A few years back, insurance-related tasks often resembled an assembly line, moving from one manual process to another. Claim forms, policy generation, and data entry were repetitive steps carried out by human hands, often prone to errors and time-consuming. It took a lot of paperwork, numerous phone calls, and days of processing just to get a claim sorted or a policy renewed.

Cut to today, where the introduction of RPA in insurance operations is like adding a turbocharger to the traditional engine. It can automate repetitive, mundane tasks, and execute them with speed and precision. The digital transformation in insurance has not only enabled fast processing but also freed up human resources to focus on complex tasks that require human intervention.

In this blog article, we will delve deeper into how RPA transforms Insurance app development, elevating the game to make insurance processes smoother, faster, and more customer-centric.

What is RPA in the insurance sector?

Robotic Process Automation is one of the top trends in InsurTech. RPA is a form of business process automation where software bots are programmed to perform rule-based and repetitive tasks. Using RPA in insurance, you can automate mundane chores like data entry, claims processing, and policy issuance with precision and speed.

Consequently, RPA use cases in insurance streamline operations, reduce errors, and allocate resources more efficiently to elevate the overall customer experience. According to Allied Market Research,

The global market of Robotic Process Automation in insurance reached a valuation of $98.6 million in 2021.

Such projections indicate a significant surge, with an expected growth of $1.2 billion by 2031, reflecting a remarkable CAGR (Compound Annual Growth Rate) of 28.3% from 2022 to 2031.

But what makes RPA in the insurance sector so important? Let’s look into the reasons behind the rising demand for automation in the insurance industry.

Explore ways to leverage Predictive Analytics and AI in Insurance to give tough competition to your competitors!

Streamlines operations

Having RPA implemented is like having a reliable assistant at work. It quickly handles repetitive tasks like processing claims and managing policies. This speed is a game-changer, especially when customers need instant assistance. RPA’s efficiency means faster responses, quicker turnaround times, and smoother processes. Ultimately, it spares you more time to focus on other critical aspects of your job.

Enhances accuracy and compliance

RPA diligently follows the rulebook, ensuring that every task is done with pinpoint precision. It significantly reduces errors, crucial in an industry where accuracy is non-negotiable. Additionally, by strictly following the industry regulations, RPA helps insurance companies maintain compliance effortlessly. With RPA, everything stays fair, accurate, and above board.

Allocates resources optimally

By automating everyday tasks including data entry and paperwork, the RPA solution frees you to focus on the crucial parts of your insurance business. This optimal use of resources maximizes productivity across the board. With RPA lending a hand, you can channel your efforts into strategic decision-making and offering personalized customer service.

Improves customer experience

RPA is one of the important factors that make customer interactions seamless. Its efficiency means faster responses and accurate information, resulting in a smoother experience for customers. Enabling quicker claim settlements and hassle-free policy management, RPA in insurance contributes to improving customer interactions with your insurance products. By utilizing RPA, insurance companies elevate their service standards, building trust and satisfaction among their clientele.

Future-proofing operations

Investing in RPA isn’t just helpful for today, but it promises a resilient tomorrow. RPA’s adaptability ensures that insurance operations can effortlessly evolve with changing times and demands. It’s like future-proofing against uncertainties, ensuring that insurance processes stay agile and effective, regardless of what changes lie ahead.

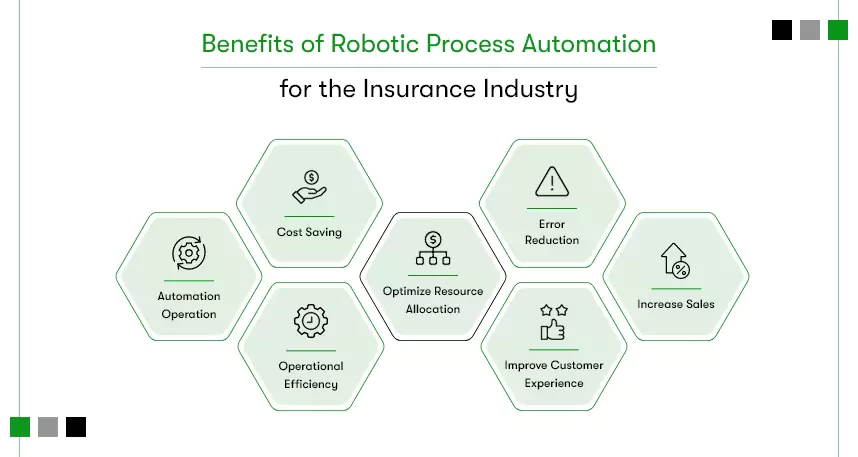

What are the benefits of using Robotic Process Automation in the insurance industry?

According to a Global RPA survey by Deloitte, 78% of RPA adopters anticipate a substantial rise in RPA investment within the upcoming three years. Let’s look at the benefits RPA promises for the insurance industry.

Automation implementation

RPA grows and evolves with the company. It’s not only about just setting up automation but continuously refining and expanding its use across various operations. This ongoing implementation ensures that insurers remain at the forefront of technological advancements, continually optimizing their processes for maximum efficiency and effectiveness.

Cost savings

By automating routine tasks, RPA significantly trims operational costs. It enables you to do more without increasing your workforce. This cost-efficient approach allows insurers to allocate their budgets more strategically, investing in areas that directly benefit customers and business growth. Ultimately, it’s a win-win, as the saved funds can be redirected towards innovation or improving customer experiences.

Increased operational efficiency

RPA speeds up every insurance process, enabling you to handle tasks quickly and effectively. This not only saves time but also amplifies output, allowing your teams to accomplish more without compromising quality. The efficient handling of workflows leads to quicker responses, faster claim settlements, and a smoother experience for both your insurance staff and the customers you serve.

Error reduction

RPA is like a proofreader in an insurance office that ensures every task is error-free. By strictly following predefined rules and automating repetitive processes, it drastically minimizes common human errors. This accuracy not only prevents costly errors but also enhances the overall reliability of insurance operations. Fewer errors mean happier customers and more trust in the services provided.

Enhanced customer satisfaction

RPA is the secret ingredient for delighting customers. Its ability to expedite processes leads to quicker responses and smoother transactions, making customers’ lives easier. Timely and accurate services translate directly to happier customers. This satisfaction boosts loyalty and encourages positive word-of-mouth, ultimately driving increased sales and fostering a strong customer base.

Increased sales

RPA’s impact directly contributes to increased sales. Increasing customer satisfaction and word-of-mouth publicity drives new customers. Also, with streamlined processes, you can identify sales opportunities more effectively, meet customer needs quickly, and provide personalized services, all of which increase sales figures.

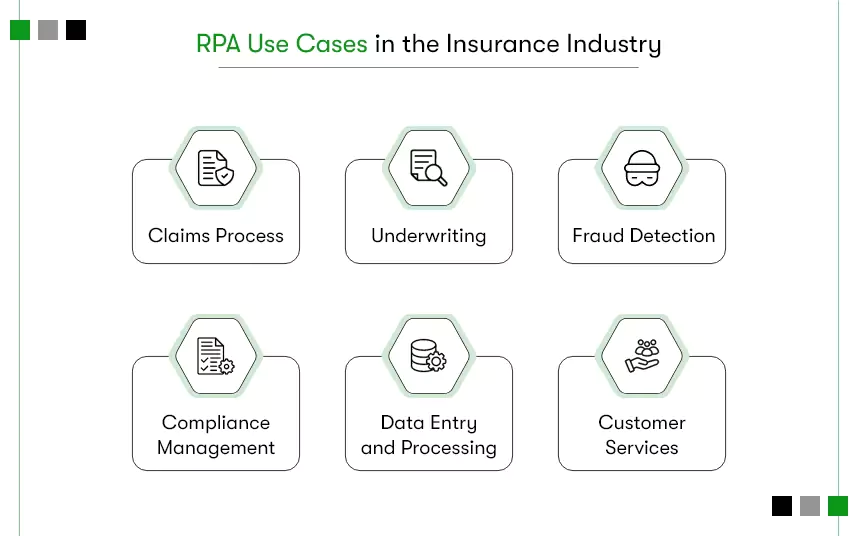

RPA use cases in the insurance industry

RPA has multifaceted use cases within the insurance sector. Let’s explore how RPA’s versatility is reshaping the way insurers handle day-to-day tasks.

1. Claims processing

RPA seamlessly handles tasks involved in claims including initiation, verification, and settlement. It accelerates the entire process and reduces the time taken to assess claims, ensuring faster settlements for policyholders.

2. Underwriting

In underwriting, RPA serves as a reliable assistant, efficiently analyzing vast amounts of data to assess risks and determine policy terms. It speeds up decision-making by automating data gathering and assessment, enabling underwriters to make informed decisions more quickly and easily.

3. Customer service

RPA helps you quickly respond to inquiries, update policy information, and facilitate smoother communication between customers and your support agents. This automation ensures prompt and accurate service, enhancing the overall customer experience.

4. Compliance management

Ensuring compliance with continually changing regulations can be daunting. By consistently following predefined rules and automating compliance-related tasks like documentation and reporting, RPA ensures that insurers stay on top of regulatory requirements.

5. Data entry and processing

RPA eliminates the redundancy of manual data entry by swiftly and accurately entering data from various sources into insurance systems. It ensures data accuracy and consistency, minimizing errors that may arise from human input.

6. Fraud detection

RPA can scan large volumes of data to detect anomalies and potential fraudulent activities. Its ability to analyze patterns and flag suspicious transactions helps in fraud prevention, ultimately safeguarding insurers and policyholders.

FAQs

1. What are the uses of RPA in the insurance industry?

RPA automates various insurance tasks like claims processing, underwriting, customer service, compliance management, data entry, and fraud detection. It automates repetitive processes, speeds up decision-making, and enhances overall operational efficiency.

2. How can RPA impact the efficiency of insurance operations?

RPA significantly boosts efficiency in insurance operations by automating routine tasks, reducing processing times, minimizing errors, and enabling optimal resource allocation. This automation allows insurers to focus more on critical decision-making and customer-centric activities.

3. What is an example of RPA in the insurance sector?

A prime example is claims processing. RPA automates tasks involved in claim initiation, verification, and settlement, expediting the process. It quickly gathers and analyzes claim data, to ensure faster settlements and smoother experiences for policyholders and insurers alike.

Closing insights: Impact of RPA in Insurance Sector

RPA integration into the insurance industry can revolutionize workflows, automating redundant tasks with unprecedented efficiency and accuracy. Furthermore, RPA in insurance makes it easier for insurers to navigate two most vital aspects– ever-changing customer needs and stringent regulatory requirements. However, insurers need a technology partner to ensure the smooth adoption of RPA in insurance.

That’s where Kody Technolab Ltd, comes into the picture. With industry experience and expertise in building AI-driven FinTech app solutions, our team can help you build efficient RPA solutions. So, tell us how you want to leverage RPA in your insurance operations and hire Fintech app developers to make it happen.

Contact Information

Contact Information