, you can link your bank account, credit cards, or other payment methods to the app, which makes it easy and convenient to make transactions without the need to carry cash or physical cards with you.

Digital wallets like Google Pay are becoming increasingly popular because they offer a convenient, secure, and fast way to make payments and manage your finances. They are particularly attractive to investors, fintech, and finance companies because of their potential to revolutionize the way people make payments and manage their money.

How does an e-wallet work? Understand the Workflow to Innovate the App

Imagine being able to manage all of your finances with just a few taps on your smartphone – that’s the power of an e-wallet!

And understanding its core can be a game-changer for fintech investors, finance companies, and anyone interested in innovating in the field of mobile payments.

So, here’s how it works: when you download an e-wallet app, you create an account and link it to your bank account or credit or debit card. You can then add funds to your digital wallet by transferring money from your linked account or card.

Once your wallet is loaded with funds, you can use it to make payments online or in person using near-field communication (NFC) technology. All you have to do is tap your smartphone against a payment terminal, and the payment is processed instantly. Nowadays, e-wallets also facilitate users to send money to other users, pay bills, or make purchases on e-commerce websites.

To ensure the security of the transactions, e-wallets use encryption and other security features to protect your personal and financial information. Many e-wallets also offer fraud protection and liability coverage for unauthorized transactions.

Innovating in the field of e-wallets means exploring new features and functionalities that can enhance the user experience and streamline the workflow. For example, integrating loyalty programs, virtual cards, or AI-powered personal finance management tools can help e-wallets stand out in a crowded marketplace.

By understanding the workflow of e-wallets and exploring new ways to innovate in the field, you can tap into the vast potential of mobile payments and revolutionize the way of managing money.

Speaking of managing money, a similar concept of Banking app development is also worth your attention.

Identify the Need to Build an app like Google Pay.

Reports state that about 1.2 billion people have access to a bank account with payment accessibilities. Moreover, about 5 billion people use smartphones, which indicates several people have the liberty to access net banking.

So, creating a Mobile Wallet App like Google Pay is a good idea for startups or large enterprises to invest in. Any financial institution will prefer to increase its customer base through mobile payment app development.

The digital wallet app development has already shaken the market, so creating a Mobile Wallet App like Google Pay with a fresh concept is robust. A mobile wallet app is far easier to access than net banking. Well, this is because the convenience of using the app is so easy, smart, and fast.

- The revenue of the global mobile payment app has increased from 450 billion dollars to 780 billion dollars.

- The US consumer rate between the age group of 25-34 is using peer-to-peer payment facilities at a 45% hike.

- And the next age group has shown a 37% hike between 35-44 years old.

Evidently, the Fintech market is booming, and now is the right time to invest in creating a Mobile Wallet App like Google Pay. But if you want to explore various other profitable Fintech app ideas, do not hesitate.

How do investors get a return on their investment in e-wallet app development?

By tapping into this lucrative market, you can generate significant revenue, improve customer engagement, gain a competitive advantage, increase security, and enhance the user experience. There are multiple ways investors and finance companies can make money by developing a digital wallet, for example;

Transaction fees: you charge transaction fees for every payment made on the platform and earn a fixed or a percentage of the transaction amount, depending on the provider’s pricing model.

Merchant fees: E-wallet providers can also generate revenue by charging merchants a fee for accepting payments through their platform.

Interest income: The app earns interest income by investing the funds held in its users’ e-wallet accounts.

Cross-selling: Offering financial products and services, such as credit products, insurance, or investment options to users, the app can generate additional revenue through commissions on sales.

Premium features: You can also generate revenue by offering premium features to their users. These features can include higher transaction limits, faster transaction processing, or advanced security features, among others.

Basically, you get a fair return on your investment into digital wallet app development as well as start gaining profit real soon.

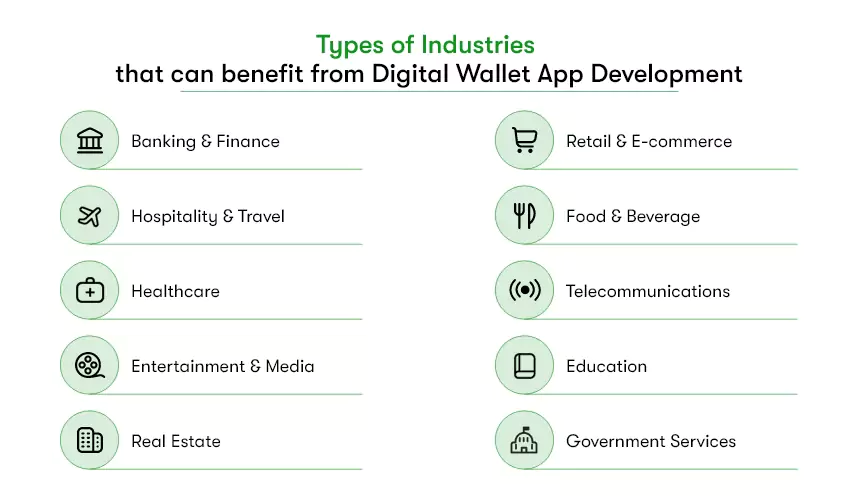

What type of Industries can benefit from Digital Wallet App Development?

Well, many industries are benefiting from digital wallet app development. The concept of mobile wallet app development allows users a way to secure payment transactions from anywhere and anytime. For example, the retailer can offer a QR code for the users to scan and pay. Below-discussed are a few mentions of other industries that are benefiting from the mobile wallet app development:

Do you feel like you can’t wait in line, recharge your metro card through your wallet hassle-free, and never be late? What if your electricity bill due date is approaching, but you don’t feel like stepping out of the house? Well, click on the option provided by your wallet app and pay your electricity bill now without worrying for a second.

This is good. But have you ever heard of an app that allows users to purchase anything on credit and pay in simple four installments with any interest? Know more about this concept, i.e., Buy Now Pay Later app development.

How to Execute and Track Digital Wallet App Development?

The most appropriate technique to execute and track the digital wallet app development will be the utilization of ‘Scrum.’ Well, it’s a well-developed and tested technique within the more extensive ‘Agile’ methodology. You can then build an MVP, i.e. a Minimum Viable Product, which is basically a functional product. Moreover, an MVP will help you get real market feedback.

And hence, you will be enhancing the app and its features based on market feedback. You iteratively undertake this method by experimenting with multiple ‘Sprints.’ After that, you’ll need to build a ‘product backlog.’ Well, it’s a list of features you will be adding to create a Mobile Wallet App like Google Pay. And subsequently, you will be planning your ‘Sprint’ by estimating the demand for features requested in the product backlog.

Once the above-discussed work is completed, you will then have to conduct a ‘Sprint review meeting.’ To ensure effective execution and to track such projects, you’ll be required to use relevant tools. Moreover, Trello and Asana are a few popular and available project management tools.

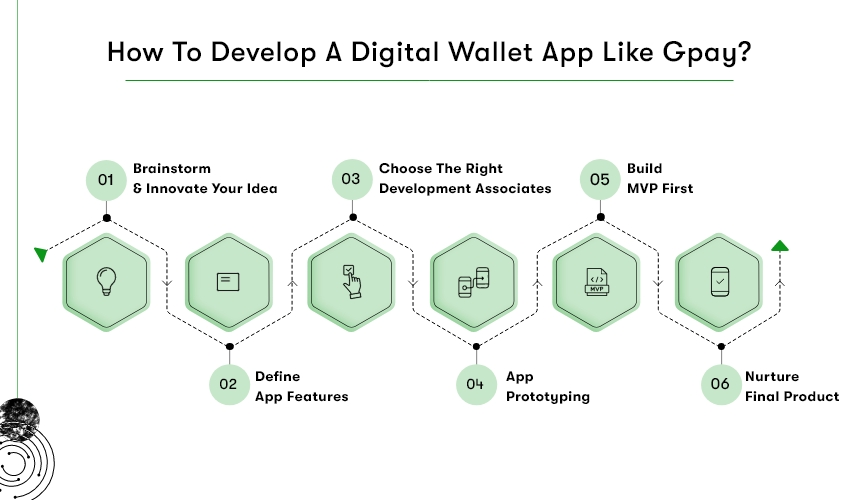

How to Initiate Digital Wallet App Development?

Brainstorm and innovate your idea.

In other words, you must analyze the market demand and whether your app concept is feasible for the same. Answering the below questions will help you get the insights to tailor your app development solution.

What is the goal you want to achieve with your mobile app?

What are the demographics of your audience, and how will this mobile app help them?

How does the user journey look on your app from login to checkout?

Are there any features you should include in your app’s first version except for must-haves?

Which technology should you use to create a high-performing app?

Define Crucial Features to Create an App like Google Pay

App features are a crucial aspect of mobile wallet app development and contribute to its success. So, let us glimpse at some features of Google Pay.

- Easy-to-use, smooth, and interactive User Interface

- Seamless and easy money Transactions User Registration or Login

- Add and then Check the Account Balance

- Fund Transfer

- Recharge/Bill Payment

- In-App Camera

- Authorizing Credit Card/Bank Account/Debit Card

- Discount / Redeem Coupons

- Digital Receipts

- Spending Analysis to allow app consumers to check their spending

- Data Synchronization

- Cloud-based Technology

- Loyalty card

- Reward offers using ad campaigns

- Gift cards

- Membership cards

- Security and Privacy of E-wallet with OTP, fingerprint, or QR code

- GPS Tracker & Navigation

- Wearable Technology and Device Integration

- Push notifications

- Integration of geotags

Choose the right development associates.

You have three methods to have a development team for your app: Freelancers, in-house development & app development agencies. The third one is the most affordable one. Because you just need to find an outsourcing app development company with a diverse portfolio and experienced developers. And they handle the rest. Our company also offers outsourcing services.

The fun fact about outsourcing is that we guarantee effective communication and project management with a quick turnaround time and timely delivery. You can inquire about anything by filling out the form at the bottom.

App prototyping

When you innovate something, you might need to iterate the design multiple times. Moreover, to attract investors, you need a substantial product design. In such a case, a click-through prototype development following wireframing that functions similarly to a real app without code is a great exercise.

Furthermore, prototyping also helps you nurture your user-friendly mobile app design and receive adequate feedback from stakeholders as a bonus.

Build MVP first

Your first product should be a Minimum Viable Product with essential functionality and features. MVP is a strategy very helpful for big to small brands to shape their final product.

Nurture Final product development.

When you launch MVP, you receive feedback from your early adopters. You can utilize such feedback to identify areas of improvement in your product. This way, you can nurture your app, making your wallet app more customer-friendly.

What Technology Stack to choose to develop a robust E-Wallet app?

When it comes to developing a robust e-wallet app, choosing the right technology stack is crucial. It can make all the difference in terms of user experience, security, scalability, and overall performance. Here are some of the key technologies you must consider:

Backend development: To ensure that your e-wallet app has a robust backend, you’ll want to consider using technologies like Node.js, Ruby on Rails, Laravel and Python These frameworks are known for their speed, scalability, and ease of use.

Database: When it comes to storing user data, security is of utmost importance. So, consider using a high-performance database like MongoDB or PostgreSQL that offers robust security features to keep user data safe.

Cloud hosting: To ensure scalability and availability, consider hosting your e-wallet app on cloud platforms like AWS, Google Cloud, or Microsoft Azure. These platforms offer easy scalability, high availability, and robust security features.

Frontend development: For a seamless and intuitive user interface, consider using frontend technologies like React Native or Flutter. These frameworks offer robust UI components, fast rendering, and easy integration with backend APIs.

Security: Security is paramount in e-wallet development. Consider using advanced security features like two-factor authentication, SSL/TLS encryption, and biometric authentication to keep user data and transactions safe.

By choosing the right technology stack, you can develop a robust, secure, and scalable e-wallet app that offers a seamless user experience and revolutionizes the way people manage their finances.

For more understanding of the tech stack, connect right with our technology geeks.

An Estimate Cost to Develop a Mobile Wallet Application

Considering the crucial elements above that are required to build a Secure Mobile Wallet App, you can estimate the final cost. The overall cost of Mobile wallet app development with minimum features and technology will come to around $25,000 to $50,000.

However, if your digital wallet application is equipped with advanced technology and features, the cost might go up from $100,000 to $150,000. It is based on the compensation of the app developers depending upon where the person is located and how much they charge per hour.

The overall cost is based on the development team, tech stack, app features, both- must-have and advanced, app complexity, size of the app, design, app platforms (iOS or Android or both), etc., that you include in your app. In this case, if you consider how much time the mobile payment app development takes, the actual cost of App Development like Google Pay might be less or more.

Conclusion

Make sure to create a mobile wallet app like Google Pay and work towards a product that can help users with digital payments in the best way possible. The app will be used by people for their convenience, and most of them may not be tech-savvy. Moreover, digital wallet users prefer a simple platform to get their work done and get easy access to services.

Apart from that, ensure that you are keeping in check all the trends and upgrades in the industry. This will further allow you to make an app like Google Pay with the best solution for the users.

Contact Information

Contact Information