Have you been worried about managing your clients, processing claims, or streamlining operations in your car insurance company? It is challenging to run through a plethora of spreadsheets and documents when you need data on crucial and urgent tasks.

However, by embracing digital transformation in Insurance, you can grow your customer base, streamline operations, and get a competitive edge over other market players.

If you go by the numbers, you would be surprised to know that the auto insurance market generated a revenue of around $865.83 billion in 2023. The amount is nowhere going to decrease in the future, indicating innovative solutions like car insurance app development are powerful moves for you.

As per valuable customer ratings and reviews, The General has rightfully earned a reputation amongst the most popular car insurance apps in the USA. If you also wish to join this prestigious place, wait no longer and delve deeper into how you can develop a car insurance app with a clear roadmap. But before that, let’s have a look at the amazing features that make the app user-friendly and thus successful.

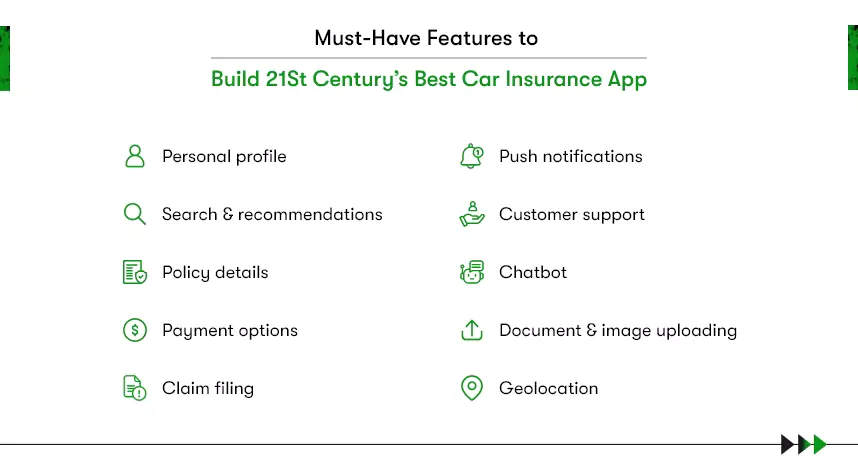

What Features Must You Have in Your Car Insurance App?

Customers expect their insurance company to offer a feature-rich and user-friendly app that alleviates the pain of managing their insurance on the go. In a world where consumers are looking for ultra-fast document uploading and claim processing with high-end security, integrating the following features in your car insurance application can be beneficial:

Personal profile

The profile contains personal details about your clients and their vehicles.

Search and recommendations

Enable your customers to easily locate all the policies and give policy recommendations as per their income, age, vehicle, family members, and so on. You can make the process smooth, helping them choose a policy quickly by letting them search as per specific parameters.

Policy details

It ensures that you show all your policies within your application so that your customers can check them at any time.

Payment options

Payment processing is a vital feature that saves time and enhances the overall customer experience. Providing multiple payment methods from your insurance app allows users to avoid the hassle of visiting their bank or frequently calling customer support. You can also offer automatic payment options to help them make timely payments without needing to remember dates.

Claim filing

Almost every car insurance app has the feature to file a claim. Therefore, we recommend adding this feature to make the app a valuable resource. The key reason many users download the insurance app is the ability to file a digital claim. So, you must leverage this benefit and make claim filing easy and efficient.

Push notifications

Whether a customer filed a claim or needs other alerts, adding push notifications to your auto insurance app is crucial. It is an easier way to send notifications regarding any modifications in the claim settlement process. Moreover, these alerts can also help you notify clients about promotional discount offers, new services, and other important details.

Customer support

Every auto insurance company has a customer support team, so your clients can get in touch with your team when you have this feature. It can be offered through calling, chat, or email features within the app. Ensure that you enable this service 24/7 to address emergencies and attend to your customers on time.

Chatbot

In a world driven by artificial intelligence, chatbots have emerged as prominent functionalities for companies wanting to elevate their customers’ journey. AI chatbots and RPA in your Insurance app can quickly aid customers in resolving claims, verifying their identity, and so on. You can have Chatbots answer generic client queries and use your teams to handle more complex issues.

Explore more use cases of AI in Insurance to leverage this futuristic technology for your benefit!

Document and image uploading.

With this feature, your customers can effortlessly upload photos, medical records, and other documents within the app. It will save time and help you collect important information without hassle.

Geolocation

Integrating your app with online maps ensures that users can create routes and find mechanics, gas stations, or other related services. This functionality allows users to share their location in case of an accident.

Admin features for your company

Your admin panel is the main platform wherein you and your staff can oversee the business performance. It also lets you seamlessly monitor your employees’ performance. You get an overall view of the customer data, employee data, and analytics from the admin panel.

You can also have a different app for agents, which may include the following features:

- Login

- Quotes

- Notifications

- Agent profile

- Policy list

- Customer data

- Claim history

- Claim status

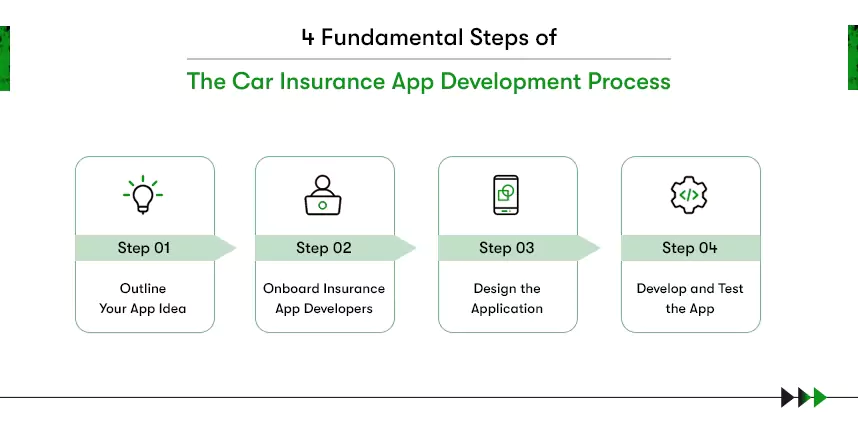

How to Develop Your Car Insurance App? A Step-by-step Overview

Almost 84% of people are using digital tools somewhere between claim filing tasks and embracing innovative ways of availing insurance. Hence, your final app developed with the above features will pave the way for success.

But how do you develop a car insurance app tailored to your unique business needs? Let’s check out these steps to understand the car insurance app development process.

Outline your Idea and Vision

Before moving further with your project, it is best to determine your goals and vision of your end product. Come up with a plan and a proper idea about the customer segments you wish to cater to, the issues you want to resolve, and how your app should look. Also, do a competitor analysis to know what competitors are offering to your target customers.

Find and hire an insurance app development company

You can hire freelance developers or a car insurance app development company through recommendations from friends or business references. Moreover, you can also search for developers on Google and social media platforms. Once you have found your potential team of experts to work with, get clear price estimates before signing the contract.

Do you want to build Android and iOS apps for your Insurance business from a single codebase, saving up to 40% of the development cost? Hire Flutter developers!

Design your app with key specifications.

A business analyst must be by your side to convert your vision into practical and technical requirements. You can document every key detail that showcases all the parts of your project: the technologies you will be using, the functionality you want in your app, etc.

Have an outline of your app design with all the goals you have in mind. This will help your developers understand the features they need to have while developing the app.

This process of the design stage may require modifications at different time frames as you will have to keep improvising with the coders. At the end of this stage, you will have the following:

- A design file

- An app prototype and UI kit

- A wireframe for the user experience

Develop and test the app

Now, we have arrived at the core technical aspect of our car insurance app development process. Here, the programmers write the codes and build the features for your mobile application.

It happens as follows:

- Backend development: Developers use Node.JS, Java, and other similar backend tech stacks to create server-side functionalities that create the complete framework. Backend development is required for the smooth operation of the insurance app. It also handles database management, authentication, user policies, and security measures.

- Frontend development: This stage is where the app is developed with all the features and functionalities like responsiveness across multiple devices. The endpoint API implementation also happens from the backend to help insurance agents and users retrieve data as required.

- Mobile app development: Here, the team focuses on building the app as per your goal, creating an intuitive and tailored user experience for various devices. Once this is done, the app is prepared for deployment on platforms such as the Apple App Store and Google Play Store, following their compliance policies and guidelines.

Once you are ready with the app, keep testing it regularly and take customer feedback to make their app usage more incredible. You can also leverage Predictive Analytics in your Insurance app to personalize your products and predict market trends and demand by processing the collected data.

What are the Key Benefits of a Car Insurance App?

When you develop a car insurance app, it comes with a myriad of benefits. Here are the primary benefits for both policyholders and insurance providers:

- Policyholders can have access to policy details and insurance information and get instant quotes at their fingertips.

- Clients can manage their policies, easily file claims, and get 24/7 assistance, minimizing the requirement for telephonic support or in-person visits.

- Users can digitally store and track their insurance documents, ensuring zero or less paperwork and going eco-friendly.

- Real-time updates and notifications help customers check any policy changes and get renewal reminders, and other alerts via the insurance app.

- Customers can easily provide feedback within the app, allowing your company to enhance its services.

- With the number of claims growing every year in the USA, automated app features ensure faster processes and elevated user experience.

- Through insurance apps, you can gather valuable information such as user behavior, preferences, and driving patterns. These are significant data to analyze risks and improve underwriting processes.

- You can also experiment with offering different types of insurance through your insurance app, including Travel, Health, or Life insurance.

- A responsive and properly designed app can make your company stand out from your competitors, making it easier to attract new customers and establish yourself as an industry leader.

- Innovation and technology help you remain at the forefront of InsurTech, making your app a go-to option for the younger demographic of tech-savvy enthusiasts.

- Automating processes, including claims processing, policy issuance, and so on, can be cost-effective as it reduces the need to hire additional human resources.

Frequently Asked Questions

1. What is the cost of developing a car insurance app like The General?

The cost to develop a car insurance app ranges between $45,000 and $60,000. However, it can increase if you add more features to your app. The factors that determine the cost are:

- App size

- Technology stack used

- Features

- App development team size

- Third-party integrations and services

- Rates of the developers or company you hire

2. What should you consider before developing the car insurance app?

You must consider the compliance laws, including, the Consumer Protection Act, GDPR (General Data Protection Regulation), Financial Services Regulatory Authority, and PCI-DSS (Payment Card Industry Data Security Standard). It would also help if you create a marketing budget for your promotional activities to draw more traffic to your company and increase the number of your insurance app users.

3. How do you choose the best car insurance app development company?

You can finalize the best app development company by checking their portfolio of previous works and experience in this field. Gather as much information about the type of apps created, technologies used, and the quality of work delivered by their teams.

In addition to this, check their reviews from past clients to analyze their reputation. Ensure you go through their websites, social media profiles, blog posts, and case studies before finalizing the one. And when you have shortlisted the top ones, have a strategy call and interview to choose the best company for your insurance app development project.

Embrace the Progressive Future of Car Insurance App Development

As per the study done by J.D. Power, there has been an 18% rise in customers adopting digital mediums to file claims since 2017. Whether it is for sending the first notice of loss, getting a digital estimation, or receiving status updates, customers are going contactless with their insurance providers.

You can also develop a car insurance app like The General, harnessing the power of the latest technology. All you need is support from a development team that has industry expertise and understands your requirements.

With a vision to digitize the world with innovation, Kody Technolab Limited lets insurance companies hire experienced app developers. With our developers, you can digitalize your insurance business with the right technology, streamlining your operations and offering 10X better customer experience.

Contact Information

Contact Information